DIpil Das

Introduction

In this E-Commerce Outlook, we examine the size and trajectory of the US online beauty sector, as well as market drivers, the competitive landscape, key themes we are watching in 2022 and beyond, and innovators in the space. We define the beauty sector as color cosmetics, fragrance, haircare and skincare.E-Commerce Performance and Outlook

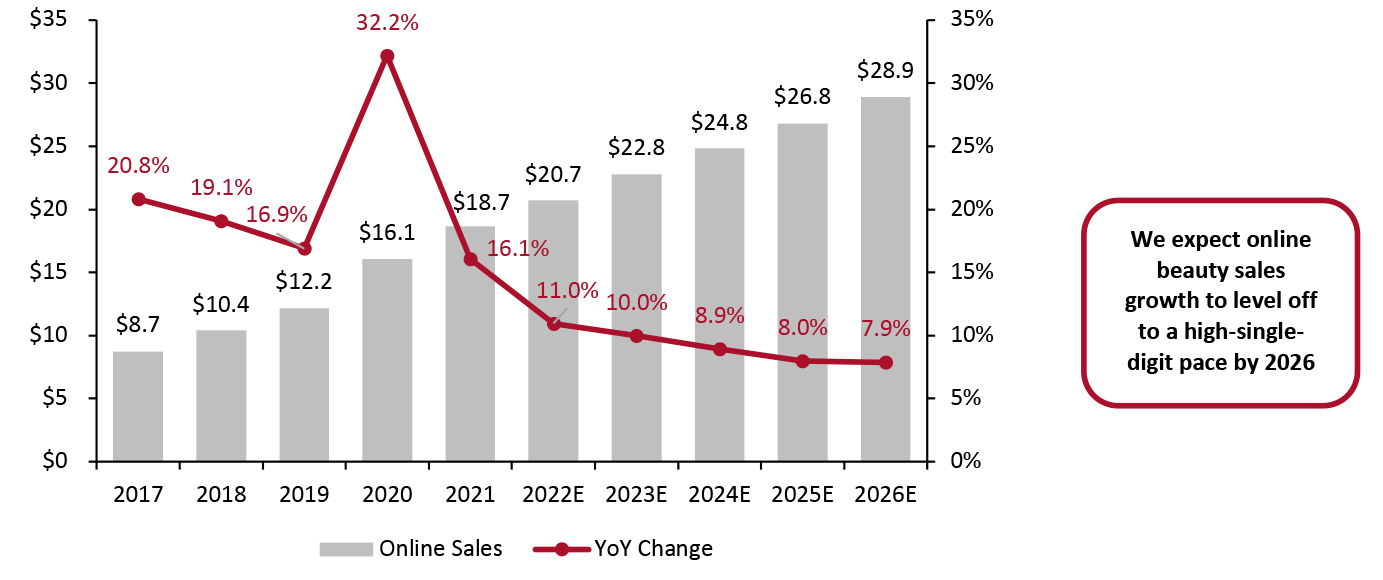

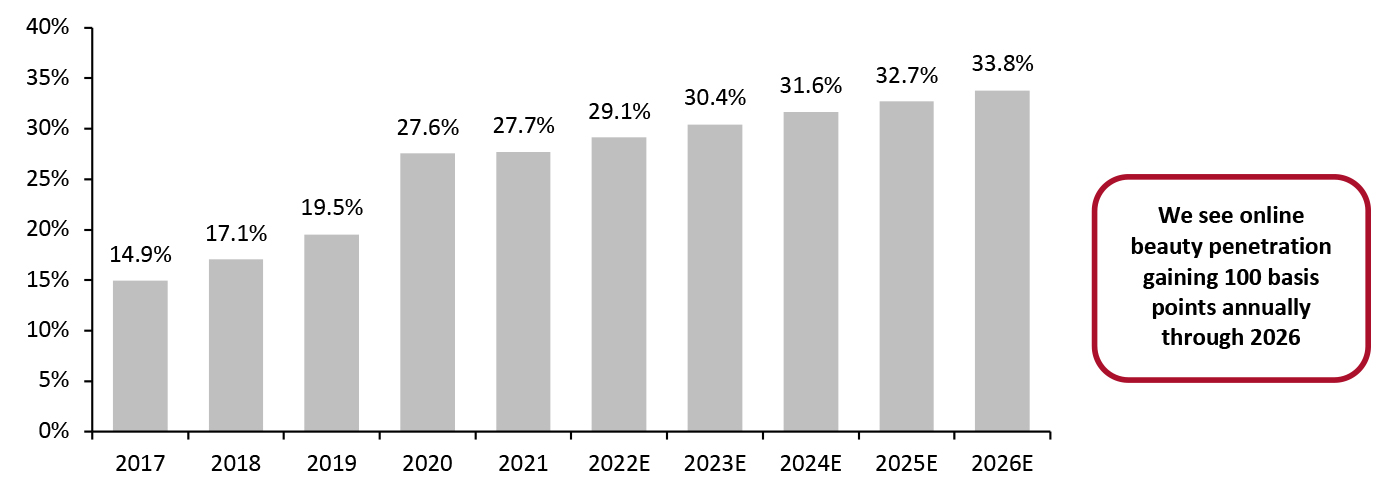

An increasing number of US beauty purchases have been made online since 2016, resulting in a 20.9% five-year CAGR for online beauty sales between 2016 and 2021, versus a 3.8% CAGR for total beauty sales during the same period, we calculate based on Euromonitor International data. Last year was a particularly strong year for the US online beauty market due to pandemic-led lockdowns: e-commerce sales grew 32.2% that year, despite the overall market contracting by 6.4%. As a result, we estimate that the US online beauty market captured an additional 804 basis points in market share in 2020, accounting for 27.6% of overall sales—up from 19.5% in 2019. In 2021, US e-commerce beauty sales continued to grow but at half the pace achieved in 2020, with online penetration in the overall beauty market slightly increasing to 27.7%, reflecting sales at Amazon, branded websites and digitally native retailers such as Violet Grey (which we discuss in more detail later in this report), as well as the online expansion of beauty specialist retailers, department stores and drugstores. Now, we are looking at a new, digitalized beauty market. Demonstrating that major players have recognized this online shift, Jean-Denis Mariani, Chief Digital Officer at Coty, said at the company’s November 2021 Investor Day:There is no digital strategy anymore, just strategy in a digital world—and this world is moving fast. Social commerce is the new e-commerce. Experience is a key differentiator. Authenticity is the core value. Services are the new cookies to collect valuable data. Video is overpassing picture. Data is a strategic asset. Advocacy is a growth engine. Disruption is everywhere, and it's a positive thing. Self-expression is the new creative. Distinctiveness is the winning recipe.

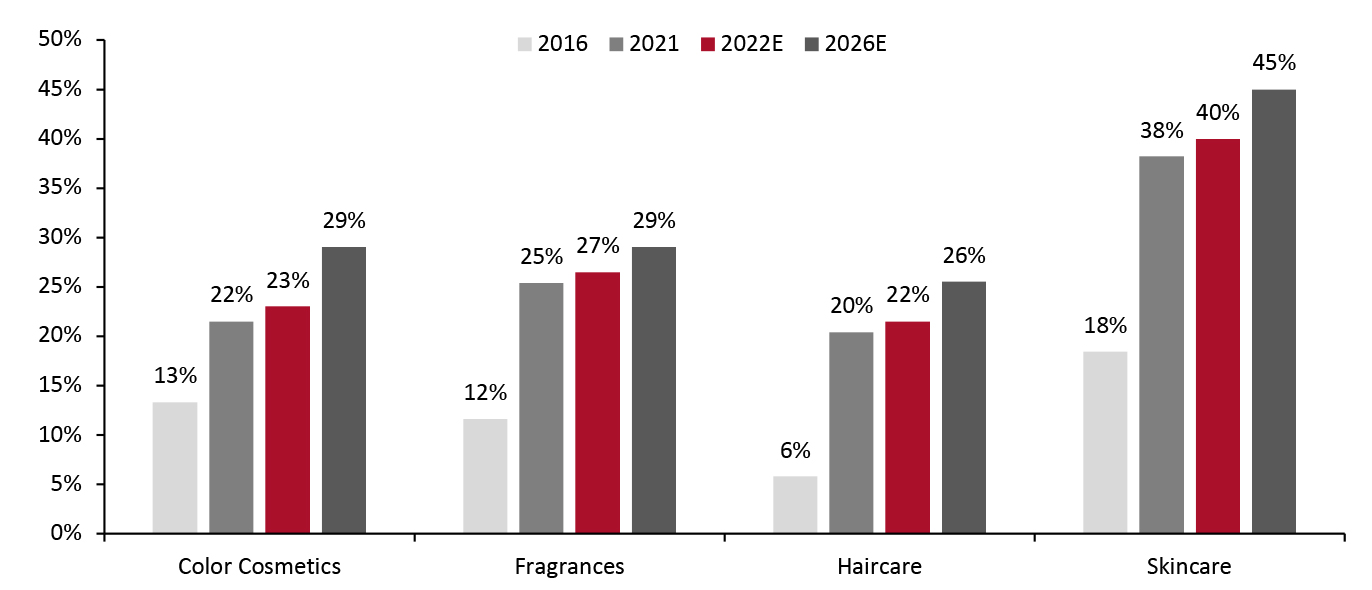

We expect e-commerce penetration to continue to increase moving forward, albeit at a slower pace, with the online channel gaining a one-percentage-point share of total sales each year from 2022 to 2026, we estimate. By the end of 2026, we predict that e-commerce will account for roughly one-third of the US beauty market. Skincare will lead the increased penetration—we estimate that online sales will account for around 45% of category sales in 2026—followed by color cosmetics and fragrance.Figure 1. US Beauty: Online Sales (Left Axis; USD Bil.) and YoY % Change (Right Axis) [caption id="attachment_151223" align="aligncenter" width="700"]

Source: Euromonitor International Limited 2022 © All rights reserved/Coresight Research[/caption]

Source: Euromonitor International Limited 2022 © All rights reserved/Coresight Research[/caption]

Emerging beauty technology, increased educational and marketing efforts, and greater consumer acceptance of new forms of selling (such as livestreaming) will also support the channel shift.

Figure 2. US Beauty: Digital Penetration (Online Sales as % of Total Sales) [caption id="attachment_151215" align="aligncenter" width="700"]

Source: Euromonitor International Limited 2022 © All rights reserved/Coresight Research [/caption]

Source: Euromonitor International Limited 2022 © All rights reserved/Coresight Research [/caption]

Online Market Factors

As previously stated, we believe that skincare will lead e-commerce growth in the US in the coming years. US online skincare sales grew at a 22.1% CAGR from 2016 to 2021, according to Euromonitor International data. During that period, skincare had the highest online penetration in 2021, at 38.2% of category sales—more than double its 2016 level. We expect online skincare sales in the US to slow to an 8.5% CAGR through 2026. By that time, we estimate that online skincare sales will account for nearly half of all category sales in the US, reflecting the intrinsic ease and efficiency of shopping online and the emergence of new selling channels, such as livestreaming. Consumers frequently replenish skincare items. As a result, many beauty companies now have online auto-replenishment or subscription options for skincare products—including Estée Lauder, L’Oréal’s Lancôme and L’Occitane—benefiting e-commerce sales. While skincare products often require a customer to test the product at home over a period, color cosmetics and fragrances both benefit from in-store discovery and trial. In 2021, online sales penetration for color cosmetics and fragrances stood at 21.5% and 25.4%, respectively, according to Euromonitor International. US online fragrance sales achieved a 25.6% CAGR over the past five years, but we expect sales to slow to a 9.5% CAGR over the next five years. This slower growth will be driven by fragrance subscriptions among millennials and Gen Zers, as well as continued market penetration. In 2021, e-commerce became the primary channel for fragrances, accounting for 25.4% of total US fragrance sales, according to Euromonitor International data. Department stores followed e-commerce fragrance sales at 24.8%, with beauty specialists at 23.6% and apparel and footwear specialty retailers at 9.6% (these sector shares reflect store-based sales only). While e-commerce is likely to remain the primary channel for fragrances, in-store sales will probably stay stable as many brands launch fragrances as a branding strategy, given that fragrance is an accessible entry point into the fashion and luxury markets for aspirational consumers. We foresee US online sales of the color cosmetics category outpacing its 2016–2021 CAGR of 10.2% and achieving a 10.4% CAGR through 2026 as emerging technologies allow for better virtual try-on, resulting in consumers becoming increasingly comfortable with buying color cosmetics online. We also expect that growing demand for lipstick auto-replenishment offerings will help drive increased online penetration. In Figure 3, we break down digital penetration in the US beauty market by category.Figure 3. US Beauty: Digital Penetration by Category (Online Sales as a % of Total Sales) [caption id="attachment_151188" align="aligncenter" width="700"]

Source: Euromonitor International Limited 2022 © All rights reserved/Coresight Research[/caption]

Each beauty category has its nuances, including haircare, which had the lowest e-commerce penetration in 2021, reflecting the continued importance of hair salons and grocers. Hair salons accounted for 20% of total US haircare sales in 2016 before declining to 15.8% in 2019. Due to the pandemic, salons’ market share of haircare sales dropped to 10.3% in 2020; however, the trend reversed in 2021, with salons capturing an 11.4% market share, according to data from Euromonitor International. Grocery stores remain the most significant channel for haircare, accounting for 23.6% of category sales in 2021, followed by mass merchants at 10.7%.

Source: Euromonitor International Limited 2022 © All rights reserved/Coresight Research[/caption]

Each beauty category has its nuances, including haircare, which had the lowest e-commerce penetration in 2021, reflecting the continued importance of hair salons and grocers. Hair salons accounted for 20% of total US haircare sales in 2016 before declining to 15.8% in 2019. Due to the pandemic, salons’ market share of haircare sales dropped to 10.3% in 2020; however, the trend reversed in 2021, with salons capturing an 11.4% market share, according to data from Euromonitor International. Grocery stores remain the most significant channel for haircare, accounting for 23.6% of category sales in 2021, followed by mass merchants at 10.7%.

Competitive Landscape

Leading Companies Beauty is a global industry, and many brands have strong businesses across the Americas, Asia and Europe. As a result, many beauty companies only report their global online sales and penetration rates. Below, in Figure 4, we list the top five largest beauty companies in the world—two of which are based outside of the US, L’Oréal (based in France) and Shiseido (Japan)—and their global online revenues and penetration rates, based on both branded website and retail partner e-commerce sales. The global penetration rates of the three largest global players roughly equal or, in the case of Shiseido, exceed the 27.7% penetration of online beauty sales in the US. L’Oréal is the largest beauty company in the world, with roughly 40 brands, most of which are available globally. With $36.7 billion in 2021 sales, it is more than twice the size of its nearest competitor, Estée Lauder, whose trailing 12 months (TTM) sales through March 31, 2022, were $18.1 billion.- For more on where L’Oréal and Estée Lauder stand in 2022, read our Head-to-Head report on these two beauty giants.

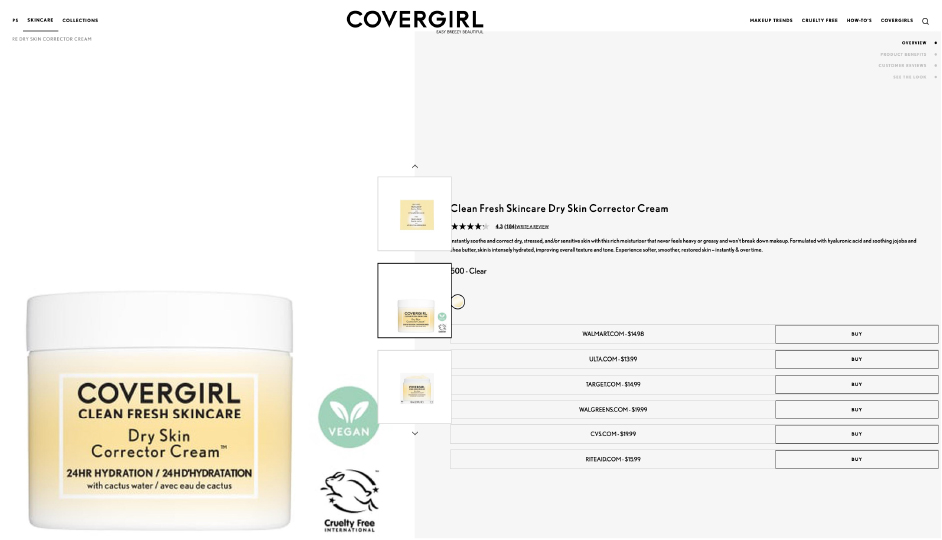

CoverGirl directs consumers to websites where they can purchase a specific product

CoverGirl directs consumers to websites where they can purchase a specific product Source: Company website [/caption] Coty is also pursuing a social selling strategy and, with its interest in GucciBeauty and Kylie Cosmetics, it has access to some of the front runners of this type of selling. Coty’s social selling strategy combines engaging brand leaders and, of course, the use of social media to foster brand awareness and product education.

Figure 4. Major Beauty Brands Operating in the US: Global E-Commerce Sales and Digital Penetration [wpdatatable id=2116 table_view=regular]

*These values include both sales from branded websites and retail e-commerce platforms Source: Company reports/Coresight Research Other Beauty Players Beauty is a highly profitable category, making mass retailers and online players attracted to the category. According to Euromonitor International data, the department store channel at physical retail lost 5.4 percentage points of market share in the US from 2007 to 2021, dropping from 16.0% to 10.6% in 2021, though their total share of the beauty market is somewhat higher given their online business. On the other hand, beauty specialists picked up 6.6 percentage points of market share at physical retail and even more in total when factoring in their share of e-commerce. In the same timeframe, mass merchants’ share of the beauty market at physical retail eroded from 7.4% to 4.3% as consumers enjoyed the convenience of online shopping and discovering new products and brands at beauty specialist retailers like Sephora, SpaceNK and Ulta. Beauty specialist retailers captured 18.3% of all beauty sales from retail locations in 2021, according to Euromonitor International. As the market share for these retailers has increased, they have, in turn, expanded their physical footprint, online capabilities and product and service offerings. During the pandemic, they enjoyed strong double-digit e-commerce sales growth; however, as stores have reopened and consumers are getting comfortable in physical spaces once again, beauty transactions are returning to physical stores. Ulta’s CEO, David Kimball, said during an earnings call on May 26, 2022, that having the company’s “e-commerce business essentially flat after all the growth we’ve seen in that business over the last couple of years was in line with our expectation.” Wisely, Kohl’s (a US-based department store), Target and Walmart are joining forces with these beauty specialist retailers to bring excitement and freshness to their in-store and online beauty offerings and reverse the trajectory. [caption id="attachment_151190" align="aligncenter" width="700"]

Ulta at Target promotional photo

Ulta at Target promotional photo Source: Target [/caption] Consumer product goods (CPG) companies are also seeing an increase in e-commerce beauty sales. Approximately 19% (or $14.4 billion) of P&G’s revenues come from its beauty businesses, namely its mass beauty brand Olay and its prestige beauty brand SK-II, both of which have shoppable branded websites. P&G recently formed a Specialty Beauty division to house its recent beauty acquisitions, Farmacy Beauty, Ouai and Tula, all direct-to-consumer brands. Other CPG companies’ beauty brands, such as Unilever’s Dove and Clorox’s Burt’s Bees, are also expanding their online availability.

In recent years, digitally native beauty brands, which include the likes of Kylie Cosmetics (majority-owned by Coty) and Glossier, have also entered the e-commerce beauty market. Both Kylie Cosmetics and Glossier were launched by young women in around 2015 and have since leveraged social media to differentiate themselves and gain traction. Today, Kylie Cosmetics has expanded into baby skincare and haircare products (reflecting her evolving lifestyle), while Glossier’s founder, Emily Weiss, has left the company as it repositions itself for growth.

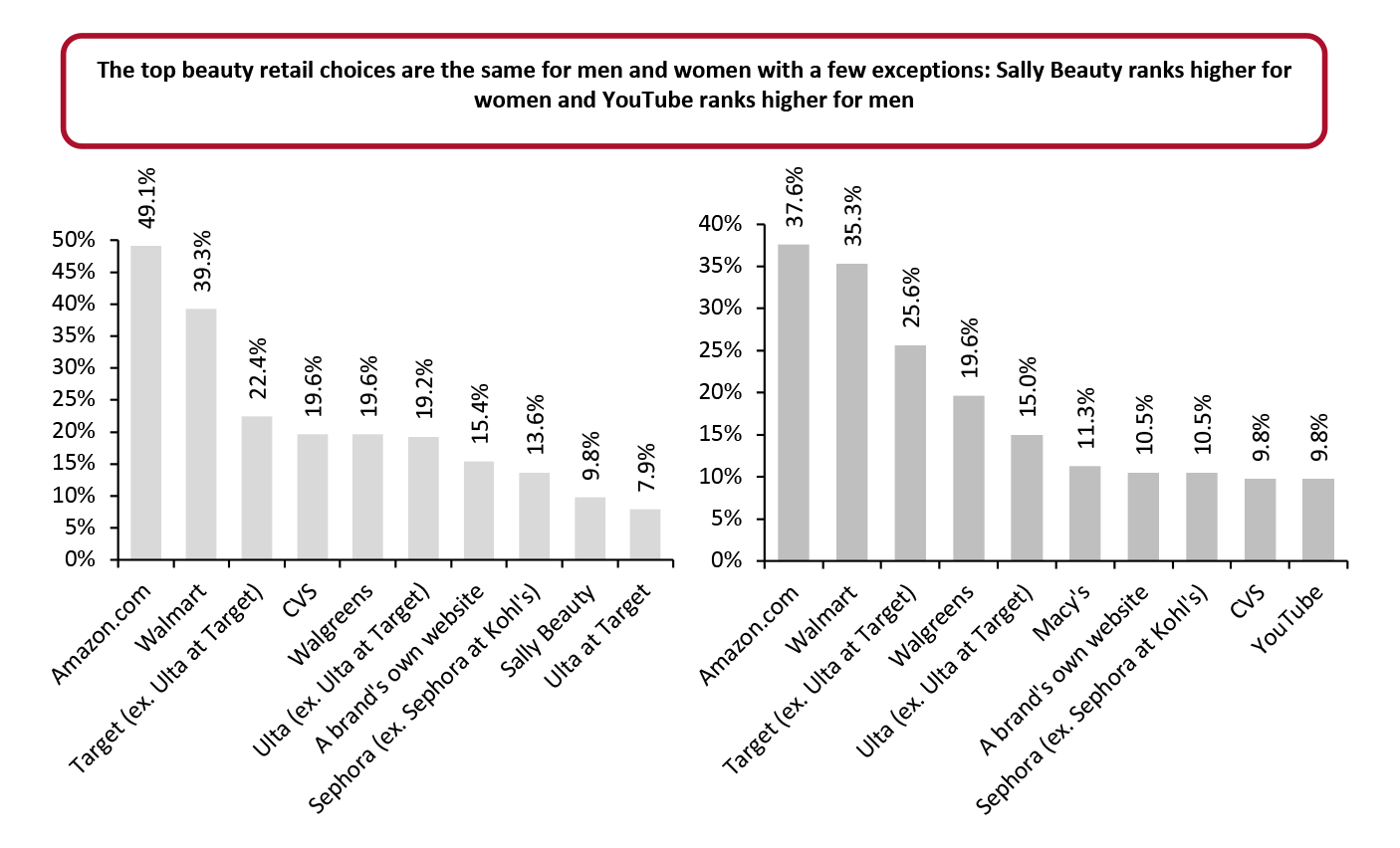

Where Men and Women Shop for Beauty According to a Coresight Research survey conducted in March 2022, Amazon was the number-one response from both men and women when asked where they shopped for beauty and personal care products in the past three months (both online and in-store; see Figure 5). Other popular choices with both sexes included CVS, a brand's own website, Sephora and Walmart; YouTube also shows up in the top 10 choices for beauty shopping by men.Figure 5. Top 10 Shopping Destinations for Beauty Products, by Gender (% of Respondents) [caption id="attachment_151216" align="aligncenter" width="700"]

Base: 347 US respondents aged 18+ who had purchased beauty or personal care products in the last three months; surveyed in March 2022

Base: 347 US respondents aged 18+ who had purchased beauty or personal care products in the last three months; surveyed in March 2022Source: Coresight Research [/caption]

Themes We Are Watching

- Increased beauty offerings in luxury marketplaces—Many large luxury e-commerce marketplaces have added beauty to their merchandise assortment, providing shoppers worldwide access to niche brands. Farfetch’s acquisition of Violet Grey earlier this year brought with it Violet Grey’s founder, Cassandra Grey, and her adept product curation and advice. Similarly, Net-a-Porter’s partnership with skincare expert Dr. Barbara Sturm’s titular brand enables product creation advice and collaboration. Moda Operandi, another luxury fashion site, hopes to “to become a complete lifestyle destination,” according to a press release, with the addition of beauty products. These e-commerce sites are frequented by fashionistas and women who care about beauty, so it is a natural extension for them and will force physical department stores to up their game to attract younger millennials and Gen Zers. Meanwhile, these new markets will further e-commerce penetration in the beauty market.

- The rise of specialty beauty marketplaces—Specialty beauty websites such as Credo Beauty, StyleKorean, The Choosy Chick and The Detox Market attract shoppers with their niche and hard-to-find products, often curated to a theme, such as clean beauty. These sites address the consumer demand for personalization and frequently include editorial, educational and instructive media to engage shoppers and foster a sense of community.

- Growing online beauty communities—Websites such as MakeupAlley provide a forum for beauty enthusiasts. MakeupAlley has a large, comprehensive product review section that includes multiple reviews for each product featured, product photos and rankings, including a monthly ranking of the top 20 beauty products currently on the market. As of summer 2020, more than 2.7 million reviews of more than 187,000 beauty and skincare products have been written by beauty enthusiasts worldwide.

E-Commerce Innovators

Bambuser is a video-streaming platform that helps beauty brands create one-to-many and one-to-one live shopping events. When done well, livestreaming combines the best of online and physical shopping as the shopping is interactive, allowing shoppers to ask questions and brands to overcome the traditional barriers of online shopping, reducing the rate of returns. Perfect Corp.’s AI-powered virtual makeup and nail polish try-on technology are currently being used by the likes of Coty, e.l.f. and Estée Lauder, according to the company’s website. Perfect Corp.’s solutions can be used by brands both online and in-store.What We Think

E-commerce penetration will continue to grow through 2026, albeit at a slower rate than during the pandemic, driven by additional players entering the space and increased usage of emerging technologies like livestreaming shopping and virtual try-on tools. However, beauty remains a category driven by discovery and trial, and, as such, we expect physical stores to keep the largest portion of beauty sales. Implications for Brands/Retailers- Brands should consider if they want brand-specific, shoppable e-commerce sites, weighing the positives of consumer proximity against the additional costs and complications.

- Brands must consider ways to bring emerging technologies and selling methods into the fold, including livestreaming and social selling.

- Where appropriate, retailers and brands should provide auto-replenishment and subscription offerings for skincare, haircare and other regular-use products (such as popular lipsticks or mascaras).

- As virtual try-on tools become more popular both online and in-store, technology companies that can develop and deploy try-on technology for beauty brands will benefit from continued e-commerce growth.

- An increasing number of beauty brands are entering the metaverse to develop their brand, demo new products and engage with customers virtually. Technology vendors who can help beauty companies enter the metaverse smoothly will benefit greatly from beauty's increased digitization.

Source for all Euromonitor data: Euromonitor International Limited 2022 © All rights reserved