Nitheesh NH

[caption id="attachment_95532" align="aligncenter" width="700"] Source: Company reports/Coresight Research[/caption]

2Q19 Results

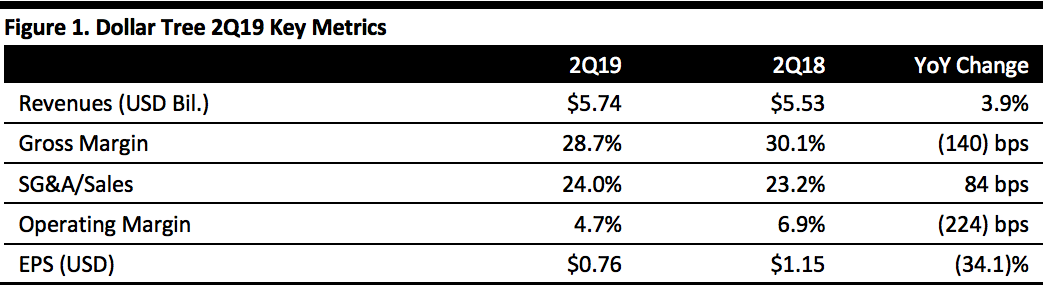

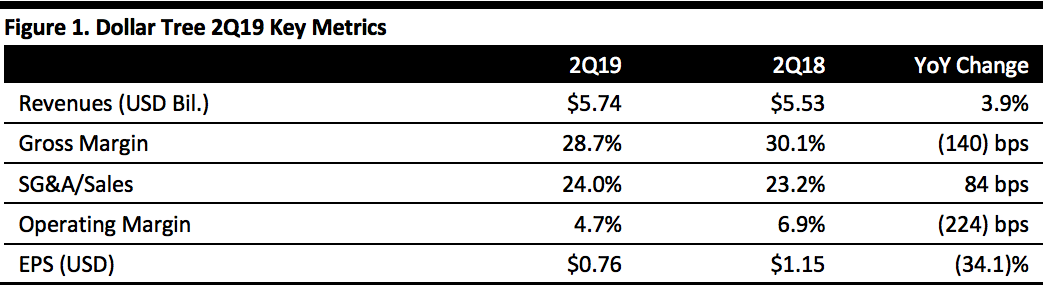

Dollar Tree reported 2Q19 revenues of $5.74 billion, up 3.9% year over year and slightly above the $5.72 consensus estimate.

Enterprise comps increased 2.4%, beating the 1.9% consensus estimate; Dollar Tree comps grew 2.4%, short of the 2.8% consensus; and, Family Dollar comps increased 2.4%, beating the consensus estimate of 1.2%.

EPS was $0.76, down 34.1% and below the $0.83 consensus.

Details from the Quarter

Source: Company reports/Coresight Research[/caption]

2Q19 Results

Dollar Tree reported 2Q19 revenues of $5.74 billion, up 3.9% year over year and slightly above the $5.72 consensus estimate.

Enterprise comps increased 2.4%, beating the 1.9% consensus estimate; Dollar Tree comps grew 2.4%, short of the 2.8% consensus; and, Family Dollar comps increased 2.4%, beating the consensus estimate of 1.2%.

EPS was $0.76, down 34.1% and below the $0.83 consensus.

Details from the Quarter

Source: Company reports/Coresight Research[/caption]

2Q19 Results

Dollar Tree reported 2Q19 revenues of $5.74 billion, up 3.9% year over year and slightly above the $5.72 consensus estimate.

Enterprise comps increased 2.4%, beating the 1.9% consensus estimate; Dollar Tree comps grew 2.4%, short of the 2.8% consensus; and, Family Dollar comps increased 2.4%, beating the consensus estimate of 1.2%.

EPS was $0.76, down 34.1% and below the $0.83 consensus.

Details from the Quarter

Source: Company reports/Coresight Research[/caption]

2Q19 Results

Dollar Tree reported 2Q19 revenues of $5.74 billion, up 3.9% year over year and slightly above the $5.72 consensus estimate.

Enterprise comps increased 2.4%, beating the 1.9% consensus estimate; Dollar Tree comps grew 2.4%, short of the 2.8% consensus; and, Family Dollar comps increased 2.4%, beating the consensus estimate of 1.2%.

EPS was $0.76, down 34.1% and below the $0.83 consensus.

Details from the Quarter

- 2Q19 represented the 46th consecutive quarter of positive comps for the company.

- Gross margin declined to 28.7% compared to 30.1% in the year-ago quarter, which the company attributed to a 55-basis-point (bps) increase in merchandise costs, including freight;

- SG&A expenses grew as a result of higher operating and corporate expenses related to the consolidation of store support centers, asset write-offs related to store closures and an increase in payroll costs due to higher average hourly rates and store-level initiatives.

- The company opened 150 stores, expanded or relocated 19 stores, and re-bannered 106 Family Dollar stores to the Dollar Tree brand during the quarter. It also closed 305 stores, including 296 Family Dollar and nine Dollar Tree stores.

- The company converted 542 Family Dollar stores to the H2 format, which features a $1.00 Dollar Tree merchandise section and includes more freezer and cooler doors.

- At the end of the quarter, Dollar Tree operated 15,115 stores, including 7,306 Dollar Tree and 7,809 Family Dollar stores.

- Net sales of $23.57-23.79 billion (up 3.3-4.2%), based on a low single-digit increase in comps and approximately 1.3% square footage growth; in line with the consensus of $23.72 billion.

- EPS of $4.90-5.11, which includes discrete costs of $0.28 per share and approximately $0.05 per diluted share in costs incurred on store closures, in line with the consensus estimate of $5.11.

- Net sales of $5.66-5.77 billion (up 2.2-4.2%), in line with the $5.75 consensus estimate, based on a low single-digit increase in comps for the enterprise.

- EPS of $1.07-1.16, below the $1.13 consensus estimate.