Nitheesh NH

What’s the Story?

The Covid-19 pandemic has significantly accelerated the growth of e-commerce and therefore demand for delivery. This report provides an overview of how e-commerce platforms around the world (e.g., Amazon, Alibaba, Flipkart and JD.com) are upgrading their logistics capabilities to meet increasing demand. Regions covered include China, India, Southeast Asia and the US.Why It Matters

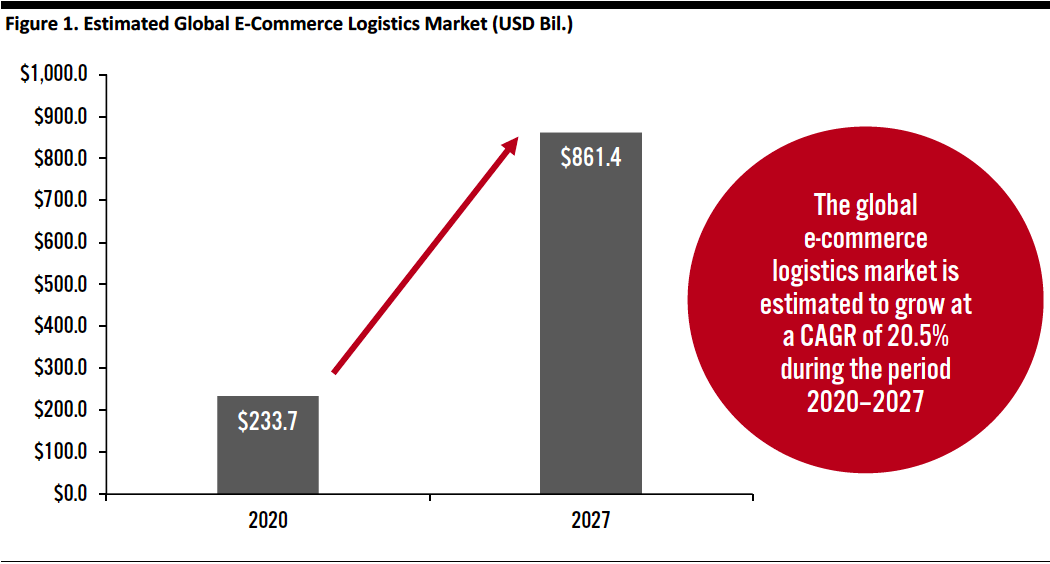

Upgrading logistics is an essential task for e-commerce companies. The booming global e-commerce logistics market—which includes spending on transportation services, warehousing and distribution services by businesses—is estimated to grow at a CAGR of 20.5% during the period 2020–2027, according to research firm Global Industry Analysts. This estimate was made after the start of the coronavirus pandemic. Market growth is primarily driven by the following factors:- The upsurge in online shopping—More customers turned to online shopping during the pandemic, and this shopping behavior is likely to be sustained post-Covid.

- Increasing cross-border e-commerce activities—Cross-border e-commerce had risen before the outbreak of Covid-19 and has continued to grow during the pandemic due to travel restrictions.

Estimates for 2020 and 2027 were made in 2020 with consideration of the impact of the coronavirus pandemic

Estimates for 2020 and 2027 were made in 2020 with consideration of the impact of the coronavirus pandemicSource: Global Industry Analysts[/caption] The coronavirus outbreak has significantly accelerated the growth of e-commerce. Coresight Research’s weekly surveys of US consumers regularly confirm that a substantial share of US consumers (i.e., over one-quarter) expect to retain the habit of shopping more online and less in stores after the crisis ends—although the incremental recovery of store-based sales indicates that we will ultimately see only partial retention of sales in the online channel. With the surge in online orders, keeping inventory stocked and having enough staff to manage fulfillment has been a challenge for many brands and retailers. In addition, delivery companies’ capacity constraints in shipping/fulfillment is evident.

E-Commerce Platforms Upgrade Logistics: A Deep Dive

Logistics serves as an important part of e-commerce platforms’ ecosystems to provide consumers with smooth shopping experiences. We have seen e-commerce platforms gear up to offer efficient delivery services through a large fulfillment network. Moreover, while retail companies have traditionally relied on major third-party shipping carriers for much of their delivery services, e-commerce platforms have led the way in taking ownership of last-mile delivery. Figure 2. An Overview of Fulfillment Capacity by Select E-Commerce Platforms [wpdatatable id=602]*Through Flipkart Quick, consumers can book a two-hour delivery for around 2,000 products such as groceries and electronics Source: Company reports/Coresight Research

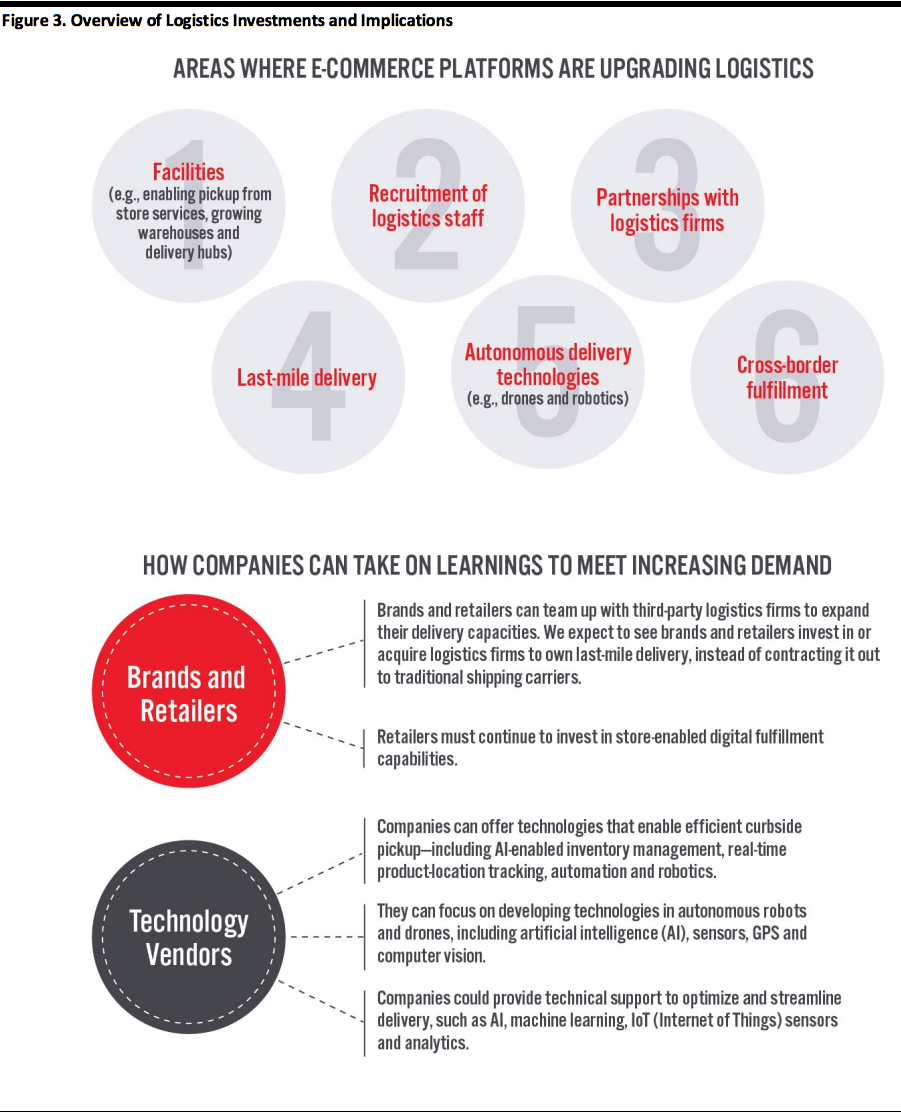

Six Key Investment Areas There are six key areas of logistics in which e-commerce platforms are investing, which we summarize in Figure 3 and discuss in more detail below. [caption id="attachment_120508" align="aligncenter" width="700"] Source: Company reports/ Coresight Research[/caption]

1. Facilities

Since the coronavirus outbreak in 2020, e-commerce platforms have focused on adding new facilities, such as pickup-from-store services, new fulfillment centers, sorting centers, specialty centers and delivery stations, to meet increasing demand for online shopping. In fulfillment centers, workers pick, pack and ship customer orders, whereas in delivery stations, orders are prepared for last-mile delivery to customers. Some e-commerce platforms, such as Amazon, also have specialty centers, which handle specific categories of items or to serve demand at peak times of the year such as the holiday season.

In Figure 4, we highlight developments in terms of new facilities for e-commerce platforms in 2020.

Figure 4. Investment in New Facilities by E-Commerce Platforms in 2020

[wpdatatable id=603]

Source: Company reports/ Coresight Research[/caption]

1. Facilities

Since the coronavirus outbreak in 2020, e-commerce platforms have focused on adding new facilities, such as pickup-from-store services, new fulfillment centers, sorting centers, specialty centers and delivery stations, to meet increasing demand for online shopping. In fulfillment centers, workers pick, pack and ship customer orders, whereas in delivery stations, orders are prepared for last-mile delivery to customers. Some e-commerce platforms, such as Amazon, also have specialty centers, which handle specific categories of items or to serve demand at peak times of the year such as the holiday season.

In Figure 4, we highlight developments in terms of new facilities for e-commerce platforms in 2020.

Figure 4. Investment in New Facilities by E-Commerce Platforms in 2020

[wpdatatable id=603]

Source: Company reports/Coresight Research

Amazon’s above-mentioned intensive logistics investments have been driven by its growing sales—the company’s net sales increased by 37% year over year to $96.1 billion in the third quarter of 2020, versus 40.2% growth in the second quarter. Amazon’s introduction of a one-hour grocery pickup service for Prime members at Whole Foods locations in the US reflects growing consumer demand for collecting groceries from stores. Our September 2020 US consumer survey highlights that a significant proportion of shoppers are collecting online grocery orders from stores—on average, survey respondents collected 68% of their online grocery orders from stores this year. In India, Amazon ramped up its effort to cater for strong online sales performance during the festive season (October 15¬–November 15). The festive season in India reportedly generated $8.3 billion in online sales, representing 65% year over year growth, according to research firm RedSeer. Flipkart held its Big Billion Days event between October 16 and October 21, and Amazon kicked off its Great Indian Festival event on October 17. In China, JD Logistics’ launch of a new warehouse/logistics park in Langfang, Hebei province, reflects its plan to better serve Tier 2 and Tier 3 markets, which represents a major opportunity for post-pandemic economic recovery. Online retail sales of physical goods in lower-tier markets will amount to an estimated ¥8.1 trillion (around $1.25 trillion) in 2025—representing a CAGR of 18.3% from 2018 and accounting for around 45% of total online retail sales in China, according to Xingye Research. These estimates were made before Covid-19, but it is likely that lower-tier markets will become increasingly important for boosting growth in a post-Covid economy. 2. Recruitment of Logistics Staff Companies are increasing their hiring efforts to ensure that they have enough staff to manage fulfillment, including pickers, packers, sorters, couriers and drivers. In order to reduce costs, not all companies are hiring e-commerce and logistics staff on a full-time basis. Amazon reported that the company hired over 175,000 new employees in March and April in the US, 125,000 of which will be offered regular full-time positions. In India, major e-commerce companies, such as Amazon, BigBasket and Flipkart, are employing different pay models to cut down on liabilities, such as lowering fixed costs (i.e., pay) per staff member. The cost per staff member hired for these companies has decreased by 10 to 20%, according to employee management firm Betterplace. Figure 5. Recruitment for Logistics Staff at Selected E-Commerce Platforms [wpdatatable id=604]Source: Company reports/Coresight Research

3. Partnerships with Logistics Firms E-commerce companies in China have strategically invested in logistics firms, which will enable them to have more control over outsourced delivery services.- Alibaba Increases Stake in Logistics Firm YTO Express

Source: Company reports/Coresight Research

- JD.com Acquires Majority Stake in Kuayue

Source: Company reports/Coresight Research

In the US, around 67% of consumers believe that inventory visibility across stores, online and on mobile phones is an important service, according to supply chains solutions provider enVista. With Amazon’s MapTracker, customers can track their orders easily—they are notified via text message or email when a package is delivered at their residence or alternative pickup location, such as an Amazon locker. Investment in launching small storage facilities, collection points and lockers in close proximity to consumers will help e-commerce companies to decrease delivery times. For instance, companies can leverage purchase data to predict what consumers will order based on their previous shopping history and then stock these products in the relevant storage locations, enabling faster delivery. 5. Autonomous Delivery Technologies E-commerce companies and logistics firms are increasing their usage of autonomous delivery technologies such as drones and robots. Automatic delivery technologies are expected to generate $33–48.4 billion in revenue globally by 2030 and account for approximately 20% of all parcel deliveries, according to research firm Lux Research. Figure 8. Investments in Autonomous Delivery Technologies by E-Commerce Platforms [wpdatatable id=607]Source: Company reports/Coresight Research

- Drones

- Autonomous Delivery Robots

What We Think

Driven by e-commerce acceleration amid the Covid-19 pandemic, the global e-commerce logistics market is estimated to grow at a CAGR of 20.5% during the period 2020–2027, according to research firm Global Industry Analysts. All companies selling online will likely need to consider investing in and upgrading their logistics capabilities. Implications for Brands/Retailers- Multicategory retailers are likely to prioritize investment in fulfillment centers, compared to other fulfillment facilities such as delivery stations or return centers: Among the 81 logistics facilities that have been built or are still to be built in 2020 in the US by Amazon, more than half (45) are fulfillment centers.

- Brands and retailers can choose to team up with third-party logistics firms to expand their delivery capacities. They can also invest in or acquire logistics firms to own last-mile delivery, which plays a significant role in improving customer experiences throughout the logistics process. As major retailers seek to compete effectively with e-commerce firms, we envisage that they will increasingly look to own last-mile delivery services internally, marking a shift away from the traditional reliance on third-party shipping carriers.

- With the increase in cross-border purchases, companies will need to invest in cross-border fulfillment, such as increasing chartered flights, partnering with air-freight carriers or expanding their overseas warehouse space.

- Brands and retailers need to enhance visibility and security in last-mile delivery, as shoppers increasingly expect up-to-date information on the delivery process, from in-transit status to final arrival date. Retailers can also develop visibility tools or invest in collection points or lockers within close proximity to consumers to reduce delivery times.

- Retailers must continue to invest in store-enabled digital fulfillment capabilities—such as BOPIS (buy online, pick up in store), curbside pickup, rapid delivery or ship-from-store. Retailers faced with surging online sales and dwindling store traffic can consider partial or full conversions of store spaces to fulfillment centers—akin to the “dark store” model used in the online grocery space.

- Brands/retailers can adopt autonomous delivery technologies, such as drones and delivery robots to improve efficiency and reduce costs in the long term. It is worthwhile to mention that there is still a space for growth in the use of drones for logistics, as large-scale drone operations are not likely to be up and running in the short term.

- Companies can offer technologies that enable efficient curbside pickup—including AI-enabled inventory management, real-time product-location tracking, automation and robotics.

- Technology vendors can focus on the developing capabilities of autonomous robots and drones, including AI, sensors, GPS and computer vision.

- Companies could provide technical support to optimize and streamline delivery, such as AI, machine learning, IoT sensors and analytics.