DIpil Das

What’s the Story?

The Covid-19 pandemic has pushed retail online, and luxury brands, which have typically been slow to digitalize, have had to accelerate their digital strategies by several years. We discuss the size and trajectory of the global personal luxury e-commerce market, as well as key market drivers, the competitive landscape, innovators making a mark in the sector and major themes we expect to see in 2022 and beyond.E-Commerce Performance and Outlook

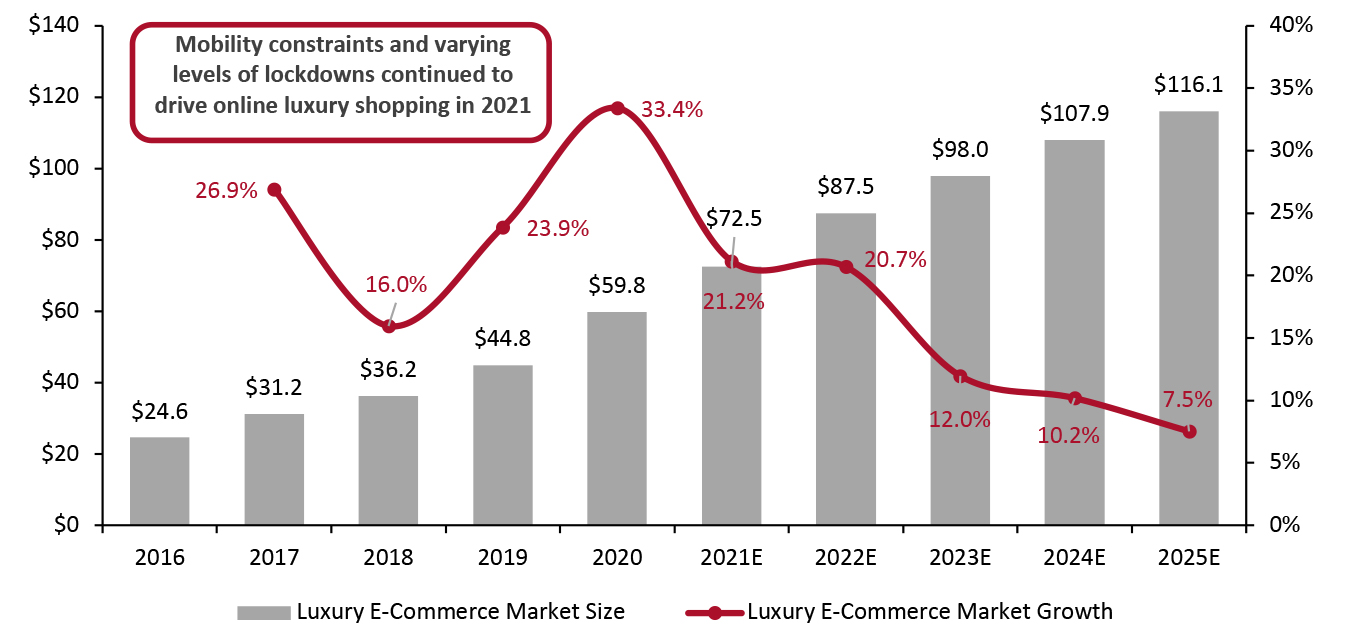

E-Commerce Retains Its Appeal in 2021 As with other retail sectors, 2020 ushered in a new era for luxury—the age of e-commerce. In past years, a number of luxury houses took a conservative approach to selling via e-commerce as digital channels cannot always replicate the intimacy of in-store customer service. Travel constraints and concerns around contracting the coronavirus have prevented shoppers from going to stores and attending social events, while government-mandated lockdowns required luxury brands to close stores and cancel events, with many turning to e-commerce and other digital channels in response to reach consumers. This forced shift to e-commerce has naturally led to heightened online luxury sales growth, as it has with other sectors. Coresight Research expects the behaviors adopted in 2020 to persist even after the pandemic fully ends, as they have (and continue) to become more deeply embedded in consumer behavior.- We estimate that global personal luxury goods e-commerce sales reached $59.8 billion in 2020, representing year-over-year growth of 33.4%. The total global personal luxury goods market, however, declined 13.2% to $295.2 billion.

- In 2021, mobility constraints, remote-working and limited social events have continued to impact the way people shopped luxury amid the pandemic, with consumers increasingly preferring to shop online. Pent-up demand has also prompted additional growth. We estimate that online personal luxury goods sales will have grown by 21.2% to $72.5 billion in 2021,while total personal luxury sales will have increased by 17.0% to $345.2 billion.

- Even as in-store shopping picks up traction, we anticipate that the market will continue to grow and expand at a slightly slower pace of 20.7%, with the online luxury personal goods market reaching $87.5 billion in 2022, as shown in Figure 1, while the total luxury goods market grows to $380.4 billion. In the following years, we expect online luxury sales to continue to grow strongly, but at a slower pace, as consumers shift some spendingback to physical retail.

Figure 1. Global Luxury E-Commerce Market Size (Left Axis; USD Bil.) and Growth (Right Axis; %) [caption id="attachment_136807" align="aligncenter" width="725"]

Source: Company reports/Coresight Research[/caption]

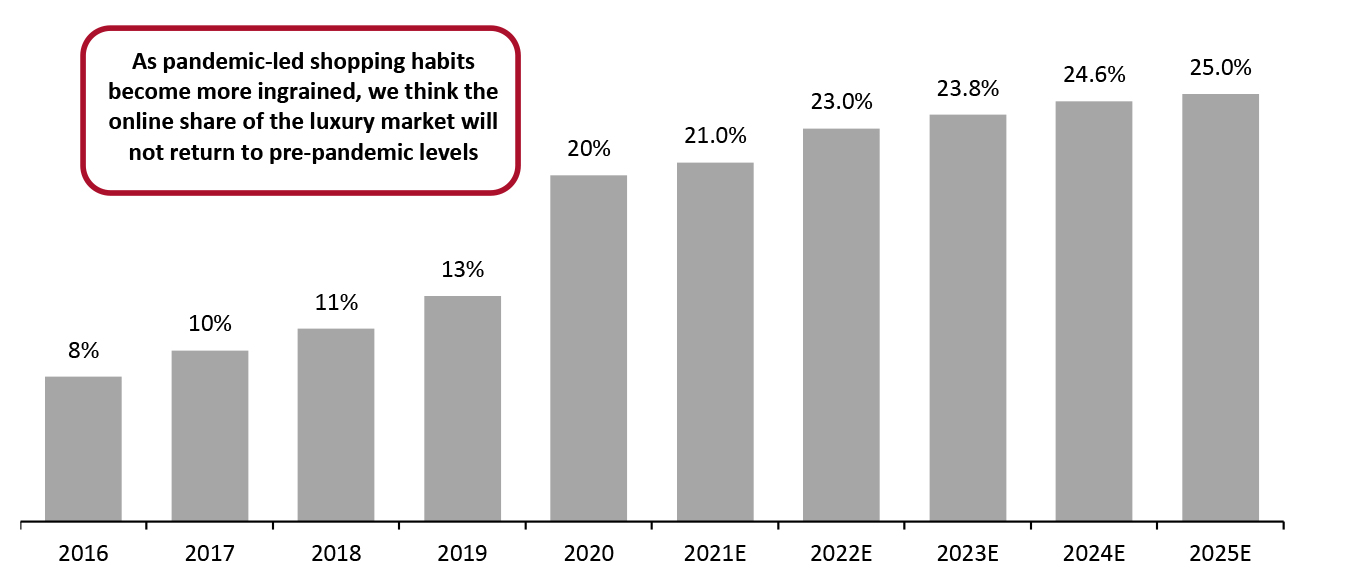

In 2020, we estimate that the online share of global personal luxury sales rose to around 20%, from 13% in 2019. We expect to see this share rise gradually to comprise 23% of total luxury sales worldwide in 2022 and ultimately reach about a quarter of total luxury sales in 2025.

As shopping habits developed over the pandemic become more ingrained, and with luxury brands focusing heavily on their digital sales and shifting away from wholesale to DTC, we think e-commerce will continue to command a significant share and not fall back to pre-pandemic levels.

Source: Company reports/Coresight Research[/caption]

In 2020, we estimate that the online share of global personal luxury sales rose to around 20%, from 13% in 2019. We expect to see this share rise gradually to comprise 23% of total luxury sales worldwide in 2022 and ultimately reach about a quarter of total luxury sales in 2025.

As shopping habits developed over the pandemic become more ingrained, and with luxury brands focusing heavily on their digital sales and shifting away from wholesale to DTC, we think e-commerce will continue to command a significant share and not fall back to pre-pandemic levels.

Figure 2. Global: Online Sales as a Share of Total Personal Luxury Sales [caption id="attachment_136808" align="aligncenter" width="701"]

Source: Company reports/Coresight Research[/caption]

Source: Company reports/Coresight Research[/caption]

Online Market Drivers

We identify three key factors that drive the global online luxury market. 1. Retention of Covid-Driven Online Buying Behavior In the near term, online buying behavior developed since the onset of the pandemic is likely to continue, and thus drive e-commerce growth in the sector. Even as vaccines are being rolled out, it may be a while before they become extensively adopted worldwide. Moreover, there may be a delay in instilling consumer confidence to visit public spaces and stores and socialize freely. 2. Increased Access to Brands Due to Digitalization Luxury brands have increasingly digitalized their operations—primarily by launching new sites, improving existing platforms and launching on luxury commerce marketplaces. Having highly convenient access to luxury brands with better e-commerce experiences via digital channels will drive online sales. 3. Near-Term Limitations on Travel A significant portion of luxury shopping takes place in Europe and North America, where many of the sector’s renowned brands were established—tourists are able to buy luxury products from their regions of origin without having to pay the additional duties and taxes they may incur if purchasing imported luxury goods in their domestic markets. With travel and tourism still restricted to some degree across many parts of the world, shoppers will turn to e-commerce as the next best option to shop their favorite luxury brands.Competitive Landscape

Online luxury retail’s competitive landscape comprises e-commerce sites from luxury brands and department stores, e-commerce marketplaces, resale platforms and rental platforms. We discuss major global players, split into two categories—omnichannel brands and e-commerce platforms. Omnichannel Luxury Brand Owners Kering recorded the second-highest e-commerce sales in 2019 among major places and saw 67% e-commerce growth in 2020. It has continued to experience strong digital sales growth in 2021 too, reporting e-commerce revenues of more than two times the levels seen in 2019 during the same period. Kering currently has higher e-commerce penetration across Europe and North America than in its Asia Pacific markets. Kering is aggressively approaching digitalization with significant investment. On its October 2021 earnings call, management stated the company has completed the process of internalizing its e-commerce operations, unifying its platforms and rolling out virtual showrooms across its brands. It also offers see now, buy now options through shoppable Instagram posts for its new collections. LVMH is the world’s biggest luxury conglomerate, and recorded e-commerce penetration of 9% in 2019. The company did not provide the penetration rate for 2020, stating that it was “too high and unsustainable.” We expect that the company still commands the highest online share of revenues among legacy luxury brand owners, as it reported strong digital sales growth through the first three quarters of 2021. Alongside websites for its brands, LVMH runs e-commerce site 24 Sèvres (24S), which offers over 300 brands, including a number of the company’s own. The platform is an extension of the group’s department store Le Bon Marché and its sales come from international shoppers across 100 countries. The group said that the platform experienced strong revenue growth in 2020. LVMH brands are also sold on several luxury e-commerce platforms, such as Farfetch and Mytheresa. Richemont sells through its brands’ digital sites, its own e-commerce platform YOOX Net-A-Porter (YNAP) and online watch retailer Watchfinder. It reported that digital sales contributed 21% to group sales in its fiscal year ended March 31, 2021, up from 19% in the prior year. Excluding YNAP and Watchfinder, online sales comprised 7% of its brands’ total sales, up from less than 3% in the prior year. Richemont expects that the rise in online luxury shopping “is here to stay and will continue to strengthen.” The company’s brands engaged with its customers through social media channels, virtual boutique tours, digital watch fairs and jewelry preview launches to grow sales through 2020 and 2021. Tapestry reported that its e-commerce sales almost doubled to a penetration of 35% in its fiscal year ended July 3, 2021, reaching $1.6 billion. The company saw higher e-commerce penetration in North America compared to other regions, particularly during the 2020 holiday season. To cater to increased demand, the company expanded its fulfillment capacity ahead of the holiday period, including increasing its total distribution center capacity by nearly 350,000 square feet. Tapestry plans to invest further in infrastructure as well as talent for its digital channels.Figure 3. E-Commerce Metrics: Major Global Omnichannel Luxury Brands [wpdatatable id=1474 table_view=regular]

Kering’s 2021 rate is for the nine months to September 30, 2021. Tapestry’s 2020 e-commerce revenues are for the trailing 12 months to February 2021 and 2021 revenues are for the fiscal year ended July 3, 2021. Richemont’s revenues are for its full fiscal years, which end March 31. Tiffany’s 2020 revenues are for the nine months to October 31, 2020. Conversions to USD are at current rates as of October 26, 2021. The penetration rates are for the brands’ retail channels only and exclude online sales made by retailers they have sold to via wholesale channels. Source: Company reports/S&P Capital IQ/Coresight Research Major Luxury E-Commerce Platforms Luxury retail via e-commerce platforms is dominated by Richemont’s YNAP and Farfetch on a global level, while Secoo and Tmall Luxury Pavilion are major players in China and other Asian markets. Figure 4 provides an overview of key metrics for the major platforms. Below, we discuss new and key players in the space.

Figure 4. Key Metrics: Major Luxury E-Commerce Platforms [wpdatatable id=1475 table_view=regular]

Revenues for Yoox Net-A-Porter include Richemont’s Watchfinder. Rebag’s revenues are estimated. Source: Company reports/S&P Capital IQ/Crunchbase/Coresight Research Amazon launched an invitation-only platform named Luxury Stores in September 2020, which can only be accessed by select Prime users in the US. Amazon enlisted designer Oscar de la Renta as its first official partner and has since added more designers to its platform. Designers can present their products in three dimensions (3D), allowing users to rotate the images for a 360-degree view of the products. Amazon has trialed other tech-driven shopping options with this platform. In September this year, Amazon held a star-studded fashion show with singer Rihanna’s Savage x Fenty lingerie brand. The show was opened by Cindy Crawford and featured other famous models and singers—it is available to watch on-demand on Prime Video and shoppers can buy products directly through links in the video. Farfetch is an online luxury goods marketplace with over 3,000 brands and designers that are typically offline boutiques with little digital presence. The company reported annual revenue growth of 64% in fiscal 2020, reaching $1.7 billion. In November 2020, the company announced a $1 billion investment from Alibaba and Richemont. Farfetch officially launched on Alibaba’s luxury online marketplace Tmall Luxury Pavilion on March 1. Furthermore, a notable investor and controlling shareholder in Farfetch is Groupe Artemis—the family investment vehicle of Kering founder François Pinault. At the time of the Alibaba-Richemont announcement, Farfetch reported that Groupe Artemis had increased its stake in the platform with a $50 million purchase of Farfetch shares. In November 2021, Farfetch and Richemont confirmed that they are in discussions about several options, including using FPS to power Richemont’s Maisons, adding the Maisons to the Farfetch marketplace, and Farfetch investing in Yoox Net-A-Porter as a minority shareholder. These initiatives will not only expand Farfetch’s marketplace offerings but also build out its FPS business further, and establish it as a technology authority in the luxury sector. Lyst is a fashion search engine that connects shoppers with online fashion stores, spanning 5 million products from 9,000 of the world’s leading brands and retailers. The company’s annual revenue was down 11% year over year in 2020. MatchesFashion.com is a UK-based online platform that features over 650 designers and offers editorials and reports on fashion and design. The company reported a year-over-year increase in annual revenue of 14% in 2020. Moda Operandi is a luxury website carrying over 1,000 brands and featuring established and emerging international designers. The company extended into offline retail with the opening of a store in New York, and it now has a global network of physical showrooms and personal stylists. Mytheresa.com was founded in 2006 as a fashion store. The platform is now an international online retailer that features 250 popular fashion brands and was acquired by Neiman Marcus Group in 2014. In January 2021, it successfully listed on the US stock market with a valuation of $3.1 billion. The platform reported year-over-year sales growth of 20% for its fiscal year ended December 31, 2020. Secoo is a major online luxury retailer in China, providing high-end products and services from 3,800 domestic and global brands. The retailer has established collaborations with 143 brands, including Prada, Stella McCartney, Thom Browne and Valentino. The company reported a sales decrease of nearly 24% in the nine months ended September 30, 2020. In January 2021, the retailer announced plans to go private, after which it has not released financial performance news. The RealReal is one of the largest online sites for consigned luxury goods. Its sales declined by 5.2% to $300 million in the fiscal year ended December 31, 2020. The company’s strategy centers around attracting new buyers and consigners, as well as investing in automation to improve operational efficiency, including copywriting and pricing. The RealReal opened a “mini store” in Palo Alto, California in late 2020. The new store has a very small footprint of 2,000–3,000 square feet, carrying only 400–500 stock-keeping units(SKUs) in the front with luxury consignment offices in the back. The company plans to open two more mini stores in California and 10 more “neighborhood stores” (bigger than mini stores but smaller than normal stores) by the end of 2021. Alibaba’s Tmall launched a luxury discount platform, named Luxury Soho in April 2020, which sells products from luxury brands at discount prices. It targets the younger luxury consumer segment, which is typically price-sensitive but also values quality and craftmanship. Through 2020, brands accumulated substantial unsold inventory as consumers were unable to travel and purchase products. Alibaba introduced Luxury Soho to provide retailers an outlet to offload aging stock lucratively.

E-Commerce Innovators

The luxury sector has experienced a digital renaissance prompted by the pandemic. We believe that this will continue through 2022, until the sector has “caught up” with retail tech innovations that are already ubiquitous in other retail sectors. As blockchain and resale continue to as overarching, multiyear themes to look forward to within luxury, we discuss three innovators that have developed unique applications for the luxury sector. ConsenSys Blockchain software company ConsenSys developed a platform named AURA in collaboration with LVMH and Microsoft, to trace the history of luxury products, authenticate their originality and attempt to restrict counterfeiting. The platform uses Ethereum blockchain technology and Microsoft Azure cloud computing services. At the time it was announced in May 2019, several LVMH brands were already using the platform. More recently, LVMH watch brand Hublot added e-warranties on its products via the AURA platform. Rebag Luxury resale platform Rebag unveiled its image recognition engine Clair AI on February 3, 2021, an image recognition engine that can identify and price luxury handbags. Rebag fed the machine-learning engine using six years of data and millions of reference images. The tool can assess the resale value of handbags from over 50 brands. Rebag also resells fashion accessories, jewelry and watches although Clair AI, currently operates with handbags. The engine is available on-demand for professional resellers and global platforms that wish to integrate it with their existing systems. ShopWorn ShopWorn defines itself as “an e-commerce shopping destination for customers who want to be the first to own authentic, unused luxury products but don't want to pay luxury prices.” The platform works with brands and authorized dealers to source unsold products that are worn due to being on display in stores. The company launched in 2015 and primarily served shoppers in the US up until its expansion in October 2020 to include shipping to China and other major Asian markets through a satellite location in Hong Kong. ShopWorn also launched on Tmall Global at the same time to reach a wider audience in China, and plans to launch on Asian digital marketplaces Global JD, Lazada and Shopee. The company plans to open additional locations in Europe and other markets over the next five years.Themes We Are Watching

The pandemic prompted a shift in consumer behavior and led luxury companies to rethink several aspects of their strategic operations, and in some cases accelerate some of their strategies, such as digital transformation. We discuss four key themes we expect to see in luxury in the near term, some of which have long-term longevity.- Greater Focus on Direct-to-Consumer (DTC) and Reduced Wholesale and E-Concession

- Resale Picks Up Traction

- The Rise of the Luxury Metaverse with a Focus on Gen Z

- Cross-Platform Collaborations To Quickly Access New Markets

What We Think

As the pandemic-induced shift to e-commerce has become a deeply ingrained consumer behavior, luxury brands are preparing to appeal to the new digitally inclined luxury shopper. As consumers and brands increasingly accept this highly digital “normal” in their shopping environments, we expect to see increased innovations and collaborations in the luxury e-commerce space. Implications for Brands/Retailers- Luxury brands and retailers that made early investments in digital strategies are ahead of the game. Those lagging behind will experience heightened competition and should invest in infrastructure and customer acquisition to keep up.

- Luxury brands need to be innovative and experimental, and open to adopting new technologies, to stay ahead of the competition. First-movers, such as LVMH with its blockchain consortium, will tend to have a competitive advantage over rival firms.

- As luxury brands look to gain increased control over their supply chains, such as by cutting down on their wholesale channels, they will need additional warehousing or fulfillment capacity to cater to their expanded retail channels.

- Retail tech innovators should specialize their offering for luxury—they should use language and terminology that luxury products use, and adapt their data dictionary to enable easy deployment with luxury brands’ systems.