Source: Company reports/FGRT

3Q17 Results

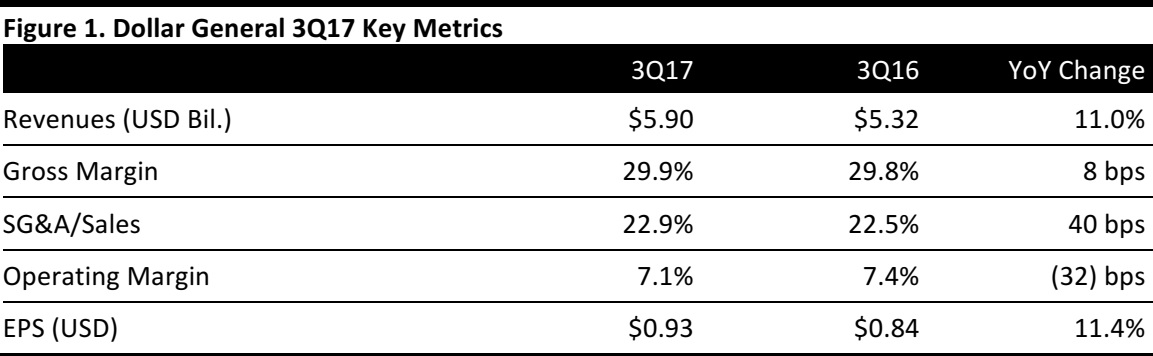

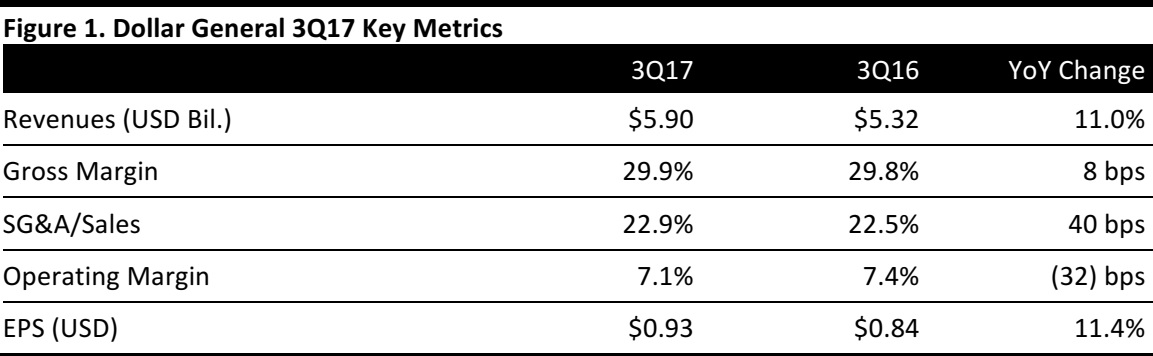

Dollar General reported 3Q17 revenues of $5.90 billion, up 11.0% year over year and beating the $5.80 billion consensus estimate.

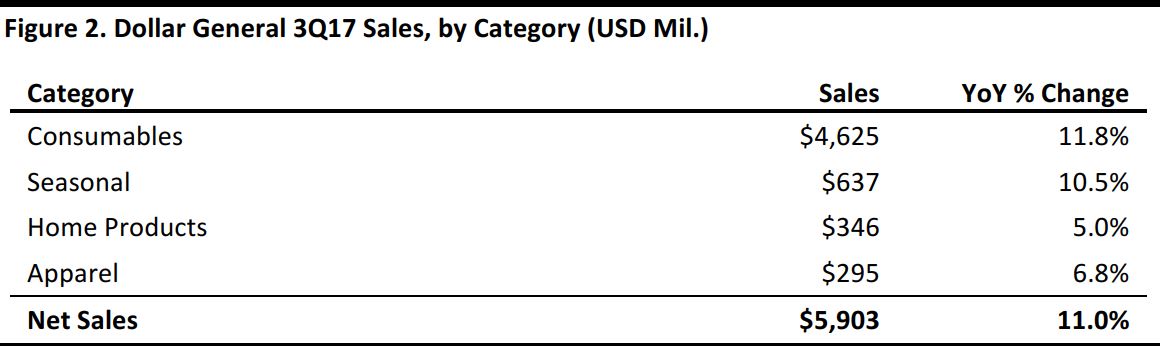

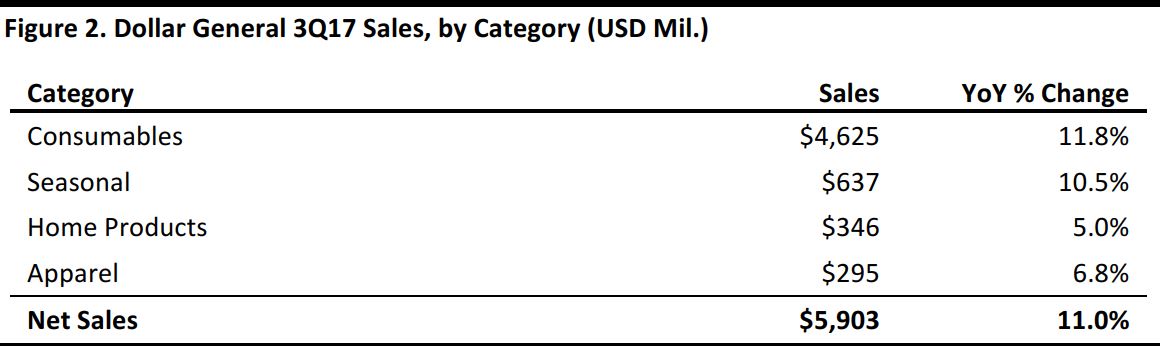

Same-store sales increased by 4.3%, owing to higher average transaction value and customer traffic and including an estimated net benefit of 30–35 basis points from hurricane-related sales. Same-store sales growth was driven by higher sales in the consumables, seasonal and apparel categories and was partially offset by negative results in the home products category. Total same-store sales results in the three nonconsumable categories were positive. The net sales increase was also driven by sales from new stores, which were modestly offset by lost sales from closed stores.

The company’s gross margin increased, with growth primarily attributable to higher initial inventory markups and an improved rate of inventory shrink, which were partially offset by a greater proportion of sales of consumables and increased transportation costs.

An SG&A increase was primarily attributable to increased retail labor expenses, mainly due to higher manager compensation, and increased incentive compensation and occupancy costs, which were partially offset by lower utilities and advertising costs. The company also recorded expenses of approximately $24.8 million related to the impact of two hurricanes that occurred during the quarter. This compares with incremental charges of $13.0 million associated with the acquisition of former Walmart Express store locations and $7.7 million of expense from natural disasters in the year-ago quarter.

EPS was $0.93, including a nickel of hurricane-related negative impact, missing the consensus estimate by a penny.

Total merchandise inventory was $3.60 billion, a decrease of 4.9%year over year on a per-store basis.

Details from the Quarter

Management characterized the 4.3% comps and increases in both average transaction value and customer traffic as strong, and the company was able to balance same-store sales growth and gross margin expansion with continued investment in the business.

Sales by category break down as shown in the table below.

Source: Company reports

In the quarter, the company opened 1,044 new stores and remodeled or relocated 719 stores. This new store growth includes the rebannering of 263 store locations acquired in the second quarter of 2017.

Outlook

The company narrowed its FY17 EPS guidance range to $4.37–$4.47 from $4.35–$4.50 previously. The revised guidance includes an estimated net negative impact of $0.05 per share related to the hurricanes.

The company also now expects the following in FY17:

- Sales growth of approximately 7%, compared with5%–7% previously.

- Same-store sales growth of 2.5%, compared with the prior expectation that same-store sales would fall at the upper end of the range of slightly positive to up 2%.

- Capital expenditures of $700–$750 million, compared with prior guidance of $715–$765 million.

The company continues to plan to open approximately 1,285 new stores in FY17, in addition to remodeling or relocating 760 stores.

For FY18, the company plans to open approximately 900 new stores, remodel approximately 1,000 mature store locations and relocate approximately 100 stores, for an approximate total of 2,000 real estate projects.