Nitheesh NH

[caption id="attachment_80457" align="aligncenter" width="640"] Source: Company reports/Coresight Research[/caption]

4Q18 Results

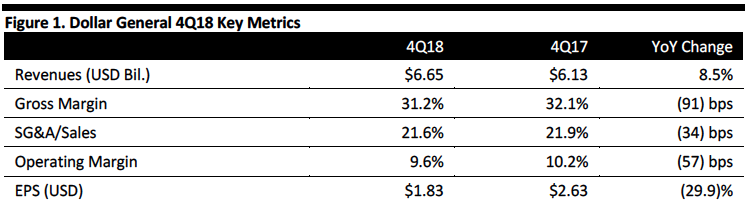

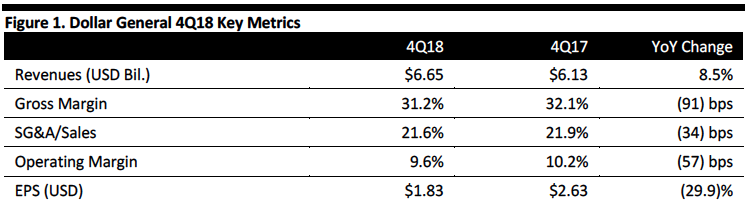

Dollar General reported 4Q18 revenues of $6.65 billion, up 8.5% year over year and in line with the consensus estimate.

The gross margin decreased by 91 basis points due to higher markdowns intended to drive traffic and grow market share. The margin was also hurt by lower initial markups on inventory purchases, an increase in the LIFO provision, a greater proportion of sales coming from the consumables category, which generally has lower margins, partially offset by lower inventory shrink.

The 34-basis-point decrease in SG&A expense was driven by reductions in repair and maintenance expense, compensation and benefit costs and lower utilities expenses, partially offset by $11.7 million in hurricane-related expenses and a $2.2 million year-over-year increase in other disaster-related expense. SG&A expense in the quarter also includes costs related to accelerated store closures.

Comps increased 4.0%, beating the 2.6% consensus estimate. Management commented that growth was driven by both consumable and non-consumable products, representing the bet stack in 21 quarters.

EPS was $1.83, down 29.9% year over year and missing the $1.89 consensus estimate, even adding back a $0.04 charge.

FY18 Results

FY18 revenues were $25.63 billion, up 9.2%

Comps increased 3.2%, up from 2.7% the prior year.

EPS was $5.97, up 6.1%.

Dollar General ended the year with total merchandise inventories, at cost, of $4.1 billion compared to $3.6 billion a year ago, an increase of approximately 7.3% on a per store basis.

Details from the Quarter

Source: Company reports/Coresight Research[/caption]

4Q18 Results

Dollar General reported 4Q18 revenues of $6.65 billion, up 8.5% year over year and in line with the consensus estimate.

The gross margin decreased by 91 basis points due to higher markdowns intended to drive traffic and grow market share. The margin was also hurt by lower initial markups on inventory purchases, an increase in the LIFO provision, a greater proportion of sales coming from the consumables category, which generally has lower margins, partially offset by lower inventory shrink.

The 34-basis-point decrease in SG&A expense was driven by reductions in repair and maintenance expense, compensation and benefit costs and lower utilities expenses, partially offset by $11.7 million in hurricane-related expenses and a $2.2 million year-over-year increase in other disaster-related expense. SG&A expense in the quarter also includes costs related to accelerated store closures.

Comps increased 4.0%, beating the 2.6% consensus estimate. Management commented that growth was driven by both consumable and non-consumable products, representing the bet stack in 21 quarters.

EPS was $1.83, down 29.9% year over year and missing the $1.89 consensus estimate, even adding back a $0.04 charge.

FY18 Results

FY18 revenues were $25.63 billion, up 9.2%

Comps increased 3.2%, up from 2.7% the prior year.

EPS was $5.97, up 6.1%.

Dollar General ended the year with total merchandise inventories, at cost, of $4.1 billion compared to $3.6 billion a year ago, an increase of approximately 7.3% on a per store basis.

Details from the Quarter

Source: Company reports/Coresight Research[/caption]

4Q18 Results

Dollar General reported 4Q18 revenues of $6.65 billion, up 8.5% year over year and in line with the consensus estimate.

The gross margin decreased by 91 basis points due to higher markdowns intended to drive traffic and grow market share. The margin was also hurt by lower initial markups on inventory purchases, an increase in the LIFO provision, a greater proportion of sales coming from the consumables category, which generally has lower margins, partially offset by lower inventory shrink.

The 34-basis-point decrease in SG&A expense was driven by reductions in repair and maintenance expense, compensation and benefit costs and lower utilities expenses, partially offset by $11.7 million in hurricane-related expenses and a $2.2 million year-over-year increase in other disaster-related expense. SG&A expense in the quarter also includes costs related to accelerated store closures.

Comps increased 4.0%, beating the 2.6% consensus estimate. Management commented that growth was driven by both consumable and non-consumable products, representing the bet stack in 21 quarters.

EPS was $1.83, down 29.9% year over year and missing the $1.89 consensus estimate, even adding back a $0.04 charge.

FY18 Results

FY18 revenues were $25.63 billion, up 9.2%

Comps increased 3.2%, up from 2.7% the prior year.

EPS was $5.97, up 6.1%.

Dollar General ended the year with total merchandise inventories, at cost, of $4.1 billion compared to $3.6 billion a year ago, an increase of approximately 7.3% on a per store basis.

Details from the Quarter

Source: Company reports/Coresight Research[/caption]

4Q18 Results

Dollar General reported 4Q18 revenues of $6.65 billion, up 8.5% year over year and in line with the consensus estimate.

The gross margin decreased by 91 basis points due to higher markdowns intended to drive traffic and grow market share. The margin was also hurt by lower initial markups on inventory purchases, an increase in the LIFO provision, a greater proportion of sales coming from the consumables category, which generally has lower margins, partially offset by lower inventory shrink.

The 34-basis-point decrease in SG&A expense was driven by reductions in repair and maintenance expense, compensation and benefit costs and lower utilities expenses, partially offset by $11.7 million in hurricane-related expenses and a $2.2 million year-over-year increase in other disaster-related expense. SG&A expense in the quarter also includes costs related to accelerated store closures.

Comps increased 4.0%, beating the 2.6% consensus estimate. Management commented that growth was driven by both consumable and non-consumable products, representing the bet stack in 21 quarters.

EPS was $1.83, down 29.9% year over year and missing the $1.89 consensus estimate, even adding back a $0.04 charge.

FY18 Results

FY18 revenues were $25.63 billion, up 9.2%

Comps increased 3.2%, up from 2.7% the prior year.

EPS was $5.97, up 6.1%.

Dollar General ended the year with total merchandise inventories, at cost, of $4.1 billion compared to $3.6 billion a year ago, an increase of approximately 7.3% on a per store basis.

Details from the Quarter

- Management commented that Dollar General gained share in highly consumable products in 2018, which was a key driver of sales performance. The company posted high single digit gains in units and dollars in 4, 12, 24 and 52-week periods through the end of January.

- The 3.2% comp growth in 2018 marked the 29th consecutive year of positive comps for the company.

- Revenue growth in 4Q was driven by both average number of units sold and average transaction value.

- During the quarter, the company took measures to provide value for its customers (i.e., lower prices) and focused on promotional activities to take share in multiple categories.

- Growth in nonconsumables was characterized as solid, and management was pleased with growth in the home category, which led comps growth. Comps for nonconsumables were higher than for consumables in the quarter.

- Comps likely also benefited from an acceleration in Supplemental Nutrition Assistance program (SNAP) benefit payments in the quarter during the government shutdown, which provided an estimated 70 basis point lift to comps.

- Inventory levels increased in the second half of the year due broadening of inventory to stock the new Longview, Texas, distribution center.

- Net sales growth of 7%.

- Comp growth of 2.5%.

- EPS of $6.30-6.50 (up 5-9%), below the $6.64 consensus estimate.

- Capital expenditure of $775-$825 million.