DIpil Das

What’s the Story?

Although discretionary retail suffered significantly in the US in 2020, the home category fared relatively well. Notwithstanding favorable crisis-related demand in the sector, strong performance among e-commerce channels is a key driver behind the success of the home and home-improvement retailers in 2020. In this report, we discuss furniture and home-furnishings e-commerce, including how online growth is driving structural shifts within the market and the outlook for 2021 and beyond.E-Commerce Performance and Outlook

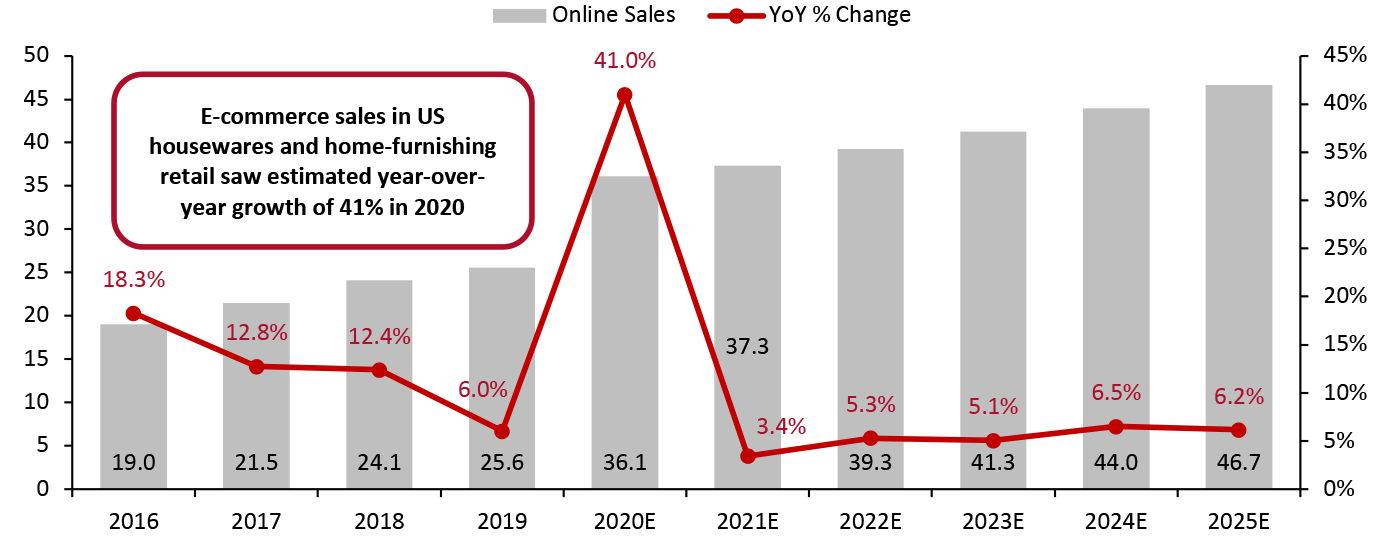

Accelerated Growth in 2020, Penetration Set To Increase Over the Longer Term Following on from steady increases in e-commerce sales from the start of the 2000’s, coronavirus-related lockdowns across the US and the ensuing changes to consumer behavior have boosted the channel’s growth within furniture and home furnishings. Various retailers, such as IKEA and Williams-Sonoma, reported significant gains in e-commerce sales, with some reporting double-digit and even triple-digit growth in recent quarters. As shown in Figure 1, we estimate that e-commerce sales of US furniture, home furnishings and housewares jumped by 41% to $36.1 billion in 2020, taking into account the historical market size from Euromonitor and 2020 data from the US Census Bureau. For 2021, we estimate low-single-digit growth that is broadly in line with our estimate for total growth in furniture and home furnishings; for 2021, we estimate that e-commerce’s share of category sales will remain approximately the same as in 2020 (see Figure 2). The category includes home furniture, furnishings and household goods such as cookware, dinnerware, floor coverings, kitchenware, lighting and soft furnishings.Figure 1. US Furniture, Home Furnishings and Housewares Online Sales (Left Axis; USD Bil.) and YoY % Change (Right Axis; %) [caption id="attachment_122690" align="aligncenter" width="725"]

The furniture, home-furnishings and housewares category includes home furniture, furnishings and household goods including cookware, dinnerware, floor coverings, kitchenware, lighting and soft furnishings.

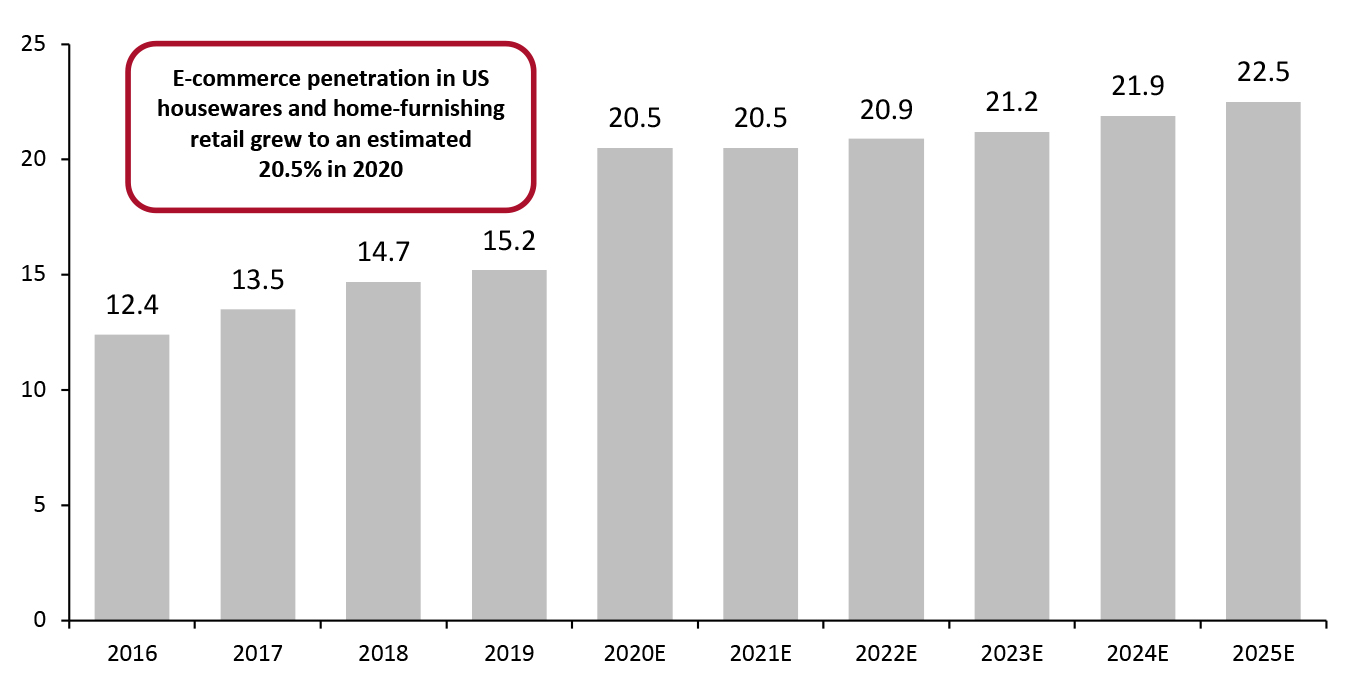

The furniture, home-furnishings and housewares category includes home furniture, furnishings and household goods including cookware, dinnerware, floor coverings, kitchenware, lighting and soft furnishings. Source: Euromonitor International Limited 2021 © All rights reserved/US Census Bureau/Coresight Research [/caption] Online sales as a percentage of US furniture, home-furnishings and housewares retail sales have climbed steadily, increasing from 12.4% in 2016 to 15.2% in 2019, according to Euromonitor. Coresight Research estimates that e-commerce sales accounted for 20.5% of total sales in 2020 and will remain at approximately that level in 2021. Thereafter, we expect the penetration rate will continue to grow, taking it to almost one-quarter of total sales by 2025. For the furniture and home-furnishings category overall (offline and online), we expect growth of around 3.4% in 2021. This compares to 6.7% growth in category spending in 2020 according to data from the Bureau of Economic Analysis. The anticipated easing in growth is against solid comparatives from 2020. In the short-term, we expect volatility in growth as we lap the lockdown period and then likely experience a post-lockdown boom. In year-over-year terms, growth is likely to be strongest in the first half of the year. Our estimate is based on the following assumptions:

- From a macro perspective, we expect the positive impact of the solid outlook for housing sales activity in 2021 to be partially offset by the fact that some of the spending in furniture and home-furnishings retail was drawn forward to 2020.

- Even as vaccination programs are being rolled out, the coronavirus crisis is likely to keep consumers at home more in 2021 than pre-crisis. The vaccination programs are likely to span many months, by which point, already established working-at-home and learning-at-home practices will be even more entrenched, which will support demand for home furniture.

- On the assumption that exceptional demand will ease off, the performance of the furniture and home-furnishings category is likely to be more closely tied to cyclical economic forces in 2021 than it was in 2020.

Figure 2. US Furniture, Home Furnishings and Housewares Online Sales as a Percentage of Total Sales [caption id="attachment_122691" align="aligncenter" width="725"]

Source: Euromonitor International Limited 2021 © All rights reserved/Coresight Research[/caption]

Source: Euromonitor International Limited 2021 © All rights reserved/Coresight Research[/caption]

Online Market Drivers

We discuss the key drivers behind growth in online sales of furniture and home-furnishings retail. Transition in Consumer Behavior From Offline to Online Buying While the adoption of e-commerce as the primary purchase channel among consumers for buying furniture and home furnishings has been growing steadily over the years since around 2000, Covid-19 has accelerated this growth, and we expect this trend to stick in 2021 and beyond. Moreover, through the use of digital platforms such as Facebook and Instagram, social commerce has enhanced online sales of furniture and home furnishings. Technological Advancements in AI, AR and VR Through the use of technology such as artificial intelligence (AI), augmented reality (AR) and virtual reality (VR), e-commerce retailers have been able to offer improved personalization and customization in catering to the needs of various consumer segments. Advancements in AR and VR technology are helping to address the absence of the “touch and feel” aspect in online shopping, by enabling customers to get a better understanding of what they are buying. The “try before you buy” experience offers prospective customers greater confidence in the product and enables e-commerce retailers to achieve greater conversion of browsers to buyers. Working from Home With a large consumer base still predominantly working from home, the demand for office furniture and other home decor items has gone up. Online furniture and home-furnishing retailers are reaping the benefits of this shift in consumers’ working environments and many have expanded the range of work-from-home furniture that they offer. Increased Leisure Time Spent at Home Consumers are also spending more time at home, in relation to lockdown requirements, social distancing precautions, travel restrictions and increased closures among stores and facility closures. As such, beyond purchases related to working from home, consumers are also investing in decorating and improving their home surroundings. In the current context of the pandemic, many consumers are choosing online shopping options over brick-and-mortar stores. These lifestyle changes have become a key driver for e-commerce sales in the sector and we expect the trend to stick over the medium-term. Shift in Consumer Spending Toward Products over Services Given the current social distancing norms in the coronavirus-impacted environment, consumers appear to be spending money on products. Products within the home category, including furniture and home furnishings, are significant beneficiaries of this trend.Competitive Landscape

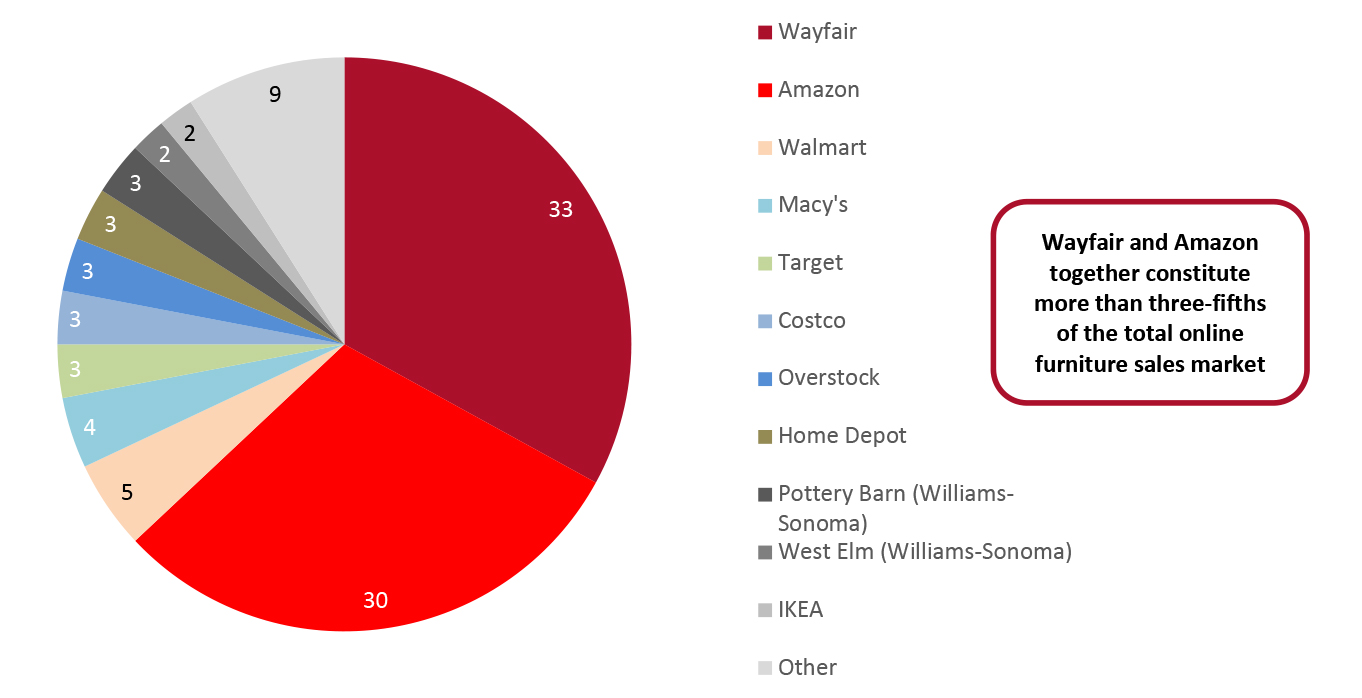

According to data analytics firm 1010data, e-commerce specialists Wayfair and Amazon together accounted for 63% of total online furniture sales in the US in 2019. Within this, Wayfair accounted for approximately 33% of total online furniture sales while Amazon accounted for around 30%. This market share represented a slight shift versus 2018—Amazon was previously the market leader with a share of approximately 31%, while Wayfair followed closely behind with a market share of around 28%. Walmart had the third-highest online market share in 2019, at 5%. Williams-Sonoma banners Pottery Barn and West Elm together constitute a 5% market share of US online furniture retail.Figure 3. Market Share of Leading US Online Furniture Retailers in 2019 (%) [caption id="attachment_122692" align="aligncenter" width="725"]

Source: 1010Data[/caption]

In this section, we profile and compare three major furniture and home-furnishings retail specialists— IKEA, Wayfair and Williams-Sonoma—all of which have a strong market share in the online furniture market. We also touch upon non-sector specialist Amazon as it accounts for a sizeable share of the online furniture market.

Source: 1010Data[/caption]

In this section, we profile and compare three major furniture and home-furnishings retail specialists— IKEA, Wayfair and Williams-Sonoma—all of which have a strong market share in the online furniture market. We also touch upon non-sector specialist Amazon as it accounts for a sizeable share of the online furniture market.

Figure 4. Industry Landscape: A Comparison of Selected Furniture and Home-Furnishings Retailers [wpdatatable id=729 table_view=regular]

*IKEA sales growth is for the financial year 2019–2020, ended 31 August, while penetration data for the US is unavailable. **Wayfair has a retail store in Natick, Massachusetts and an outlet store in Florence, Kentucky, but total in-store sales from these outlets do not constitute a material proportion of total sales. The company also permanently shut its Natick store on December 31, 2020. The Wayfair and Williams-Sonoma metrics are as of their most recent quarters that ended September 30 and November 1, respectively. Source: Company reports

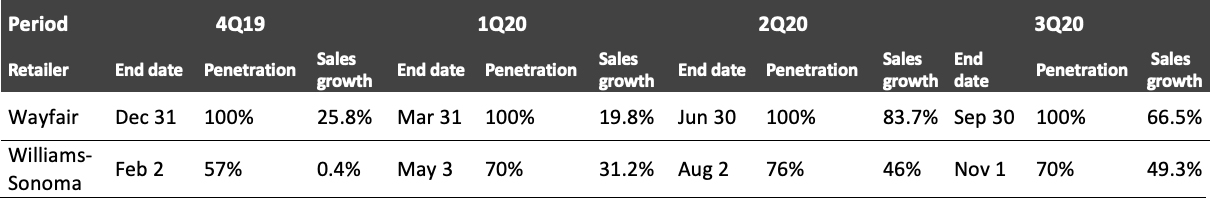

Figure 5. Industry Landscape: A Head-to-Head Comparison of E-Commerce Metrics for Wayfair and Williams-Sonoma

*Wayfair has a retail store in Natick, Massachusetts and an outlet store in Florence, Kentucky, but total in-store sales from these outlets do not constitute a material proportion of total sales. The company also announced that it shut its Natick store on December 31, 2020. Source: Company reports IKEA In its financial results for the broken financial year 2019–2020, ended August 31, Ingka Group (owner of most IKEA stores) saw its turnover decline by 4.8% to €37.4 billion ($45.5 billion) as a result of the coronavirus crisis. Its net profit also declined to €1.2 billion ($1.5 billion), versus €1.8 billion ($2.2 billion) in 2019. Although its overall revenue dipped for the financial year 2019–2020, the company registered 60% growth in online sales globally, and 32% growth in its US e-commerce business. This growth was facilitated by an acceleration in the company’s digital focus, whereby it converted many of its stores into fulfillment centers and launched click and collect services with contactless pick-up points. E-commerce accounts for 18% of the company’s total global sales as of fiscal year 2020, ended August 31, 2020. Nevertheless, there have been reports that the company still faces challenges in implementing fulfillment for its e-commerce orders. Many customers have complained that deliveries have taken more than a month to arrive and that slots for the company’s click and collect services are difficult to find, while customer care phone lines are congested. This has exposed the company’s slow embrace of e-commerce before the pandemic, which could not be fully remedied by the measures implemented amidst the crisis. The company is reportedly working on addressing these challenges, for instance by developing a new online system to enable customers to track and cancel their orders, which should reduce pressure on its customer care phone service. The company also ships some orders directly from its stores to reduce delivery times, although most of the larger furniture products continue to be shipped from distribution centers. The company also announced that it is hiring around 200 staff in the US to develop its digital capabilities toaddress its customer and market needs, while also hiring more staff for order fulfillment.

Figure 6. Summary of IKEA’s Recent E-Commerce and Omnichannel Initiatives and Key Developments [wpdatatable id=730 table_view=regular]

Source: Company reports/Coresight Research Wayfair Given the spike in online demand related to the coronavirus crisis, Wayfair has focused significant efforts on improving the efficiency of its fulfillment processes. According to CEO Niraj Shah, some of the company’s warehouses increased storage and throughput to handle the increased sales volume—introducing racking and tweaking processes to speed up sortation. Shah also said that the company is leveraging its scale to procure additional space on cargo ships for its suppliers and our suppliers, and seeing its ocean forwarding business grow considerably in the process. In its second quarter of 2020, Wayfair reported a profit for the first time since it went public in 2014—largely driven by the consumer shift toward buying home goods online. The company’s gross margin in the second quarter of 2020 was 30.7%, significantly higher than the company’s estimation of 26%. In its third quarter, Wayfair reported a profit of $278 billion. In its third quarter earnings call on November 3, 2020, the company’s management expressed confidence that it has a long runway for continued strong profitable growth ahead, even after the current circumstances pass. Wayfair CFO Michael Fleisher said that it expects strong growth for the whole of its fourth quarter–well above pre-Covid levels.

Figure 7. Summary of Wayfair’s E-Commerce and Omnichannel Initiatives and Key Developments [wpdatatable id=731 table_view=regular]

Source: Company reports/Coresight Research Williams-Sonoma Unlike many other retailers that are still in the process of scaling their online business, Williams-Sonoma has been making significant investments in its e-commerce platforms since first launching website in 1999, which has given it a distinct competitive advantage in light of the current market landscape that is seeing accelerated e-commerce growth. The company’s e-commerce business operating margin over the last 10 years has averaged above 21%. Williams-Sonoma’s net e-commerce comparable brand revenue growth rose to 49.3% in its third quarter of 2020, with online penetration rising to almost 70% of its total net revenue. The Williams Sonoma brand, which has always had a smaller online percentage compared to the retailer’s other banners such as Pottery Barn and West Elm, experienced a solid third quarter with net year-over-year comparable revenue growth of 30.4%. The company considers this to be a big opportunity to scale its e-commerce sales. In its third quarter earnings call on November 19, 2020, the company said that it will be enhancing its omnichannel capabilities, such as ship from store and buy online pickup in-store services to supplement its supply chain fulfillment capacity. During the holiday season, the company estimated that its omnichannel services fulfilled up to 20% of its expected total DTC sales volume. The company also highlighted in the call that it has acquired new customers in its digital channels at a rate of over 30% year-to-date as of November 19, 2020—a considerable acceleration versus previous years. The growth in new customers via digital channels is particularly notable given that stores have historically been the key driver of new customer growth for the company. The company considers that the overall increase in new customers, which came amid limited store traffic, indicates the effectiveness of its current digital marketing strategy on new customer acquisition. As e-commerce continues to gain traction, Williams-Sonoma plans to rationalize its brick-and-mortar presence. In its third-quarter earnings call on November 19, 2020, EVP and CFO Julie Whalen said that the company plans to close a total of 40 stores in the current fiscal year ending January 31, 2021. With half of the company’s leases due for renewal in the next three years, it intends to evaluate each lease and factor in the economics of the deal as well as the capacity of the stores to enhance the brand. This is in line with the company’s long-term plan of operating with “fewer, better, more profitable stores.”

Figure 8. Summary of Williams-Sonoma’s Recent E-Commerce and Omnichannel Initiatives and Key Developments [wpdatatable id=732 table_view=regular]

Source: Company reports/Coresight Research Non-Specialist Retailers Various non-specialist retailers have reported “home” as an outperforming category in their latest quarterly earnings releases. These include Big Lots, Burlington Stores, Costco, Dollar General, Dollar Tree, Five Below, Kohl’s, Nordstrom, Ollie’s Bargain Outlet, Ross Stores, The TJX Companies and Urban Outfitters. Moreover, Macy’s, Target and Walmart, each representing a significant share of the online furniture market, noted in their respective third-quarter earnings calls that their home categories performed strongly. In recent years, Amazon has scaled up its furniture and home business significantly and furnishings have become a key product category. In November 2017, Amazon launched its first two private-label furniture brands: Rivet and Stone & Beam. In October 2018, Amazon launched its third private-label furniture brand, Ravenna Home. In 2019, Amazon introduced a VR shopping experience called Showroom on its website and app. The feature allows users to visualize furniture and home furnishings in a customizable virtual living room.

E-Commerce Innovators

Marxent Marxent Labs is an omnichannel 3D content and visual design platform that offers AR, VR and three-dimensional solutions for furniture and home goods retailers. Its “3D Cloud” platform facilitates enterprises in digitalizing and selling products and services from individual furnishings to fully designed rooms via e-commerce. The company raised $15 million in Series C funding in January this year, and announced that it will expand its 3D home design platform following funding infusion. With growing enterprise interest in solutions that can convert 2D photos and real-world objects into commercially viable 3D content, Marxent’s expansion is significant for furniture and home goods retail. Fernish Fernish is a direct-to-consumer (DTC) furniture-as-a-service company with a subscription-based rental business model. The company provides access to quality furniture with the flexibility of not having to pay full price. For a monthly subscription fee, customers can select home-furnishing products and use them for a time period of their choosing. Customers can then swap, buy or return furniture to the company at the end of the subscription period. Fernish’s unique selling point is this flexibility. The market gap that the company aims to address is furniture solutions for millennials and young professionals living in big cities. Given the impermanency of living arrangements for many consumers in this demographic, temporary access to quality products is an attractive offering. Following the outbreak of the Covid-19 pandemic, Fernish experienced a significant rise in demand for bookshelves, chairs, desks, lamps and other home office furniture and home decor items. The company decided to make long-term investments in reconfiguring its supply chain and expanding its mix of desks and other home office essentials. According to the company, as of October 2020, this reaped immediate rewards in terms of remarkable growth of 315% in office furniture rentals and 100% growth in other decorative items since mid-March. Despite the challenging economic context, Fernish managed to raise $15 million in May this year, in a Series A funding round spearheaded by Khosla Ventures, PLG Ventures and Real Estate Technology Ventures, taking its total funding to $45 million. The company has also expanded its product line by introducing new categories, such as televisions and plants, which it states are seeing significant demand. The company began selling plants in fall 2020 via a partnership with Detroit-based online plant retailer Bloomscape. Lovesac With the rapid acceleration in e-commerce sales following the outbreak of the Covid-19 crisis, product returns present a significant challenge to retailers. DTC specialty furniture retailer Lovesac has partnered with leading 3D and AR imaging e-commerce platform, Threekit, in order to reduce e-commerce product returns, while delivering a superior user experience. Last month, the retailer announced its online launch with electronics retailer Best Buy. Lovesac partnered with Best Buy last year to open shop-in-shops. As Best Buy is an established leader in innovation in the online retail space, Lovesac’s recent online launch on BestBuy.com will significantly expand the retailer’s reach significantly.Themes We Are Watching

Furniture-as-a-Service Startups Are Performing Well One business model that appears to be flourishing during the pandemic is the “furniture-as-a-service” or subscription model. Fernish for example registered 300% growth in home-office orders between mid-March and mid-May, according to Forbes. It also saw 90% growth in accessories and decorative-item sales and 75% growth in rugs, pillows, vases and bowls, while lamp rentals grew 40%. New York-headquartered furniture rental startup Feather has also seen a spike in demand, and the retailer has recently expanded its range of products under the “Home Office” category. East Coast furniture rental startup Conjure raised $9 million via a seed round in September 2020 and plans to invest the funding towards broadening its collection of home furniture and accessories, expanding its consumer base, hiring more designers and artists and widening its delivery beyond the greater New York City area. According to Co-Founder and CEO Daniel Ramirez, the company has seen more than 7.6x revenue growth in the past two years and in March 2020, it registered 3.8x growth in monthly signups. Social Commerce With consumers spending a lot more time at home, the time that they are spending on social media has also increasedWhile social commerce has so far been underutilized by retailers in e-commerce, many are realizing the immense potential that the channel has in the current environment, including platforms such as Facebook, Instagram and Pinterest. Being most relevant to lifestyle retail categories, social commerce enjoys considerable traction in the home decor category. In September 2020, Crate & Barrel launched new decor for its “Crate & Kids” segment on Pinterest, and decided to do away with its print catalog for the first time ever. The digital catalog offers bedding, furniture, lighting and toys for children’s rooms and nurseries. Shoppers can purchase by clicking the “shop the look” button on each Pinterest image. Quick and seamless purchase options are a top priority for consumers. Through social commerce, consumers can enjoy a frictionless shopping experience and a smooth transition between discovering and purchasing. We expect that retailers will invest more and increase their focus on this channel in the coming years. Handling Returns One of the major challenges digital furniture retailers face is returns—an expensive process, which often requires two-person teams to collect bulky items. Increased e-commerce penetration in sales in the current environment is accelerating the need to optimize returns logistics. In some furniture and furnishings categories, AR and VR-powered apps and services can help to minimize uncertainty around buying furniture online by offering a better perspective of prospective purchases, with regard to appearance as well as fit within home spaces. Retailers will likely continue to invest in digital tools to help online shoppers make informed decisions and drive down return rates. Lovesac’s partnership with Threekit, which we discussed in our e-commerce innovators section, is an example of solutions that retailers are adopting to minimize returns. Managing Last-Mile Delivery and Logistics Last-mile delivery and logistics are among the most complex operations in the retail supply chain. Following the outbreak of the coronavirus pandemic, challenges on this front have exacerbated. Consumer demand for faster, more secure and more visible last-mile fulfillment is driving the last-mile delivery market to expand and adapt. A key aspect of the challenge from the retailer’s point of view is in ensuring that the customer experience remains consistent and satisfactory. According to a recent study conducted by Furniture Today Strategic Insights in partnership with supply chain management company Fidelitone, some 88% of furniture retailers in the US are targeting an increase in their e-commerce sales over the next five years. Moreover, some 80% of furniture retailers are uncomfortable with assigning customer service elements to last-mile delivery partners according to the study. Wayfair is among the leading digital-first furniture retailers that prefer to rely significantly on its own last-mile facilities. As of this year, Wayfair operates around 39 last-mile delivery facilities. Developing an Effective Mobile Strategy With the steady growth of mobile shopping, shoppers are increasingly demanding smooth and seamless shopping experiences, and in an increasingly competitive market, retailers should optimize their investments in mobile apps and websites. For instance, while mobile websites offer greater audience reach and better search engine rankings, mobile apps offer a more immersive experience to shoppers through features such as alerts, personalization and push notifications. However, smartphones users tend to use certain apps frequently and delete those they use rarely. As furniture is not bought frequently, getting shoppers to download and keep a furniture-focused app could represent a challenge. To overcome these issues, retailers are investing in digital tools to enhance the appeal and user functionality of their apps and mobile websites. Overstock CEO Jonathan Johnson stated in August 2020 that the future is moving to mobile and in its third quarter earnings call on October 29, 2020, highlighted that both its second and third quarters this year saw over half of its sales come via its mobile channel. Johnson also pointed out that previously mobile has had good traffic but lagged in conversion and emphasized that the company’s efforts toward improving mobile customer experience has resulted in a significant increase in conversion, registering a 16% growth in 3Q20. AR and VR Among the key challenges that digital-first retailers face is the absence of the “touch and feel” aspect when shopping online, which is traditionally a significant factor among furniture buyers. The introduction of AR and VR has helped to address this gap, by enabling customers to get a better understanding of what they are buying through various virtual tools. The “try before you buy” experience often gives potential customers greater confidence in the product and thus helps convert browsers to buyers. While some retailers have implemented AR and VR technologies in recent years, overall it has been at the periphery in terms of widespread acceptance across the industry, given the still relative nascence of these technologies. In light of the acceleration in e-commerce sales in the sector, AR and VR have assumed greater significance within the industry landscape, and we expect many retailers to make notable investments in this area. In a furniture pilot carried out by AR software company Seek, it found out that the time that consumers spend on the site when AR was used was 26 minutes (versus nine minutes for the control group), and order size when AR was used was $1,900 (versus $1,200 otherwise). According to Jon Cheney, Founder and CEO of Seek, AR’s impact for the furniture and appliances sector will continue to grow as AR wearable devices become mainstream, and at that point retailers without AR selling capabilities will be left behind. Wayfair first invested in AR in 2016. Its mobile app has an AR-powered feature called “View in Room,” which runs on Apple’s ARKit AR platform. Shoppers can virtually place and move a selected product around in their homes from the company’s online catalog on their smartphone screens. Products can be viewed from different angles, giving users a sense of their look and appeal in the context of their homes. Wayfair expanded the app to android devices in 2018. Through its partnership with wearable-technology startup Magic Leap, Wayfair launched another AR-driven interior design app called Wayfair Spaces in October 2018. The app leverages AR and VR technology to offer shoppers an immersive experience of the room-design process. Using a Magic Leap VR headset, shoppers can view a range of 3D digital rooms curated by Wayfair stylists, and can furnish and decorate a computer-generated home environment with Wayfair furnishings. The high-tech glasses that are needed to use the app are expensive, however, and as a result, its use case has been largely limited to interior decorators and professionals—the app has not resonated as much with the average consumer. [caption id="attachment_122693" align="aligncenter" width="725"] Wayfair Spaces: Innovation in Mixed Reality

Wayfair Spaces: Innovation in Mixed Reality Source: Wayfair’s Tech blog [/caption] Williams-Sonoma’s AR app includes 3D room design and product visualization tools for its subsidiary brand Pottery Barn. When it launched in March 2017, this feature was only available on Android mobile devices that supported Google’s Tango AR technology, but Williams-Sonoma released an iOS version of the 3D Room View app later that year in November. Other digital-first furniture retailers such as Overstock have also introduced AR-based shopping apps, and the technology is slowly becoming a norm in the US industry.

What We Think

Considering the relative immaturity of the e-commerce market in furniture and home furnishings, we think that the notable acceleration in the category’s e-commerce penetration rate in 2020, although in unprecedented circumstances, is an indicator of a long runway for growth in online sales. The growth rate in e-commerce is likely to moderate sharply from the 2020 peak, but we think there is potential for close to one-quarter of sales of US furniture, home-furnishings and homeware to be online by 2025. Implications for Brands/Retailers- Competition will heat up in the e-commerce space and retailers will look to differentiate on the basis of delivering superior customer experience.

- Brick-and-mortar focused retailers will need to evolve their e-commerce and omnichannel operations in order to compete effectively for consumers’ attention and market share.

- Owing to increased sales in the e-commerce channel, retailers will need to step up their shipping and fulfillment capabilities and be prepared to handle a higher volume of returns.

- Some retailers will consider rationalizing their store footprint, and malls or shopping centers that house furniture stores may experience store closures.

- The positive outlook for e-commerce in the sector indicates opportunity for technology vendors, particularly for those specializing in AR and VR with applications for the sector.

- There are significant opportunities to work with retailers to help them enhance their digital capabilities and deliver superior online shopping experience for consumers.