Source: Company reports/Fung Global Retail & Technology

Source: Company reports/Fung Global Retail & Technology

3Q16 RESULTS

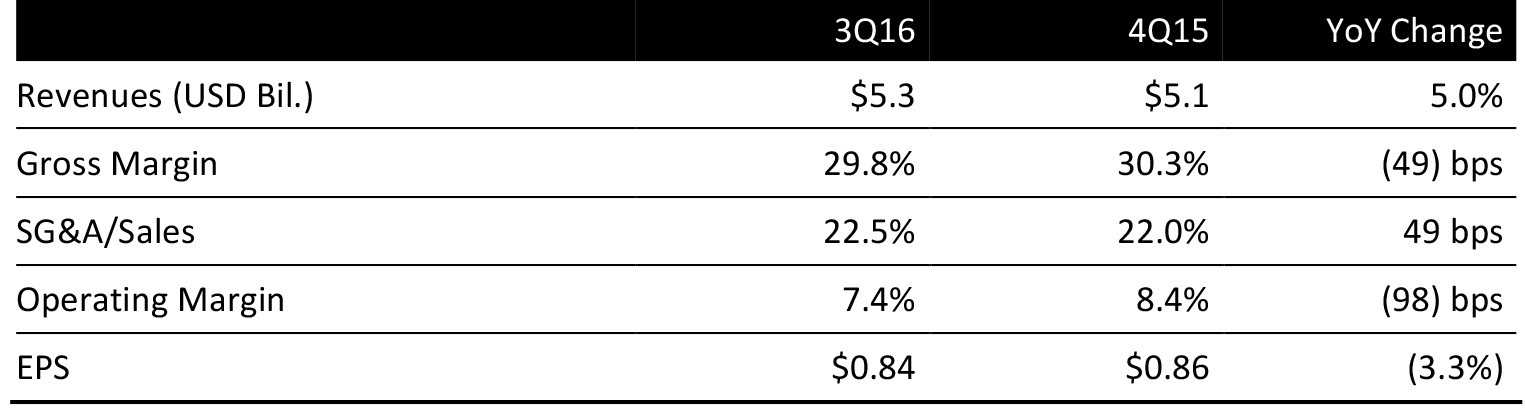

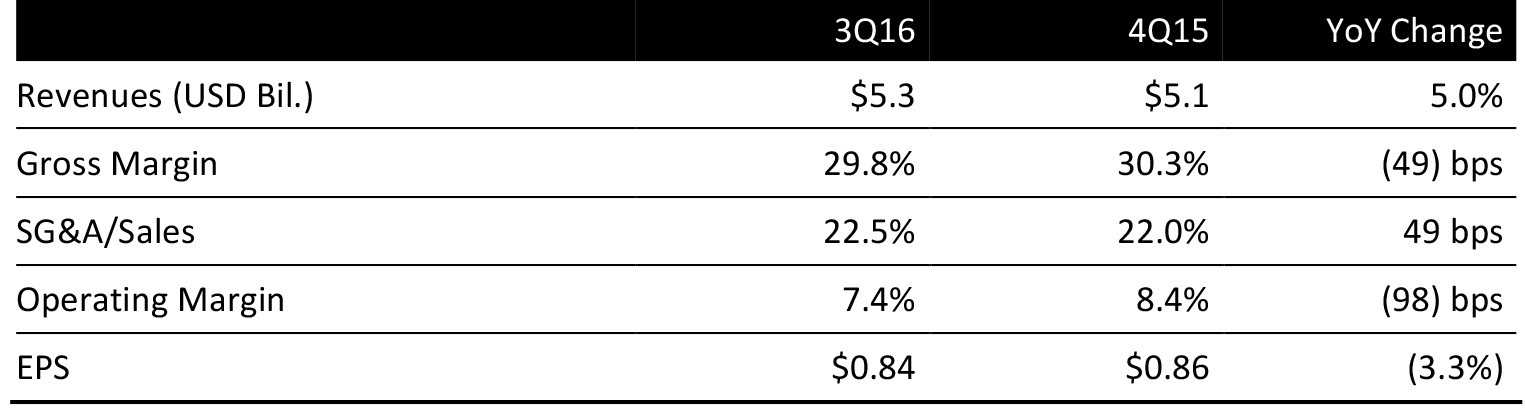

Dollar General reported 3Q16 net sales of $5.32 billion, up 5.0%, and slightly below the consensus estimate of $5.36 billion.

The gross margin was 29.8% in the quarter, down 49 bps from the year-ago quarter, owing to higher markdowns, primarily for inventory clearance and promotions, as well as a greater proportion of sales of lower-margin consumables and increased inventory shrink, which was partially offset by higher initial inventory markups.

SG&A was 22.5% of revenues in the quarter, compared to 22.0% a year ago, due in part to increased retail labor and occupancy costs. In addition, the company recorded a $13 million (or 25 bps) charge and related expenses associated with the acquisition of the former Walmart Express store locations, primarily related to costs for lease termination for existing stores and the conversion of acquired stores to DG stores. The company also recorded $7.7 million (or 14 bps) of disaster-related expenses in the 2016 period, most of which were hurricane related, partially offset by lower payroll costs, incentive compensation expenses and advertising costs.

The effective tax rate was 36.2% in the quarter, lower year over year, primarily due to the recognition of the Work Opportunity Tax Credit.

EPS was $0.84, missing the $0.93 consensus estimate. Store relocation costs and disaster-related expenses hurt EPS by $0.05.

DETAILS FROM THE QUARTER

Management commented on the continuing impact of deflation in the quarter, the impact of which increased from 2Q to 3Q. Management estimated that the combined headwind from retail price deflation and a reduction in SNAP (Supplemental Nutrition Assistance Program—formerly known as food stamps) benefits hurt 2Q same-store sales by 100 bps–115 bps and 3Q same-store sales by 150 bps–175 bps.

Comps declined by 0.1%, due to a decline in traffic, partially offset by higher transaction values. Same-store sales growth was positive for consumables, offset by a decline for nonconsumables.

August and October had positive sales growth in the quarter, with October being the strongest month.

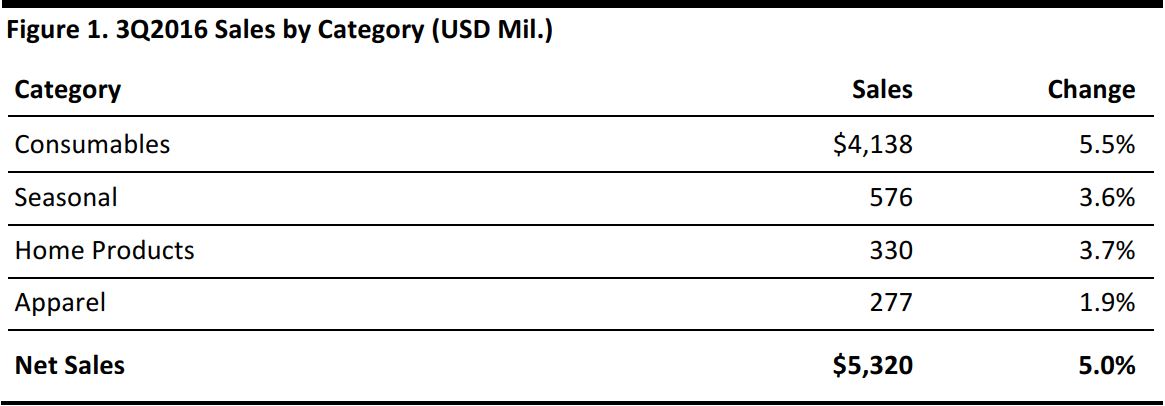

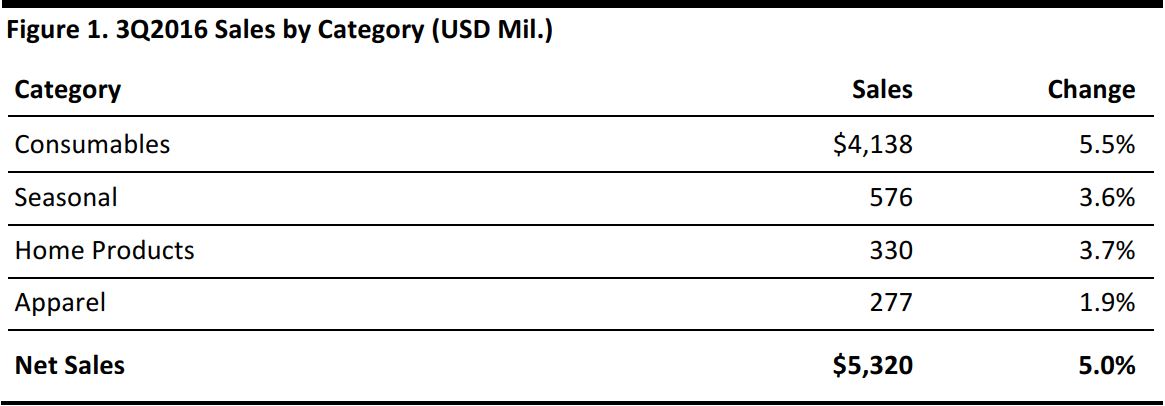

Sales by category break down as follows:

Source: Company reports

In the quarter, Dollar General invested gross margin dollars in a number of strategies designed to drive traffic. Moreover, the company also made pricing, labor and marketing investments in designated market areas in order to improve same-store sales and market share, as well as provide customers with affordability, value and convenience. These pricing actions were implemented selectively across about 70% of the company’s store base on about 450 items targeting high-household-penetration and fast-turning categories. Although these investments will take time to be fully realized, the company is already seeing improvements in transactions, units and weekly same-store sales across most of the stores in which it made these investments.

In the quarter, Dollar General converted 42 Walmart Express locations to the Dollar General banner, which was ahead the company’s plan.

During the first 39 weeks of the year, the company opened 768 new stores and closed 46 new stores, ending the quarter with 13,205 stores. Square footage increased 6.8% in the 39-week period.

In 2016, the company remains on track to open 900 new stores and relocate or remodel a total of 900 stores.

REVISED 2016 OUTLOOK

Dollar General now expects 2016 EPS growth at the low end of the 10%–15% growth range, i.e., $4.36–$4.55, based on 2016 adjusted EPS of $3.96. The current consensus estimate is $4.46.

Using 1Q–3Q EPS of $2.95 and EPS at the low end of the range (i.e., $4.36) implies 4Q EPS of $1.41, below the current consensus estimate of $1.44.

Source: Company reports/Fung Global Retail & Technology

Source: Company reports/Fung Global Retail & Technology