Nitheesh NH

Introduction

As part of our E-Commerce Outlook series, we examine the size and trajectory of the US online apparel and footwear sector. We explore market drivers, the competitive landscape, key themes we are watching in 2022 and beyond, as well as innovators in the space.E-Commerce Performance and Outlook

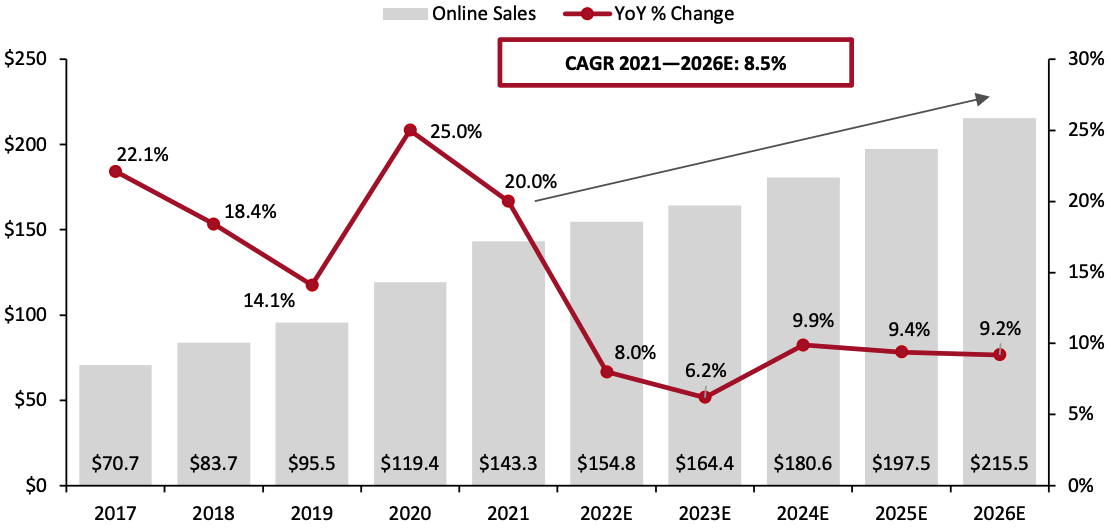

We anticipate that many consumers will retain online shopping habits in 2022 and beyond—having shifted to the digital channel amid the pandemic. We expect US online apparel and footwear sales to grow 8%, year over year, in 2022, reaching $154.8 billion and capturing 33.3% of the total US apparel and footwear market (excluding military clothing and clothing materials). We anticipate that this will be followed by mid-to-high-single-digit growth in 2023 and beyond. We estimate that online sales of apparel and footwear grew by 20%, year over year, to $143.3 billion in 2021. This was in the context of nearly 30% growth in the overall US apparel and footwear market, translating into a 2.4-percentage-point loss in share of sales for the online channel (see Figure 2) and reflecting e-commerce ceding some share back to stores.Figure 1. US Online Apparel and Footwear Sales (Left Axis; USD Bil.) and YoY Change (Right Axis; %) [caption id="attachment_143890" align="aligncenter" width="700"]

Source: Euromonitor International Limited 2022 © All rights reserved/Bureau of Economic Analysis/Coresight Research[/caption]

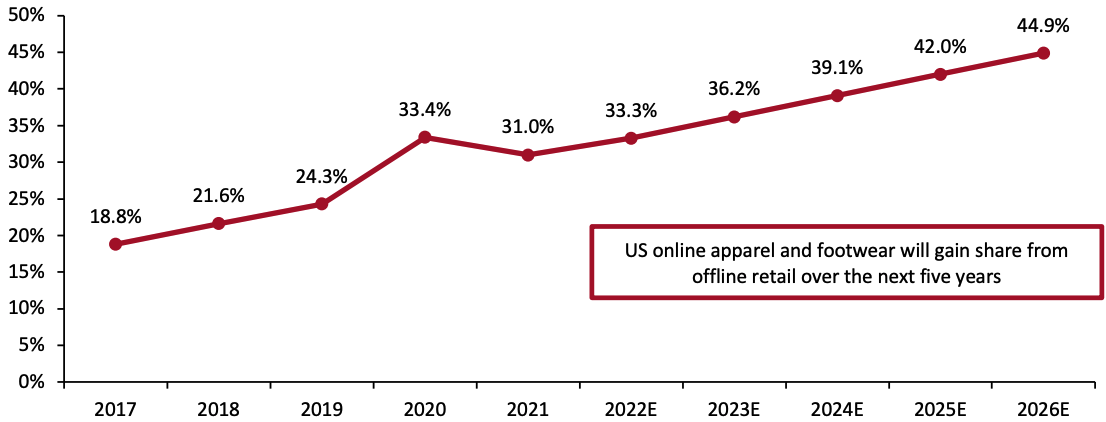

Coresight Research estimates that the online channel accounted for 31.0% of total apparel and footwear sales in 2021 versus 33.4% in 2020. On the assumption that shoppers continue to shop online in 2022 and beyond, we expect the penetration rate of apparel and footwear e-commerce to grow in each of those years.

Source: Euromonitor International Limited 2022 © All rights reserved/Bureau of Economic Analysis/Coresight Research[/caption]

Coresight Research estimates that the online channel accounted for 31.0% of total apparel and footwear sales in 2021 versus 33.4% in 2020. On the assumption that shoppers continue to shop online in 2022 and beyond, we expect the penetration rate of apparel and footwear e-commerce to grow in each of those years.

Figure 2. US Apparel and Footwear Market: E-Commerce Penetration (Online Sales as a % of Total Sales) [caption id="attachment_143891" align="aligncenter" width="700"]

Source: Euromonitor International Limited 2022 © All rights reserved/Bureau of Economic Analysis/Coresight Research[/caption]

Source: Euromonitor International Limited 2022 © All rights reserved/Bureau of Economic Analysis/Coresight Research[/caption]

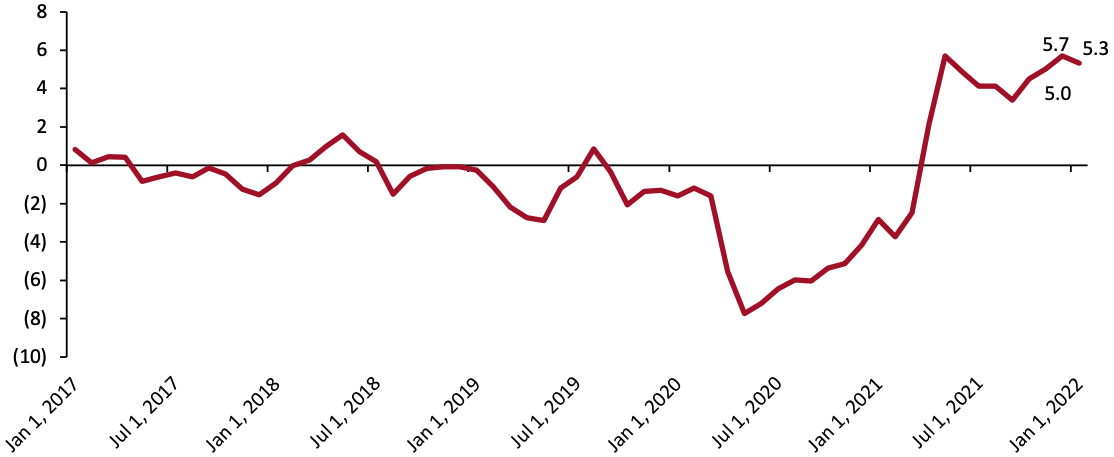

Market Factors

Consumers’ Retention of Online Shopping Habits We are seeing an overall trend of more consumers buying clothing, footwear or fashion accessories online than in stores, according to our US Consumer Tracker series of weekly surveys, indicating an opportunity for apparel and footwear brands and retailers to expand their digital businesses. Our survey findings also indicate that many US consumers are likely to retain the habit of purchasing more online, even after the crisis: Consistently more than one-quarter of consumers say that they expect to buy more online and less in stores once the crisis ends. Although stores in many areas of the US have reopened, consumers are only switching part of their retail spending back to the brick-and-mortar channel. We therefore expect to see continued growth in e-commerce sales of apparel and footwear over the short to medium term. Greater Capacity on the Digital Supply Side Apparel and footwear brands’ and retailers’ increasingly mature service offerings for e-commerce provide a convenient alternative to in-store shopping and may bolster consumers’ shift to buying more online, as well as better serving existing demand. To meet consumer demand for convenience in the shopping journey and account for coronavirus-related safety precautions, apparel and footwear brands and retailers have increased their investments in omnichannel capabilities—such as enhancing fulfillment capacity and improving delivery efficiency—which has supported their e-commerce sales growth. BOPIS (buy online, pick up in-store) and curbside pickup are continuing to gain momentum, with apparel and footwear brands and retailers extending these omnichannel services to more stores. We expect BOPIS and curbside-pickup options to remain popular among consumers post crisis due to their convenience. Inflation We see inflation as an important driver of the US apparel and footwear e-commerce market. The US inflation rate in the apparel and footwear sector rose 5.7%, year over year, in December 2021—the highest increase since 1991, according to the US Bureau of Labor Statistics.Figure 3. US Apparel and Footwear: Consumer Price Index for All Urban Consumers (YoY % Change, Seasonally Adjusted) [caption id="attachment_143892" align="aligncenter" width="700"]

Source: US Bureau of Labor Statistics[/caption]

Source: US Bureau of Labor Statistics[/caption]

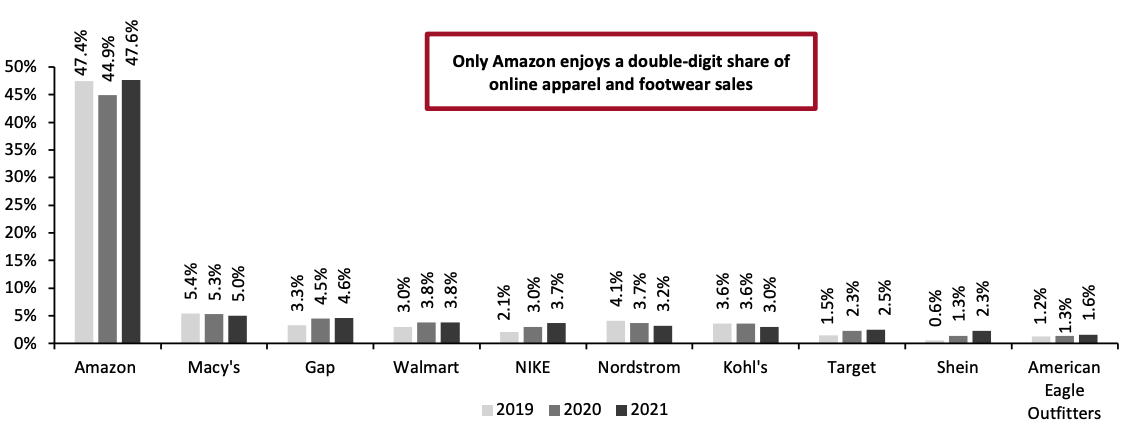

Competitive Landscape

The US apparel and footwear e-commerce industry is concentrated, with the top 10 companies accounting for 77.3% of online sales in 2021, according to Euromonitor International. However, that concentration is driven primarily by Amazon’s estimated 47.6% share per Euromonitor. Amazon is followed by retailers with single-digit channel shares—including Macy’s (with 5.0%) and Gap (with 4.6%). Coresight Research pinned its own estimate for Amazon’s sales of clothing, footwear and accessories at close to $39 billion in 2020, which implies a share closer to one-third of our apparel and footwear e-commerce market size in that year, versus the near-one-half estimated by Euromonitor. Amazon does not report sales (gross merchandise volume) by category, so all data for its apparel and footwear sales are estimated.Figure 4. US Apparel and Footwear E-Commerce Retail Share (%) [caption id="attachment_143893" align="aligncenter" width="700"]

Amazon includes first-party and third-party sales

Amazon includes first-party and third-party salesSource: Euromonitor International Limited 2022 © All rights reserved/Coresight Research[/caption]

Figure 5. Top 10 Apparel and Footwear Retailers’ and Brands’ E-Commerce Metrics

| Company | Digital Penetration (Whole Company) | ||

| 2018 | 2019 | 2020 | |

| Amazon | 100% | 100% | 100% |

| Strategy |

|

||

| Macy’s | 23% | 25% | 44% |

| Strategy |

|

||

| Gap | 22.4% | 25.0% | 45.5% |

| Strategy |

|

||

| Walmart | 4.7% | 7.1% | 11.6% |

| Strategy |

|

||

| NIKE | ~30% | 30% | 35% |

| Strategy |

|

||

| Nordstrom | 30% | 33% | 55% |

| Strategy |

|

||

| Kohl’s | ~20% | 24% | 40% |

| Strategy |

|

||

| Target | 7.1% | 8.8% | 18% |

| Strategy |

|

||

| Shein | 100% | 100% | 100% |

| Strategy |

|

||

| American Eagle Outfitters | 28% | 29% | 45% |

| Strategy |

|

||

Some data are estimated. NIKE’s e-commerce data are for North America. NIKE’s fiscal years typically ended the last weekday of May in the next calendar year. Source: Company reports/ Euromonitor International Limited 2022 © All rights reserved/Coresight Research

Figure 6. Further Apparel and Footwear Retailers’ and Brands’ E-Commerce Metrics

| Company | Digital Penetration (Whole Company) | ||

| 2018 | 2019 | 2020 | |

| Old Navy (Gap, Inc.) | 22.4% | 25.0% | 45.5% |

| Strategy |

|

||

| Lululemon | 23.4% | 25.3% | 44.0% |

| Strategy |

|

||

| Dick’s Sporting Goods | ~14% | ~16% | ~30% |

| Strategy |

|

||

| adidas | 8.9% | 11.1% | 20% |

| Strategy |

|

||

| Carter’s | N/A | N/A | 33.1% |

| Strategy |

|

||

| Levi’s | ~10% | 13% | 22% |

| Strategy |

|

||

| Under Armour | N/A | N/A | 19.3% |

| Strategy |

|

||

| Skechers | N/A | N/A | 20% |

| Strategy |

|

||

| Columbia Sportswear Company | 11% | 11% | 19% |

| Strategy |

|

||

| Stitch Fix |

|

||

| Strategy |

|

||

| Hanesbrands | N/A | 16% | 21% |

| Strategy |

|

||

| VF Corporation | 8.3% | 11.5% | 22.5% |

| Strategy |

|

||

| ASOS | 100% | 100% | 100% |

| Strategy |

|

||

| PVH Corp. | >10% | 12.5% | 25% |

| Strategy |

|

||

| Boohoo Group | 100% | 100% | 100% |

| Strategy |

|

||

| Academy Sports and Outdoors | 4.9% | 5.1% | 10.3% |

| Strategy |

|

||

Some data are estimated. Adidas’s e-commerce data are for North America. Columbia Sportswear Company’s and VF Corporation’s disclosure of e-commerce sales includes DTC (direct-to-consumer) e-commerce only (excluding e-commerce sales generated through third-party retailers/marketplaces) Source: Company reports/ Euromonitor International Limited 2022 © All rights reserved/Coresight Research

Themes We Are Watching

Returns Retail returns rates increased to 16.6% in 2021, up from 10.6% in 2020, according to the National Retail Federation and Appriss Retail, driven largely by online shopping. Consumers who shop clothing and footwear online are more inclined to return products compared to other categories, because it is hard to visualize how apparel products will look or fit. We expect the returns dilemma to continue with the growth of e-commerce in the next few years. We recommend that apparel brands and retailers adopt new approaches to reduce returns rates, such as by implementing virtual try-on technology to help consumers choose sizes and styles.- Walmart bought virtual fitting-room company Zeekit in May 2021.

- Brands and retailers including Amazon, ASOS, Levi’s and NIKE have also adopted virtual fitting technology.

- Walmart is investing in automation and new warehouse systems that help cut the time it takes for returned products to become sale inventory.

- American Eagle Outfitters has set up more warehouses to receive, clean and repackage returns. It also employs technology to gauge product demand to determine in advance which warehouse should process each return and which items are worth fast-tracking back onto shelves. The company reported that it gives priority to leggings, which have been harder to import due to manufacturing delays in Vietnam.

- For DHL, Direct Signature will change from $5.55 per shipment to $5.90 per shipment.

- FedEx has added several new charges. For example, shippers will trigger the residential surcharge sooner—when they hit 25,000 packages rather than 2021’s threshold of 30,000 packages. Ground Economy shippers will be subject to a new $1.00 per package surcharge for any package that is classified as “delivered or returned.”

- UPS is increasing shipping rates by 5.9% on average for ground and air services.

- NIKE has accelerated investments to evolve its distribution network and scale a digital-first supply chain, leveraging analytics, automation and technology, the company reported on its earning call on December 20, 2021. NIKE has opened two new regional service centers on both coasts in the US, which are able to deliver more units to consumers with shorter delivery times and costs.

- American Eagle Outfitters is investing in its distribution hubs to increase overall fulfillment capacity. The retailer describes these distribution hubs as a “decentralized fulfillment network” as they are located closer to customers and stores and so can deliver products to customers more quickly. Overall, these capabilities will enable the company to provide better customer service while reducing the inventory volume in its network; optimize shipment flows to manage delivery cost pressures; and maximize its operational flexibility.

- Brands and retailers such as Amazon, Guess?, Macy’s, NIKE, PVH Corp. and Vera Bradley have already turned to livestreaming e-commerce, hosting events to engage with consumers.

- During the 2020 holiday season, Ralph Lauren launched virtual flagship stores (including Beverly Hills, Paris and New York), enabling customers worldwide to digitally view and purchase the stores’ assortments.

- Brands and retailers such as Adidas, Amazon and NIKE have incorporated AR developments such as virtual try-on technologies into their selling processes.

- In August 2021, Ralph Lauren partnered with Zepeto, a metaverse platform, to create a virtual world that allows consumers to view apparel products digitally and create 3D avatars.

- In December 2021, Ralph Lauren partnered with Roblox, another metaverse creation platform, to debut a holiday-themed experience allowing consumers to explore products and socialize with others.

- Also in December 2021, Forever 21 entered the metaverse with a Roblox store.

- NIKE released Nikeland on Roblox in November 2021.

E-Commerce Innovators

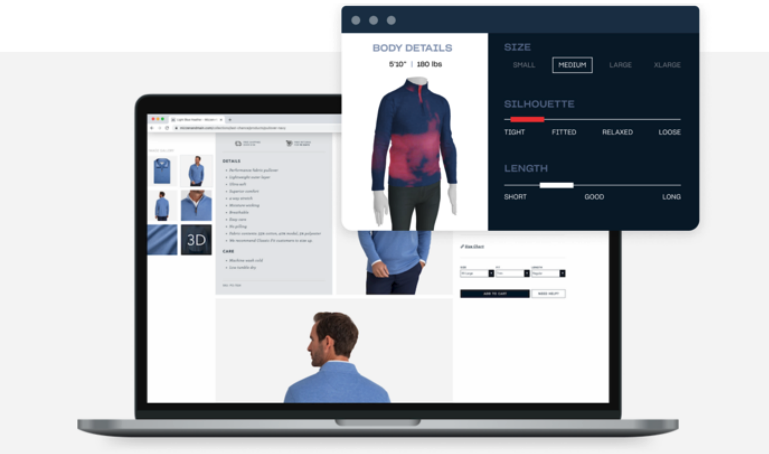

We expect solutions developed by retail innovators to play a significant role in driving growth in the online apparel and footwear industry. We discuss three key innovators in this section. Drapr Founded in 2019 and headquartered in San Francisco, Drapr is an online application based on technology that helps customers quickly create 3D avatars of their own sizes that can virtually try on clothes. The company was acquired by Gap on August 26, 2021, for an undisclosed amount. Drapr has worked with apparel retailers and brands such as &Collar, Mizzen + Main and Untuckit. Many retailers and brands have begun to devote more resources to help customers find sizes. Sizing is inconsistent across styles, making it difficult for consumers to choose the right size. Uncertainty around sizing inconsistencies may be exacerbated by online shopping, a sales channel with limited options to understand fit. We believe that technologies that can help customers virtually try on clothes and find sizes and styles will gain a competitive advantage in the market. [caption id="attachment_143895" align="aligncenter" width="700"] An example of Drapr’s 3D avatar solution

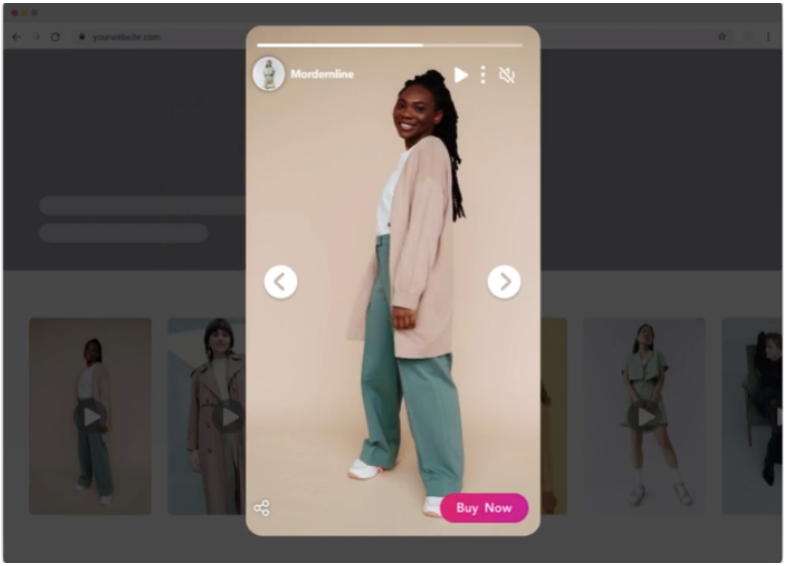

An example of Drapr’s 3D avatar solutionSource: Drapr[/caption] Firework Founded in 2017 and headquartered in Silicon Valley, Firework is an interactive short-video platform for retailers and brands to engage with website visitors. As of January 13, 2022, Firework has raised a total of $119.3 million in funding over eight rounds. The startup aims to transform brand or retailer websites with compelling short-video content that typically include links to product descriptions and a “BuyNow” option to make customers’ shopping journey easier. Brand representatives can connect with customers virtually in real time and simulcast the live stream to multiple websites at the same time. Apparel brands and retailers such as Astouri, CoFi Leathers and Linda's Stuff have worked with Firework on livestreaming their apparel, footwear or accessories products. Livestreaming is just beginning to take hold in the US and is a powerful way for brands and retailers to engage with consumers. [caption id="attachment_143896" align="aligncenter" width="700"]

An example of Firework’s livestreaming sessions

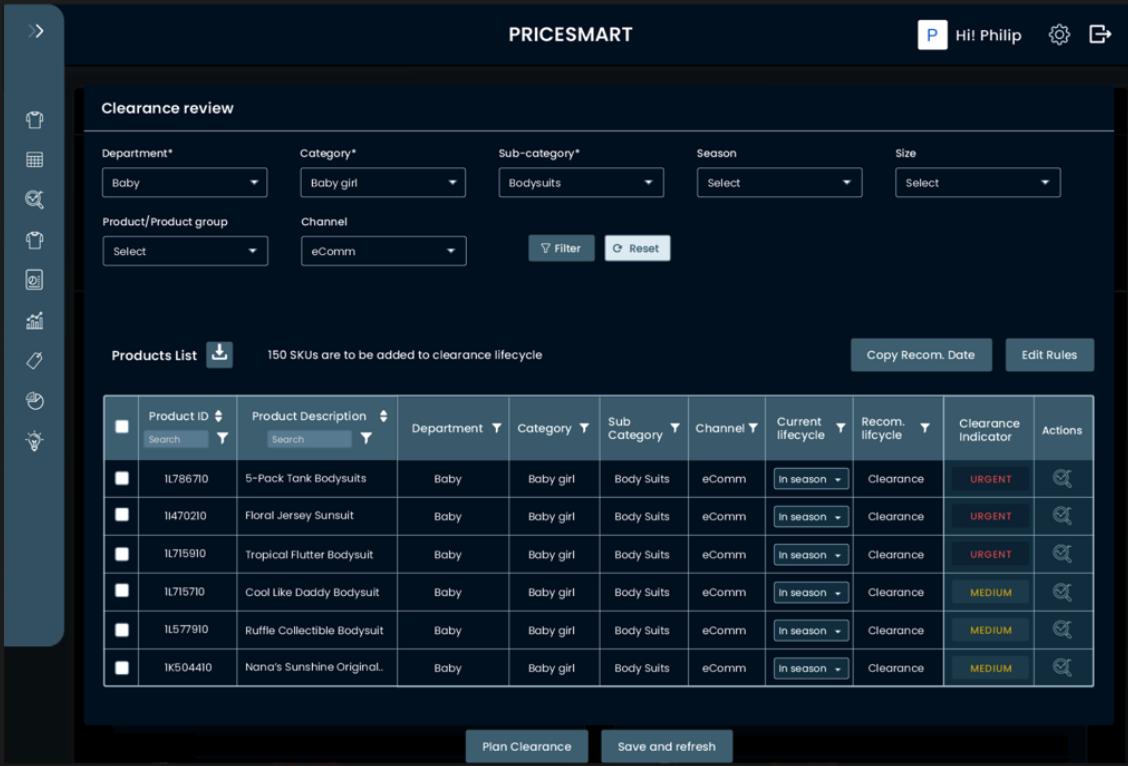

An example of Firework’s livestreaming sessionsSource: Firework[/caption] Impact Analytics Founded in 2015 and headquartered in Linthicum Heights, Maryland, Impact Analytics is an analytics solutions provider. As of January 13, 2022, Impact Analytics has raised a total of $11.8 million in funding over two rounds. The company leverages artificial intelligence to help retailers and brands optimize product assortments, simplify or automate product allocation processes, generate sales forecasts, optimize pricing and manage inventory. It can accurately predict demand and help retailers and brands maintain optimal inventory levels even for high-priced and long-tail SKUs (stock-keeping units). Besides, the startup offers actionable recommendations on marketing and personalized promotions, helping retailers and brands understand channel return on investment and optimize marketing budget. The startup has worked with leading apparel retailers and brands such as Coach, Dick’s Sporting Goods, Puma, Vera Bradley and Swarovski. It helped its clients achieve a maximum 15% reduction in churn rates, 30% improvement in margins and 20% reduction in lost sales due to accurate SKU-level forecasting, according to the company. [caption id="attachment_143897" align="aligncenter" width="700"]

An example of Impact Analytics’ dashboard for product pricing optimization solution

An example of Impact Analytics’ dashboard for product pricing optimization solutionSource: Impact Analytics[/caption]

What We Think

Implications for Brands/Retailers- We estimate mid- to high-single-digit growth of the total US apparel and footwear e-commerce market in 2022 and beyond. We believe the market presents opportunities for brands to capture since it is fragmented from a brand perspective. Brands and retailers can increase their market share by presenting innovative online selling processes, offering interesting virtual experiences and improving their supply chain capabilities.

- Offering interesting online experiences is important in building efficient e-commerce ecosystems. We see opportunities to drive e-commerce growth through livestreaming and metaverse experiences.

- Higher delivery costs and returns rates will be headwinds for apparel and footwear brands and retailers. We suggest brands and retailers create solutions that lower the costs of last-mile shipping and improve the efficiency of reducing and processing returns.

- Technology vendors play an important role in e-commerce, given the need for apparel brands and retailers to optimize their product assortment, selling process, analytics ability and supply chain efficiency to align with consumer preferences and thus boost sales. Consumer preferences include fast delivery and returns, personalized content and virtual services. Technology companies can offer technologies that enable functions in these areas, such as efficient shipping, artificial intelligence-enabled inventory management, content optimization, livestreaming, customized marketing and metaverse experiences.

Source for all Euromonitor data: Euromonitor International Limited 2022 © All rights reserved