Dollar General

Sector: Food, drug and mass retailers

Country of operation: The US

Key product categories: Apparel, food and beverages, general merchandise, and health and beauty products

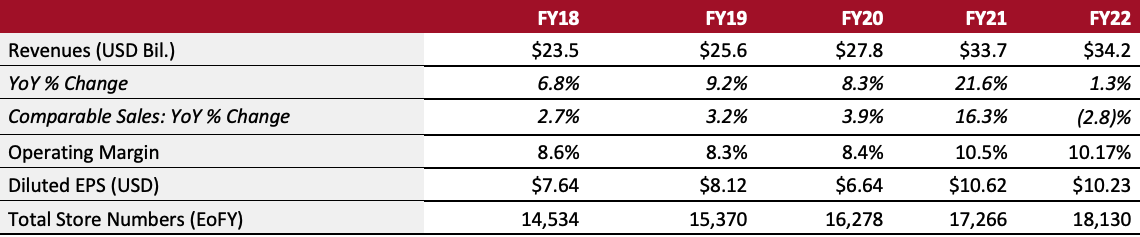

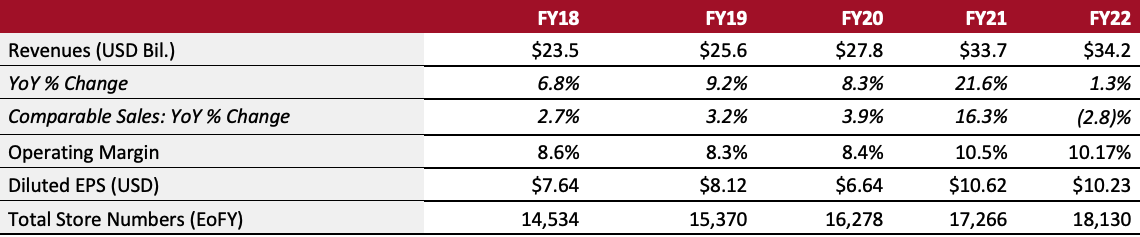

Annual Metrics

[caption id="attachment_145087" align="aligncenter" width="700"]

Fiscal year ends close to January 31. FY22 ended January 28, 2022.

Fiscal year ends close to January 31. FY22 ended January 28, 2022.[/caption]

Summary

Established in 1930, Dollar General is a discount retailer offering a broad selection of merchandise across categories including apparel, consumables, home products and seasonal items. Headquartered in Goodlettsville, Tennessee, the company’s stores are concentrated in the East, Midwest, South and Southwest of the US. Its merchandise includes national brands from leading manufacturers, as well as private-label brands. In March 2022, the company opened its first store in Idaho, its 47th state; as of March 31, 2022, the company operates 18,130 stores.

Company Analysis

Coresight Research insight: Dollar General offers products at highly competitive prices in convenient locations. It operates a small-box store format, making it easier for shoppers to get in and out rapidly. The company aims to maintain everyday low prices on quality merchandise—supported by its low-cost operating structure and its limited number of items per merchandise category, which helps to boost purchasing power. The company’s store profile is distinctly rural—low population densities and lack of public transportation in the rural US offer ideal conditions for Dollar General’s stores to thrive as a convenient retail option.

Dollar General has performed strongly during the pandemic—consumers have traded down to discount retail formats. The company’s real estate expansion plans remain firmly in place, backed by its revamped self-distribution network. It currently operates 12 distribution centers in 2022, increasing from just one in 2019. These efforts have helped the company to add fresh produce to 3,000 stores, while its self-distribution network services more than 16,000 stores. The company opened 1,039 stores in the US in calendar 2021, the highest number in the country across all retailers in all sectors, according to our US Store Tracker 2021 review. Dollar General spent $268 billion on distribution and transportation project.

| Tailwinds |

Headwinds |

- Comprehensive self-distribution network that shields business from cost gyrations and supply-chain interruptions and that helps to expand grocery offerings.

- Partnership with DoorDash offering on-demand delivery of daily essentials

- Opportunities to bolster and expand e-commerce capabilities

- Partnership with a “buy now, pay later” financial platform

|

- Higher focus on store expansion and price cuts weighing on margins

- Intense competition from other discounters and retail formats, including department stores, drugstores, Internet retailers, mass retailers and warehouse clubs

- Rising inflation could squeeze Dollar General stores margins further

- Continued or additional supply chain disruptions could impact overall financial results

|

Strategy

Dollar General outlined the following five long-term priorities in its annual report for fiscal 2022 (ended January 28, 2022):

1. Leverage growth opportunities

Develop new digital tools and technologies that provide customers with additional shopping access points and greater convenience

2. Drive profitable sales growth

- Increase customer traffic and the average transaction amount

- Enhance margins through initiatives covering effective category management, inventory shrinkage reduction, private brands penetration, distribution and transportation efficiencies, global sourcing, and pricing and markdown optimization

3. Capture growth opportunities

- Execute real estate projects, including new stores and remodeling and relocating existing locations

4. Enhance its position as a low-cost operator

- Employ ongoing cost optimization processes without affecting customers’ shopping experiences

5. Invest in people

- Build a competitive advantage through the creation of an environment that attracts and retains talented personnel—particularly at the store level

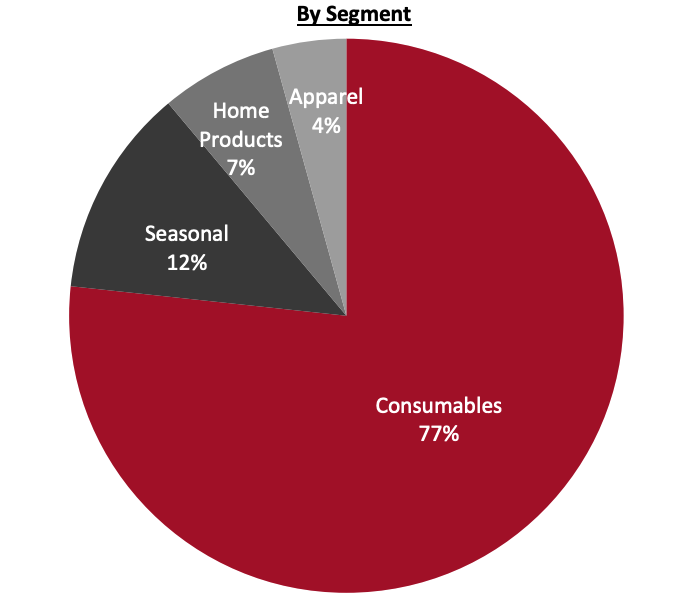

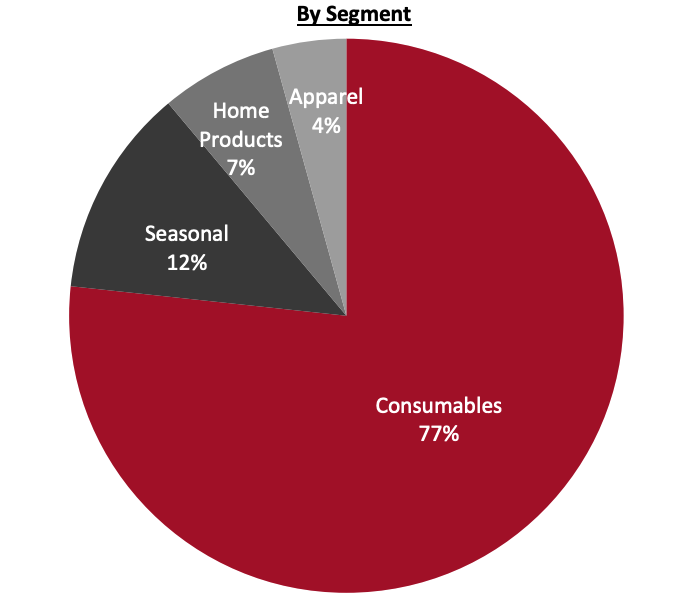

Revenue Breakdown (FY22)

Company Developments

Company Developments

| Date |

Development |

| April 12, 2022 |

Announces plans to donate over 60,000 books to elementary schools in 2022. |

| March 8, 2022 |

Tests a “buy now, pay later” (BNPL) platform, aiming to increase its range of payment options. |

| March 5, 2022 |

Opens first store in Idaho, its 47th state. |

| November 13, 2021 |

Opens its 18,000th store, located in Gulf Shores, Alabama. |

| November 11, 2021 |

Enters into a partnership with DoorDash to offer same-day delivery. |

| September 27, 2021 |

Announces its planned expansion into Idaho, increasing the retailer’s presence into its 47th state. Construction is underway on N. Old Highway 95 in Athol, Kootenai County, for the store, which is currently scheduled to open by spring 2022. |

| September 1, 2021 |

Looks to hire additional employees to serve its customers and communities with opportunities currently available in stores, distribution centers, the DG Private Fleet and its Store Support Center. |

| August 12, 2021 |

Announces a $250,000 partnership with the American Red Cross to extend the Company’s disaster relief efforts and support the nonprofit’s Disaster Responder Program. |

| July 28, 2021 |

Announces the opening of its newest shop-in-shop concept; first two DG Market and Popshelf Stores. |

| July 7, 2021 |

Announces plans to increase access to health care products and services to rural communities across America. |

| June 30, 2021 |

Announces an operational partnership with Feeding America, as well as a $1 million donation to the organization, to provide access to food resources in rural and otherwise underserved communities, and to proactively address food insecurity across the country. |

| May 13, 2021 |

The Dollar General Literacy Foundation announces the organization’s largest one-day grant donation in its 28-year history of more than $10.5 million to support literacy and education in the communities that Dollar General serves. |

| March 18, 2021 |

Announces the planned retirement of Mike Kindy, Executive Vice President of Global Supply Chain, effective April 15, 2021. |

| February 4, 2021 |

Announces its commitment to join the Consortium to Reinvent the Retail Bag as its Value Sector Lead Partner. The Consortium, through its Beyond the Bag Initiative, aims to identify, test and implement viable design solutions that can more sustainably serve the purpose of the current plastic retail bag. |

| December 14, 2020 |

Dollar General and the Dollar General Literacy Foundation announce three initial grant recipients as part of a $5 million racial justice and education commitment shared earlier in the year. |

| ember 14, 2020 |

Opens a new store in Fountain, Colorado, with the official opening used to celebrate the company’s store total reaching 17,000. |

| November 10, 2020 |

Announces plans to build a new distribution center in Blair, Nebraska, with an approximate investment of $85 million. |

| October 8, 2020 |

Announces the opening of its new retail concept store “Popshelf,” with approximately 95% of items priced at $5 or less. |

| September 25, 2020 |

Promotes Emily Taylor to EVP and Chief Merchandising Officer. |

| August 5, 2020 |

Announces plans to expand its distribution centers by adding one traditional distribution center in Kentucky and three DG Fresh cold storage facilities—one each in California, Kentucky and Oklahoma. |

| April 20, 2020 |

Announces the opening of its first store in Washington State, increasing its presence to 46 states. |

Management Team

- Todd J. Vasos—Chief Executive Officer

- Jeffery Carl Owen—Chief Operating Officer

- John W. Garatt—Chief Financial Officer

- Rita F. Branham—General Merchandise Manager of Consumables

Source: Company reports and Capital IQ

Fiscal year ends close to January 31. FY22 ended January 28, 2022.[/caption]

Summary

Established in 1930, Dollar General is a discount retailer offering a broad selection of merchandise across categories including apparel, consumables, home products and seasonal items. Headquartered in Goodlettsville, Tennessee, the company’s stores are concentrated in the East, Midwest, South and Southwest of the US. Its merchandise includes national brands from leading manufacturers, as well as private-label brands. In March 2022, the company opened its first store in Idaho, its 47th state; as of March 31, 2022, the company operates 18,130 stores.

Company Analysis

Coresight Research insight: Dollar General offers products at highly competitive prices in convenient locations. It operates a small-box store format, making it easier for shoppers to get in and out rapidly. The company aims to maintain everyday low prices on quality merchandise—supported by its low-cost operating structure and its limited number of items per merchandise category, which helps to boost purchasing power. The company’s store profile is distinctly rural—low population densities and lack of public transportation in the rural US offer ideal conditions for Dollar General’s stores to thrive as a convenient retail option.

Dollar General has performed strongly during the pandemic—consumers have traded down to discount retail formats. The company’s real estate expansion plans remain firmly in place, backed by its revamped self-distribution network. It currently operates 12 distribution centers in 2022, increasing from just one in 2019. These efforts have helped the company to add fresh produce to 3,000 stores, while its self-distribution network services more than 16,000 stores. The company opened 1,039 stores in the US in calendar 2021, the highest number in the country across all retailers in all sectors, according to our US Store Tracker 2021 review. Dollar General spent $268 billion on distribution and transportation project.

Fiscal year ends close to January 31. FY22 ended January 28, 2022.[/caption]

Summary

Established in 1930, Dollar General is a discount retailer offering a broad selection of merchandise across categories including apparel, consumables, home products and seasonal items. Headquartered in Goodlettsville, Tennessee, the company’s stores are concentrated in the East, Midwest, South and Southwest of the US. Its merchandise includes national brands from leading manufacturers, as well as private-label brands. In March 2022, the company opened its first store in Idaho, its 47th state; as of March 31, 2022, the company operates 18,130 stores.

Company Analysis

Coresight Research insight: Dollar General offers products at highly competitive prices in convenient locations. It operates a small-box store format, making it easier for shoppers to get in and out rapidly. The company aims to maintain everyday low prices on quality merchandise—supported by its low-cost operating structure and its limited number of items per merchandise category, which helps to boost purchasing power. The company’s store profile is distinctly rural—low population densities and lack of public transportation in the rural US offer ideal conditions for Dollar General’s stores to thrive as a convenient retail option.

Dollar General has performed strongly during the pandemic—consumers have traded down to discount retail formats. The company’s real estate expansion plans remain firmly in place, backed by its revamped self-distribution network. It currently operates 12 distribution centers in 2022, increasing from just one in 2019. These efforts have helped the company to add fresh produce to 3,000 stores, while its self-distribution network services more than 16,000 stores. The company opened 1,039 stores in the US in calendar 2021, the highest number in the country across all retailers in all sectors, according to our US Store Tracker 2021 review. Dollar General spent $268 billion on distribution and transportation project.

Company Developments

Company Developments