albert Chan

What’s the Story?

US department store sales have been severely impacted by the Covid-19 pandemic, namely because the sector previously relied on its massive fleet of brick-and-mortar stores for nearly 75% of its revenues, we estimate. However, aligning with the wider consumer shift to e-commerce amid pandemic-led lockdowns and safety concerns, the department store sector saw huge growth in online sales.

In this E-Commerce Outlook, we explore the US department store sector’s recent online performance and future e-commerce prospects, as well the strategies that major players are implementing in the online space.

US Department Store Sector: E-Commerce Performance and Outlook

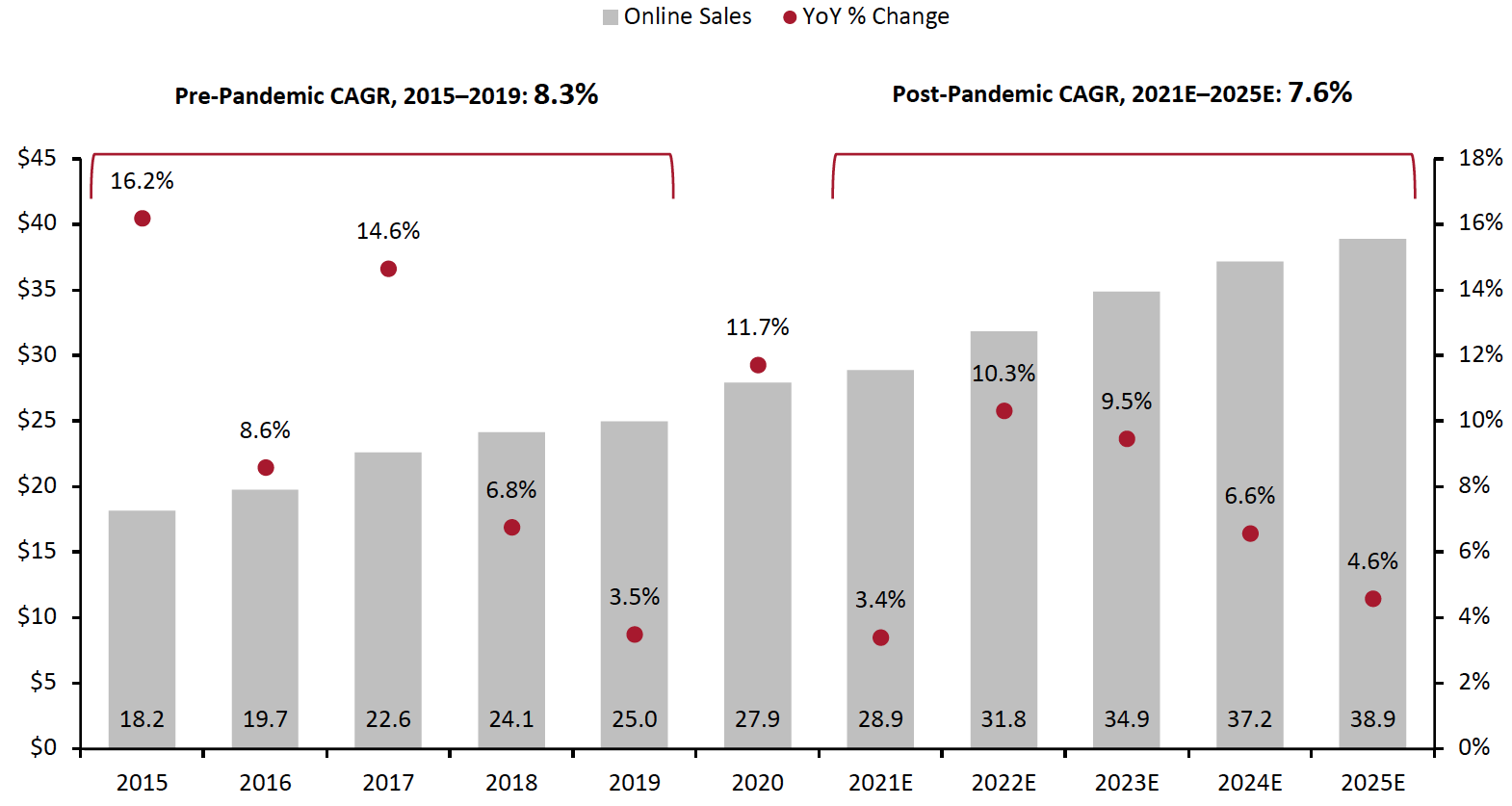

Online sales in the US department store sector were growing steadily prior to the pandemic, at an 8.3% CAGR between 2015 and 2019. Last year, a pandemic-impacted 49.1% decline in in-store sales drove a year-over-year decline in overall sector sales of 33.2%, Coresight Research estimates based on Euromonitor International data. However, e-commerce saw an 11.7% increase sales in 2020 as consumers shifted spending online (see Figure 1).

We expect e-commerce growth to moderate in 2021, to 3.4%— underperforming the 26.6% estimated growth in total sector sales—with online revenue totaling approximately $28.9 billion. Physical department store sales are expected to grow from extreme lows in 2020 of $35.9 billion to $52.0 billion in 2021, 44.6% year over year growth to account for 64.3% of department store sales in 2021. Correspondingly, e-commerce penetration in 2021 is moderating from record highs in 2020; e-commerce grew from 26.1% of total sales penetration in 2019 to 43.7% of total sales penetration in 2020. In the first- and second-quarter earnings results from the three major department store retailers in the US—Kohl’s, Macy’s and Nordstrom—reported that e-commerce penetration was below fiscal 2020 quarterly e-commerce penetration levels (which we discuss further in a later section of this report).

We expect e-commerce sales growth to accelerate in 2022, to 10.3% year over year, with the sector set to total $31.8 billion. We assume that digital acceleration will then continue as consumers will shop more online than in-store in the future. Over the next four years, we estimate that online sales in the US department store sector will grow at a CAGR of 7.6%—alongside a corresponding decline of in-store sales at a CAGR of (5.7)% over the same time frame.

Coresight Research assumes that e-commerce sales penetration will continue to grow back to the peak levels at the major department stores during 2022 and 2023, accounting for 40% to 50+% of total sales at the biggest chains. Post 2023, we project that e-commerce will continue to grow more slowly from already high e-commerce penetration rates. We project that in 2024 and 2025, the e-commerce penetration levels at the major department stores will exceed 2020 levels; these assumptions are built into our department store sector e-commerce penetration rates and growth.

Figure 1. US Department Store Sector: Online Sales (Left Axis; USD Bil.) and YoY % Change (Right Axis; %)

[caption id="attachment_134519" align="aligncenter" width="700"] Source: US Euromonitor International Limited 2021 © All rights reserved/Coresight Research[/caption]

Source: US Euromonitor International Limited 2021 © All rights reserved/Coresight Research[/caption]

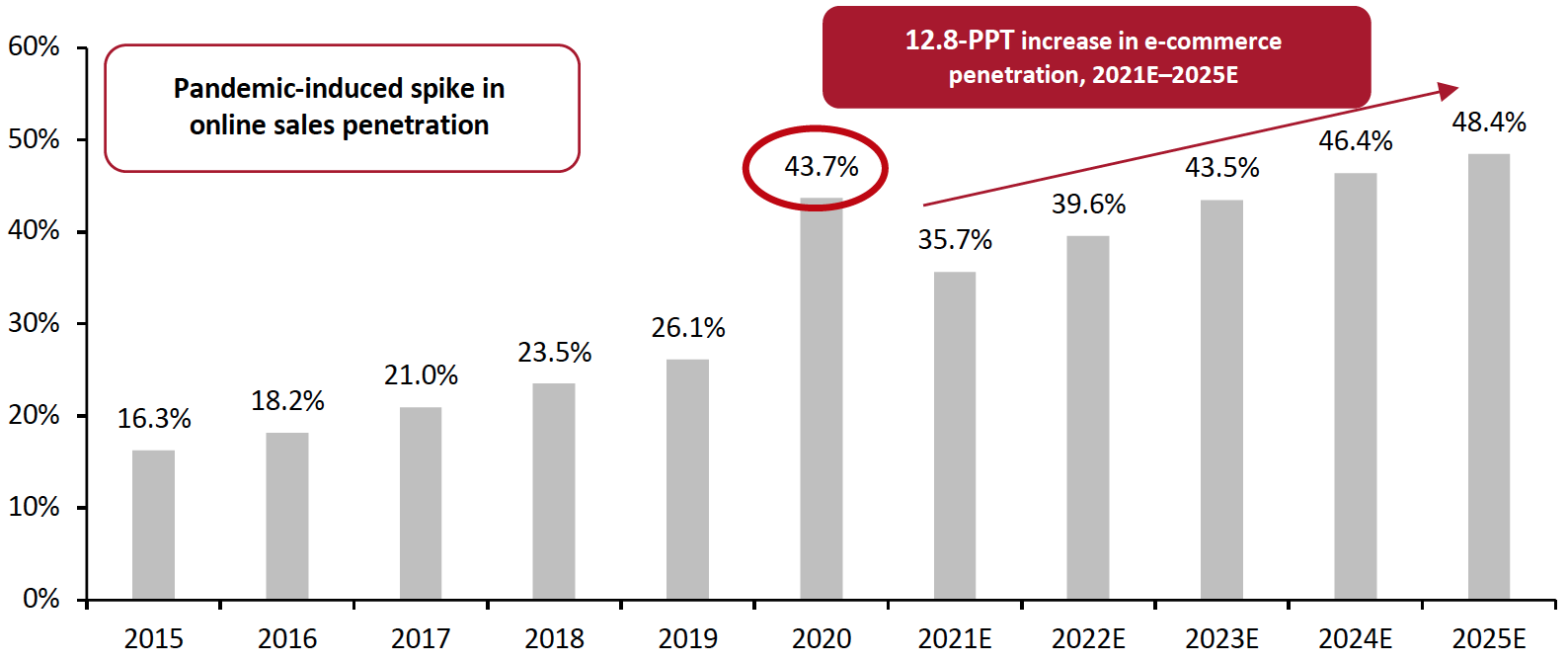

In terms of e-commerce penetration, online sales accounted for 43.7% of total department store sector sales last year—over 1.5X the level in 2019, at 26.1%—according to Coresight Research estimates based on Euromonitor International data. Combined, Kohl’s, Macy’s and Nordstrom saw e-commerce penetration increase from an average of 26.6% in fiscal 2019 to 45.1% in fiscal 2020.

We estimate that the department store sector will see e-commerce penetration drop in 2021, to an estimated 35.7% of total online sales, based Euromonitor International data.

- Kohl’s has reduced its e-commerce penetration projection for fiscal 2021 to 30% of total sales, down from 39.4% last year.

- Macy’s expects e-commerce to account for 35% of total sales in fiscal 2021, down from 44.5% in fiscal 2020.

- Nordstrom expects 50% e-commerce penetration in fiscal 2021.

Figure 2. US Department Store Sector: E-Commerce Penetration (Online Sales as % of Total Sales) [caption id="attachment_134520" align="aligncenter" width="700"]

Source: Euromonitor International Limited 2021 © All rights reserved/Coresight Research[/caption]

Source: Euromonitor International Limited 2021 © All rights reserved/Coresight Research[/caption]

Online Market Drivers

We discuss three key drivers of growth in e-commerce department store sales.

1. Sustained Shift in Consumer Shopping BehaviorStrong online growth is being supported by declining brick-and-mortar sales in the US department store sector even prior to the pandemic. The department store sector then had to adjust quickly to the pandemic-led shift to e-commerce in retail overall.

Consumers are returning to the brick-and-mortar channel as Covid-19 concerns abate; however, many shoppers are likely to retain the changed behavior of shopping online for at least some of their total spending. As the sector is typically reliant on the physical channel, both online and offline sales growth strategies will be integral for department store retailers moving forward, in order to effectively capture share of the modern, omnichannel consumer’s wallet.

- Read our analysis of five key trends across physical and digital retail channels in our separate report, The Future Model of Department Stores.

Consumer demand for speed and convenience provided the impetus for department stores to offer store-based fulfillment solutions for online orders. These include BOPIS (buy online, pick up in store) and curbside pickup, which give consumers control of the delivery process. Convenience positively impacts shopper sentiment and is likely to boost e-commerce sales.

- This holiday, Kohl’s will be testing self-pickup and self-returns in about 100 stores. Last year, store-based fulfillment accounted for 40% of its online orders.

- Macy’s and Nordstrom are investing in integrating the online and offline shopping experience through virtual selling and livestreaming (which we discuss later in this report).

Retailers are offering consumers flexible payment options, both online and in-store. Macy’s reported at the Morgan Stanley Virtual Global and Retail Conference in December 2020 that it has implemented flexible installment pay option Klarna, due to “consistent callouts” from its digital customers. In May 2021, management at Macy’s noted on the company’s earnings call for the first quarter of fiscal 2021 that Klarna purchases carry a higher spend per visit than the average customer visit.

Competitive Landscape

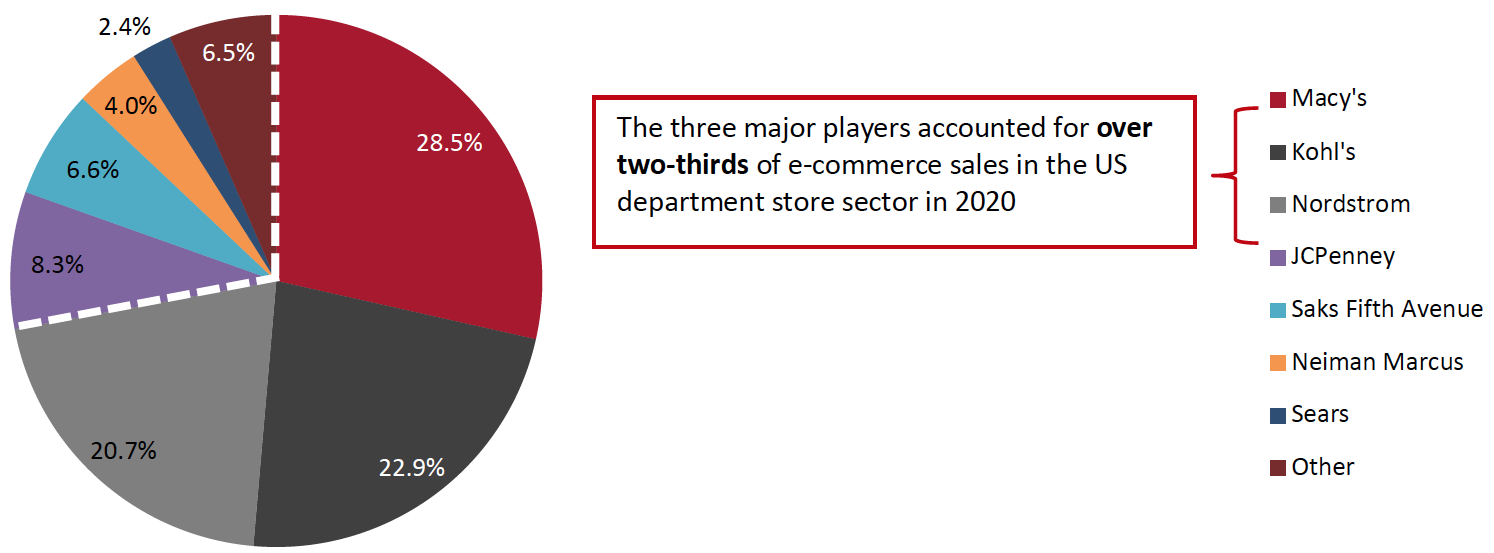

The department store sector is increasingly being led by fewer major department stores. Last year, Macy’s held the highest e-commerce market share, followed by Kohl’s and Nordstrom; together, these three major players accounted for an estimated 72.1% of online sales in the department store sector (see Figure 3).

Figure 3. US Department Store Sector: Breakdown by % of E-Commerce Sales, 2020

[caption id="attachment_134521" align="aligncenter" width="700"] Source: Euromonitor International Limited 2021 © All rights reserved/Coresight Research[/caption]

Source: Euromonitor International Limited 2021 © All rights reserved/Coresight Research[/caption]

Kohl’s, Macy’s and Nordstrom: Recent E-Commerce Acceleration

In this section, we provide an overview and comparison of the e-commerce penetration and online sales growth at the three major department stores in the US: Kohl’s, Macy’s and Nordstrom.

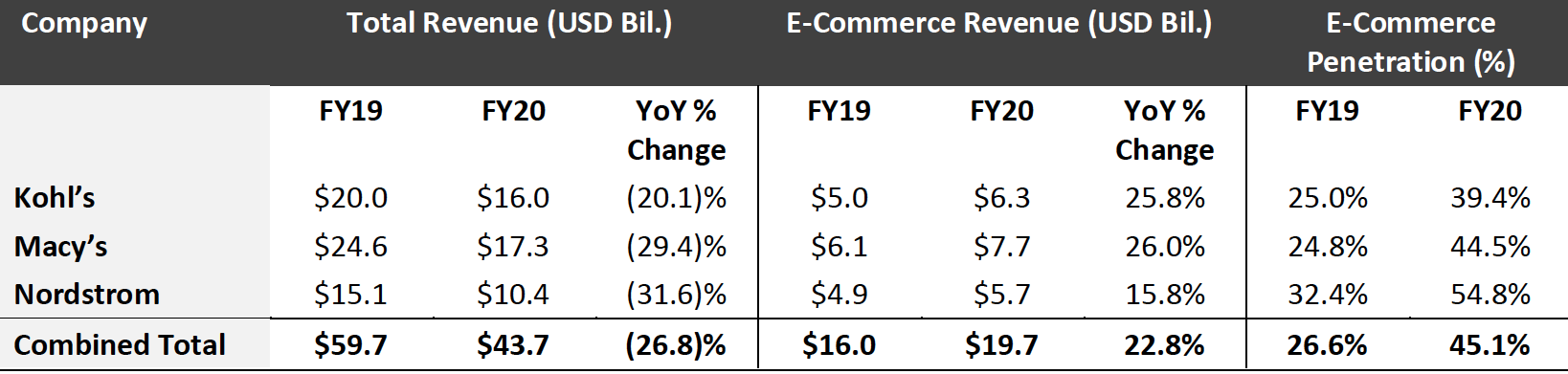

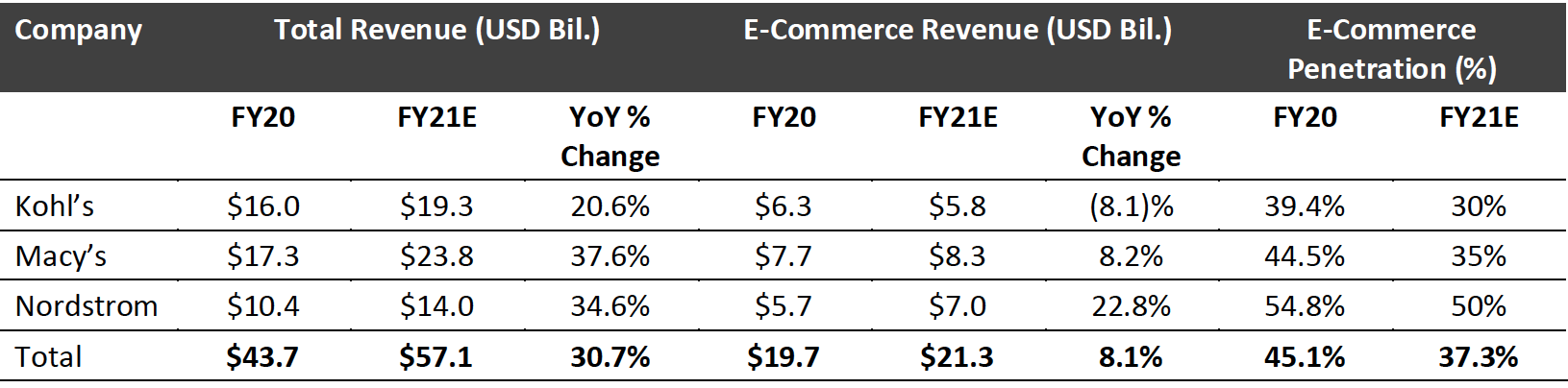

The companies all reported rapid acceleration in online sales in fiscal 2020 (ended January 30, 2021), with combined e-commerce revenue amounting to $19.7 billion, up from $16.0 billion in fiscal 2019. This represents year-over-year growth of 22.8%—a stark difference to the overall 26.8% decline in total sales.

- Macy’s achieved the highest e-commerce revenue of the three department stores in fiscal 2020, totaling $7.7 billion.

- While Nordstrom had the highest e-commerce penetration, of 54.8%, in fiscal 2020, the retailer’s year-over year online sales growth was the lowest of the three department stores. This can be attributed to the fact that Nordstrom’s overall fiscal 2020 revenue was down by (31.6% year over year—the biggest decline among the major players.

Figure 4. Kohl’s, Macy’s and Nordstrom: Total Revenue, E-Commerce Revenue and E-Commerce Penetration, FY19–FY20

[caption id="attachment_134522" align="aligncenter" width="700"] Fiscal 2019 ended February 1, 2020; fiscal 2020 ended January 30, 2021

Fiscal 2019 ended February 1, 2020; fiscal 2020 ended January 30, 2021Source: Company reports[/caption]

Kohl’s, Macy’s and Nordstrom: E-Commerce Growth Moderation in Fiscal 2021

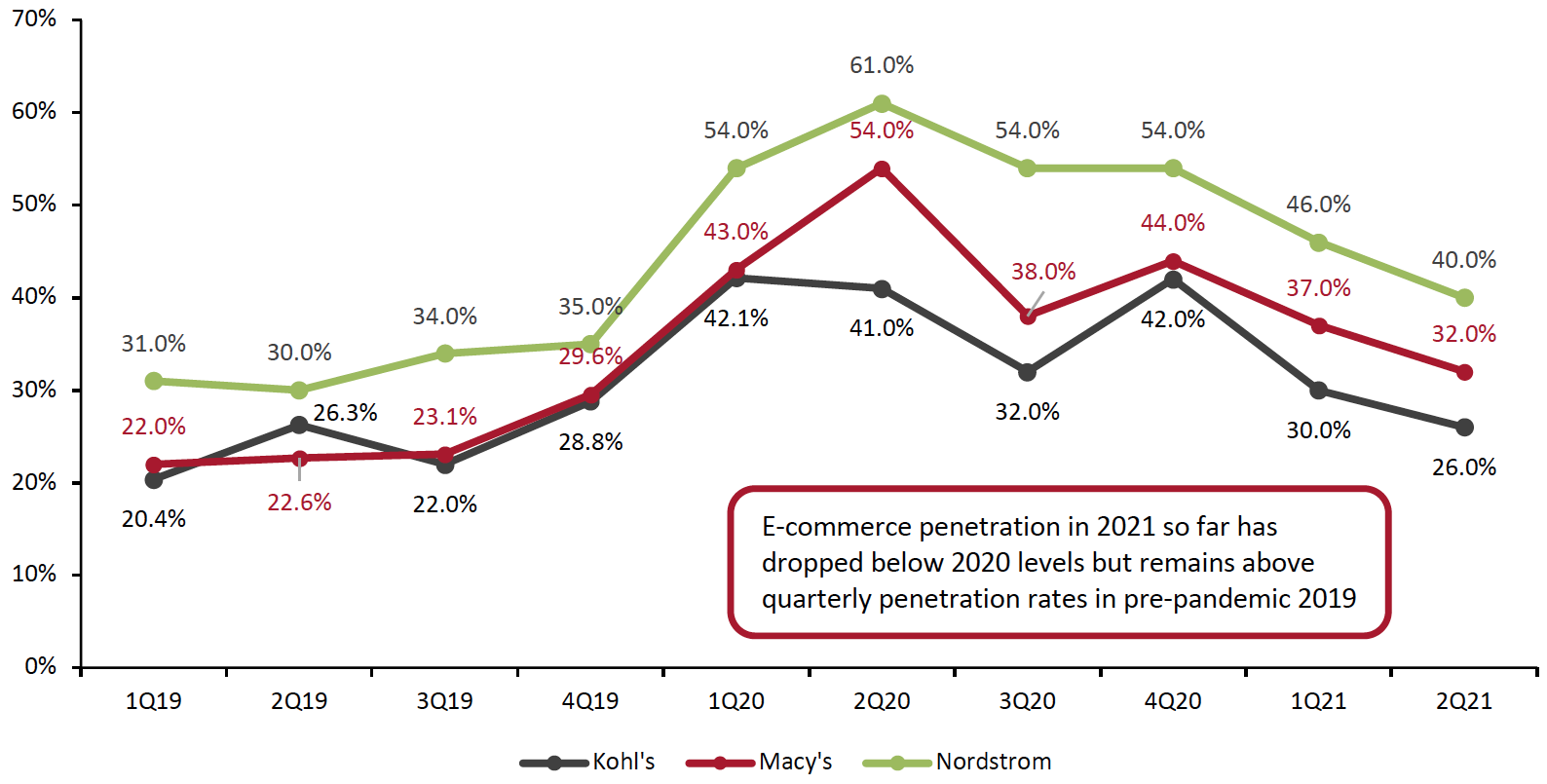

In the first quarter of fiscal 2021, e-commerce penetration at the major department stores moderated from the previous year’s surge, dropping below quarterly e-commerce penetration levels reported during fiscal 2020, but remaining above pre-pandemic 2019 levels. Levels continued to moderate in the second quarter (see Figure 5).

Nordstrom has consistently seen the highest e-commerce penetration rate compared to Kohl’s and Macy’s, totaling 40% in the second quarter of fiscal 2021—representing $1.4 billion in revenue.

Figure 5. Kohl’s, Macy’s and Nordstrom: E-Commerce Penetration (Online Sales as a % of Total Sales)

[caption id="attachment_134523" align="aligncenter" width="700"] Source: Company reports[/caption]

Source: Company reports[/caption]

In terms of full-fiscal-year 2021 e-commerce projections, each of the three major department store retailers are projecting more moderate e-commerce revenue compared to fiscal 2020 (see Figure 6). The retailers’ guidance suggests combined e-commerce growth of 8.1%—significantly down from the 22.8% growth last year. For fiscal 2021, based on the retailers’ guidance, the expected e-commerce penetration is 37.3% across the three major retailers, compared to 45.1% in fiscal 2020.

- Kohl’s reported at the Goldman Sachs Global Retailing Conference in September 2021 that it expects its e-commerce penetration to be a little over 30% in fiscal 2021, compared to 39.4% in fiscal 2019. Management further projected that it expects online sales to grow to 40% of total sales by 2023.

- In its September 2021 earnings call for the second quarter of fiscal 2021, Macy’s increased its revenue guidance for its total fiscal 2021 sales to between $23.5 billion and $23.95 billion, with e-commerce contributing $8.35–8.45 billion—equating to approximately 35% of total sales. This penetration is down slightly from its prior estimate in May 2021, which projected total sales of $21.75–$22.23 billion with e-commerce sales contributing approximately 37%.

- Nordstrom reported on its March 2021 earnings call for the fourth quarter of fiscal 2020 that it expects the digital channel to account for 50% of total sales in fiscal 2021. During its earnings call for the second quarter of fiscal 2021, the company projected total sales for the full year to be 35% above 2020 levels of $10.4 billion, totaling $14.0 billion.

Figure 6. Kohl’s, Macy’s and Nordstrom: Total Revenue, E-Commerce Revenue and E-Commerce Penetration, FY20–FY21E

[caption id="attachment_134524" align="aligncenter" width="700"] Source: Company reports[/caption]

Source: Company reports[/caption]

Kohl’s, Macy’s and Nordstrom: Investing in E-Commerce for Future Growth

The major department store retailers are investing in digital capabilities to support future e-commerce growth. Below, we present highlights of investment focus areas for Kohl’s, Macy’s and Nordstrom.

Kohl’s: Investing into Digital Capabilities To Support Omnichannel Growth

Kohl’s is investing in omnichannel growth. The retailer reported at a company presentation on March 9, 2021, that its omnichannel customer is six times more productive than a digital-only customer and four times more productive than a store-only customer. The company also reported that 43% of digital sales were fulfilled by stores in fiscal 2020.

Kohl’s is focused on enhancing its digital capabilities, including its website, app and digital brand portfolio. The company also opened its sixth e-commerce fulfillment center in April 2021, a 1.2 million-square-foot facility in Ohio, to support online demand and digital sales acceleration. The facility is the company’s largest fulfillment center and includes automated technology to make fulfilling orders faster and more efficient.

[caption id="attachment_134525" align="aligncenter" width="550"] Source: Company reports[/caption]

Source: Company reports[/caption]

Macy’s: Focusing on Redesigning the Consumer Shopping Experience Online

Macy’s plans to grow its digital business to $10 billion by 2023. The company reported in its first-quarter earnings call in May 2021 that it is focusing on differentiated experiences across three main areas: immersive categories, expanding its shopping channels and redesigning the overall digital experience.

The company stated that live video shopping (known as livestreaming e-commerce) is an emerging channel that Macy’s is developing to enable its vendors and colleagues to host live events, with the goal of making “online shopping just as social and fun as in person.” Macy’s hosted its first livestream event in March 2021 and most recently participated in Coresight Research’s livestreaming-focused 10.10 Shopping Festival.

The company announced an upgrade to its app in October 2021, which includes weekly live shopping events through which customers can interact with hosts and Macy’s stylists via chat as well as view featured products in more detail and access real-time reviews and recommendations. Viewers can shop products during the sessions or afterward, through on-demand videos.

Nordstrom: Expanding Online Inventory and Personal Styling Programs

Nordstrom plans to grow its e-commerce product inventory to an endless aisle from 300,000 products to over 1.5 million products. The company is also integrating its Nordstrom Rack (its off-price business) online. In the first quarter of fiscal 2021, the company reported that customer choice count increased by approximately 20% versus 2019, primarily driven by an expanded dropship assortment in its core categories and in-demand categories such as home, active and kids. Management said this allows Nordstrom to drive sales growth in its digital business without a corresponding increase in its inventory investment, because the retailer does not physically hold the inventory.

Nordstrom is expanding its personalized styling programs. The retailer added new tools in the first quarter of fiscal 2021 that will allow its salespeople to offer customers highly relevant recommendations, both in-store and digitally. More than 50% of salespeople are utilizing these remote styling tools, a 10-percentage-point increase compared to the prior quarter, according to the company.

The company has launched “Nordstrom Live” on its website, a channel devoted to shoppable livestreaming content. The sessions are available to watch and shop after the live recordings are over. Nordstrom’s Senior Director of Styling and Sales reported in August 2021 that the company has hosted over 60 livestreams over the past year. The company also offers virtual consultations with consumers—both one-to-one and one-to many—where a Nordstrom styling associate helps shoppers select looks based on their preferences.

Themes We Are Watching

Virtual Selling

Using advanced technology, retailers across the industry are selling through alternative channels, such as using virtual personal assistants and stylists, and hosting livestreaming sessions—both on a one-to-one and one-to-many basis. As consumers have become more digitally connected, social media is an additional channel that retailers are leveraging to showcase products.

We expect the livestreaming trend to evolve across the department store sector, providing another avenue for online consumers to discover and purchase selected merchandise, particularly in the highly visual product categories of apparel, accessories and beauty.

Expansion of E-Commerce Inventory, Beyond In-Store Offerings

We expect department stores to expand their online product offerings to attract new customers. Online expansion allows department stores to add greater category depth by offering consumers additional styles, brands and designers online that a department store retailer does not carry in its in-store inventory. Hudson’s Bay Company, Macy’s and Nordstrom are investing significantly in bolstering their online product selections and categories.

The Use of Stores as Fulfillment Hubs

We expect the department store to evolve into a fulfillment and services hub in order to remain competitive in the retail market, maximize efficiency and reduce shipping costs. Retailers are increasingly using stores to fulfill online orders, effectively creating micro-fulfillment centers for e-commerce orders.

Connecting Online and Offline

Linked to the use of stores as fulfillment hubs, we expect department store retailers to continue to focus on offering shoppers convenience through alternative fulfillment services and automation—such as for BOPIS, curbside pickup and returns.

At a company presentation in June 2021, Kohl’s management said that the retailer is testing more self-service options for consumers; it is starting with self-pickup for BOPIS and self-returns, which will evolve into self-checkout. This fall, Kohl’s will have self-pickup and self-returns testing in over 100 stores.

We expect department stores to offer more options that allow the consumer to control their own shopping experience.

What We Think

As consumers are shopping more in store, we expect department store e-commerce sales to moderate in 2021 from the highs last year. This is supported by slower e-commerce penetration in the first half of fiscal 2021 at each of the three major department store retailers (Kohl’s, Macy’s and Nordstrom), with e-commerce levels below quarterly levels in fiscal 2020.

We expect that investments such as virtual selling, livestreaming, and virtual consultations will help to support further expansion in e-commerce sales. Additionally, convenience services including buy online, pick up in-store and more self-sufficiency services like self-returns which Kohl’s is testing this holiday will help to drive e-commerce.

Thus, in less than five years, nearly half of the department store sector sales will be derived from online. Consumers will spend more online versus pre-pandemic, resulting in a higher growth rate in the next four years than we saw during 2015–2019. Aligning with this growth trend, we expect a corresponding decline of in-store sales, at a CAGR of (5.6)% between 2021 and 2025.

Source for all Euromonitor data: Euromonitor International Limited 2021 © All rights reserved