albert Chan

What’s the Story?

As part of our E-commerce Outlook series, we examine the size and trajectory of the US grocery e-commerce market. We also detail the online grocery market’s competitive landscape, retail innovators, and three themes we are watching in 2021 and beyond.

E-Commerce Performance and Outlook

US Online Food and Beverage Market Performance and Outlook

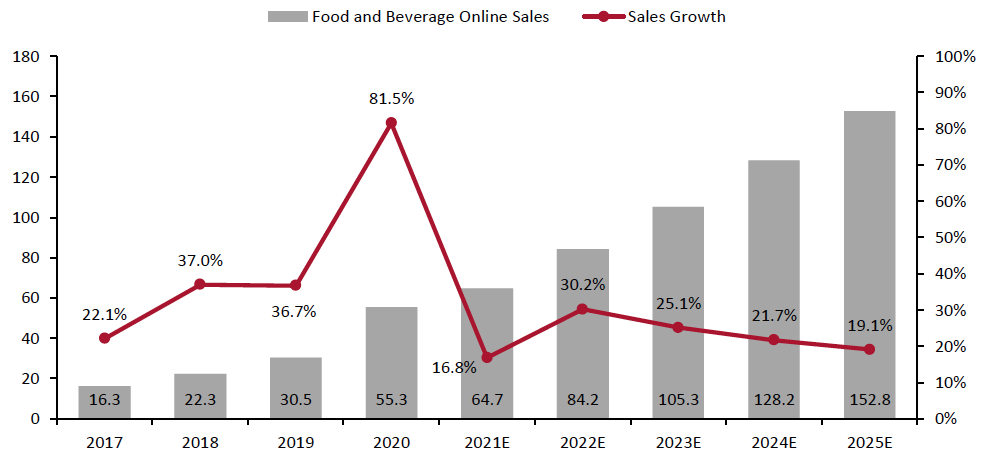

The penetration of e-commerce into the grocery space has lagged behind most other retail sectors, but the pandemic shook this status quo by fueling a dramatic acceleration in online grocery growth. We estimate that US food and beverage e-commerce sales grew to $55.3 billion in 2020, up 81.5% year over year.

The outlook for 2021 remains uncertain: rising infection rates could yet fuel a further acceleration in grocery e-commerce. However, we do not anticipate a repeat of the early Covid-era surge; the online grocery market will still be impacted by the ongoing recovery of on-premise consumption and consumers’ return to in-store shopping.

Considering these factors, we estimate the market will slow to 16.8% growth in 2021. That said, the slowdown in growth will be temporary, and partly a function of the demanding comparatives from 2020. In the longer term, channel stickiness from the pandemic will support solid online growth. According to Coresight Research’s annual online grocery survey conducted in April 2021, over one-third of online grocery shoppers do not expect to change their online grocery shopping habits once the crisis eases or ends. Additionally, over one-quarter of shoppers said that they plan to buy groceries online more frequently after the crisis subsides than they did during the crisis.

Figure 1. US Online Food and Beverage Market: Total Sales (Left Axis; USD Bil.) and YoY % Change (Right Axis; %)

[caption id="attachment_134345" align="aligncenter" width="700"] Online sales of alcoholic beverages are not included.

Online sales of alcoholic beverages are not included.Source: IRI E-Market Insights™/Coresight Research[/caption]

Key Market Driver: Engrained Online Shopping Habits

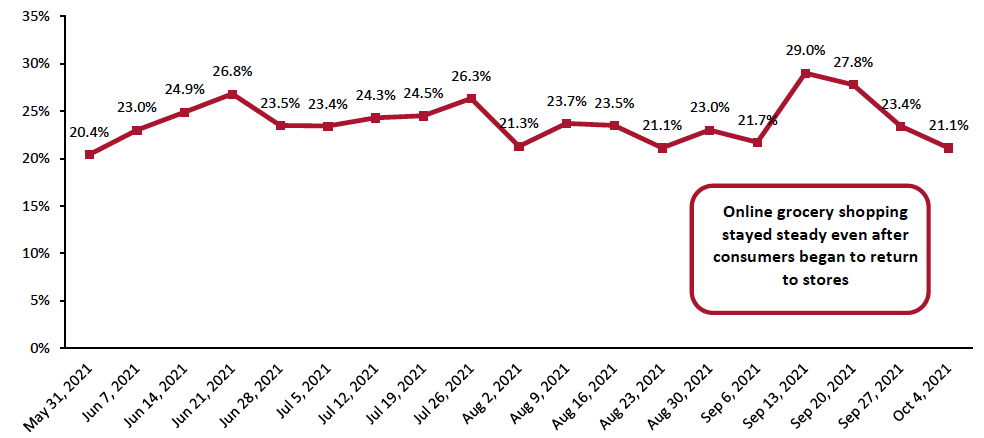

The pandemic has rapidly accelerated the e-commerce pivot, leading to a dramatic spike in online grocery shopping in 2020. Despite consumers’ gradual return to in-store shopping, many are still choosing to fill their carts virtually. Our US Consumer Tracker has consistently found that more than one-fifth of respondents are buying food online, reflecting the retention of pandemic-induced behaviors in the channel. Growing concerns over the highly transmissible Delta variant could play a role in keeping consumers shopping online, further strengthening the already resilient e-commerce channel.

Figure 2. Respondents That Have Bought Groceries Online in the Past Two Weeks (% of Respondents)

[caption id="attachment_134346" align="aligncenter" width="700"] Base: US respondents aged 18+

Base: US respondents aged 18+Source: Coresight Research[/caption]

As demand for online grocery in the US remains higher than historical norms, many grocers are investing in initiatives to improve their capabilities, including more fulfillment automation and additional capacity in pickup and delivery. Amazon, for example, continues to invest in online grocery delivery capabilities, including expanding the availability of its two-hour delivery services (from Amazon Fresh and Whole Foods Market) to more than 5,000 locations in the US. Walmart plans to spend $14 billion in the current financial year on improvements to its supply chain and technology to expand its e-commerce assortment, step up automation and enhance its grocery pickup and delivery capacity, according to the company. Kroger opened its first centralized fulfillment center with Ocado in April 2021, and has announced plans for up to 19 additional Ocado centers to fulfill its online grocery orders.

Competitive Landscape

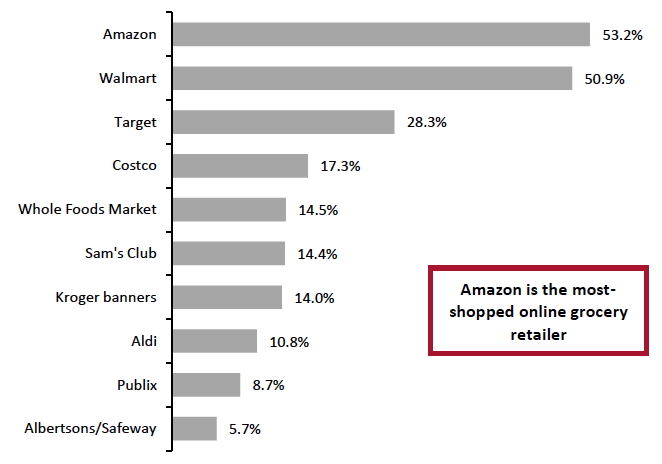

Coresight Research’s April 2021 US online grocery survey confirmed that Amazon is the most-shopped online grocery retailer, with 53.2% of respondents reporting that they bought groceries online from Amazon in the last 12 months. Walmart—the second most-shopped grocery retailer—is marginally behind, with 50.9% of online shoppers buying from the retailer.

Figure 3. Top 10 Retailers from Which Shoppers Bought Groceries Online in the Past 12 Months (% of Respondents)

[caption id="attachment_134347" align="aligncenter" width="550"] Base: 975 US respondents aged 18+ who have purchased groceries online in the past 12 months, surveyed in April 2021

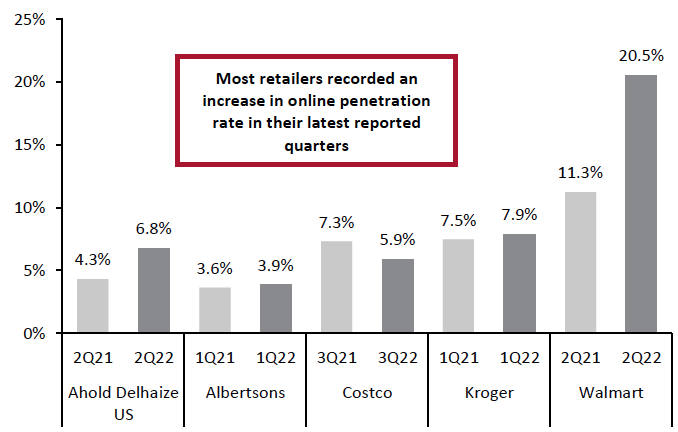

Base: 975 US respondents aged 18+ who have purchased groceries online in the past 12 months, surveyed in April 2021Source: Coresight Research[/caption] Figure 4 shows the approximate digital share of grocery revenues of selected retailers in their latest fiscal quarters, based on our calculations. All retailers except Costco recorded an increase in their online penetration rate in their latest reported quarters.

Figure 4. Approximate Digital Share of Grocery Sales at Selected Retailers in Their Latest Quarters [caption id="attachment_134348" align="aligncenter" width="550"]

Source: Company reports/Coresight Research[/caption]

Source: Company reports/Coresight Research[/caption]

E-Commerce Innovators

We expect solutions developed by retail innovators to play a significant role in catering to operational development that will drive the growth in the online grocery industry. We discuss three key innovators in this section:

ciValue

ciValue provides an AI-powered software-as-a-service (SaaS) platform that helps retailers (grocery, drug and specialty) and CPG suppliers collaborate to better understand and serve their customers. The company offers omnichannel personalization, retail media and brand collaboration and monetization services.

ciValue’s approach helps retailers provide their suppliers with aggregated market insights and identify customer segments with significant growth potential. The platform can analyze purchase history owned by the retailer and translate it into brand-oriented shopper profiling. The company also provides predefined analytical dashboards and ad-hoc query tools that enable brands to identify shopping trends early.

Fabric

Israel-based Fabric provides micro-fulfillment center (MFC) solutions designed to improve online fulfillment speed from a small footprint. Through robotic automation, Fabric allows retailers to reduce costs and cut fulfillment times.

Fabric offers partners a choice of two deployment models:

- A platform model, in which Fabric builds a private network of sites for partners that retailers can operate and run independently.

- A service model, in which Fabric builds and operates its own MFCs and leases the space inside the facility to retailers, requiring minimal capital expenditure from the retailers.

In July 2021, Fabric partnered with delivery provider Instacart to offer MFC solutions to grocery retailers in the US and Canada. Under the deal, Fabric software and robotics will be paired with Instacart front-end e-commerce technology to provide faster, more efficient fulfillment at dedicated warehouses and existing retailer spaces.

Fabric also partnered with FreshDirect to build a 10,000-square-foot facility, which became operational in January 2021 and is capable of processing 700–1,000 orders per day. Walmart announced a partnership with Fabric in January 2021, which will help the retailer to build local fulfillment centers. Fabric’s own MFC in Brooklyn launched in November 2020 and the innovator anticipates having 100 global MFCs operational by the end of 2022.

Store.ai

Store.ai provides e-commerce platform solutions designed to facilitate end-to-end online grocery services. It offers a picking tool that maps in-store fulfillment, a digital storefront for retailers and integration with micro-fulfillment providers.

Store.ai raised $21 million in an extended Series A round in March 2021. The company said it will use the capital to integrate next-generation features into its core offering, accelerate its growth in North America, and enter new markets in Latin America and Europe, helping grocery stores adapt to an increasingly digitized market.

Themes We Are Watching

Inflation

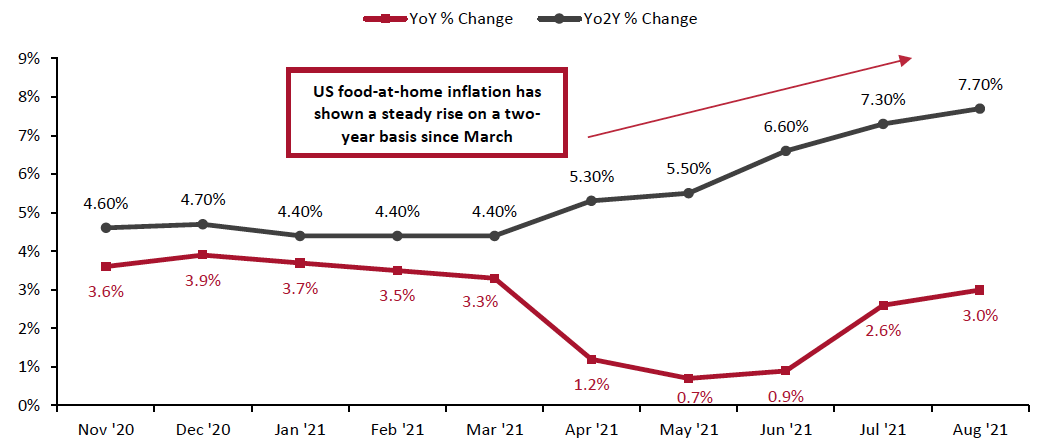

As the US economy recovers, prices for grocery goods continue to rise. According to the latest data available from Bureau of Labor Statistics, the food-at-home CPI grew further in August, increasing 3.0% year over year. Prices for meat, poultry and fish surged 7.9%, including a 9.8% jump for pork items.

On a two-year basis, food-at-home inflation was steady since November, at around 4%. However, from March 2021, it has been trending upward. This may prove to be a dominant theme over the next six months, including the holiday season.

Figure 5. US Consumer Price Inflation for Food at Home

[caption id="attachment_134349" align="aligncenter" width="700"] Source: BLS/Coresight Research[/caption]

Source: BLS/Coresight Research[/caption]

The recent rise in food costs can be attributed to many factors, including supply chain issues, fuel costs and labor shortages. Gas prices have risen dramatically, stoking concerns around inflation. According to the US Energy Information Administration, gas prices have now risen for seven consecutive months, to $3.27 per gallon as of the end of September—an increase of 48.7% or $1.07 per gallon since November 2020, and 12.9% or $0.37 per gallon since March 2021. In addition, average hourly wages across all private-sector employees rose to $30.85 in September 2021, according to the Bureau of Labor Statistics, up 4.6% from September 2020. Companies including Amazon, Kroger and Walmart have recently announced wage rises and signup bonuses.

Grocery chains, so far, have strategically passed on price rises in categories and to shoppers best able to absorb them. In its first-quarter 2021 earnings call, Kroger CEO Rodney McMullen stated that the company performs best when inflation is 3–4%. He added that Kroger can pass costs on to consumers when inflation hovers around that mark and “customers don’t overly react to that.” Albertsons CEO Vivek Sankaran also stated in the company’s first-quarter 2021 earnings call that the company had performed well in periods when inflation was at 3–4%.

However, there is a risk for grocery stores if inflation runs too high. Consumers may purchase less, trade down to cheaper brands or migrate to hard discounters if inflation continues to rise. Raising prices effectively without alienating shoppers will require retailers to monitor product price elasticity across channels and tailor revenue management strategies accordingly to maximize sales and margins.

Superfast Grocery Delivery

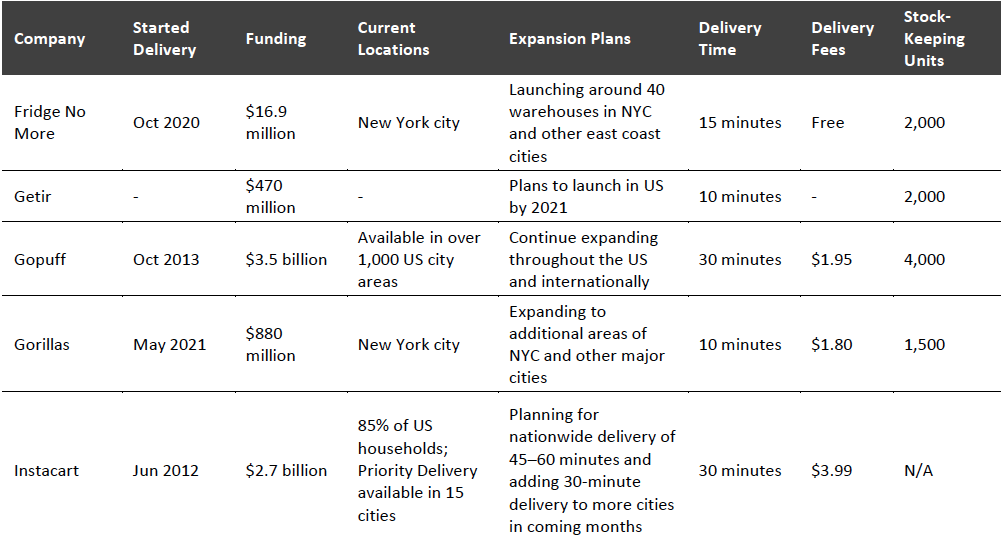

The grocery delivery landscape is changing, with demand for faster delivery growing in the US and beyond. In the last 12 months, many supermarkets established partnerships with takeaway food delivery operators (such as Doordash and Uber) and hyperlocal providers (such as Instacart and Shipt) in order to offer rapid delivery in less than two hours. Over the same period, the market also saw the rise of a new breed of instant-commerce startups, including Fridge No More and JOKR, that have aggressively launched operations in the US with the promise of 10–15-minute grocery deliveries. These join longstanding vertically integrated instant-commerce player Gopuff, which was established in 2013 and has expanded to hundreds of MFCs.

Instant-commerce operators build their own hyper-local, delivery-only fulfillment centers (also known as dark stores) and remove intermediaries from the distributor-warehouse-supermarket supply chain. They typically carry a product assortment of 1,000–2,000 goods (although some offer up to 4,000)—much less than the 15,000–20,000 in an average grocery store.

Nearly all of these superfast grocery delivery platforms have raised significant capital in seed or sequential financing rounds since the beginning of the year. Gopuff raised $1.15 billion in March and another $1 billion in July, pushing its valuation to $15 billion; Gopuff has attracted by far the most funding ($3.5 billion in total) in this sector. In March 2021, Fridge No More closed a $15.4 million Series A funding round, while JOKR raised $170 million in its Series A round in July. These developments point to a change in investment: Venture capitalists are increasingly seeking to invest in more capital-intensive businesses rather than gig-based models.

Demand for faster delivery has galvanized hyperlocal delivery providers to adapt their offering to compete: Instacart has launched a new “Priority Delivery” option allowing for delivery in as little as 30 minutes.

Figure 6. Comparison of Superfast Grocery Delivery Providers in the US

[caption id="attachment_134350" align="aligncenter" width="700"] Source: Company reports/Coresight Research[/caption]

Source: Company reports/Coresight Research[/caption]

Given their nascent nature and lack of scale, new entrants in this space are still loss-making, having offered discounts to attract customers and made investments in real estate, marketing and technology. However, more-established Gopuff has highlighted that it has achieved profitability in cities where it has been operating for more than 18 months.

Retail Media

Traditionally, “retail media” refers to advertising placements within brick and mortar retail locations. In current parlance, retail media refers to advertising within retailer-owned digital properties, including its app and e-commerce websites.

With the rise in e-commerce amid the pandemic, retail media is emerging as a promising category for digital advertising. It allows retailers to develop closer ties with CPG suppliers, monetize the traffic already coming to their e-commerce site or app and offset the higher operating expenses associated with online fulfillment. CPG brands seeking to develop their visibility throughout consumers’ purchasing journey are also increasingly turning to retail media to influence the customer at the digital point of sale.

Amazon spearheaded this trend by taking advantage of its massive audience and offering sponsored products and other promoted marketing on its platform. Those incremental advertising dollars have a high drop-through to the bottom line and allow Amazon to continue to invest in price and service capabilities.

Walmart, Kroger and Albertsons are among the major retailers to roll out media platforms, either by partnering with third-party media agencies or developing their own in-house. In January 2021, Walmart announced an expanded version and rebrand for its media business, Walmart Connect (formerly known as Walmart Media Group). Kroger launched retail media solution Kroger Precision Marketing in 2017 under its 84.51° data science subsidiary. Albertsons, meanwhile, has developed Albertsons Performance Media in partnership with third-party provider Quotient.

In addition to retailers, on-demand grocery delivery providers have also joined the retail media fray, as they seek additional revenue streams. In May 2020, Instacart launched an advertising program that CPG brands can use to promote their products on Instacart’s website and app. The self-service tool provides advertisers with the option to have their products “Featured” and ranked highest in Instacart searches. In June 2021, Gopuff teamed up with retail media solutions provider CitrusAd to launch Gopuff Ad Solutions. The new feature enables the delivery provider to monetize its digital shelf-space by allowing brand partners to run media placements of sponsored products.

CPG brands are also attracted by this form of advertising as an effective way to capture online sales, since interest from shoppers who are browsing e-commerce sites can be converted into sales with minimum friction. Additionally, platforms can offer in-depth shopper data, which the brands can use to develop segmented and targeted campaigns with much higher conversion rates than traditional media advertising. According to Inmar Brand Survey, around 66% of CPG companies plan to run a media campaign with a retail media network in 2021.

Better access to valuable shopper data is also an incentive driving US grocery retailers’ increasing adoption of e-commerce subscription programs—another field in which Amazon has led the way.

We believe retail media will increase in importance as consumers continue to shift their shopping habits online. The advertising solution can benefit all parties involved, with shoppers profiting from personalized offers, CPG companies experiencing increased brand awareness and a higher return on their advertising spend, and retailers garnering increased product sales and an alternative source of revenue.

What We Think

The grocery e-commerce market will continue to grow, driven by consumers’ retention of newly developed online shopping habits and retailers’ ongoing investments in e-commerce infrastructure. Retailers should look to improve online shopping experiences, including making apps and websites easier to use, providing friction-free last-mile services and taking measures to strengthen and reorient their supply chains in the face of ongoing challenges.

Implications for Retailers

- As more retailers join the retail media bandwagon, competition for CPGs’ advertising budgets will increase, underscoring the need to provide brands and advertisers with a valuable data and greater ROI. Retailers should ensure they provide efficient workflows, greater access to data and more accurate measurement with their retail media solutions.

- Regional grocers who rely solely on delivery-provider marketplaces such as Instacart are excluded from the benefits of retail media. By developing their own e-commerce websites and digital capabilities they can take advantage of this advertising channel and grow new revenue streams.

- Due to the inflationary environment, retailers should fine-tune their assortment by strengthening both premium and value offerings. To cater to low-income shoppers, retailers must ensure adequate opening price points and value products—while also driving sales of premium products to shoppers who can spend more on CPG products. Armed with segmented customer data, retailers will benefit from using promotions strategically to drive growth where there is greater price elasticity.

- With the influx of funds into the US instant grocery delivery space, the market is reaching the point of saturation, with many startups operating with the same underlying technology and offering broadly the same service. As the sector matures, we anticipate some consolidation in the market with retailers or established delivery companies acquiring the startups.

Implications for Technology Vendors

- As the pandemic prompted a surge in e-commerce, many grocers will launch retail media networks or allocate additional resources to existing their existing platforms. Technology vendors can best capitalize on this if they offer a holistic media solution including display, native ads, search and activation to help retailers monetize their digital shelf space.