albert Chan

Opportunities in Southeast Asia

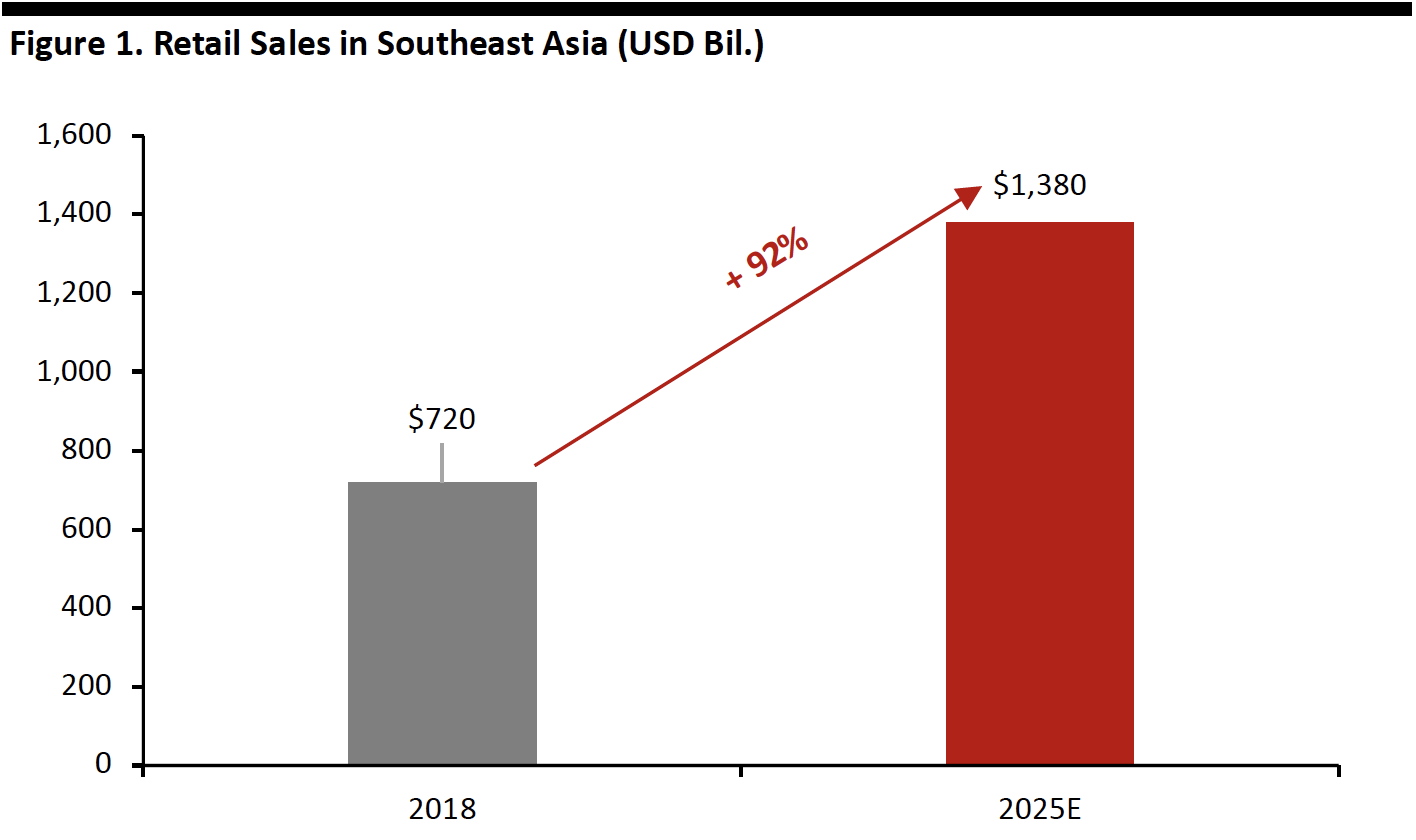

In this report, we outline the scale and potential of retail and e-commerce in Southeast Asia. We discuss the opportunities in e-commerce platforms that brands can leverage, and the strategies brands can adopt to enter the e-commerce market in Southeast Asia. We look at six key markets in Southeast Asia: Indonesia, Singapore, Malaysia, Thailand, the Philippines and Vietnam. Essentially, ASEAN minus the smaller and less-developed markets. Southeast Asia Retail Set to Be Worth $1.4 Trillion by 2025 Retail is growing quickly in Southeast Asia, with retail sales forecast to almost double to $1.38 trillion in 2025 from $720 billion in 2018, an increase of 92%, according to a study by Google and Temasek. And, as we discuss later, the growth opportunities are even bigger in e-commerce. [caption id="attachment_94459" align="aligncenter" width="700"] Note: Southeast Asia, specifically Indonesia, Singapore, Malaysia, Thailand, the Philippines and Vietnam.

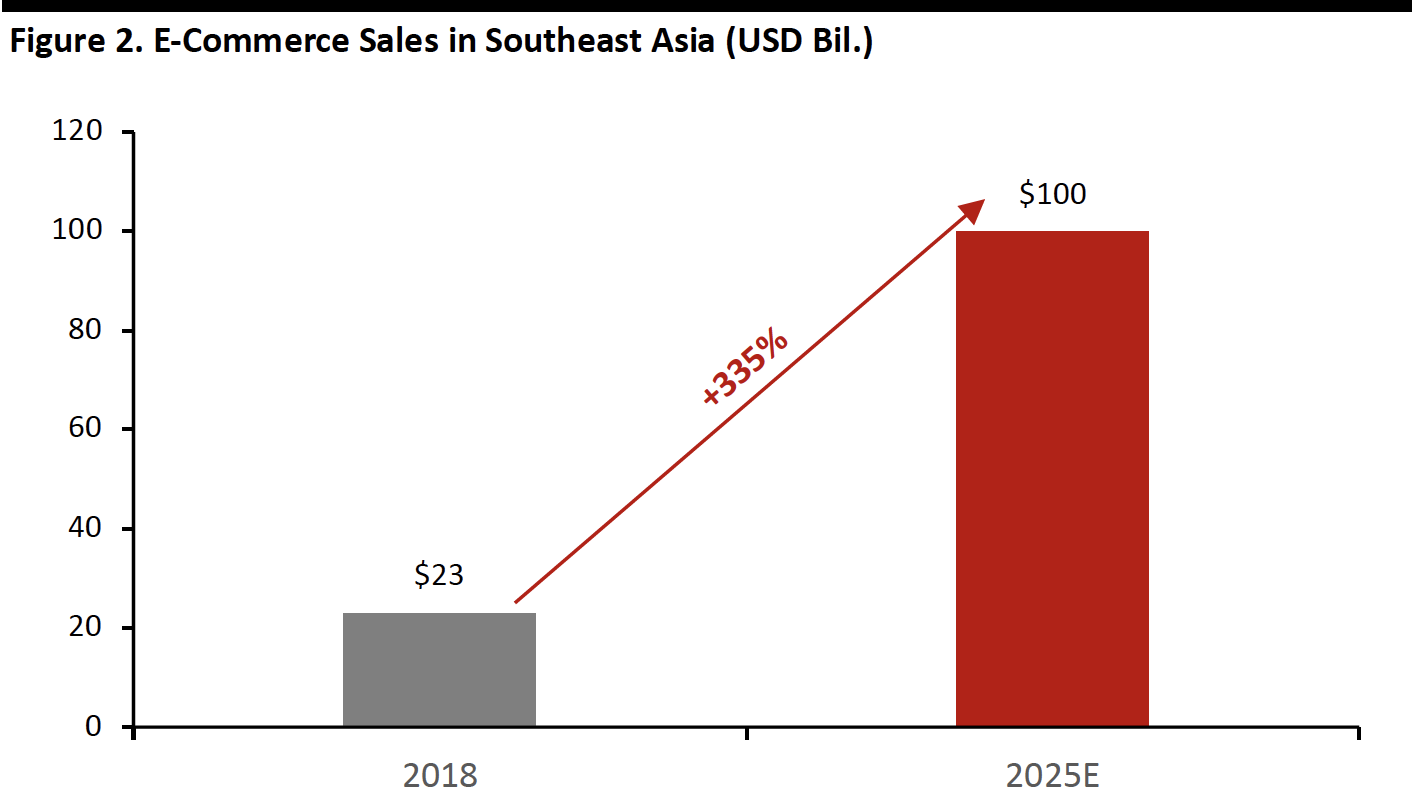

Note: Southeast Asia, specifically Indonesia, Singapore, Malaysia, Thailand, the Philippines and Vietnam.Source: Google/Temasek[/caption] Southeast Asia’s E-Commerce Market Southeast Asia is projected to be one of the fastest growing Internet economies around the globe. The Internet economy in the region comprises of ride hailing, online media, online travel and e-commerce. Google and Temasek’s study showed the market size (in terms of gross merchandise volume) of such an Internet-based economy could reach $240 billion by 2025. Within this broader Internet economy, e-commerce is projected to grow rapidly: E-commerce sales are expected to virtually quadruple to $100 billion by 2025 from $23 billion in 2018, according to Google and Temasek. [caption id="attachment_94460" align="aligncenter" width="700"]

Note: Southeast Asia, specifically Indonesia, Singapore, Malaysia, Thailand, the Philippines, and Vietnam.

Note: Southeast Asia, specifically Indonesia, Singapore, Malaysia, Thailand, the Philippines, and Vietnam.Source: Google/Temasek[/caption] Indonesia is Southeast Asia's largest e-commerce market, with a value of $12.2 billion in 2018, according to Google and Temasek. This figure will reach $53 billion by 2025, according to Google and Temasek. Google and Temasek also predicted that Vietnam, Thailand and the Philippines will all have e-commerce markets worth more than $10 billion by 2025. Young Consumers and Growing Middle Class Pose Opportunities for Southeast Asia E-Commerce Southeast Asia’s e-commerce potential lies in many factors unique to the region:

- Its burgeoning middle class: the middle class population in Southeast Asia is expected to double to 400 million in 2020, according to Nielsen.

- A young population: 70% are under age 40 according to Google and Temasek.

- A GDP growth rate of 4.8% in 2019-2023, according to real estate services. firm Jones Lang LaSalle (JLL).

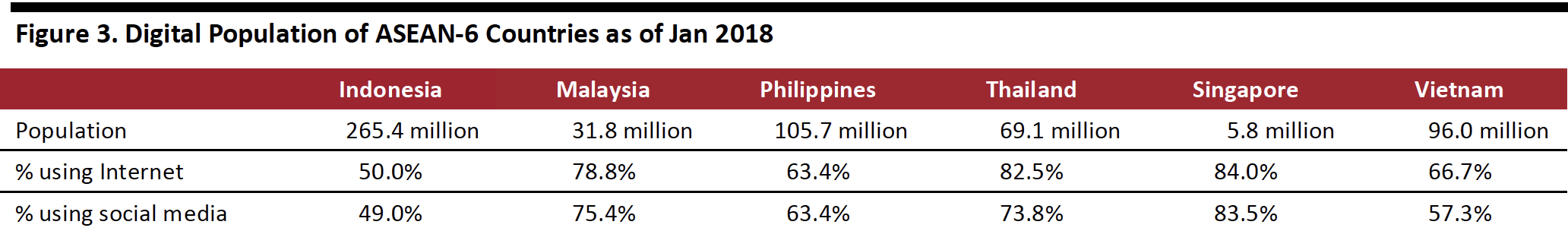

- A high rate of Internet and mobile penetration.

Source: WeAreSocial/Hootsuite/Coresight Research[/caption]

The geography in the region also facilitates the prosperity of e-commerce because the lack of physical stores, especially in archipelagos like Indonesia and the Philippines with underdeveloped transportation infrastructure, make online shopping the only option. But even in main cities where malls and stores are centralized, offline retailers can no longer ignore the booming Internet market.

Chinese Companies See the Opportunity

China’s digital giants — including Alibaba, Baidu, DiDi, JD.com, and Tencent — see the huge potential in this fast-growing market and have invested at least $8 billion in mergers and acquisitions to build out their e-commerce capabilities in Southeast Asia. One of Alibaba’s investments was to set up a “digital free trade zone” in Malaysia to make cross-region shipments more affordable for Malaysian small- and medium-sized companies – the majority of businesses in the country. A core element of the scheme is an electronic world trade platform (eWTP) which is designed to ease trade between Malaysian and Chinese firms. The virtual platform will connect businesses, manage cargo authorizations and assist on customs.

Source: WeAreSocial/Hootsuite/Coresight Research[/caption]

The geography in the region also facilitates the prosperity of e-commerce because the lack of physical stores, especially in archipelagos like Indonesia and the Philippines with underdeveloped transportation infrastructure, make online shopping the only option. But even in main cities where malls and stores are centralized, offline retailers can no longer ignore the booming Internet market.

Chinese Companies See the Opportunity

China’s digital giants — including Alibaba, Baidu, DiDi, JD.com, and Tencent — see the huge potential in this fast-growing market and have invested at least $8 billion in mergers and acquisitions to build out their e-commerce capabilities in Southeast Asia. One of Alibaba’s investments was to set up a “digital free trade zone” in Malaysia to make cross-region shipments more affordable for Malaysian small- and medium-sized companies – the majority of businesses in the country. A core element of the scheme is an electronic world trade platform (eWTP) which is designed to ease trade between Malaysian and Chinese firms. The virtual platform will connect businesses, manage cargo authorizations and assist on customs.

Market Entry 101

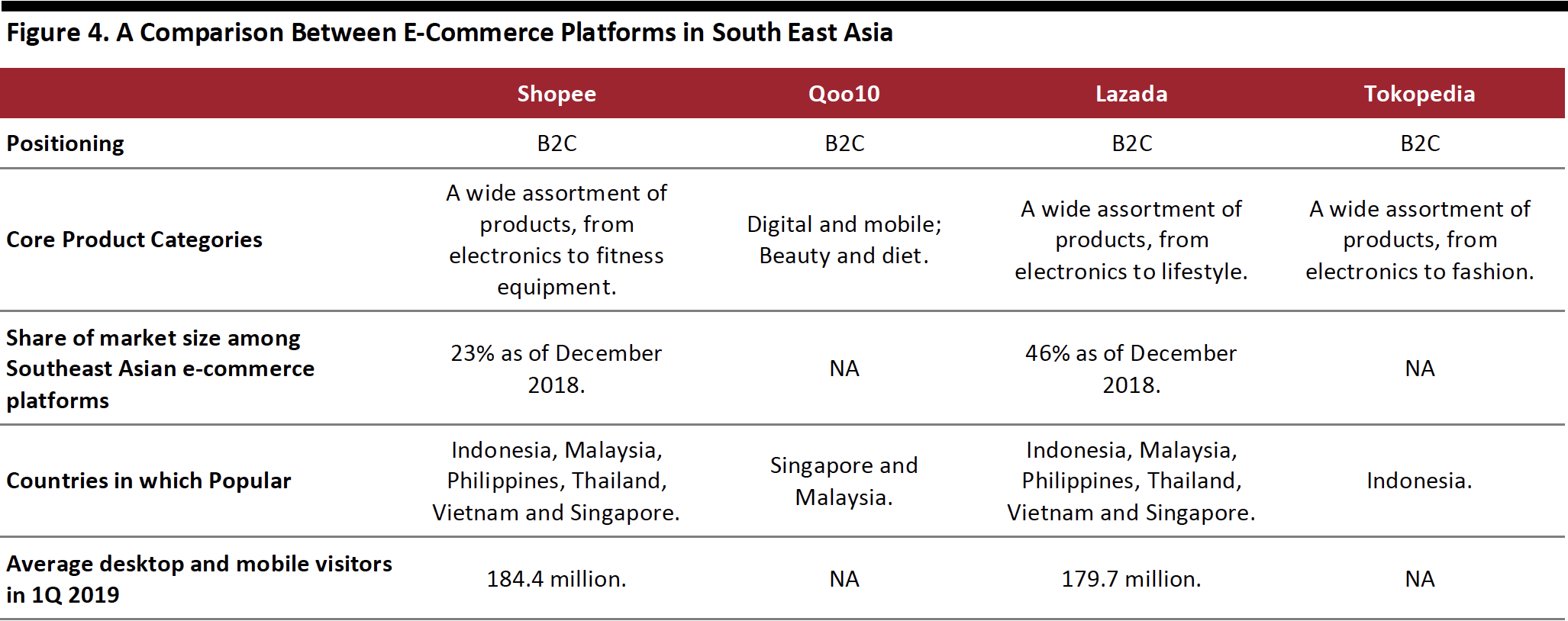

E-Commerce Platforms in Southeast Asia Traditional and online retailers have stepped up their online game, seeking to tap into the potential in the region. B2C marketplaces have seen particularly rapid development over recent years. [caption id="attachment_94462" align="aligncenter" width="700"] Source: Company reports/iPrice Group/Coresight Research[/caption]

Singapore-based Shopee has become the most visited e-commerce platform in Southeast Asia, according to a report by iPrice, a price comparison provider for online shopping that also conducts market research. Shopee had a total average of 184.4 million visits per quarter on desktop and mobile in the first quarter of 2019.

Lazada, another Singapore-based e-commerce platform, is in second place, at 179.7 million visitors in the first quarter of 2019.

In Indonesia, e-commerce platform Tokopedia plays a dominant role: It claims to serve an impressive 93% of the country’s 7,000 districts. In February 2019, it raised $1.1 billion in a Series G round led by SoftBank and Alibaba.

Duties and Taxes in Southeast Asia

Although the six countries we include in the report are all members of the ASEAN trading block, import tariffs and regulations can vary dramatically from one country to the next. Unlike the EU, member states grant one another preferential trading treatment but it is not a common market.

For example, income tax can be different depending on whether the importer is registered with the country or not. In some countries such as Indonesia, this tax is higher for unregistered importers more than for registered importers.

In some countries, there is a threshold below which fewer or no taxes are charged on shipments, known as the de minimis value. For instance, Indonesia’s de minimis value is $75: merchants importing a product worth less than $75 pay not tax or import duty.

The table below outlines the key differences in import rules as they apply to online sales.

[caption id="attachment_94463" align="aligncenter" width="700"]

Source: Company reports/iPrice Group/Coresight Research[/caption]

Singapore-based Shopee has become the most visited e-commerce platform in Southeast Asia, according to a report by iPrice, a price comparison provider for online shopping that also conducts market research. Shopee had a total average of 184.4 million visits per quarter on desktop and mobile in the first quarter of 2019.

Lazada, another Singapore-based e-commerce platform, is in second place, at 179.7 million visitors in the first quarter of 2019.

In Indonesia, e-commerce platform Tokopedia plays a dominant role: It claims to serve an impressive 93% of the country’s 7,000 districts. In February 2019, it raised $1.1 billion in a Series G round led by SoftBank and Alibaba.

Duties and Taxes in Southeast Asia

Although the six countries we include in the report are all members of the ASEAN trading block, import tariffs and regulations can vary dramatically from one country to the next. Unlike the EU, member states grant one another preferential trading treatment but it is not a common market.

For example, income tax can be different depending on whether the importer is registered with the country or not. In some countries such as Indonesia, this tax is higher for unregistered importers more than for registered importers.

In some countries, there is a threshold below which fewer or no taxes are charged on shipments, known as the de minimis value. For instance, Indonesia’s de minimis value is $75: merchants importing a product worth less than $75 pay not tax or import duty.

The table below outlines the key differences in import rules as they apply to online sales.

[caption id="attachment_94463" align="aligncenter" width="700"] Updated as of December 3, 2018

Updated as of December 3, 2018Source: Fung Omni Services/Janio[/caption]

Marketing 101 for E-Commerce in Southeast Asia

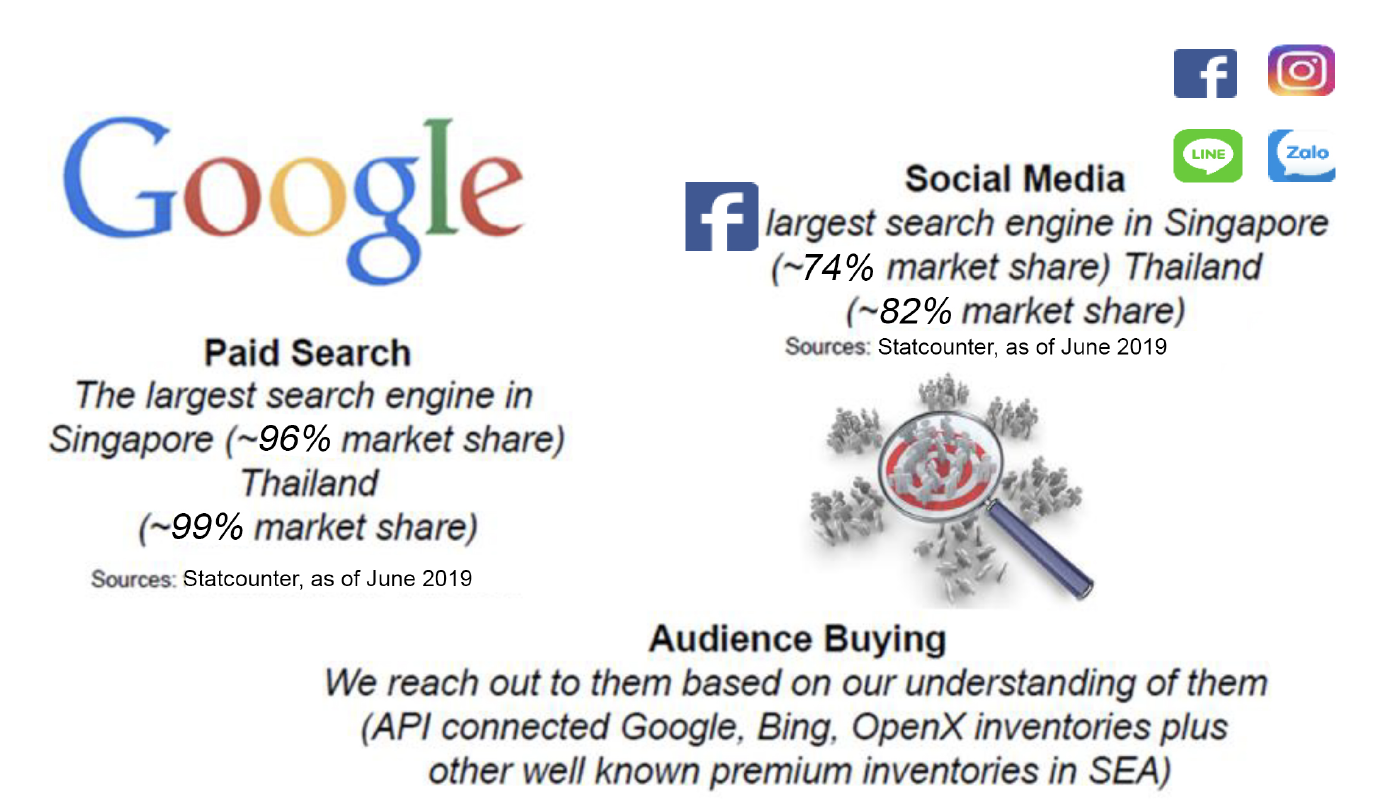

Southeast Asia includes multiple markets and multiple ethnicities. Managing digital transformation in such a complex part of the world poses various challenges to brands. These are some of the key steps brands can leverage to tap into the growing Southeast Asia market:- Conduct search engine optimization and social media marketing.

- Leverage key opinion leaders.

- Conduct audience buying.

- Leverage shopping festivals.

Source: Fung Omni Services[/caption]

[caption id="attachment_94465" align="aligncenter" width="700"]

Source: Fung Omni Services[/caption]

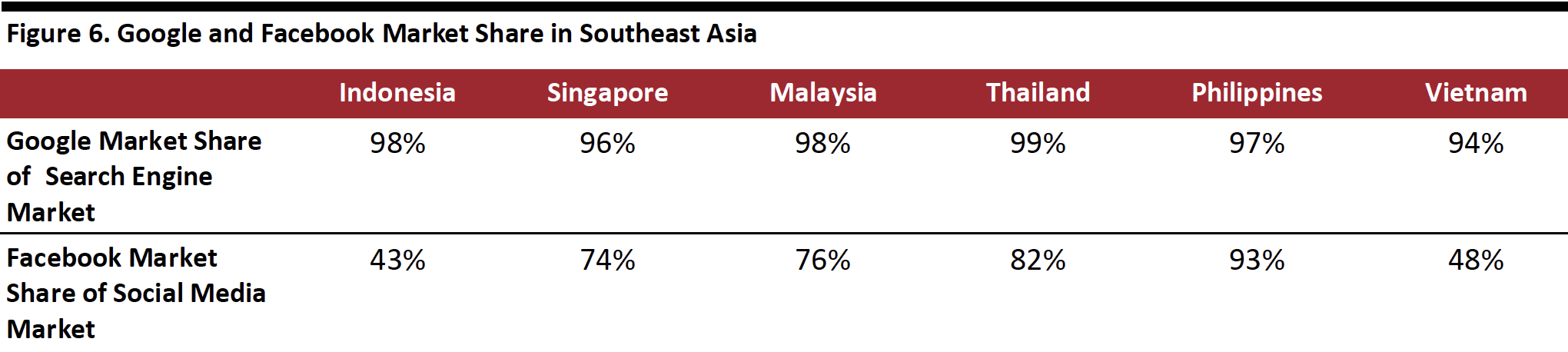

[caption id="attachment_94465" align="aligncenter" width="700"] Note: Data as of June 2019; for search engine market share, data was collected based on over 10 billion page views per month across the StatCounter network of over 2 million websites. For social media market share, data was collected based on social media platforms’ traffic generation capabilities i.e. the amount of traffic they refer to other websites, but not based on the amount of traffic these social media platforms receive.

Note: Data as of June 2019; for search engine market share, data was collected based on over 10 billion page views per month across the StatCounter network of over 2 million websites. For social media market share, data was collected based on social media platforms’ traffic generation capabilities i.e. the amount of traffic they refer to other websites, but not based on the amount of traffic these social media platforms receive.Source: Statcounter/Coresight Research[/caption] Partner with Key Opinion Leaders (KOLs) for Marketing With high penetration rates for internet and mobile in SEA, KOL marketing can be very helpful. Brands can send free samples to influencers, known as product seeding, to create organic user-generated content that can facilitate word-of-mouth referrals. A 2018 survey by e-commerce platform Rakuten found that 87% of global consumers have been inspired to make a purchase based on what they saw from an influencer, while 41% said they find at least one new brand or product from an influencer every week. Brands can also reach out to fashion magazines and bloggers, to leverage the cultural credibility of magazine brands. As magazines generally undergo a rigorous editorial review process, consumers tend to read and trust these media. [caption id="attachment_94466" align="aligncenter" width="700"]

Source: Fung Omni Services[/caption]

Leverage Audience Buying For Targeted Audiences

Historically, advertisers use contextual buying that relies on the content of the page as a proxy for a user’s interest. The primary benefit is that it allows advertisers to reach an individual at the moment they are browsing related web content. But the limitation is that it reaches a broad segments of visitors.

Audience buying, on the other hand, shifts away from using content as a proxy and instead allows advertisers to directly buy audience segments based on a broad range of historical data. Made possible by deep pools of consumer information and technology of identify consumer segments, audience buying enables the buying of targeted audiences rather than broad segments of visitors.

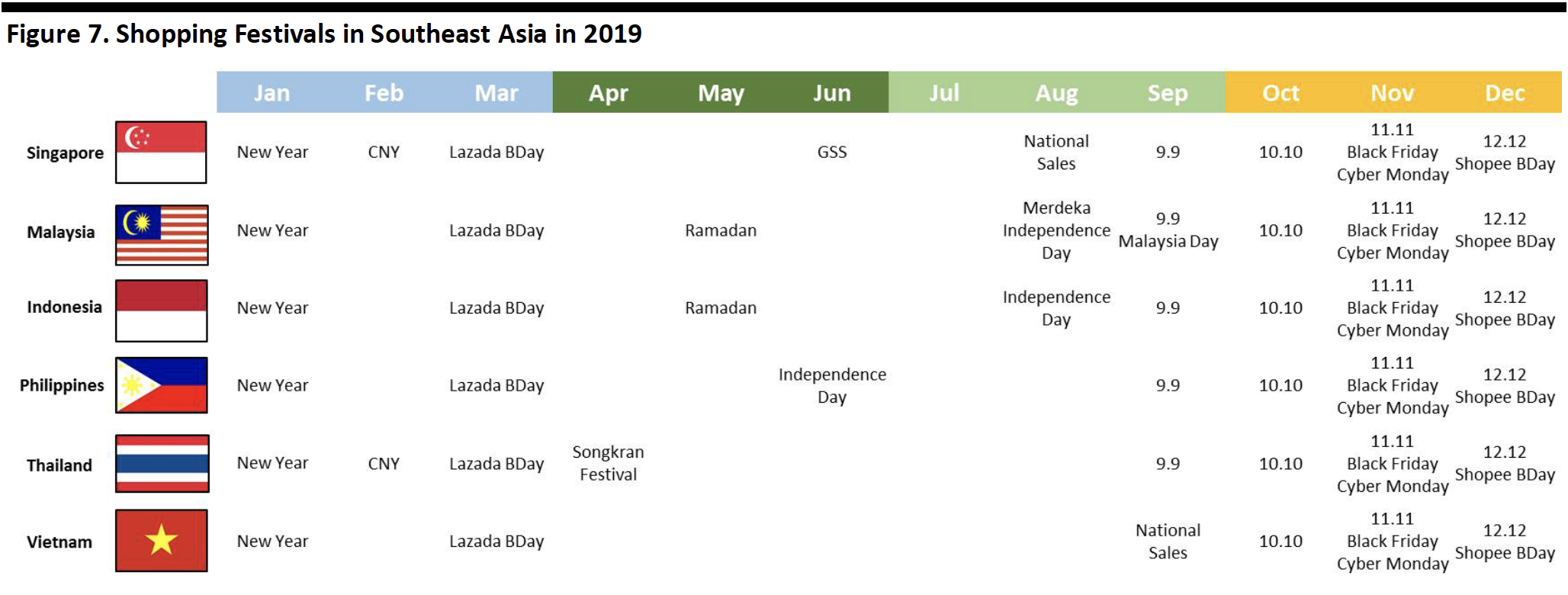

Brands Can Participate in Shopping Festivals to Boost Sales

Brands can participate in various shopping festivals throughout the year in 2019 in South East Asia, ranging from Lazada Birthday in March, Philippines’ Independence Day in June to the 12.12 shopping festival in December.

[caption id="attachment_94467" align="aligncenter" width="700"]

Source: Fung Omni Services[/caption]

Leverage Audience Buying For Targeted Audiences

Historically, advertisers use contextual buying that relies on the content of the page as a proxy for a user’s interest. The primary benefit is that it allows advertisers to reach an individual at the moment they are browsing related web content. But the limitation is that it reaches a broad segments of visitors.

Audience buying, on the other hand, shifts away from using content as a proxy and instead allows advertisers to directly buy audience segments based on a broad range of historical data. Made possible by deep pools of consumer information and technology of identify consumer segments, audience buying enables the buying of targeted audiences rather than broad segments of visitors.

Brands Can Participate in Shopping Festivals to Boost Sales

Brands can participate in various shopping festivals throughout the year in 2019 in South East Asia, ranging from Lazada Birthday in March, Philippines’ Independence Day in June to the 12.12 shopping festival in December.

[caption id="attachment_94467" align="aligncenter" width="700"] Source: Fung Omni Services/Coresight Research[/caption]

Source: Fung Omni Services/Coresight Research[/caption]

Key Insights

The digital economy in Southeast Asia is predicted to triple in size to reach $240 billion by 2025 from 2019, according to Google and Temasek. E-commerce is one of the key drivers of digital economy growth in the region. Brands can get registered on these platforms to sell their products. Strategies such as launching hero products, joining shopping festivals can help brands to raise their brand awareness and connect to customers effectively.Company Contact Michelle Leung, SVP & Head of Fung Omni Services Fung Omni Services FungOmniSZXOnline@FungOmni.com www.fungomni.com