DIpil Das

*Attributable to common shareholders

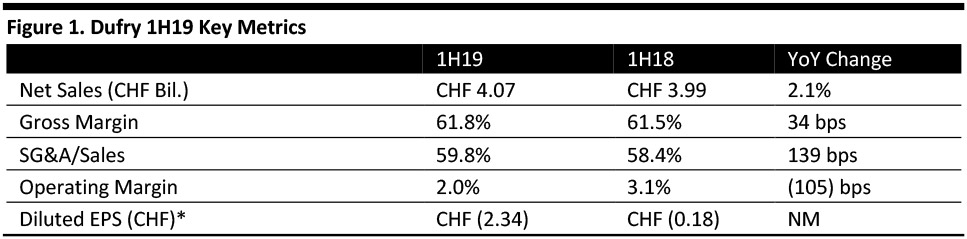

*Attributable to common shareholders NM = not meaningful

Source: Company reports/Coresight Research [/caption]

1H19 Results

Dufry reported 1H19 results with revenues in line with the consensus estimate and EPS below expectations.

Highlights for 1H19 are as follows:

- Dufry reported net sales of CHF 4.1 billion, up 2.1% year over year and in line with the consensus estimate.

- The company reported organic growth (same-store-sales and net new concessions) of 2.2%, missing the consensus estimate of 2.3% growth, with same-store sales growth contributing (0.6) percentage points while net new concessions added 2.8 percentage points.

- Exchange rates had a marginal negative impact on revenues, contributing (0.2)% to growth, mainly due to the net effect of a strengthening US dollar and weakening euro and British pound.

- Gross margin expanded 34 basis points (bps) to 61.8% mainly due to improved global and regional negotiations with suppliers and implementation of brand plans, such as the launch of exclusive products and novelties.

- Operating margin contracted 105 basis points to 2.0%, due to an increase in depreciation, amortization and impairment costs and personnel expenses partially offset by a decrease in lease expenses and other expenses. The company adopted IFRS 16 pertaining to leases, which resulted in higher depreciation related to right-of-use assets. While lease expenses as percentage of sales declined to 17.7% from 29.5% in the same quarter last year, depreciation, amortization and impairment as a percentage of sales increased to 19.9% from 6.9%.

- The company reported a diluted loss per share of CHF 2.34, compared to loss per share of CHF 0.18 in the same quarter last year, and missing the consensus EPS of CHF 1.46, due to higher interest expenses.

- The company added 15,400 square meters of gross retail space and signed up for 15,300 additional square meters to open in 2019 and 2020 in existing and new locations worldwide. It also extended existing contracts and refurbished 31,700 square meters of retail space in the first half of 2019.

- Organic growth in the first three weeks of July accelerated and reached around 3%.

- Dufry’s Europe and Africa revenues fell 1.0% year over to CHF 1.73 billion, while organic growth was 3.9%.

- Adjusted operating profit fell 30% year over to CHF 92.1 million.

- The company noted that in the UK, performance accelerated, driven by strong results at Heathrow Airport. In Spain, performance improved with June showing promising growth for the summer season. Turkey posted solid growth while France, Italy, Malta and Africa also reported positive growth.

- Dufry’s Asia Pacific and Middle East division showed robust performance, with revenues growing 14.1% year over year to CHF 624 million. Organic growth was 13.9%, due mainly new concessions.

- Adjusted operating profit fell 27.4% year over to CHF 30.5 million.

- Dufry highlighted that Eastern Europe was positive, with good performance in Serbia (the company’s Eastern Europe division includes this region). Asia Pacific posted double digit growth driven by new openings, such as a new outlet in Hong Kong’s high-speed railway station. China, Macau and Cambodia also showed modest growth. In Australia, sales grew double digits, supported by the start of operations in Perth.

- The company grew North America sales 6.5% year over year to CHF 955 million.

- Organic growth was 3.7%, driven by healthy performance of the duty-paid business.

- Adjusted operating profit increased 21.0% year over to CHF 85.8 million.

Central and South America

- Dufry’s Central and South America segment revenues fell 7.2% year over year to CHF 762 million. Organic growth was (10.6)%.

- Adjusted operating profit fell 7.2% year over to CHF 762 million.

- Mexico and the Caribbean posted modest performance led by the cruise business. The company said that in South America, most operations continued to be impacted by the devaluation of local currencies, particularly in Brazil and Argentina.

2Q19 Results

- Dufry reported net sales of CHF 2.2 billion, up 0.9% year over year and roughly in line with consensus.

- Gross margin expanded 31 bps to 61.6%.

- Adjusted operating profit fell 6.4% year over year to CHF 191 million, beating the consensus of CHF 140.7 million.

- Operating margin contracted 57 basis points to 5.1%, due to an increase in depreciation, amortization and impairment costs and personnel expenses partially offset by a decrease in lease expenses and other expenses.

- The company reported a diluted loss per share of CHF 0.14, compared to earnings per share of CHF 0.71 in the prior year’s quarter and below the consensus EPS estimate of CHF 2.29, due to higher interest expenses.

By Geography:

Europe and Africa

- Dufry’s Europe and Africa revenues fell 0.1% year over to CHF 1.02 billion.

- Adjusted operating profit fell 10.5% year over to CHF 96.2 million.

Asia Pacific and the Middle East

- Dufry’s Asia Pacific and Middle East division showed strong performance, with revenues growing 9.9% year over year to CHF 318.8 million.

- Adjusted operating profit fell 33.7% year over to CHF 16.9 million.

North America

- The company grew North America sales 4.0% year over year to CHF 512.1 million.

- Adjusted operating profit increased 22.2% year over to CHF 61.7 million.

Central and South America

- Dufry’s Central and South America segment revenues fell 8.6% year over year to CHF 377.8 million.

- Adjusted operating profit fell 6.9% year over to CHF 13.4 million.

Julián Díaz, CEO of Dufry Group, said:

The good operational performance was the result of a combination of commercial and market initiatives launched in several markets. Organic growth further benefitted from strong contributions from our new concessions. The improving market conditions in all divisions seen in the first half of 2019 continue as expected and are encouraging. Our goals for 2019 remain unchanged; to drive further growth with a strong focus on the customer, to leverage our business model to generate efficiencies, and to accelerate the implementation of the digital strategy. We therefore confirm our mid-term organic growth guidance of 3%-4% as well as the expected range of CHF 350-400 million for the 2019 equity free cash flow generation.

Outlook

Management maintained its earlier mid-term organic growth guidance of 3-4%, and, for 2019, equity free cash flow generation in the range of CHF 350-400 million.

The StreetAccount consensus estimate calls for FY2019 revenues of CHF 8.94 billion and EPS of CHF 8.07.