Source: Company reports

4Q15 RESULTS

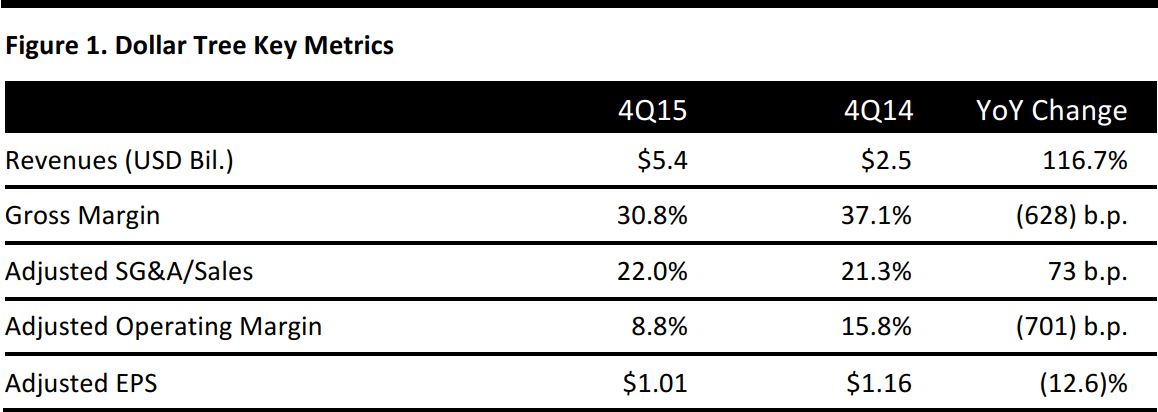

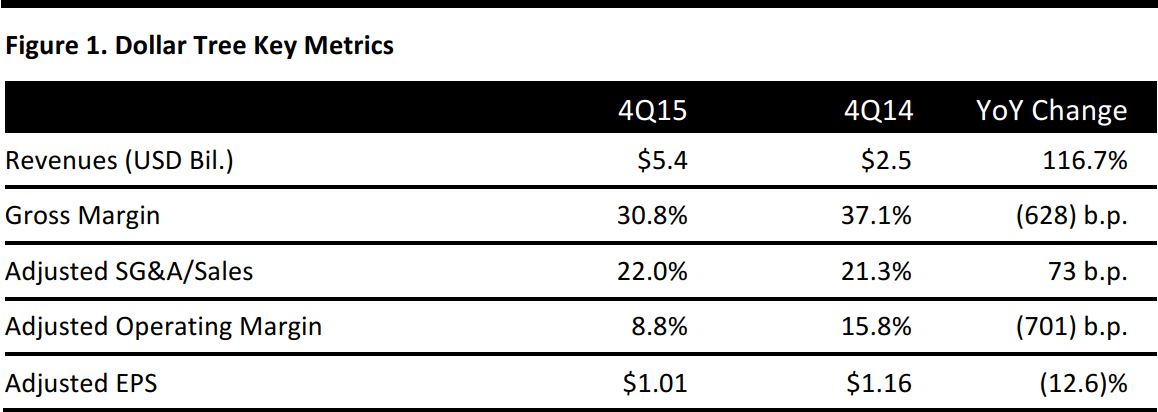

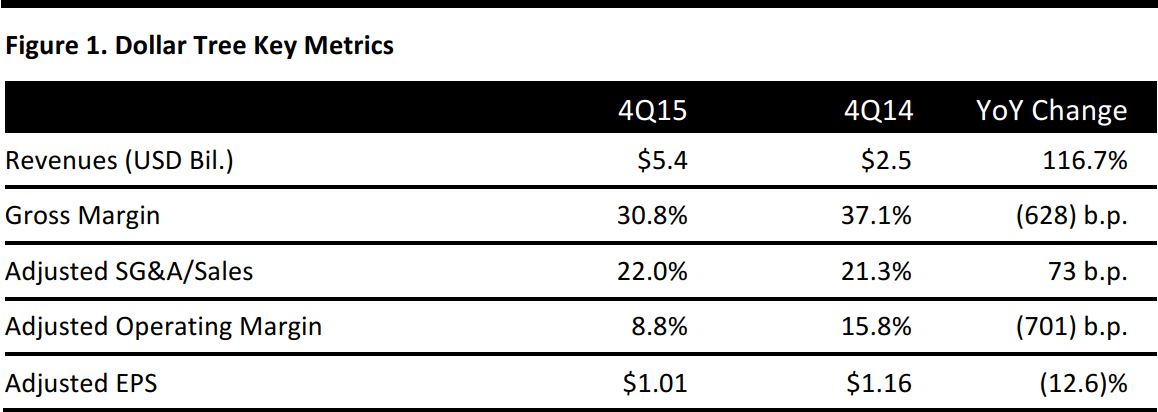

Dollar Tree’s reported 4Q15 revenues were $5.4 billion, up 116.7% from $2.5 billion in the year-ago quarter. The revenue figure includes $2.7 billion from the Family Dollar chain the company acquired.

Comps were 1.7% on a constant-currency basis, and 1.3% when adjusted for the Canadian dollar, following a 5.6% comp in the year-ago quarter.

Gross margin declined by 628 basis points, to 30.8%, due to lower-margin products in the Family Dollar business, a $15.9 million charge for the amortization of stepped-up inventory and $11.5 million in markdowns due to rebannering Deals stores.

GAAP EPS was $0.97, which includes SG&A and interest expense related to the acquisition of Family Dollar.

2015 RESULTS

Revenues in 2015 were $15.5 billion, an 80.2% increase year over year, which includes $6.2 billion from the acquisition of Family Dollar.

Sales increased by 2.5% on a constant-currency basis and by 2.1% excluding fluctuations in the Canadian dollar, compared to a 4.4% increase in 2014.

Adjusted EPS was $2.32 for the year, compared to $3.12 in 2014. GAAP EPS was $1.27 for the year.

GUIDANCE

For 2016, Dollar Tree expects revenues of $20.8–$21.1 billion, based on low-single-digit growth in same-store sales, plus 4.0% growth in square footage. The consensus estimate is $21.0 billion. The company expects EPS of $3.35–$3.65, below the consensus estimate of $3.78.

For 1Q16, the company expects revenues of $5.05–$5.12 billion and EPS of $0.75–$0.83, in line with the consensus estimates of $5.1 billion and $0.81, respectively.