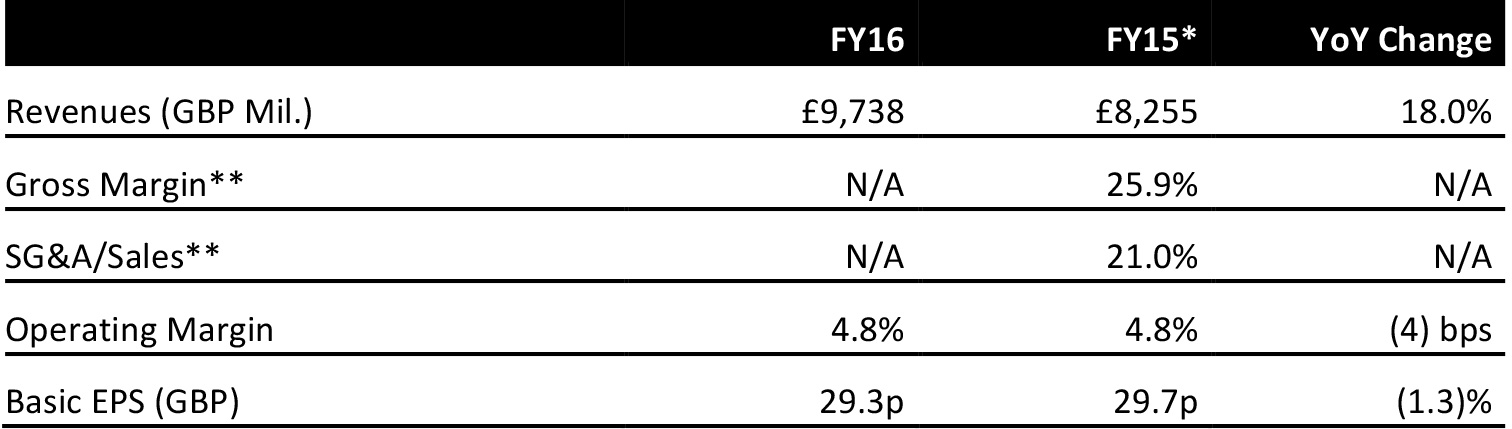

FY16 was the 12 months ended April 30, 2016; FY15 was the 13 months ended May 2, 2015.

*Carphone Warehouse and Dixons Retail merged on August 6, 2014, so the FY15 results are pro forma.

**Gross margin and SG&A were not stated in FY16 preliminary results.

Source: Company reports/Fung Global Retail & Technology

FY16 was the 12 months ended April 30, 2016; FY15 was the 13 months ended May 2, 2015.

*Carphone Warehouse and Dixons Retail merged on August 6, 2014, so the FY15 results are pro forma.

**Gross margin and SG&A were not stated in FY16 preliminary results.

Source: Company reports/Fung Global Retail & Technology

FY16 RESULTS

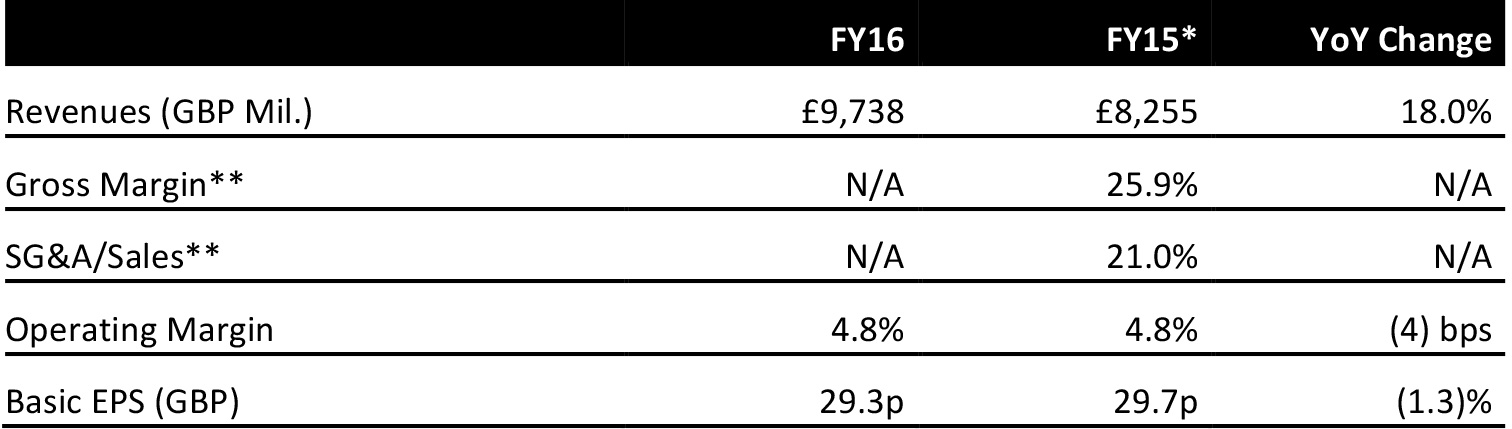

Dixons Carphone reported £9,738 million in group revenues in the 12 months ended April 30, 2016, beating the consensus estimate of £9,647 million. Revenues were up 18%, from £8,255 for the 13 months ended May 2, 2015.

Operating margin decreased by four basis points, to 4.8%. Profit before tax was impacted by costs incurred in relation to the Carphone Warehouse and Dixons Retail merger and property rationalization. The company said net profit was impacted by an increase in the tax charge due to “certain nondeductible items.” Basic EPS was 29.3 pence, down 1.3% from 29.7 pence in FY15 and in line with consensus.

Group comps were up 5% at constant exchange rates and on a comparable 12-month basis.

PERFORMANCE BREAKDOWN

Dixons Carphone said it increased its market share in virtually all of its markets. On a 12-month basis, by region, the company’s comps were:

- Up 6% in the UK and Ireland.

- Up 4% in the Nordics.

- Up 4% in Southern Europe.

Connected World Services, which is Dixon Carphones’ business-to-business services division, saw its comps increase by 26%.

The company noted that it saw strong growth in the UK and Ireland, with television sales performing well, partly due to the World Cup, but that demand for computing was weaker. Carphone Warehouse reported its biggest trading day ever on Black Friday 2015 in the UK and Ireland. In January 2016, the company launched a three-in-one store concept that will involve merging remaining PC World and Currys stores and adding Carphone Warehouse shops-in-shops to stores that do not yet have them.

In the Nordic region, white goods, mobile and laptops performed well, while sales of PCs and tablets were weaker. The company noted that revenue grew in the region despite a challenging commercial environment and aggressive competitive pricing.

White goods and tablets performed well in Greece, although the ending of a government laptop promotion slowed laptop sales in the country. Sales performance in Greece was positive despite the challenging environment.

In Spain, post-pay mobile phone volumes were down, but the company said it retained its multiplay, SIM-only and handset-only market shares in the country. The number of owned stores in Spain was down by 52, to 249, as the company continued to shift its store mix to franchises.

Connected World Services continued to perform well, and the company will keep focusing on its three business areas—connected retailing, technology platform, and support and services.

GUIDANCE

On Brexit, CEO Sebastian James said, “Our view is that, as the strongest player in our market and despite the volatility that is the inevitable consequence of such change, we expect to find opportunities for additional growth and [to] further consolidate our position as the leader in the UK market.”

The company’s future plans include making all of the former UK Dixons stores into new three-in-one shops, opening Europe’s most modern distribution center in Sweden, introducing same-day deliveries and expanding Connected World Services to the US.

For FY17, the consensus estimate is for basic EPS to increase to 31 pence. Analysts expect revenues for the current year to increase by 2.4%, to £9,974 million.

FY16 was the 12 months ended April 30, 2016; FY15 was the 13 months ended May 2, 2015.

*Carphone Warehouse and Dixons Retail merged on August 6, 2014, so the FY15 results are pro forma.

**Gross margin and SG&A were not stated in FY16 preliminary results.

Source: Company reports/Fung Global Retail & Technology

FY16 was the 12 months ended April 30, 2016; FY15 was the 13 months ended May 2, 2015.

*Carphone Warehouse and Dixons Retail merged on August 6, 2014, so the FY15 results are pro forma.

**Gross margin and SG&A were not stated in FY16 preliminary results.

Source: Company reports/Fung Global Retail & Technology