albert Chan

What’s the Story?

The coronavirus pandemic has significantly accelerated the growth of e-commerce in apparel and footwear. This report provides an overview of e-commerce development in apparel and footwear, based on our insights from US Census Bureau data, as well as analysis of post-crisis expectations. We discuss major growth drivers in the market, the competitive landscape and key themes. We also cover strategies from key e-commerce apparel and footwear players and profile market innovators.

E-Commerce Performance and Outlook

US Apparel and Footwear Online Sales

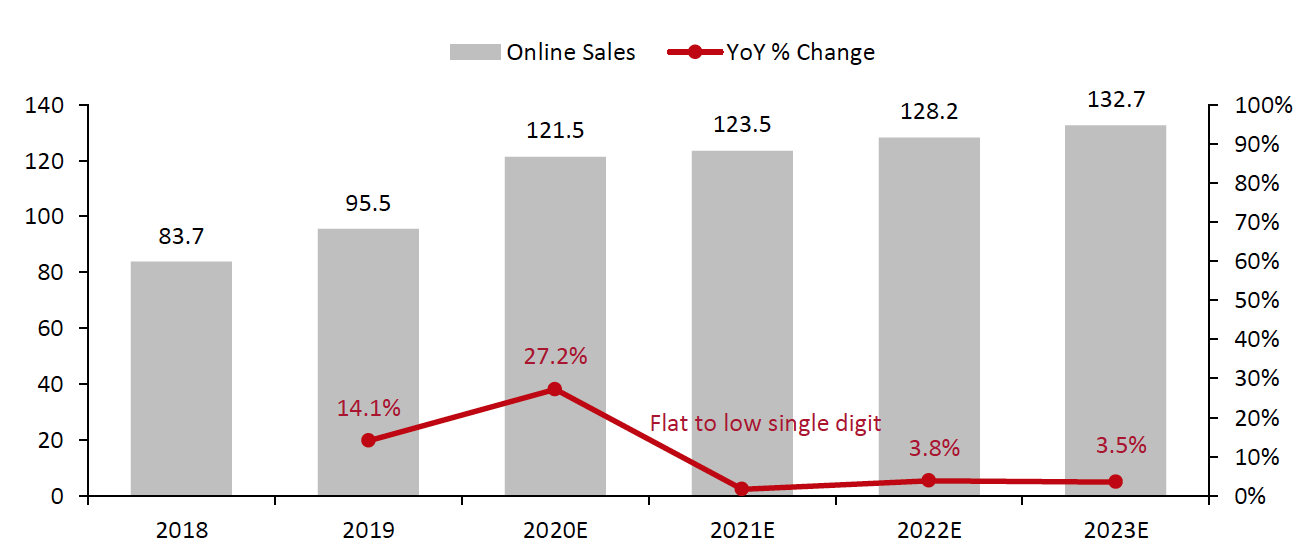

We estimate that online sales of apparel and footwear grew by 27.2% to $121.5 billion in 2020. This was in the context of a total US apparel and footwear market that fell by an estimated 12.1%, translating into an 11.6-percentage-point gain in share of sales for the online channel (see Figure 2).

We estimate online apparel and footwear sales to be in the range of flat to up by low single digits in 2021. This is in the context of a total US apparel and footwear market that we expect to grow by around 7%, reflecting e-commerce ceding some share back to stores.

We anticipate that this will be followed by mid-single-digit online growth in both 2022 and 2023: We currently model online growth of slightly below 4% in each year. We expect a return to in-store shopping to straddle 2021 and 2022. However, we anticipate that many consumers will retain online shopping habits.

We note that the outlook even for just 2021 remains highly uncertain, with the still-serious health crisis set to be counterbalanced by the rollout of vaccines, and with considerable uncertainty around the retention of recent consumer habits. We assume that the health crisis will moderate through 2021, and that any return to more regular ways of living, working and spending will occur predominantly in the second half of the year and into 2022.

Figure 1. US Online Apparel and Footwear Sales (Left Axis; USD Bil.) and YoY % Change (Right Axis; %) [caption id="attachment_121680" align="aligncenter" width="700"]

Source: Euromonitor International Limited 2021 © All rights reserved/US Census Bureau/Coresight Research[/caption]

Source: Euromonitor International Limited 2021 © All rights reserved/US Census Bureau/Coresight Research[/caption]

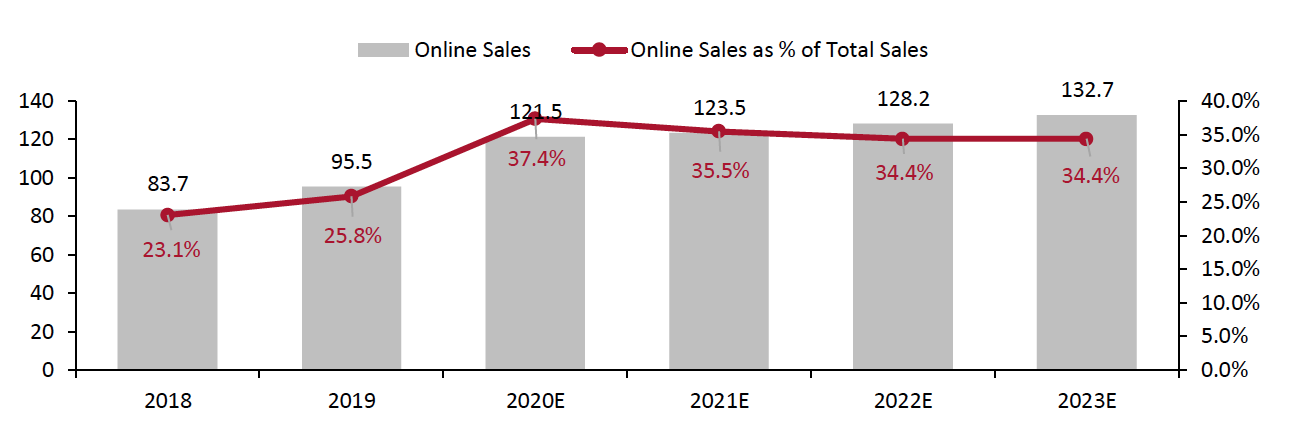

Coresight Research estimates that the online channel grew to account for 37.4% of total apparel and footwear sales in 2020, versus just over one-quarter in 2019. On the assumption that shoppers return to stores in 2021 and into 2022, albeit not at the levels seen before the crisis, we expect the penetration rate of apparel and footwear e-commerce to ease in each of those years. We currently model a levelling off in terms of share in 2023, although this outlook to 2023 is highly tentative.

Major retailers such as American Eagle Outfitters, Gap and NIKE are likely to exceed the category average, which is offset by the performance of less digitally agile retailers.

Figure 2. US: Online Apparel and Footwear Sales (Left Axis; USD Bil.) and Online Share of Total Apparel and Footwear Sales (Right Axis; %)

[caption id="attachment_121681" align="aligncenter" width="700"] Source: Euromonitor International Limited 2021 © All rights reserved/US Census Bureau/Coresight Research[/caption]

Source: Euromonitor International Limited 2021 © All rights reserved/US Census Bureau/Coresight Research[/caption]

Market Drivers

We discuss two major drivers that are supporting the online expansion of apparel and footwear sales.

Retention of Consumers’ Crisis-Driven Online Shopping Habits

In recent months, we have seen a consistent proportion of over 70% of consumers buying more online than they used to, according to our weekly US consumer survey, indicating an opportunity for apparel retailers in expanding their digital businesses. Our survey also indicates that many US consumers are likely to retain the habit of purchasing more online, even after the crisis: Consistently over one-quarter of consumers say that they expect to buy more online and less in stores once the crisis ends.

Though stores in many areas of the US have reopened, consumers are only switching part of their retail spending back to the brick-and-mortar channel. Traffic trends for the last week of November, which includes the Friday and Saturday of the Black Friday Weekend, declined by 41% year over year, with net sales declining by 26.1% year over year, according to in-store analytics company RetailNext. Therefore, we expect to see continued growth in e-commerce sales in apparel and footwear over the short to medium term.

Greater Capacity on the Digital Supply Side

Apparel retailers’ increasingly mature service offerings for e-commerce provide a convenient alternative to in-store shopping and may bolster consumers’ shift to buying more online, as well as better serving existing demand. To meet consumer demand for convenience in the shopping journey and account for coronavirus-related safety precautions, apparel retailers and brands have increased their investments in omnichannel capabilities—such as enhancing fulfillment capacity and improving delivery efficiency—which has supported their e-commerce sales growth.

Buy online, pick up in store (BOPIS) and curbside pickup omnichannel strategies are also gaining momentum. Apparel retailers are extending BOPIS and curbside pickup to more stores to cater for the digital shift in apparel and footwear retail. We expect BOPIS and curbside pickup options to also remain popular options post crisis due to their convenience.

Competitive Landscape

Brands and retailers in apparel and footwear are increasing their focus on e-commerce, with the aim of capturing increased share in this market. Coresight Research categorizes industry players by three tiers, according to their level of digital penetration.

Tier 1: Digital penetration over 30%

This includes American Eagle Outfitters, Foot Locker, Gap and PVH Corp. Gap is one of the big winners in e-commerce in 2020, with a digital penetration rate of 40% as of November 24, 2020 and 61% e-commerce sales growth in its third quarter. The three pillars of the retailer’s e-commerce strategy are:

- Strong omnichannel capabilities—the company offers smooth services in stores, on mobile (through its app and website), as well as online and through new capabilities such as curbside pickup.

- Digital campaigns that engage with customers, for example, Old Navy's “We Are We” campaign, which highlighted the brand’s commitment to equality and inclusivity.

- Personalized online services, such as virtual styling appointments.

American Eagle Outfitters has a 37% digital penetration rate as of November 24, 2020. The company has focused on social engagement and enhancing its operational efficiency and fulfillment capacity. For instance, the company sought consumer engagement through social media, including its recently launched partnership with Disney on November 9, 2020. The company posted a campaign video on TikTok, featuring TikTok stars Addison Rae and Wisdom Kaye, along with Disney characters Mickey and Minnie Mouse, which saw 5.2 million likes and 44.3 million views as of December 16, 2020.

In terms of operations, American Eagle Outfitters launched local shipping sites in countries including Brazil, Israel and Russia in 2020, and improved its US website page load speed by 60% as of November 24, 2020. Moreover, the company has invested in its fulfillment offerings, such as testing same-day delivery services, expanding curbside pickup options and building new distribution hubs to increase its overall fulfillment capacity.

Tier 2: Digital penetration from 25% to 30%

This tier includes Hanesbrands, Levi’s, and VF Corp. These apparel retailers and brands have also achieved satisfactory e-commerce results and engaged with consumers meaningfully. For example, Levi’s teamed up with Kohl’s to host a unique virtual closet experience on Snapchat on October 7, 2020, enabling consumers to browse an assortment of denim, Trucker jackets and t-shirts and then virtually mix-and-match options to create new looks.

The North Face, a subsidiary of VF Corp., unveiled a collaborative collection online with Gucci on December 23, 2020, celebrating the “spirit of exploration” both in fashion and the outdoors.

Tier 3: Digital penetration under 25%

Less digitally exposed but fast-growing retailers in the third tier include Dick’s Sporting Goods and PVH Corp. PVH Corp has been very digitally active in the China market through e-commerce livestreaming, but the company’s e-commerce penetration still lags from a global perspective, given that 43% of PVH’s businesses are in North America.

Figure 3. Selected Apparel and Footwear Retailers’ E-Commerce Metrics (Most Recent Quarter of Calendar Year 2020)

[wpdatatable id=683]Source: Company reports/Coresight Research

E-Commerce Innovators

We discuss three innovators and their impact on e-commerce in apparel and footwear.

1. Market BeyondMarket Beyond provides retailers and brands with consumer insights on product performance and customer shopping behavior across all major e-commerce platforms. It uses AI, including machine learning (ML) software, to sort and analyze billions of unique shopper journeys. The company can help players in apparel and footwear to use a diverse set of data sources, including mobile, desktop, ad networks and product-level data. This enables brands and retailers to determine and display patterns, as well as identify consumer preferences on products and touchpoints in order to support sales growth.

2. Happy ReturnsHappy Returns provides a centralized, in-person return services for online retailers. The California-based startup started out by setting up return kiosks in high-traffic areas, such as shopping malls, to accept returned items in person for online retailers and provide returns customers with an immediate refund.

During the pandemic, Happy Returns has helped apparel retailers and brands to manage frictionless returns and improve efficiency. Happy Returns has upgraded its process to ensure contactless transactions, in light of the coronavirus. Shoppers can now scan QR codes and place their return package into secure Happy Returns lockers, reducing the interactions between customers and store associates.

[caption id="attachment_121683" align="aligncenter" width="700"] Happy Returns now offers a contact-light returns experience

Happy Returns now offers a contact-light returns experienceSource: Happy Returns[/caption] 3. True Fit

As described by the company, True Fit is a “data-driven personalization platform for footwear and apparel retailers.” Its “Genome” platform hosts connected data sets from designers and manufacturers at leading apparel and footwear brands, as well as anonymized consumer order data and personal preference data from its registered users. True Fit then maps the style, fit and other attributes from apparel items to match the preferences of individual shoppers, providing consumers with a personalized experience that includes style rankings, fit details and ratings, and size recommendations.

With the boom in e-commerce, True Fit has helped apparel retailers and brands to solve pain points in sizing that can arise from not trying clothes in person. True Fit can offer customized suggestions based on a customer’s style and size preferences for clothing and footwear, therefore personalizing the shopping journey and reducing the return rates due to inappropriate sizing.

Themes We Are Watching

Fulfillment Costs

With shipping carriers such as Fedex and UPS levying more fees, the costs of delivery will be a headwind for apparel and retailers. In addition, retailers have reported that the cost pressure of moving products from warehouses to distribution centers is also rising due to increased digital shipment volumes and higher costs per shipment. Alongside a continued rise in online shopping, we expect distribution center delivery costs to increase—which will spur apparel retailers to seek out cost streamlining solutions.

For example, American Eagle Outfitters has built four new distribution hubs this year to increase its overall fulfillment capacity. The retailer described these distribution hubs as a “decentralized fulfillment network” as they are located closer to customers and stores and can thus deliver products to customers more quickly.

American Eagle Outfitters has announced that it plans to realize one-day fulfillment for approximately 400 store locations and two-day for a further 900 stores. Overall, these capabilities will enable the company to provide better customer service while reducing the inventory volume in its network, optimize shipment flows to manage delivery cost pressures and maximize its operating flexibility.

Customer Acquisition

In the most recent quarter, we have seen retailers reporting strong online customer acquisition (with increased marketing costs) and changes in their customer demographics. Many retailers have announced plans to lower the costs related to their customer acquisition strategies.

NIKE mentioned in its recent earnings call on December 18 that it aims to lower customer acquisition costs by focusing on retaining members with increased buying frequency and higher engagement levels, so that the company can increase its return on advertising spending and improve the overall digital operating margin. We expect to see more retailers growing their digital engagement strategically and seeking to deepen their connection with customers, in order to achieve more sustainable customer acquisition development.

Omnichannel Capabilities

Consumer demand for omnichannel shopping is continuing to grow, particularly with the implementation of social-distancing measures impacting the in-store experience. We have seen retailers expanding BOPIS and curbside pickup options to adapt to this trend. In addition, we expect apparel retailers to upgrade their omnichannel capabilities such as allowing curbside returns and offering same-day shipping and virtual styling or consultation services. For example, Dick’s Sporting Goods is expanding curbside returns offering, allowing customers to return products without having to get out of their cars. Moreover, American Eagle Outfitters is testing same-day delivery and in-store self-check-out facilities.

Brand Collaborations

Collaboration between apparel retailers and brands continues to be an important theme, as partnerships can further customer reach and create interesting and iconic products by sharing resources and ideas. We continue to see retailers and brands embracing collaborations to create special collections to be sold alongside their regular offerings.

- In October 2020, Levi's collaborated with Valentino to unveil a collection on the runway in Milan, featuring an updated version of Levi’s 517 Bootcut jeans, which were originally released in 1969. Levi’s mentioned in its earnings call on October 6 that the company’s mobile app, download and acquisition rates continue to increase, driven by more frequent exclusive collaborations and opportunities for consumers to gain early product access. We expect that the company will continue to leverage collaboration to win customers.

- VF Corp has been very active in creating brand partnerships and marketed them mostly online. Its subsidiary brand North Face collaborated with Supreme on October 26, 2020 and is in the process of designing and creating clothes with Gucci. Moreover, its subsidiary brand Timberland collaborated with Jimmy Choo to launch a collection of designer boots in September 2020.

- Retailers have also expanded partnerships to co-create games for consumers. For instance, Louis Vuitton promoted its League of Legends capsule apparel and footwear collection, designed by Nicolas Ghesquière, through a partnership with Riot Games.

Partnership with influencers is another key theme for the year ahead. We have seen retailers including American Eagle Outfitters, Levi’s and VF Corp leverage influencers with large social media followings to attract customers and enhance their brand image. For instance, Levi’s partnered with TikTok influencers Callen Schaub, Cosette Rinab, Everett Williams and Gabby Morrison for its Haus Miami activation—the influencers used Levi’s laser-powered 3D denim customization technology to create their own personalized denim items. TikTok users could watch the videos and click through to purchase the same design on Levi’s website.

What We Think

Implications for Brands/Retailers

- Omnichannel capabilities are important in building seamless, convenient and efficient e-commerce ecosystems. Although apparel and footwear retailers and brands have already begun investing in omnichannel capabilities, they would benefit from expanding these capabilities to more stores and more channels. We see opportunity in BOPIS and curbside collection offerings in terms of drive e-commerce growth. In addition, with more online shopping in the future, we expect distribution center delivery costs to increase. Apparel retailers will therefore benefit from solutions that reduce fulfillment costs.

- As customer acquisition costs are rising with the surge in e-commerce and heightened competition in the online apparel landscape, it will be beneficial for apparel and footwear retailers and brands to build a strategic focus in this area. This involves refining consumer engagement through personalization or membership perks, improving retention, digital demand forecasting, and reducing unnecessary marketing costs to unlock value for both existing consumers and new customers.

- Collaboration and partnership will continue to be an important theme, as they help apparel retailers and brands to further customer reach and create interesting and iconic products by sharing resources and ideas. We expect to continue to see retailers and brands embracing collaborations to create special collections to be sold alongside their regular offerings.

Implications for Technology Vendors

- Technology vendors play important role in e-commerce, given the need for apparel brands and retailers to optimize their product assortment, analytics ability and supply chain efficiency to align with consumer preferences and thus boost sales. Consumer preferences include contactless delivery and returns, personalized content and virtual services. Technology companies can offer technologies that enable functions in these areas, such as efficient curbside pickup and returns, AI-enabled inventory management, real-time delivery tracking and customized marketing.