Source: Company reports/Coresight Research

Source: Company reports/Coresight Research

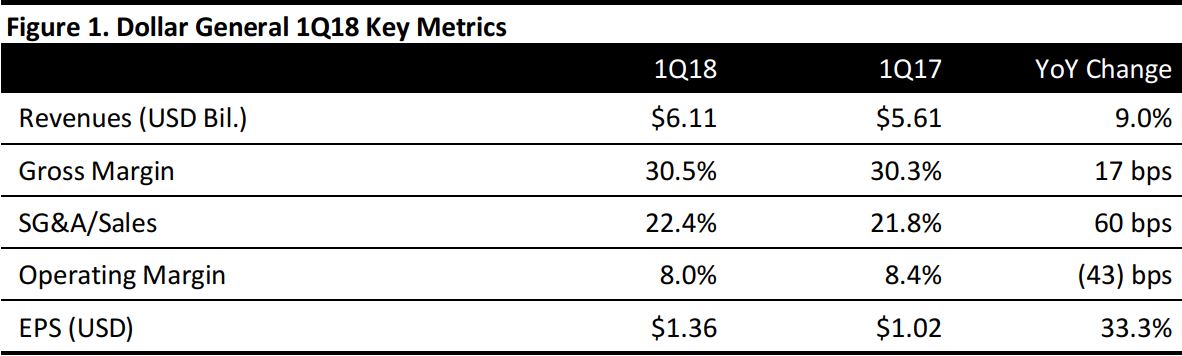

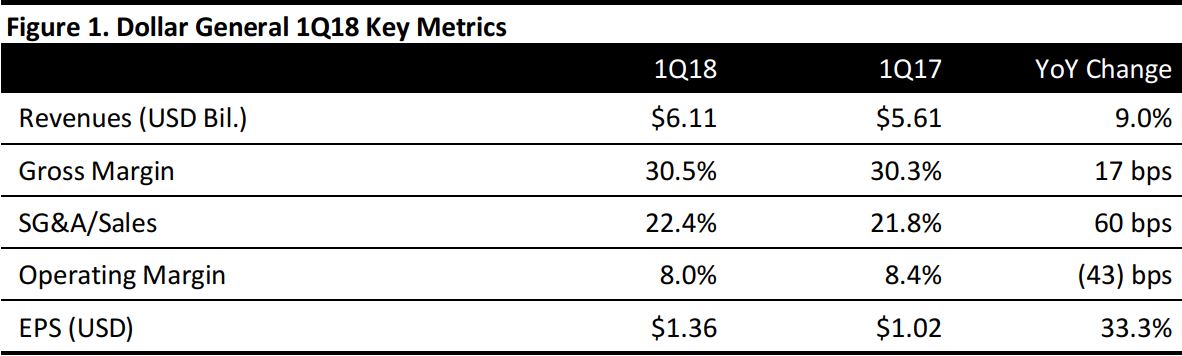

1Q18 Results

Dollar General reported 1Q18 EPS of $1.36, up 33.3% from $1.02 in the year-ago period, but below the $1.40 consensus estimate. Revenues were $6.11 billion, up 9.0% year over year and below the $6.18 billion consensus estimate. Sales growth was driven by sales from new stores, which were modestly offset by sales lost from closed stores.

Comps were up 2.1%, below the consensus estimate of 3.2%. The comp growth was due to an increase in average transaction value, which was partially offset by a decline in customer traffic. Other growth drivers included positive results in the consumables category, which was partially offset by sales declines in the apparel, seasonal and home categories. Management noted certain category comp sales were negatively affected by unseasonably cold and damp weather.

The increase in SG&A expense as a percentage of sales was primarily due to higher occupancy costs, retail labor expenses and increased incentive compensation.

Merchandise inventories were $3.59 billion, an increase of approximately 0.4% year over year on a per-store basis.

The company completed a strategic review of its real estate portfolio and subsequently closed 14 under performing stores, the majority of which were part of the mature store base, having been open five years or more. During the quarter, the company opened 241 new stores, remodeled 322 stores and relocated 31 stores. In total, the company operates 13,534 stores, compared to 13,320 stores in the year-ago quarter.

Outlook

In FY18, management anticipates that investments will primarily focus on the acceleration of long-term strategic initiatives and on new store expansion and infrastructure to support future growth. The company plans to prioritize capital spending on new stores, remodels and relocations, as well as on the two new distribution centers that are under construction. Additionally, management plans to accelerate capital spending on selected infrastructure projects and other key initiatives. Dollar General expects to open 900 new stores, remodel 1,000 stores and relocate 100 stores in FY18.

In FY18, the company also plans to test bold new assortments and expanded assortments in key categories. The company seeks to enhance the treasure hunt experience by offering a new, differentiated, limited assortment that will change throughout the year. The company will display the new offering in high-traffic areas. It will also continue to deliver value by pricing the majority of offerings at $5 or below. These changes will initially be tested in approximately 700 store locations.

The goal of the company’s long-term growth model (introduced on March 10, 2016) remains the same: grow adjusted, diluted EPS at a rate of 10% or higher.

Management reaffirmed its FY18 guidance and expects:

- Net sales to increase by 9.0%, implying revenues of $25.58 billion (compared with the $25.47 billion consensus estimate).

- Comps of around 2.0%.

- EPS of $5.95–$6.15, in line with the consensus estimate of $6.08.

Source: Company reports/Coresight Research

Source: Company reports/Coresight Research