DIpil Das

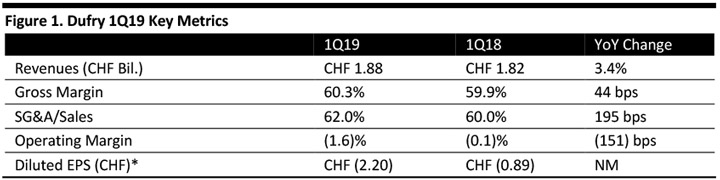

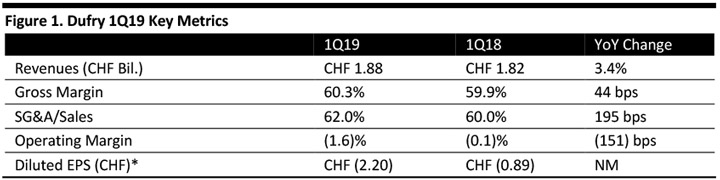

[caption id="attachment_87783" align="aligncenter" width="720"] *Attributable to common shareholders NM = not meaningful

*Attributable to common shareholders NM = not meaningful

Source: Company reports/Coresight Research [/caption] 1Q19 Results Dufry reported 1Q19 results with revenues beating the consensus estimate, while EPS came in below expectations. Highlights for 1Q19 are as follows:

*Attributable to common shareholders NM = not meaningful

*Attributable to common shareholders NM = not meaningful Source: Company reports/Coresight Research [/caption] 1Q19 Results Dufry reported 1Q19 results with revenues beating the consensus estimate, while EPS came in below expectations. Highlights for 1Q19 are as follows:

- Dufry reported total sales of CHF 1.88 billion, up 3.4% year over year and above the consensus estimate of CHF 1.86 billion recorded by StreetAccount.

- The company reported organic growth (same-store-sales and net new concessions) of 2%, beating the consensus estimate of 1.8% growth, with same-store sales growth contributing (1.3)% while net new concessions added 3.3%.

- Exchange rates positively impacted revenues, contributing 1.4% to growth, mainly due to the strengthening of the US dollar versus the Swiss franc.

- Gross margin expanded 44 basis points (bps) to 60.3%, led by improvements in global negotiations with suppliers, brand plans and the launch of exclusive products.

- Operating margin contracted 151 basis points to (1.6)%, due to an increase in personnel costs, depreciation, amortization and impairment costs. The company adopted IFRS 16 pertaining to leases, which resulted in higher depreciation related to right-of-use assets. The company did not restate 2018 results, which is allowed by IFRS 16.

- After adjusting for amortization costs related to acquisitions, operating income fell 39.2% year over year to CHF 46 million. Adjusted operating margin contracted 172 bps to 2.4%.

- The company reported diluted EPS of CHF (2.20), compared to CHF (0.89) in the prior year’s quarter and below the consensus estimate of CHF 1.06 recorded by StreetAccount.

- Organic growth in April reached 2.4%.

- In the current quarter, the company refurbished 14,400 square meters of retail space and plans to refurbish an additional 34,700 square meters in 2019. Dufry also opened and expanded 9,100 square meters of gross retail space and plans to open a further 18,800 square meters between 2019 and 2020.

- Dufry’s Europe and Africa revenues fell 2.3% year over to CHF 702.2 million, while organic growth was 2.4%.

- The company noted that performance improved and sales were positive in Spain, due to increased passenger numbers and the introduction of several commercial initiatives. Turkey posted double digit growth. France, Italy, Malta and Africa showed positive performance. In the UK, performance was healthy, supported by ongoing marketing initiatives.

- Dufry’s Asia Pacific and Middle East division showed robust performance, with revenues growing 18.9% year over year to CHF 305 million. Organic growth reached 17.3%, mainly due to the contribution of new concessions.

- Dufry highlighted that Eastern Europe was positive, with good performance in Serbia (Eastern Europe includes this region). Asia Pacific posted double digit growth driven by new openings, such as the successful opening in the MTR high-speed railway station in Hong Kong. China, Bali and Cambodia also showed modest growth. In Australia, sales grew double digits, supported by the start of operations in Perth.

- The company grew North American sales 9.4% year over year to CHF 442.4 million.

- Organic growth was 5.3%, driven by healthy performance of the duty-paid business.

- Dufry’s Central and South American segment revenues fell 5.9% year over year to CHF 384 million.

- Mexico and the Caribbean posted modest performance led by the cruise business. The company said that in South America, most operations continued to be impacted by the devaluation of local currencies, particularly in Brazil and Argentina.

The good operational performance with an organic growth of 2.0% is a positive development, to which all divisions – except for the South American markets – have contributed. In particular, Asia Pacific and the Middle East as well as North America have continued with their strong performance, while recovery has started in Europe. A combination of commercial and marketing initiatives launched in several markets as well as strong contributions from new concessions supported the ongoing improvement in organic growth. The improving market conditions seen in the first months of 2019 in all divisions, with the exception of Brazil and Argentina where the environment remains challenging, have continued and are encouraging.

Outlook Management maintained its earlier mid-term organic growth guidance of 3-4%, and, for 2019, equity free cash flow generation in the range of CHF 350-400 million. In FY19, according to the consensus estimate by StreetAccount, analysts expect Dufry to report revenues of CHF 8.97 billion and EPS of CHF 8.66.