Source: Company reports/Fung Global Retail & Technology

* Note: Results not comparable due to acquisition of Family Dollar in July 2015.

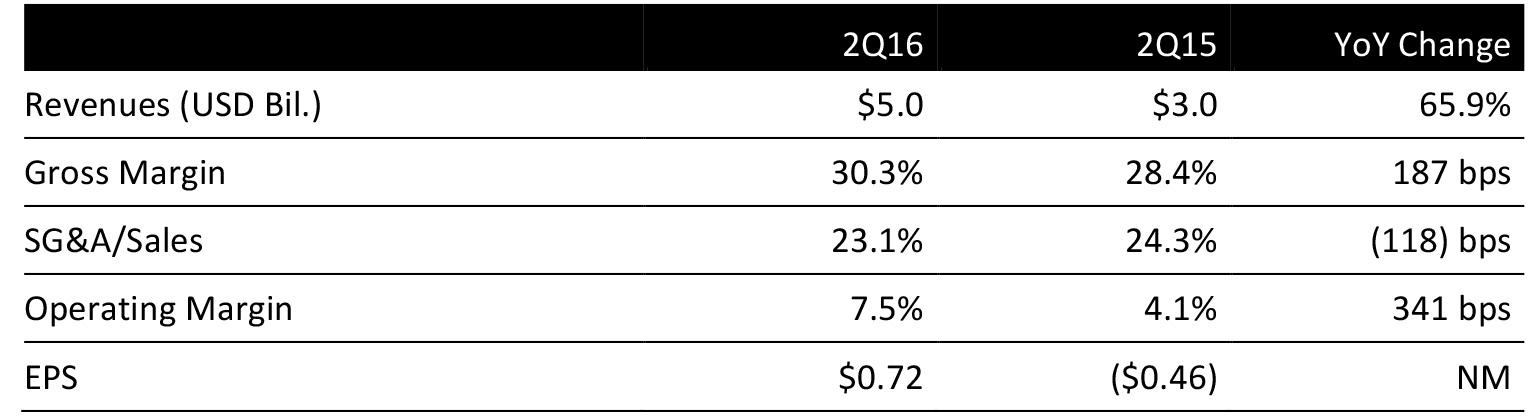

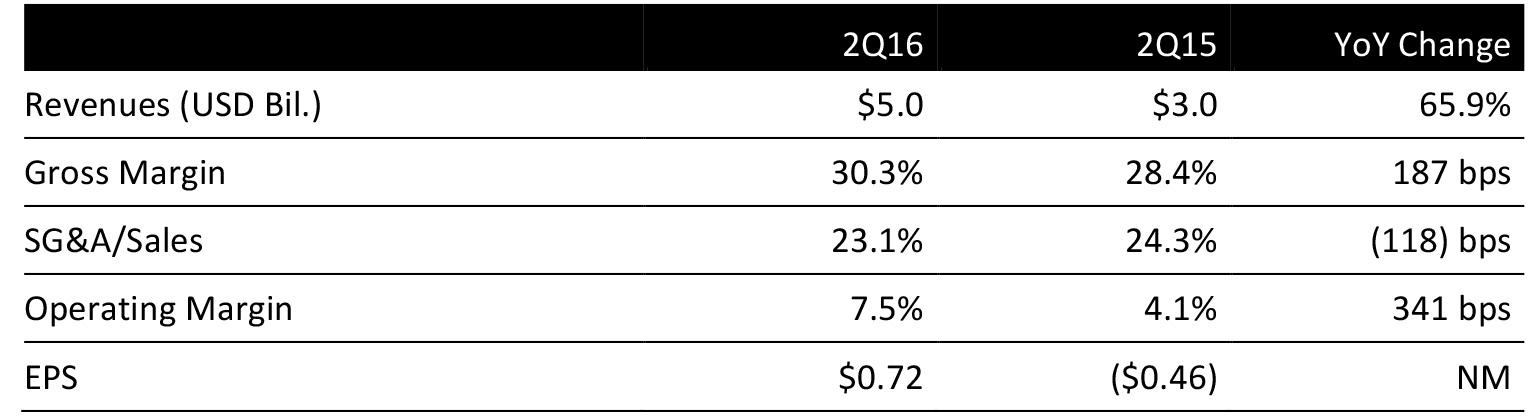

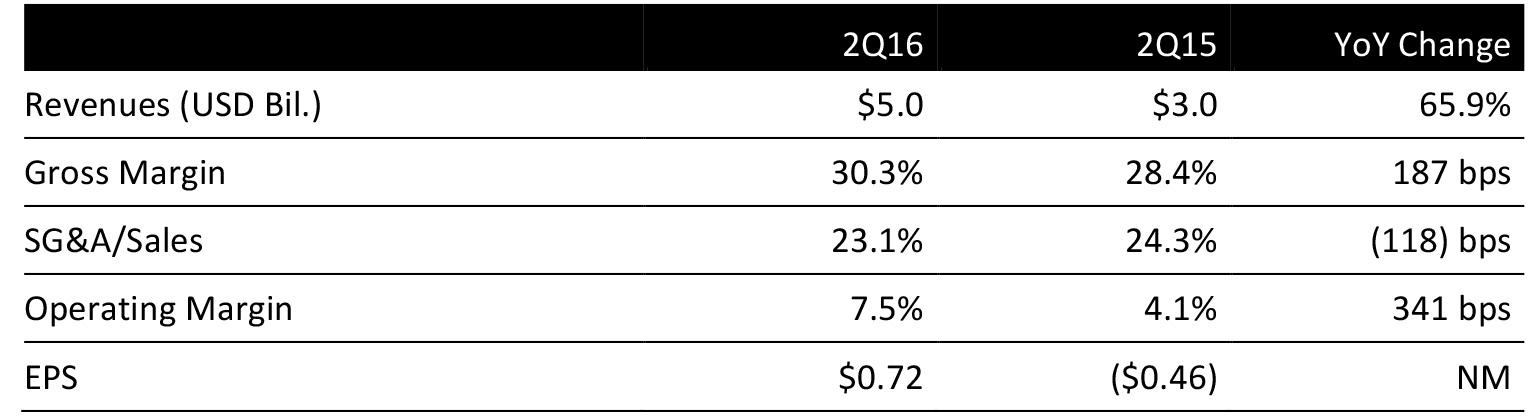

2Q16 RESULTS

Results for 2Q16 include nine weeks of operations from Family Dollar, which was acquired on July 6, 2015, compared to only four weeks of operations in the year-ago quarter.

Revenues were $5.0 billion, below the $5.08 billion consensus estimate, compared to $3.0 billion in the year-ago quarter. Management was pleased with the company’s performance in a challenging retail environment, and delivered improved operating margins and the 34th consecutive quarter of positive same-store sales in the Dollar Tree segment. Moreover, the integration of Family Dollar continues according to plan, with cleaner stores, greater values and improving assortments as management develops a shared-services model and focuses on achieving cost-related synergies, targeted to hit $300 million in the third year.

The gross margin increased to 30.3% compared to 28.4% in the year-ago quarter, which included $60 million of markdowns expense to product assortment rationalization and planned liquidations at Family Dollar.

Same-store sales were up 1.2%, driven by higher customer count and average ticket, up from up 2.7% in the year-ago quarter. Comps increased 1.1% adjusted for Canadian currency fluctuations.

Excluding $17.7 million of acquisition-related costs, SG&A as a percentage of revenue improved to 23.1% from 23.7%, because of lower payroll and operating and corporate expenses, partially offset by higher store repairs and maintenance and depreciation expense.

EPS was $0.72, below the $0.73 consensus estimate.

Details in the Quarter

In the Dollar Tree segment, the top-performing categories included party supplies, snacks and beverage, and toys and household products. Sales in discretionary categories outpaced consumables.

Geographically, the Dollar Tree segment’s same-store sales growth was strong in the Midwest and in the Southwest.

Merchant teams continue to focus on locating products that can be sold for a dollar at a cost that meets the company’s margin requirements, and management commented merchandise values at

Dollar Tree are better than ever; the merchandise margin increased again in the quarter.

On a seasonal basis, management commented seasonal energy was hot in May, and beginning with Mother's Day, stores were well-stocked and seasonal sell-through was good. Stores quickly and efficiently transitioned to stocking items for Mother’s Day and Memorial Day. May had the best comps.

The company commented it ended the quarter with inventory that was clean, well-balanced, seasonally relevant and its stores are well-prepared for the back-to-school season.

In the quarter, the company opened 99 new Dollar Tree stores, relocated or expanded 18 Dollar Tree stores, rebannered the remaining 32 Deals stores to Dollar Tree stores, and rebannered 47 Family

Dollars to Dollar Trees, for a total of 196 Dollar Tree projects during the quarter. Total Dollar Tree-banner selling square footage increased 10.4% year over year, and the company ended the quarter with a total of 6,184 Dollar Tree stores in North America.

During the quarter, the company completed the rebannering of its Deals stores, of which 210 Deals stores were converted to Dollar Tree stores, 9 Deals stores were converted to Family Dollar stores, and 3 were closed when their leases expired. During the last four quarters, the aforementioned 210 Deals stores were rebannered to Dollar Tree and 251 underperforming Family Dollar stores were rebannered as Dollar Tree, in addition to the opening of 384 new Dollar Tree stores. The company ended the quarter with a total of 845 more Dollar Tree stores than a year ago. These new and newly rebannered stores are showing good sales and improved profitability. Cannibalization hurt comps by about 80 additional basis points during the quarter, which is expected to create a headwind through the remainder of the year.

2016 Outlook

The company reduced 2016 revenue guidance to $20.69–$20.87 billion from $20.79–$21.08 billion previously, on a low-single-digit increase in comps and a 4% increase in square footage, up from 2.4% previously. Dollar Tree narrowed its EPS guidance range to $3.67–$3.82 from $3.38–$3.80.