Nitheesh NH

During the coronavirus crisis, Chinese domestic retailers had to react quickly to the new reality of shopping in a nationwide lockdown. We discuss the actions taken by grocery retailers to enhance efficiency in response to a surge in demand, as well as the launch of other initiatives to weather the storm of the pandemic, such as creating product bundles and forming collaborations with other industry players. We consider how learnings from these examples could be applied to other markets.

The Launch of Direct-to-Consumer and Community Group-Buy Bundles

In the context of the coronavirus pandemic, grocery retailers in China faced challenges due to a sudden surge in demand. With the prevailing consumer mindset of panic-buying in bulk to prepare for home quarantines, brick-and-mortar grocery stores have seen many empty shelves and long lines, both at store entrances and at checkouts

Lockdowns were implemented nationwide in China to prevent the spread of the coronavirus. This meant that consumers were unable to physically shop in stores, and even residents that were not subject to the strictest measures looked to reduce their potential exposure to the virus by staying indoors and avoiding public places such as shops. Although major retailers operate an e-commerce platform and/or work with “to-home” (rapid-delivery) apps, efficiently getting groceries into the hands of consumers proved to be an issue across the sector.

Many to-home apps, which promised 30- to 60-minute delivery services prior to the coronavirus outbreak, showed all time slots as “fully booked” and had to delay online orders for one to two days. Liang Changlin, CEO of the Dingdong Buy (Ding Dong Mai Cai) app, told Retail Boss Review that the app saw the number of order increase threefold following the 2020 Chinese New Year holiday at the end of January, as the coronavirus situation worsened. The company had to add delivery time slots as early as 5:30 a.m. Daily Fresh, a fresh-food online retailer, had to change its delivery service from 30 minutes to at least two hours.

[caption id="attachment_107322" align="aligncenter" width="520"] A number of “to-home” apps: Dingdong Buy, JD Daojia and Meituan Buy (left to right)

A number of “to-home” apps: Dingdong Buy, JD Daojia and Meituan Buy (left to right)

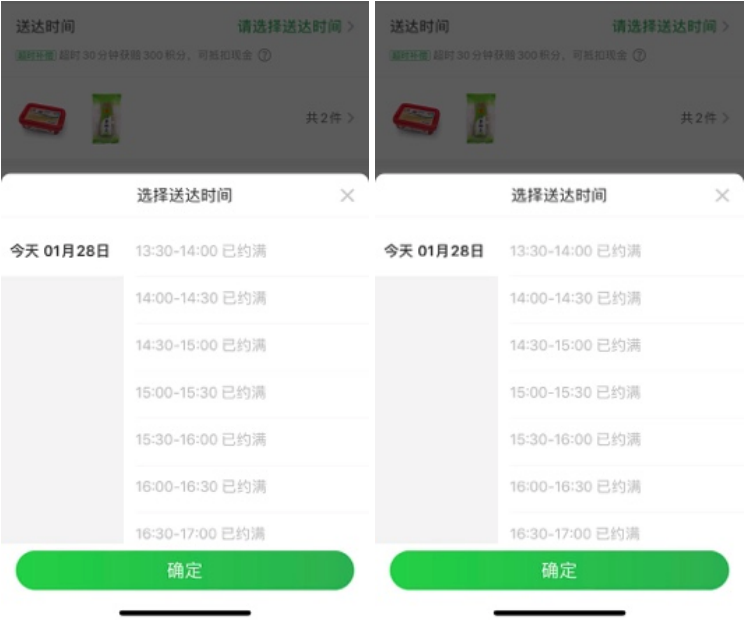

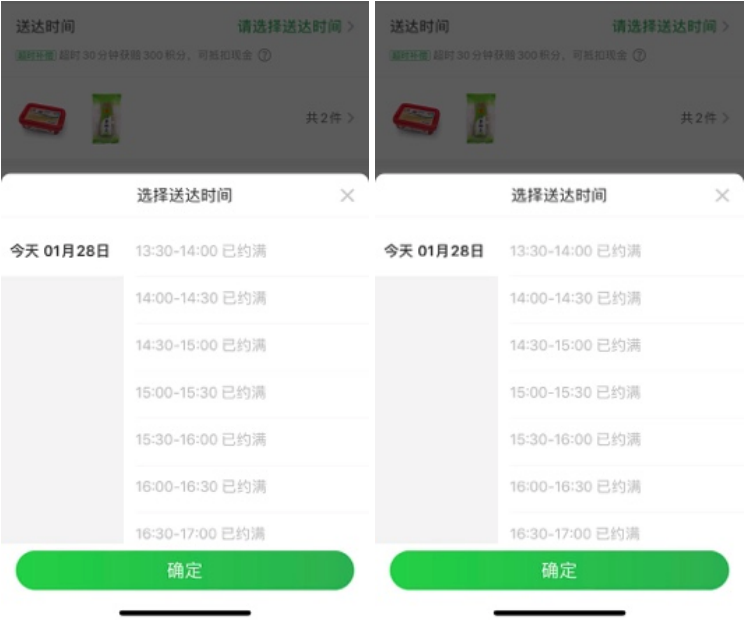

Source: Apple’s App Store[/caption] [caption id="attachment_107323" align="aligncenter" width="420"] The Dingdong Buy app showed that delivery slots were “fully booked” in the few days following January 27, 2020

The Dingdong Buy app showed that delivery slots were “fully booked” in the few days following January 27, 2020

Source: Dingdong Buy app[/caption] Faced with these challenges, some retailers launched direct-to-consumer grocery bundles and community group-buy grocery bundles, which comprise a predetermined selection of products. For example, retail chain CR Vanguard stated that it analyzed consumption behaviors and crunched big data about consumers in various local areas, in order to design bundles that most suited local needs. Bundles began to emerge on the market in February, and those first launched were mostly fresh vegetables; retailers later added fruit bundles as well as options for egg and meat bundles. [caption id="attachment_107324" align="aligncenter" width="420"] CR Vanguard launched “Love To Home” bundles

CR Vanguard launched “Love To Home” bundles

Source: CR Vanguard WeChat official account[/caption] Direct-to-consumer bundles have been made available by retailers in offline stores as well as through online platforms. For community group-buy bundles, volunteers make orders on behalf of groups of local individuals for large quantities of product. These orders are prepared by the retailers and either picked up by the volunteers or delivered to a central location for further distribution by a “community distribution team,” comprising residence committee members, community workers and volunteers. The standardization provided by both types of bundle—versus the variability of regular online grocery orders—enable retailers to more effectively adjust to demand by preparing appropriate volumes and types of inventory in advance. This also increases efficiency in the supply chain and reduces logistics costs. Furthermore, buying bundles is advantageous for consumers, as direct delivery minimizes exposure risks and saves shoppers the time and trouble of traveling to physical stores, making product selections from diminished inventory, waiting in lines and checking out. [caption id="attachment_107325" align="aligncenter" width="520"] Community group-buy bundles: Volunteers take group orders and then distribute products among the community

Community group-buy bundles: Volunteers take group orders and then distribute products among the community

Source: Weibo[/caption] With the coronavirus having now spread to the West, we are seeing retailers in other countries follow China’s lead by launching similar grocery bundles: In the UK, major grocery retailers Morrisons and Marks & Spencer launched food-box services in late March—and both reported that the first bundles launched rapidly sold out. Retail Collaborations within Communities Retailers across China have partnered with local convenience stores, fruit vendors and gas stations to deliver product bundles, significantly improving efficiency in fulfillment logistics. For example, retailers have set up food stands selling these ready-to-take bundles inside gas stations and convenience stores. Consumers have the option of using an app or WeChat mini program (either the retailer’s or gas station’s) to place orders and schedule pickup time slots. Gas station employees are then on hand to help shoppers load their purchases into their vehicle if required, so that the consumer does not need to leave their vehicle, thus guaranteeing a contactless experience. Retailers have also worked with logistics companies such as JD Logistics to employ robots for contactless delivery services. With fewer people on the street, robots can move faster and deliver more accurately than they would in usual conditions. [caption id="attachment_107326" align="aligncenter" width="520"] JD’s delivery robot in Wuhan—the robot traveled from JD’s delivery station to Wuhan Ninth People’s Hospital to make a delivery

JD’s delivery robot in Wuhan—the robot traveled from JD’s delivery station to Wuhan Ninth People’s Hospital to make a delivery

Source: JD Corporate Blog[/caption] Implications for US Retailers With the coronavirus situation becoming more severe in the West, grocery retailers and supermarket chains may experience similar capacity and efficiency challenges. Consumer demand continues to surge in the US both online and offline, and retailers are struggling to get the orders into the hands of consumers. Following the initiatives undertaken in China, retailers could consider launching a series of direct-to-consumer bundles, which would benefit both the companies and consumers. We have already seen some retailers in Europe launch similar pre-selected food boxes. For retailers, it is a good solution to help manage inventory in response to increased consumer demand and reduce pressure on the supply chain and logistics. Product bundles can also be made available and promoted across channels—such as in physical stores, convenience stores and e-commerce platforms—thus increasing sales potential in an environment where consumers are shopping less frequently and lockdowns are increasing. Online, grocery bundles offer a more efficient alternative to the variability of regular grocery orders, where each shopper picks a unique selection of products. Furthermore, when picking up orders in store or at a collection point, consumers are able to minimize their risk of exposure to the coronavirus compared to regular in-store shopping. This is because, as we have seen in China, buying bundles shortens the shopping journey and can be done through a contactless process. As we recently noted, we expect a strong, double-digit increase in US grocery sales during the coronavirus crisis. We also anticipate that online grocery sales will approximately double. In this context, US retailers should look for ways to ease supply-chain pressures and deliver on essential needs.

A number of “to-home” apps: Dingdong Buy, JD Daojia and Meituan Buy (left to right)

A number of “to-home” apps: Dingdong Buy, JD Daojia and Meituan Buy (left to right)Source: Apple’s App Store[/caption] [caption id="attachment_107323" align="aligncenter" width="420"]

The Dingdong Buy app showed that delivery slots were “fully booked” in the few days following January 27, 2020

The Dingdong Buy app showed that delivery slots were “fully booked” in the few days following January 27, 2020Source: Dingdong Buy app[/caption] Faced with these challenges, some retailers launched direct-to-consumer grocery bundles and community group-buy grocery bundles, which comprise a predetermined selection of products. For example, retail chain CR Vanguard stated that it analyzed consumption behaviors and crunched big data about consumers in various local areas, in order to design bundles that most suited local needs. Bundles began to emerge on the market in February, and those first launched were mostly fresh vegetables; retailers later added fruit bundles as well as options for egg and meat bundles. [caption id="attachment_107324" align="aligncenter" width="420"]

CR Vanguard launched “Love To Home” bundles

CR Vanguard launched “Love To Home” bundlesSource: CR Vanguard WeChat official account[/caption] Direct-to-consumer bundles have been made available by retailers in offline stores as well as through online platforms. For community group-buy bundles, volunteers make orders on behalf of groups of local individuals for large quantities of product. These orders are prepared by the retailers and either picked up by the volunteers or delivered to a central location for further distribution by a “community distribution team,” comprising residence committee members, community workers and volunteers. The standardization provided by both types of bundle—versus the variability of regular online grocery orders—enable retailers to more effectively adjust to demand by preparing appropriate volumes and types of inventory in advance. This also increases efficiency in the supply chain and reduces logistics costs. Furthermore, buying bundles is advantageous for consumers, as direct delivery minimizes exposure risks and saves shoppers the time and trouble of traveling to physical stores, making product selections from diminished inventory, waiting in lines and checking out. [caption id="attachment_107325" align="aligncenter" width="520"]

Community group-buy bundles: Volunteers take group orders and then distribute products among the community

Community group-buy bundles: Volunteers take group orders and then distribute products among the community Source: Weibo[/caption] With the coronavirus having now spread to the West, we are seeing retailers in other countries follow China’s lead by launching similar grocery bundles: In the UK, major grocery retailers Morrisons and Marks & Spencer launched food-box services in late March—and both reported that the first bundles launched rapidly sold out. Retail Collaborations within Communities Retailers across China have partnered with local convenience stores, fruit vendors and gas stations to deliver product bundles, significantly improving efficiency in fulfillment logistics. For example, retailers have set up food stands selling these ready-to-take bundles inside gas stations and convenience stores. Consumers have the option of using an app or WeChat mini program (either the retailer’s or gas station’s) to place orders and schedule pickup time slots. Gas station employees are then on hand to help shoppers load their purchases into their vehicle if required, so that the consumer does not need to leave their vehicle, thus guaranteeing a contactless experience. Retailers have also worked with logistics companies such as JD Logistics to employ robots for contactless delivery services. With fewer people on the street, robots can move faster and deliver more accurately than they would in usual conditions. [caption id="attachment_107326" align="aligncenter" width="520"]

JD’s delivery robot in Wuhan—the robot traveled from JD’s delivery station to Wuhan Ninth People’s Hospital to make a delivery

JD’s delivery robot in Wuhan—the robot traveled from JD’s delivery station to Wuhan Ninth People’s Hospital to make a deliverySource: JD Corporate Blog[/caption] Implications for US Retailers With the coronavirus situation becoming more severe in the West, grocery retailers and supermarket chains may experience similar capacity and efficiency challenges. Consumer demand continues to surge in the US both online and offline, and retailers are struggling to get the orders into the hands of consumers. Following the initiatives undertaken in China, retailers could consider launching a series of direct-to-consumer bundles, which would benefit both the companies and consumers. We have already seen some retailers in Europe launch similar pre-selected food boxes. For retailers, it is a good solution to help manage inventory in response to increased consumer demand and reduce pressure on the supply chain and logistics. Product bundles can also be made available and promoted across channels—such as in physical stores, convenience stores and e-commerce platforms—thus increasing sales potential in an environment where consumers are shopping less frequently and lockdowns are increasing. Online, grocery bundles offer a more efficient alternative to the variability of regular grocery orders, where each shopper picks a unique selection of products. Furthermore, when picking up orders in store or at a collection point, consumers are able to minimize their risk of exposure to the coronavirus compared to regular in-store shopping. This is because, as we have seen in China, buying bundles shortens the shopping journey and can be done through a contactless process. As we recently noted, we expect a strong, double-digit increase in US grocery sales during the coronavirus crisis. We also anticipate that online grocery sales will approximately double. In this context, US retailers should look for ways to ease supply-chain pressures and deliver on essential needs.