Nitheesh NH

[caption id="attachment_79420" align="aligncenter" width="620"] Source: Company reports/Coresight Research[/caption]

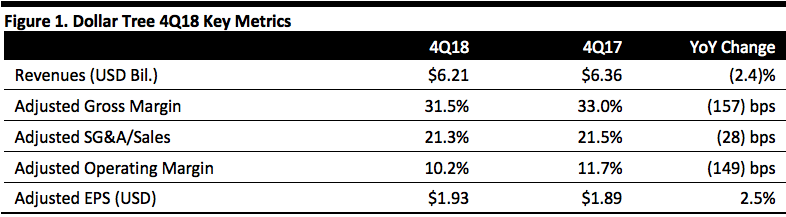

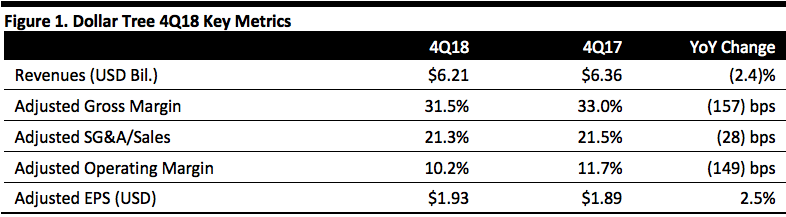

4Q18 Results

Dollar Tree reported 4Q18 revenues of $6.21 billion, down 2.4% year over year and in line with the consensus estimate. Sales increased 4.2% excluding the extra week in the year-ago quarter.

Enterprise comps increased 2.4%, beating the 1.4% consensus; Dollar Tree comps grew 3.2%, beating the 2.9% consensus; and Family Dollar comps increased 1.4%, beating the consensus estimate of flat growth.

Adjusted EPS was $1.93, up 2.5% and beating consensus by a penny. GAAP EPS was $(9.69), compared to $4.38 in the year-ago quarter. Noncash charges in the quarter primarily include a $2.7 billion goodwill impairment charge related to the acquisition of Family Dollar.

FY18 Results

2018 revenues were $22.8 billion, up 2.4%.

Reported enterprise comps increased 1.7%. Comps increased 4.5% excluding the extra week in the year-ago quarter. Enterprise comps Dollar Tree comps grew 3.2%, and Family Dollar comps increased 0.1%.

Adjusted EPS was $5.45, up 12.3%. GAAP EPS was $1,18, compared with $1.01 the prior year.

2019 Store-Optimization Program

The company announced the rollout of a new model for both new and renovated Family Dollar stores known internally as H2. This new model significantly improved merchandise offerings, including Dollar Tree $1 merchandise, and produced a traffic and provided an average comp lift of more than 10% over control stores. H2 has performed well in a variety of locations, particularly where Family Dollar has been the challenged. Dollar Tree plans to renovate at least 1,000 stores this year and pursue an accelerated renovation schedule in future years.

The company also announced the following:

Source: Company reports/Coresight Research[/caption]

4Q18 Results

Dollar Tree reported 4Q18 revenues of $6.21 billion, down 2.4% year over year and in line with the consensus estimate. Sales increased 4.2% excluding the extra week in the year-ago quarter.

Enterprise comps increased 2.4%, beating the 1.4% consensus; Dollar Tree comps grew 3.2%, beating the 2.9% consensus; and Family Dollar comps increased 1.4%, beating the consensus estimate of flat growth.

Adjusted EPS was $1.93, up 2.5% and beating consensus by a penny. GAAP EPS was $(9.69), compared to $4.38 in the year-ago quarter. Noncash charges in the quarter primarily include a $2.7 billion goodwill impairment charge related to the acquisition of Family Dollar.

FY18 Results

2018 revenues were $22.8 billion, up 2.4%.

Reported enterprise comps increased 1.7%. Comps increased 4.5% excluding the extra week in the year-ago quarter. Enterprise comps Dollar Tree comps grew 3.2%, and Family Dollar comps increased 0.1%.

Adjusted EPS was $5.45, up 12.3%. GAAP EPS was $1,18, compared with $1.01 the prior year.

2019 Store-Optimization Program

The company announced the rollout of a new model for both new and renovated Family Dollar stores known internally as H2. This new model significantly improved merchandise offerings, including Dollar Tree $1 merchandise, and produced a traffic and provided an average comp lift of more than 10% over control stores. H2 has performed well in a variety of locations, particularly where Family Dollar has been the challenged. Dollar Tree plans to renovate at least 1,000 stores this year and pursue an accelerated renovation schedule in future years.

The company also announced the following:

Source: Company reports/Coresight Research[/caption]

4Q18 Results

Dollar Tree reported 4Q18 revenues of $6.21 billion, down 2.4% year over year and in line with the consensus estimate. Sales increased 4.2% excluding the extra week in the year-ago quarter.

Enterprise comps increased 2.4%, beating the 1.4% consensus; Dollar Tree comps grew 3.2%, beating the 2.9% consensus; and Family Dollar comps increased 1.4%, beating the consensus estimate of flat growth.

Adjusted EPS was $1.93, up 2.5% and beating consensus by a penny. GAAP EPS was $(9.69), compared to $4.38 in the year-ago quarter. Noncash charges in the quarter primarily include a $2.7 billion goodwill impairment charge related to the acquisition of Family Dollar.

FY18 Results

2018 revenues were $22.8 billion, up 2.4%.

Reported enterprise comps increased 1.7%. Comps increased 4.5% excluding the extra week in the year-ago quarter. Enterprise comps Dollar Tree comps grew 3.2%, and Family Dollar comps increased 0.1%.

Adjusted EPS was $5.45, up 12.3%. GAAP EPS was $1,18, compared with $1.01 the prior year.

2019 Store-Optimization Program

The company announced the rollout of a new model for both new and renovated Family Dollar stores known internally as H2. This new model significantly improved merchandise offerings, including Dollar Tree $1 merchandise, and produced a traffic and provided an average comp lift of more than 10% over control stores. H2 has performed well in a variety of locations, particularly where Family Dollar has been the challenged. Dollar Tree plans to renovate at least 1,000 stores this year and pursue an accelerated renovation schedule in future years.

The company also announced the following:

Source: Company reports/Coresight Research[/caption]

4Q18 Results

Dollar Tree reported 4Q18 revenues of $6.21 billion, down 2.4% year over year and in line with the consensus estimate. Sales increased 4.2% excluding the extra week in the year-ago quarter.

Enterprise comps increased 2.4%, beating the 1.4% consensus; Dollar Tree comps grew 3.2%, beating the 2.9% consensus; and Family Dollar comps increased 1.4%, beating the consensus estimate of flat growth.

Adjusted EPS was $1.93, up 2.5% and beating consensus by a penny. GAAP EPS was $(9.69), compared to $4.38 in the year-ago quarter. Noncash charges in the quarter primarily include a $2.7 billion goodwill impairment charge related to the acquisition of Family Dollar.

FY18 Results

2018 revenues were $22.8 billion, up 2.4%.

Reported enterprise comps increased 1.7%. Comps increased 4.5% excluding the extra week in the year-ago quarter. Enterprise comps Dollar Tree comps grew 3.2%, and Family Dollar comps increased 0.1%.

Adjusted EPS was $5.45, up 12.3%. GAAP EPS was $1,18, compared with $1.01 the prior year.

2019 Store-Optimization Program

The company announced the rollout of a new model for both new and renovated Family Dollar stores known internally as H2. This new model significantly improved merchandise offerings, including Dollar Tree $1 merchandise, and produced a traffic and provided an average comp lift of more than 10% over control stores. H2 has performed well in a variety of locations, particularly where Family Dollar has been the challenged. Dollar Tree plans to renovate at least 1,000 stores this year and pursue an accelerated renovation schedule in future years.

The company also announced the following:

- Dollar Tree closed 84 underperforming stores in Q4, 37 more than originally planned for the year. In fiscal 2019, the company is seeking to obtain material rent concessions from landlords on under-performing stores. Without these concessions, it plans to accelerate its pace of store closings to as many as 390 stores in fiscal 2019 (as compared to the typical closing cadence of closing approximately 75 stores per year).

- The company plans to rebanner approximately 200 Family Dollar stores as Dollar Tree stores in 2019, in addition to installing adult beverages in approximately 1,000 stores and expanding freezers and coolers in approximately 400 stores.

- These actions are expected to provide a comp lift of up to 1.5 percentage points once implemented by the end of 2019.

- The extra week in the year-ago quarter contributed $406.6 million to sales and $0.21 to diluted EPS.

- 4Q18 represented the 44th consecutive quarter of positive comps for the company.

- In many different economic environments, management characterized the sweet spot of Dollar Tree’s gross margins as 35-36% during nine of the past 10 years.

- Since the Family Dollar acquisition, management has taken the following actions to stabilize the business: capture synergies in both brands, rebuild the leadership team, introduce and develop a shared services infrastructure, integrate IT systems, improve store standards, invest in labor, repay more than $4 billion in debt and earn an investment-grade rating.

- In 2018, the company renovated 522 Family Dollar stores, re-bannered 52 stores under the Dollar Tree brand and closed 122 underperforming Family Dollar stores.

- The proposed 390 closures in 2019 represent underperforming stores due to age, layout, location, unfavorable lease terms or other factors and are not expected to provide an adequate return on investment for the cost of renovation.

- Net sales of $23.45-23.87 billion (up 3.0-4.6%), based on a low single-digit increase in comps and approximately 1.0% square footage growth.

- EPS of $4.85-5.25, which includes discrete costs of approximately $0.31 per share and an additional $0.18 per share expense due to a higher tax rate.

- Net sales of $5.74-5.85 billion (up 3.0-4.6%), in line with the $5.81 consensus, based on a low single-digit increase in comps.

- EPS of $1.05-1.15, below the $1.30 consensus estimate.