Source: Company reports/Fung Global Retail & Technology

1Q17 Results

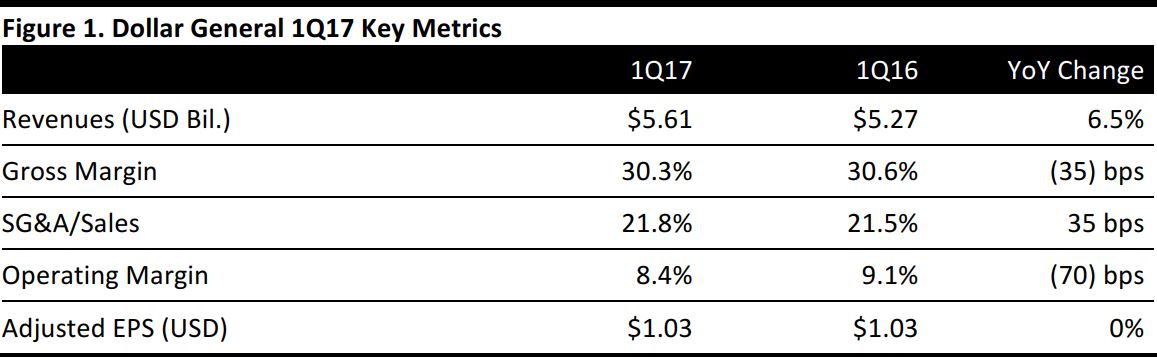

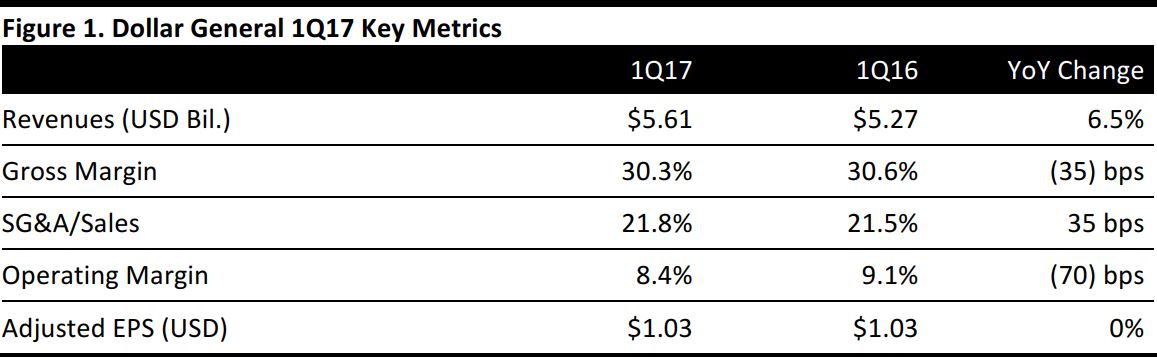

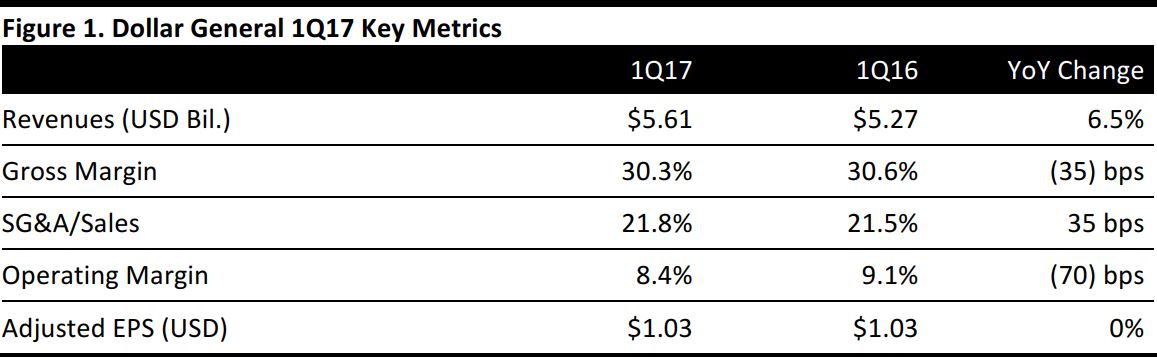

Dollar General reported 1Q17 adjusted EPS of $1.03, including a charge of $0.01 related to the early retirement of long-term debt. Adjusted EPS was flat versus the year-ago quarter and slightly above the $1.00 consensus. Total revenues were $5.61 billion versus analysts’ expectations of $5.58 billion, and were up 6.5% year over year. By category, consumables were up 6.8% from the year-ago quarter, while apparel was up 6.7%, seasonal goods were up 6.2% and home products were up 3.2%.

Total comps increased by 0.7% for the quarter, in line with the consensus estimate; comp growth was driven by an increase in average transaction that was partially offset by a decline in traffic. Comp sales were driven by positive results in consumables and apparel categories that were partially offset by results in home and seasonal categories.

Gross margins were 30.3% for the quarter, compared with 30.6% in the year-ago period. The decrease was primarily driven by higher markdowns, promotional activities and a greater portion of sales of consumables, which have a lower gross profit compared with other categories.

FY17 Outlook

Dollar General reaffirmed its FY17 EPS guidance of $4.25–$4.50 compared with consensus of $4.46. The company expects comps to be “slightly positive” to up 2%. The company raised its full-year guidance for revenue growth from 4%–6% to 5%–7%, assuming the purchase of 322 stores from a small-box retailer is completed; consensus calls for full-year revenue growth of 5.5%.

Including the stores related to the pending acquisition, the company now expects to open 1,290 new stores by the end of FY17, up from a previously expected 1,000.