DIpil Das

[caption id="attachment_89724" align="aligncenter" width="720"] Source: Company reports/Coresight Research[/caption]

1Q19 Results

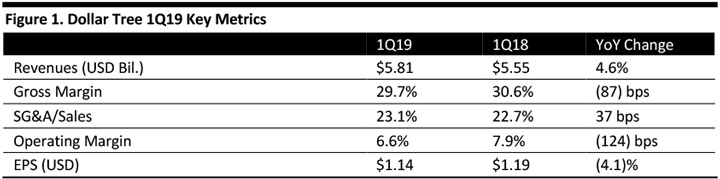

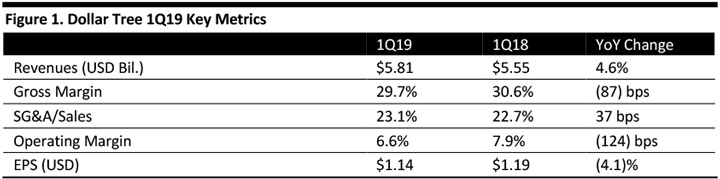

Dollar Tree reported 1Q19 revenues of $5.81 billion, up 4.6% year over year and slightly above the consensus estimate.

Enterprise comps increased 2.2%, beating the 2.1% consensus; Dollar Tree comps grew 2.5%, short of the 3.0% consensus; and Family Dollar comps increased 1.9%, beating the consensus estimate of 1.1%.

Adjusted EPS was $1.14, down 4.1% and in line with the consensus. GAAP EPS was $1.12, compared to $0.67 in the year-ago quarter.

Details from the Quarter

Source: Company reports/Coresight Research[/caption]

1Q19 Results

Dollar Tree reported 1Q19 revenues of $5.81 billion, up 4.6% year over year and slightly above the consensus estimate.

Enterprise comps increased 2.2%, beating the 2.1% consensus; Dollar Tree comps grew 2.5%, short of the 3.0% consensus; and Family Dollar comps increased 1.9%, beating the consensus estimate of 1.1%.

Adjusted EPS was $1.14, down 4.1% and in line with the consensus. GAAP EPS was $1.12, compared to $0.67 in the year-ago quarter.

Details from the Quarter

Source: Company reports/Coresight Research[/caption]

1Q19 Results

Dollar Tree reported 1Q19 revenues of $5.81 billion, up 4.6% year over year and slightly above the consensus estimate.

Enterprise comps increased 2.2%, beating the 2.1% consensus; Dollar Tree comps grew 2.5%, short of the 3.0% consensus; and Family Dollar comps increased 1.9%, beating the consensus estimate of 1.1%.

Adjusted EPS was $1.14, down 4.1% and in line with the consensus. GAAP EPS was $1.12, compared to $0.67 in the year-ago quarter.

Details from the Quarter

Source: Company reports/Coresight Research[/caption]

1Q19 Results

Dollar Tree reported 1Q19 revenues of $5.81 billion, up 4.6% year over year and slightly above the consensus estimate.

Enterprise comps increased 2.2%, beating the 2.1% consensus; Dollar Tree comps grew 2.5%, short of the 3.0% consensus; and Family Dollar comps increased 1.9%, beating the consensus estimate of 1.1%.

Adjusted EPS was $1.14, down 4.1% and in line with the consensus. GAAP EPS was $1.12, compared to $0.67 in the year-ago quarter.

Details from the Quarter

- 1Q19 represented the 45th consecutive quarter of positive comps for the company.

- Gross margin declined to 29.7% as against 30.6% in the year-ago quarter. The company attributed this decline to lower initial markup at Family Dollar, increase in domestic freight and distribution costs, and contraction in the Family Dollar segment. It also blamed an increase in occupancy costs to the tune of $6.7 million pertaining to accelerated rent expenses for Family Dollar stores scheduled for closure in 2019, owing to the implementation of ASC 842, the new lease accounting standard.

- SG&A expenses grew as a result of higher operating and corporate expenses related to the consolidation of store support centers, payroll costs and legal fees. Expenses were partly offset by lower depreciation and amortization costs in proportion to sales.

- During the quarter, the company initiated testing and conducted extensive planning for “Dollar Tree Plus!” This is the company’s test of multi-price points, which aims to assess customer acceptance to the addition of merchandise priced above $1.

- The company opened 91 stores, expanded or relocated 11 stores, and re-bannered 45 Family Dollar stores to the Dollar Tree brand during the quarter. It also closed 25 stores, comprising 16 Family Dollar and nine Dollar Tree stores.

- Net sales of $23.51–23.83 billion (up 3.0–4.4%), based on a low single-digit increase in comps and approximately 1.0% square footage growth.

- EPS of $4.77–5.07, which includes discrete costs of approximately $0.31 per share.

- Net sales of $5.66–5.76 billion (up 2.4–4.2%), in line with the $5.72 consensus, based on a low single-digit increase in comps.

- EPS of $0.64–0.73, below the $0.91 consensus estimate.