Dollar Tree (NASDAQ: DLTR)

Sector: Food, drug and mass retailers

Countries of operation: Canada and the US

Key product categories: Apparel, food and beverage, general merchandise, and health and beauty products

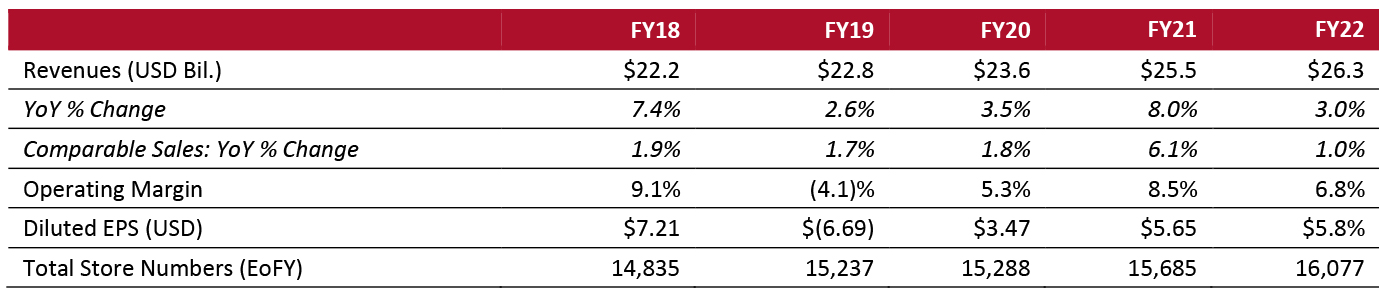

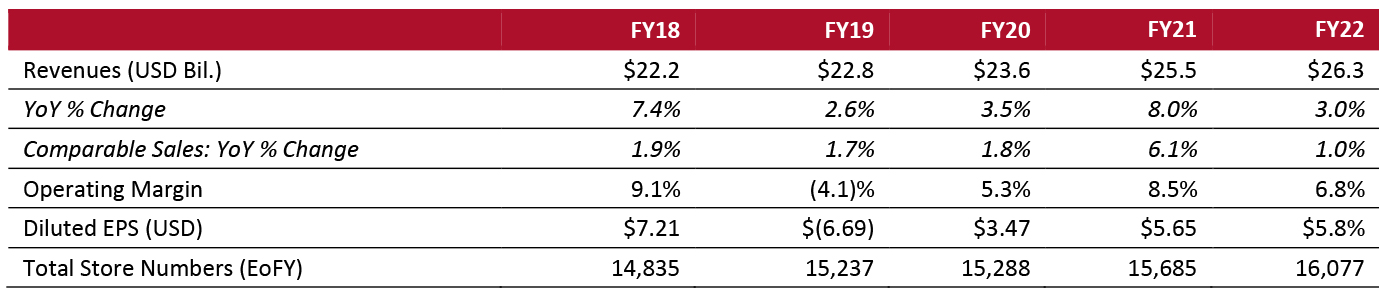

Annual Metrics

[caption id="attachment_144491" align="aligncenter" width="700"]

Fiscal year ends close to January 31 of the same calendar year

Fiscal year ends close to January 31 of the same calendar year[/caption]

Summary

Founded in 1986 and headquartered in Chesapeake, Virginia, Dollar Tree operates discount variety stores in Canada and the US. The company offers apparel and accessories, food and beverages, hardware and automotive, health and beauty, home decor, and household products. The company completed the acquisition of Family Dollar in July 2015 and operates stores under that brand name, as well as Dollar Tree and Dollar Tree Canada. As of January 29, 2022, the company operates 16,077 stores across 48 states and five Canadian provinces.

Company Analysis

Coresight Research insight: Dollar Tree is a fixed-price retailer, with almost everything priced $1.25 or lower. Family Dollar, however, is more of a traditional general store with a variable pricing model similar to other mass merchants.

With its steadfast emphasis on low prices, Dollar Tree initially saw strong sales during the pandemic. As consumers attempted to stretch their dollars as far as possible amid economic uncertainty, Dollar Tree attracted more customers across the income spectrum. However, the price structure of Dollar Tree is vulnerable to cost fluctuations compared with its peers, as it lacks an in-house distribution network. The company purchases about 14% of consumables—which make up about 60% of its net sales—from a single outside distributor, McLane Company. It relies entirely on third-party vendors for purchasing and transporting frozen and refrigerated food, and both Dollar Tree and Family Dollar have been expanding these offerings. This has left Dollar Tree vulnerable to supply-chain interruptions and inflationary pressures.

In November 2021, Dollar Tree raised its baseline price to $1.25 from its namesake dollar amount, citing inflation—although the rise exceeded rates of inflation, aiming to rein in rising supply chain and labor costs. These cost increases, coupled with pre-pandemic financial challenges, undid its uptick in business and has left the fixed-price retailer vulnerable to outside pressure. In March 2022, Dollar Tree agreed to give five director seats to Mantle Ridge, an activist fund which used a 5.7% stake to field a slate of director nominees four months prior. Mantle Ridge and Dollar Tree also agreed to form a board finance committee to assess the company’s corporate strategy. Previously, Dollar Tree stated that it would spend about 1.3 billion opening 590 stores and updating refrigeration capacity and supply chain infrastructure—how the new finance committee will reshape the ongoing expansion initiative has yet to be seen.

| Tailwinds |

Headwinds |

- Continued momentum in consumables and discretionary business at both Dollar Tree and Family Dollar

- Trading down amid an inflationary environment may introduce more shoppers to Dollar Tree, with potential for customer retention

|

- Intense competition from other discounters and retail formats, including department stores, drugstores, mass retailers, e-commerce retailers and warehouse clubs

- Supply-chain disruptions may continue to adversely impact the pricing structure of the fixed-price retailer

- Rising inflation and Covid 19-related challenges could further undermine the company’s store margins

- Potential for adverse consumer reaction to 25% price hike at the Dollar Tree banner

|

Strategy

Dollar Tree’s strategy focuses on the following four growth drivers, reiterated in its annual report for its fiscal year ended January 31, 2022:

1. Continue to execute its proven, best‑in‑class retail business strategy

- Aim to “wow” the customer with a compelling, fun and fresh merchandise assortment in bright, clean and friendly stores

- Maintain a flexible sourcing merchandise model

- Maintain relevance to the customer by reinventing constantly through new merchandise categories and initiatives

- Maintain a prudent approach to the use of capital for the benefit of its shareholders

2. Operate a diversified, complementary business model across both fixed‑price and multi‑price point strategies

- Use the reach and scale of both Dollar Tree and Family Dollar to serve a broader range of customers in new ways, offering better prices and greater value

3. Take advantage of significant white-space opportunities

- Capitalize on the significant white-space opportunities that exist for both the Dollar Tree and Family Dollar store concepts

4. Maintain profitable stores with strong cash flow

- Maintain a disciplined, cost-sensitive approach to store site selection

- Minimize the initial capital investment required and maximize its potential to generate high operating margins and strong cash flows

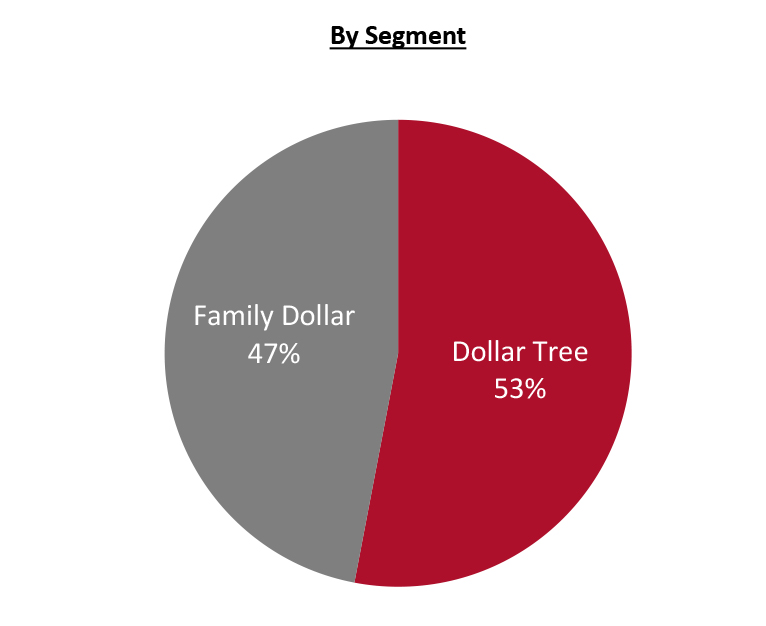

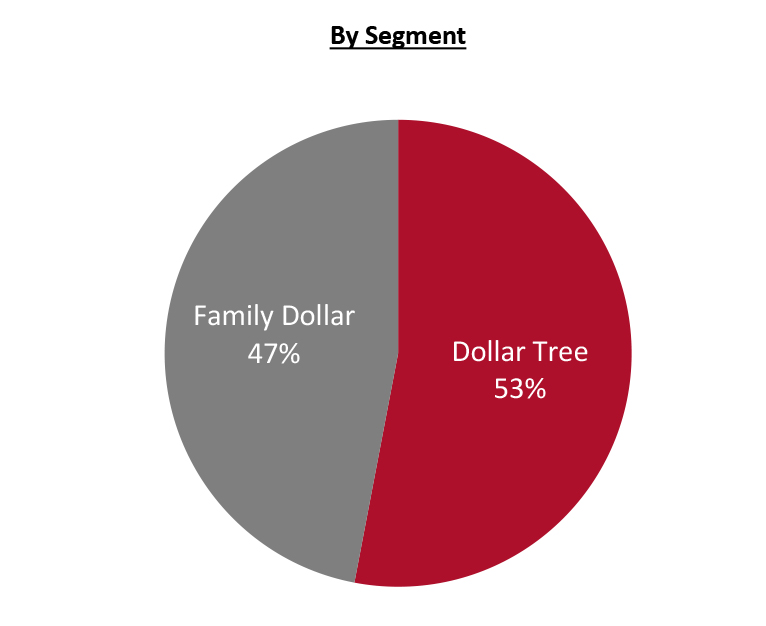

Revenue Breakdown (FY22)

Company Developments

Company Developments

| Date |

Development |

| March 17, 2022 |

Is federally subpoenaed after inspections and recalls. |

| March 8, 2022 |

Names Richard Dreiling as Executive Chairman and adds five new members to its Board of Directors from activist fund Mantle Ridge. |

| February 23, 2022 |

Temporarily closes 404 stores until further notice after rodent infestations. |

| February 18, 2022 |

Announces the retirement of Executive Chairman Bob Sasser. |

| December 10, 2021 |

Faces a proxy fight as activist investment fund Mantle Ridge nominates 11 individuals to its Board of Directors. |

| November 29, 2021 |

Announces the pricing of $1.2 billion in senior notes. |

| November 23, 2021 |

Begins raising its base price point to $1.25, citing inflation. |

| October 15, 2021 |

Hosts a nationwide hiring event. |

| September 29, 2021 |

Reports that its Board of Directors has increased the company’s share repurchase authorization by $1.05 billion to an aggregate amount of $2.5 billion, including approximately $1.45 billion available for repurchases under the Board’s previous repurchase authorization approved on March 2, 2021. |

| June 28, 2021 |

Joins forces with Operation Homefront to help military children start strong and stay strong for the back-to-school season. |

| May 27, 2021 |

Reiterates its plan to open 600 new stores and to renovate 1,250 Family Dollar stores. The new stores are expected to consist of 400 Dollar Tree stores and 200 Family Dollar stores. The Family Dollar stores will be comprised of H2 and Combo Store formats, based upon market locations. |

| April 15, 2021 |

Introduces its new retail media network, Chesapeake Media Group, to connect brands with shoppers in real time. |

| February 4, 2021 |

Family Dollar announces a partnership with Instacart for the delivery of items from the discount chain’s more than 6,000 stores across the US. |

| 5, 2020 |

Announces plans to hire more than 25,000 associates for its stores and distribution centers. |

| September 3, 2020 |

Announces the opening of its 25th and 26th distribution centers in Ocala, Florida, and Rosenberg, Texas. |

| June 8, 2020 |

Partners with security solutions provider ADT Commercial, which will provide comprehensive security and monitoring services at the majority of Dollar Tree and Family Dollar locations across the US. |

| March 20, 2020 |

Announces plans to hire more than 25,000 full and part-time associates at its distribution centers and stores in the US. |

Management Team

- Richard Dreiling--Executive Chairman

- Michael A. Witynski—CEO

- Kevin S. Wampler—CFO

- David A. Jacobs—Chief Strategy Officer

Source: Company reports

Fiscal year ends close to January 31 of the same calendar year[/caption]

Summary

Founded in 1986 and headquartered in Chesapeake, Virginia, Dollar Tree operates discount variety stores in Canada and the US. The company offers apparel and accessories, food and beverages, hardware and automotive, health and beauty, home decor, and household products. The company completed the acquisition of Family Dollar in July 2015 and operates stores under that brand name, as well as Dollar Tree and Dollar Tree Canada. As of January 29, 2022, the company operates 16,077 stores across 48 states and five Canadian provinces.

Company Analysis

Coresight Research insight: Dollar Tree is a fixed-price retailer, with almost everything priced $1.25 or lower. Family Dollar, however, is more of a traditional general store with a variable pricing model similar to other mass merchants.

With its steadfast emphasis on low prices, Dollar Tree initially saw strong sales during the pandemic. As consumers attempted to stretch their dollars as far as possible amid economic uncertainty, Dollar Tree attracted more customers across the income spectrum. However, the price structure of Dollar Tree is vulnerable to cost fluctuations compared with its peers, as it lacks an in-house distribution network. The company purchases about 14% of consumables—which make up about 60% of its net sales—from a single outside distributor, McLane Company. It relies entirely on third-party vendors for purchasing and transporting frozen and refrigerated food, and both Dollar Tree and Family Dollar have been expanding these offerings. This has left Dollar Tree vulnerable to supply-chain interruptions and inflationary pressures.

In November 2021, Dollar Tree raised its baseline price to $1.25 from its namesake dollar amount, citing inflation—although the rise exceeded rates of inflation, aiming to rein in rising supply chain and labor costs. These cost increases, coupled with pre-pandemic financial challenges, undid its uptick in business and has left the fixed-price retailer vulnerable to outside pressure. In March 2022, Dollar Tree agreed to give five director seats to Mantle Ridge, an activist fund which used a 5.7% stake to field a slate of director nominees four months prior. Mantle Ridge and Dollar Tree also agreed to form a board finance committee to assess the company’s corporate strategy. Previously, Dollar Tree stated that it would spend about 1.3 billion opening 590 stores and updating refrigeration capacity and supply chain infrastructure—how the new finance committee will reshape the ongoing expansion initiative has yet to be seen.

Fiscal year ends close to January 31 of the same calendar year[/caption]

Summary

Founded in 1986 and headquartered in Chesapeake, Virginia, Dollar Tree operates discount variety stores in Canada and the US. The company offers apparel and accessories, food and beverages, hardware and automotive, health and beauty, home decor, and household products. The company completed the acquisition of Family Dollar in July 2015 and operates stores under that brand name, as well as Dollar Tree and Dollar Tree Canada. As of January 29, 2022, the company operates 16,077 stores across 48 states and five Canadian provinces.

Company Analysis

Coresight Research insight: Dollar Tree is a fixed-price retailer, with almost everything priced $1.25 or lower. Family Dollar, however, is more of a traditional general store with a variable pricing model similar to other mass merchants.

With its steadfast emphasis on low prices, Dollar Tree initially saw strong sales during the pandemic. As consumers attempted to stretch their dollars as far as possible amid economic uncertainty, Dollar Tree attracted more customers across the income spectrum. However, the price structure of Dollar Tree is vulnerable to cost fluctuations compared with its peers, as it lacks an in-house distribution network. The company purchases about 14% of consumables—which make up about 60% of its net sales—from a single outside distributor, McLane Company. It relies entirely on third-party vendors for purchasing and transporting frozen and refrigerated food, and both Dollar Tree and Family Dollar have been expanding these offerings. This has left Dollar Tree vulnerable to supply-chain interruptions and inflationary pressures.

In November 2021, Dollar Tree raised its baseline price to $1.25 from its namesake dollar amount, citing inflation—although the rise exceeded rates of inflation, aiming to rein in rising supply chain and labor costs. These cost increases, coupled with pre-pandemic financial challenges, undid its uptick in business and has left the fixed-price retailer vulnerable to outside pressure. In March 2022, Dollar Tree agreed to give five director seats to Mantle Ridge, an activist fund which used a 5.7% stake to field a slate of director nominees four months prior. Mantle Ridge and Dollar Tree also agreed to form a board finance committee to assess the company’s corporate strategy. Previously, Dollar Tree stated that it would spend about 1.3 billion opening 590 stores and updating refrigeration capacity and supply chain infrastructure—how the new finance committee will reshape the ongoing expansion initiative has yet to be seen.

Company Developments

Company Developments