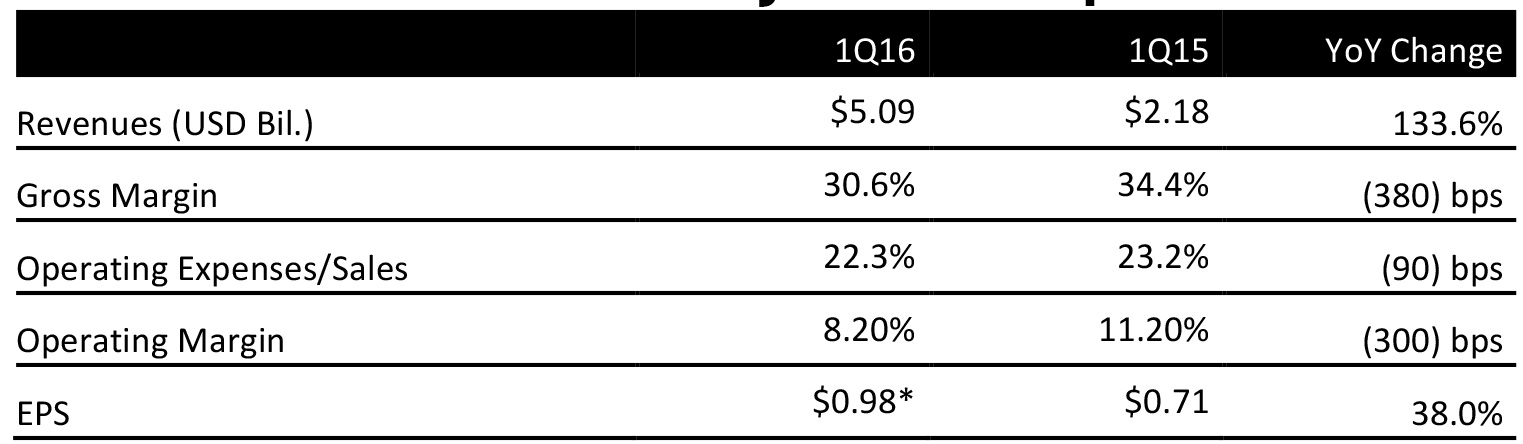

*Including a $0.09 tax benefit

Source: Company reports

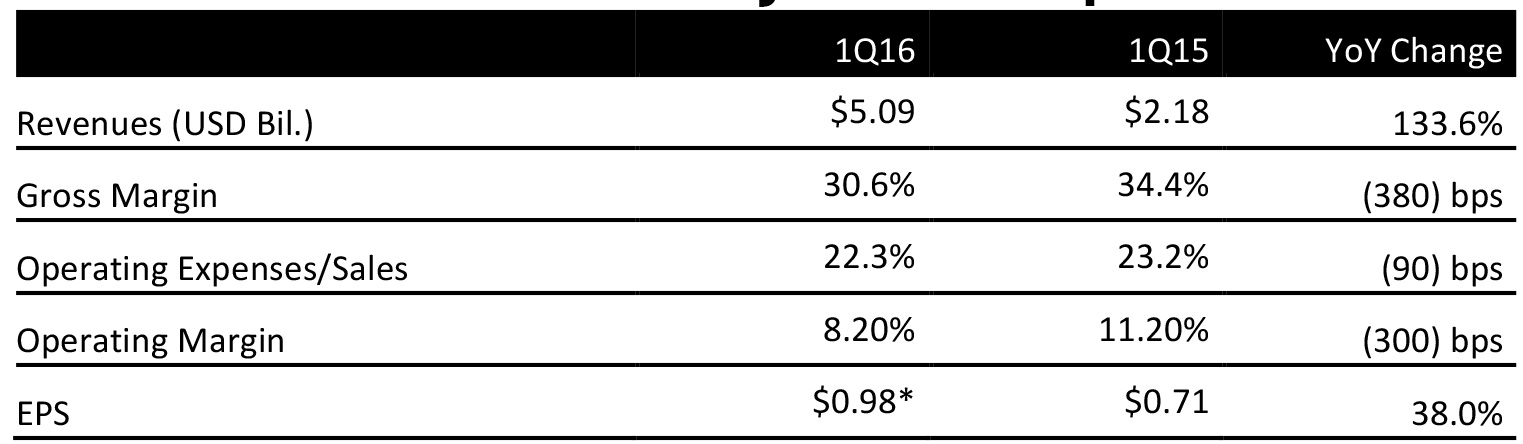

*Including a $0.09 tax benefit

Source: Company reports

1Q16 RESULTS

Dollar Tree reported 1Q16 consolidated net sales of $5.09 billion, up 133.6% from the same period last year, including $2 billion in sales from acquired Family Dollar stores and new Dollar Tree stores.

Revenues were in line with analysts’ estimates and were at the midpoint of the guidance range.

Dollar Tree’s comparable-store sales increased by 2.3% on a constant-currency basis, beating the consensus estimate of 2.1%. This represents the company’s 33rd consecutive quarter of positive same-store sales. The positive result was driven by a higher number of transactions and a higher average transaction value. The company saw solid growth in both basic consumables and discretionary products. Top-performing categories were household products, candy, food, snacks, beverages and party supplies. The Mid-Atlantic, the Midwest and the Northeast were the top-performing regions.

Reported EPS was $0.98 (or $0.89, excluding a onetime tax benefit), versus the consensus estimate of $0.81.

In the quarter, the company opened 171 stores, expanded or relocated 66 stores, and closed 19 stores. The company is also in the process of re-bannering some Family Dollar stores and converting Deals stores.

2016 OUTLOOK

The company forecasted 2Q16 revenue of $5.09 billion, in line with analysts’ expectations. EPS guidance for the quarter is $0.66–$0.72, versus consensus of $0.75. Comp growth is expected to be in the low-single digits, versus consensus of 2.2%.

For FY16, the company raised its EPS guidance to $3.58–$3.80 from $3.35–$3.65 previously. Analysts had previously expected EPS of $3.67. Revenue guidance was also raised slightly, to $20.69–$21.08 billion.

For comps, the company reaffirmed its previous expectation of a low-single-digit increase for the year.

*Including a $0.09 tax benefit

Source: Company reports

*Including a $0.09 tax benefit

Source: Company reports