DIpil Das

[caption id="attachment_89719" align="aligncenter" width="720"] Source: Company reports/Coresight Research[/caption]

1Q19 Results

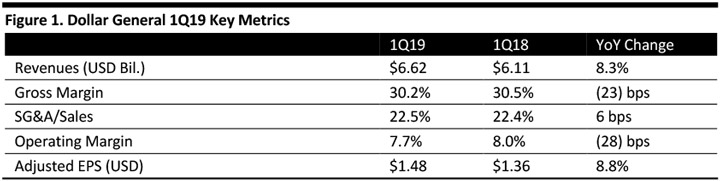

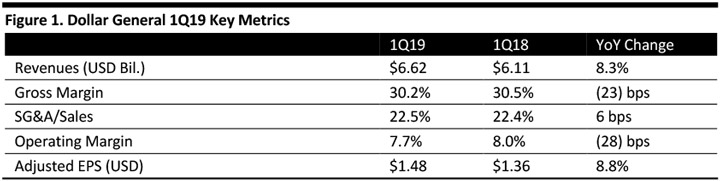

Dollar General reported 1Q19 revenues of $6.62 billion, up 8.3% year over year and marginally above the $6.57 billion consensus estimate.

Gross margin decreased 23 basis points, driven by an increase in distribution and transportation costs; a greater proportion of sales coming from the consumables category, which generally has lower margins; and, lower-margin product sales constituting a higher proportion of sales within the consumables category, partially offset by higher initial markups on inventory purchases.

The six-basis-point increase in SG&A expense as a percentage of net sales was driven by a rise in employee benefits and occupancy costs as a percentage of sales, offset partly by a decline in repairs, maintenance and workers’ compensation expenses.

Comps increased 3.8%, beating the 2.7% consensus estimate, driven by growth in both average transaction amount and customer traffic. From a segment perspective, an increase in comps was driven by growth in consumables, seasonal and home categories which were partially offset by a decline in the apparel category.

Adjusted EPS was $1.48, up 8.8% year over year, which beat the $1.39 consensus estimate.

Details from the quarter

Source: Company reports/Coresight Research[/caption]

1Q19 Results

Dollar General reported 1Q19 revenues of $6.62 billion, up 8.3% year over year and marginally above the $6.57 billion consensus estimate.

Gross margin decreased 23 basis points, driven by an increase in distribution and transportation costs; a greater proportion of sales coming from the consumables category, which generally has lower margins; and, lower-margin product sales constituting a higher proportion of sales within the consumables category, partially offset by higher initial markups on inventory purchases.

The six-basis-point increase in SG&A expense as a percentage of net sales was driven by a rise in employee benefits and occupancy costs as a percentage of sales, offset partly by a decline in repairs, maintenance and workers’ compensation expenses.

Comps increased 3.8%, beating the 2.7% consensus estimate, driven by growth in both average transaction amount and customer traffic. From a segment perspective, an increase in comps was driven by growth in consumables, seasonal and home categories which were partially offset by a decline in the apparel category.

Adjusted EPS was $1.48, up 8.8% year over year, which beat the $1.39 consensus estimate.

Details from the quarter

Source: Company reports/Coresight Research[/caption]

1Q19 Results

Dollar General reported 1Q19 revenues of $6.62 billion, up 8.3% year over year and marginally above the $6.57 billion consensus estimate.

Gross margin decreased 23 basis points, driven by an increase in distribution and transportation costs; a greater proportion of sales coming from the consumables category, which generally has lower margins; and, lower-margin product sales constituting a higher proportion of sales within the consumables category, partially offset by higher initial markups on inventory purchases.

The six-basis-point increase in SG&A expense as a percentage of net sales was driven by a rise in employee benefits and occupancy costs as a percentage of sales, offset partly by a decline in repairs, maintenance and workers’ compensation expenses.

Comps increased 3.8%, beating the 2.7% consensus estimate, driven by growth in both average transaction amount and customer traffic. From a segment perspective, an increase in comps was driven by growth in consumables, seasonal and home categories which were partially offset by a decline in the apparel category.

Adjusted EPS was $1.48, up 8.8% year over year, which beat the $1.39 consensus estimate.

Details from the quarter

Source: Company reports/Coresight Research[/caption]

1Q19 Results

Dollar General reported 1Q19 revenues of $6.62 billion, up 8.3% year over year and marginally above the $6.57 billion consensus estimate.

Gross margin decreased 23 basis points, driven by an increase in distribution and transportation costs; a greater proportion of sales coming from the consumables category, which generally has lower margins; and, lower-margin product sales constituting a higher proportion of sales within the consumables category, partially offset by higher initial markups on inventory purchases.

The six-basis-point increase in SG&A expense as a percentage of net sales was driven by a rise in employee benefits and occupancy costs as a percentage of sales, offset partly by a decline in repairs, maintenance and workers’ compensation expenses.

Comps increased 3.8%, beating the 2.7% consensus estimate, driven by growth in both average transaction amount and customer traffic. From a segment perspective, an increase in comps was driven by growth in consumables, seasonal and home categories which were partially offset by a decline in the apparel category.

Adjusted EPS was $1.48, up 8.8% year over year, which beat the $1.39 consensus estimate.

Details from the quarter

- Management commented that Dollar General gained share in highly consumable products in the first quarter, which was a key driver of sales performance. The company posted mid to high single digit gains in both units and dollars in 4, 12, 24 and 52-week periods ending May 4, 2019.

- Revenue growth in the quarter was driven by growth in same-store sales and positive sales contributions from new stores, slightly offset by the impact of store closures.

- The company attributed growth in non-consumable sales primarily to strong results in seasonal and home categories. The company’s non-consumable initiative (NCI), under which the company offers an expanded product range in key non-consumable categories, was expanded to include over 1,100 stores by the end of the quarter. The company intends to roll out NCI to 2,400 stores by the end of this year.

- Capital expenditure in the first quarter of 2019 was $145 million, including approximately: $67 million for upgrades, revamps and relocations of existing stores; $36 million on new leased stores; $25 million on distribution and transportation related projects; and, $15 million on information systems upgrades and technology-related projects.

- The company opened 240 new stores, revamped 330 stores and relocated 27 stores in the quarter.

- Merchandise inventory levels increased in the first quarter, due primarily to a replenishment process change to enhance on-shelf availability.

- Net sales growth of 7%.

- Comp growth of 2.5%.

- EPS of $6.30-6.50 (up 5-9%), in line with the $6.41 consensus estimate.

- Capital expenditure of $775-825 million.