Nitheesh NH

[caption id="attachment_80444" align="aligncenter" width="748"] Source: Company reports/Coresight Research[/caption]

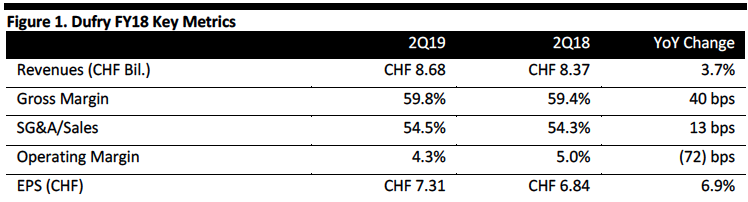

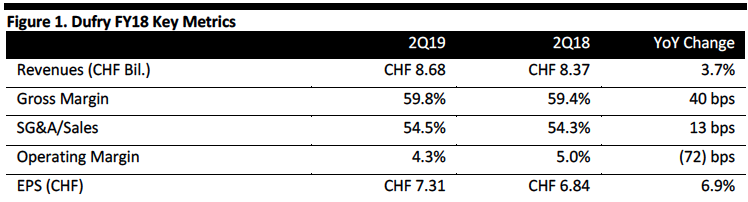

FY18 Results

Dufry reported FY18 revenues of CHF 8.68 billion, marginally ahead of consensus, with organic revenue growth of 2.7%, ahead of expectations of 2.4%. That 2.7% consisted of a 1.0% contribution from comparable sales growth and 1.7% from new concessions. Gross profit climbed 4.4%, resulting in a 40-bps gain in the gross margin. Management pointed to a beneficial impact of the sales mix and better terms or higher compensation from supplies.

The company reported EBITDA of CHF 1.04 billion, up 3.3% and in line with consensus.

Dufry reported the following revenues by region:

Source: Company reports/Coresight Research[/caption]

FY18 Results

Dufry reported FY18 revenues of CHF 8.68 billion, marginally ahead of consensus, with organic revenue growth of 2.7%, ahead of expectations of 2.4%. That 2.7% consisted of a 1.0% contribution from comparable sales growth and 1.7% from new concessions. Gross profit climbed 4.4%, resulting in a 40-bps gain in the gross margin. Management pointed to a beneficial impact of the sales mix and better terms or higher compensation from supplies.

The company reported EBITDA of CHF 1.04 billion, up 3.3% and in line with consensus.

Dufry reported the following revenues by region:

Source: Company reports/Coresight Research[/caption]

FY18 Results

Dufry reported FY18 revenues of CHF 8.68 billion, marginally ahead of consensus, with organic revenue growth of 2.7%, ahead of expectations of 2.4%. That 2.7% consisted of a 1.0% contribution from comparable sales growth and 1.7% from new concessions. Gross profit climbed 4.4%, resulting in a 40-bps gain in the gross margin. Management pointed to a beneficial impact of the sales mix and better terms or higher compensation from supplies.

The company reported EBITDA of CHF 1.04 billion, up 3.3% and in line with consensus.

Dufry reported the following revenues by region:

Source: Company reports/Coresight Research[/caption]

FY18 Results

Dufry reported FY18 revenues of CHF 8.68 billion, marginally ahead of consensus, with organic revenue growth of 2.7%, ahead of expectations of 2.4%. That 2.7% consisted of a 1.0% contribution from comparable sales growth and 1.7% from new concessions. Gross profit climbed 4.4%, resulting in a 40-bps gain in the gross margin. Management pointed to a beneficial impact of the sales mix and better terms or higher compensation from supplies.

The company reported EBITDA of CHF 1.04 billion, up 3.3% and in line with consensus.

Dufry reported the following revenues by region:

- North America: Organic growth of 6.8% to CHF 1.88 billion, compared to consensus of CHF 1.89 billion. The strong performance was driven by passenger growth and new openings.

- UK and Central Europe: Organic growth of 0.3% to CHF 1.97 billion, versus consensus of CHF 2.14 billion. Excluding the impact of closing operations in Geneva in October 2017, organic growth was 3.4%. Performance was “solid” in the UK.

- Eastern Europe, Middle East, Asia and Australia: Organic growth of 15.1% to CHF 1.15 billion, compared to consensus of CHF 1.01 billion. Eastern Europe and Asia slowed in the second Management pointed to “solid performance” in Cambodia, Macau, Korea and Indonesia.

- Latin America: Organic sales down 3.5% to CHF 1.62 billion versus the CHF 1.67 billion consensus. Devaluation of local currencies created “challenging conditions.”

- Southern Europe and Africa: Organic sales down 2.6% to CHF 1.85 billion, versus the CHF 1.90 billion consensus.