Nitheesh NH

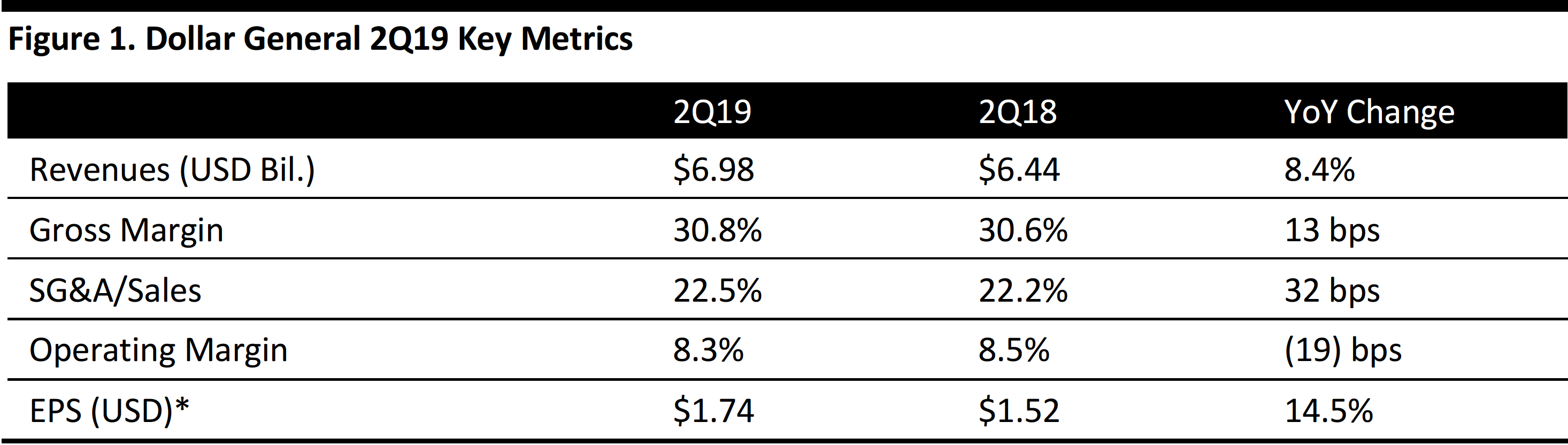

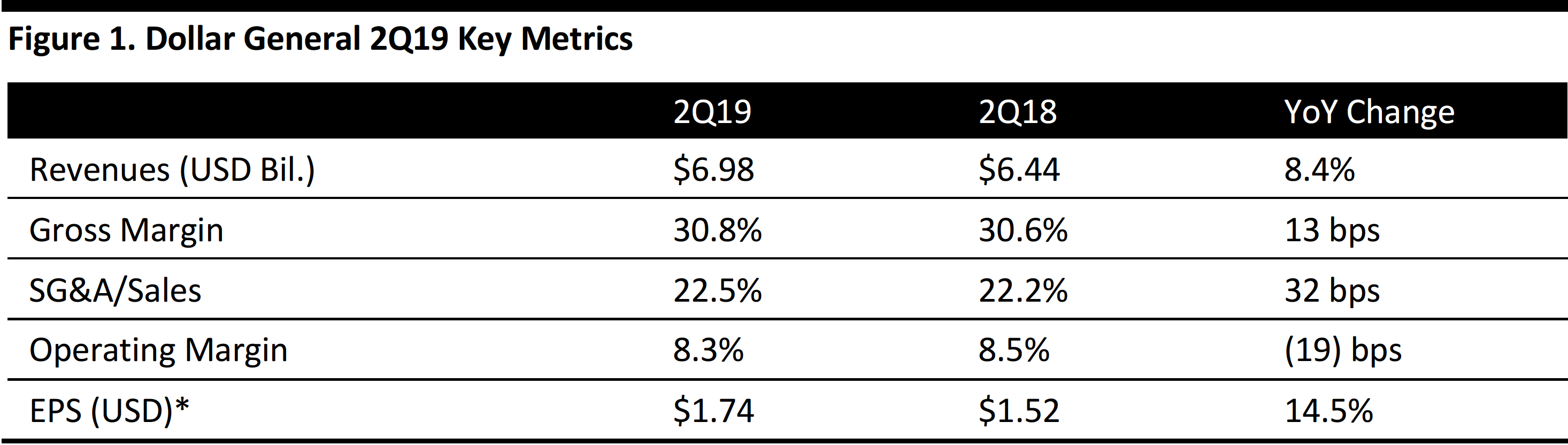

[caption id="attachment_95562" align="aligncenter" width="700"] *EPS is adjusted for after-tax impact of legal expenses

*EPS is adjusted for after-tax impact of legal expenses

Source: Company reports/Coresight Research[/caption] 2Q19 Results Dollar General reported 2Q19 revenues of $6.98 billion, up 8.4% year over year and above the $6.89 billion consensus estimate. Adjusted EPS, excluding the impact of significant legal expenses, was $1.74, up 14.5% year over year, which beat the $1.57 consensus estimate. Gross margin improved 13 basis points, driven mainly by a decline in markdowns as a percentage of net sales and higher initial markups on inventory purchases. The margin gains werepartially offset by higher shrink, a rise in distribution costs, a higher proportion of sales coming from the consumables category (which generally has lower margins) and lower-margin products constituting a higher proportion of sales within the consumables category. The 32-basis-point increase in SG&A expense as a percentage of net sales was driven by a rise in significant legal expenses and store supply expenses, offset partly by a decline in utility costs as a percentage of sales and lower benefits costs, workers’ compensation expenses and general liability expenses. Comps increased 4.0%, beating the 2.5% consensus estimate, driven by growth in both average transaction amount and customer traffic. Segment-wise, increased comps were driven by growth in consumables, seasonal and home categories, partially offset by a decline in apparel. Details from the quarter

*EPS is adjusted for after-tax impact of legal expenses

*EPS is adjusted for after-tax impact of legal expensesSource: Company reports/Coresight Research[/caption] 2Q19 Results Dollar General reported 2Q19 revenues of $6.98 billion, up 8.4% year over year and above the $6.89 billion consensus estimate. Adjusted EPS, excluding the impact of significant legal expenses, was $1.74, up 14.5% year over year, which beat the $1.57 consensus estimate. Gross margin improved 13 basis points, driven mainly by a decline in markdowns as a percentage of net sales and higher initial markups on inventory purchases. The margin gains werepartially offset by higher shrink, a rise in distribution costs, a higher proportion of sales coming from the consumables category (which generally has lower margins) and lower-margin products constituting a higher proportion of sales within the consumables category. The 32-basis-point increase in SG&A expense as a percentage of net sales was driven by a rise in significant legal expenses and store supply expenses, offset partly by a decline in utility costs as a percentage of sales and lower benefits costs, workers’ compensation expenses and general liability expenses. Comps increased 4.0%, beating the 2.5% consensus estimate, driven by growth in both average transaction amount and customer traffic. Segment-wise, increased comps were driven by growth in consumables, seasonal and home categories, partially offset by a decline in apparel. Details from the quarter

- Management commented that Dollar General continued to experience strong growth in highly consumable products in the second quarter. The company posted mid to high single digit gains in both units and dollars in the 4, 12, 24 and 52-week periods ending July 27, 2019.

- Revenue growth in the quarter was driven by growth in same-store sales and positive sales contributions from new stores, slightly offset by the impact of store closures.

- The company attributed growth in non-consumable sales primarily to strong results in seasonal and home categories. The company’s non-consumable initiative (NCI), under which the company offers a wider product range in key non-consumable categories, was expanded to include over 1,500 stores by the end of the quarter. The company intends to roll out NCI to 2,400 stores by the end of this year.

- Capital expenditure in the second quarter of 2019 was $148 million, including investments in new stores, refurbishment and relocations of existing stores; construction of a distribution center in Amsterdam (in upstate New York); and, spending on strategic initiatives.

- The company opened 249 new stores, revamped 323 stores and relocated 19 stores in the quarter.

- Merchandise inventory levels increased in the second quarter, due mainly to a replenishment process change implemented in the previous quarter designed to enhance on-shelf availability.

- Net sales growth of 8%, up from the 7% guidance provided in 1Q19.

- Comp growth of low-to-mid 3% range, raised from previous guidance of 2.5% growth.

- EPS of $6.36-6.51 (up 6-9%), below the $6.53 consensus estimate; raised from previous guidance of $6.30-6.50.

- Capital expenditure of $775-825 million.