Source: Company reports/FGRT

2Q17 Results

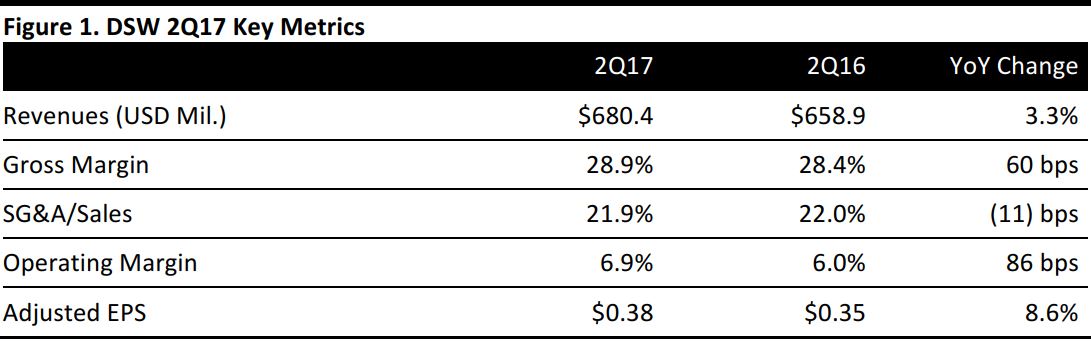

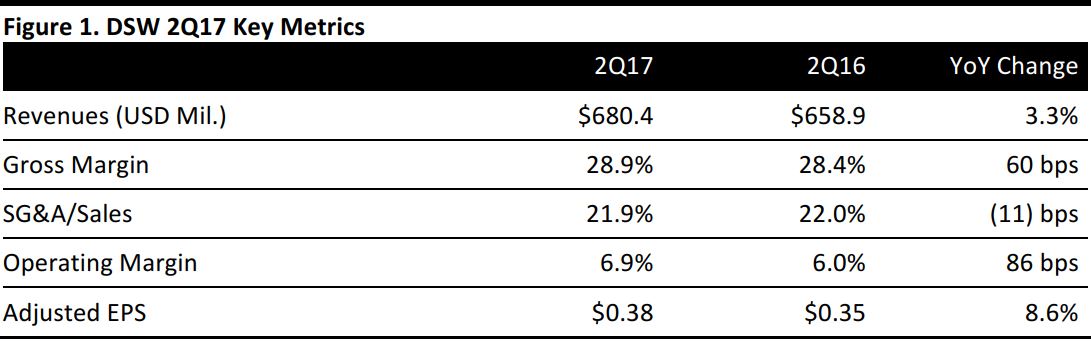

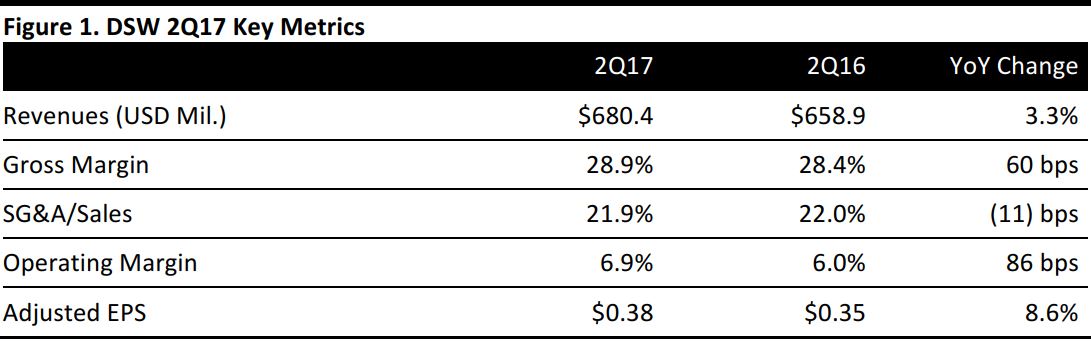

Discount shoe retailer DSW reported 2Q17 adjusted EPS of $0.38, ahead of the $0.29 consensus estimate and up 8.6% from the year-ago period. Total revenues were $680.4 million, up 3.3% year over year and above the $666.1 million consensus estimate.

Comparable-store sales were up 0.6%, which was better than the 2.2% decline analysts had expected and the 1.2% decline recorded in the year-ago quarter. This was the first positive same-store sales number the company has seen since 2015. Comps benefited from an increase in sales of regular-priced items and strong performance by athleisure categories.

Performance by Segment

DSW segment comp sales were up 1.0%, led by strong performance by the women’s business and athleisure categories, including both performance and fashion athletic lines. DSW revenues increased by 4%, to $628.4 million, driven by digital growth due to improved conversion and increased mobile traffic.

The DSW segment’s gross margin increased by 120 basis points due to improved sourcing, less clearance and lower markdowns, which more than offset higher shipping costs and marketing promotions.

Comps for the ABG division declined by 0.1% compared with the year-ago period, an improvement from the first quarter’s 2% decline. Revenues declined by 11.6%, to $31.3 million, due to the closure of 30 Gordmans stores at the start of the second quarter.

Outlook

The company did not update its prior EPS guidance of $1.45–$1.55 for FY17. The consensus calls for EPS of $1.44. FY17 guidance calls for revenue growth of 3.0%–4.0% and for comp growth to be flat year over year.

Management noted that consolidation in the retail industry means that DSW has an opportunity to acquire market share moving forward and that the company is gearing up to unveil several new initiatives that are expected to boost brand loyalty.