SOLID TOP-LINE NUMBERS AND A FULL-YEAR PROFIT UPGRADE

Dixons Carphone’s Christmas period comps were impressive: the UK and Ireland were up 5%, the Nordic region was up 3% and Southern Europe was up 9%. The UK performance translated to market share gains, the company claimed, with the Currys PC World operation (the Dixons Retail half of the merged UK business) growing share to 25.0% from 24.6% in the same period last year.

Finance Director Humphrey Singer said that margins were stable in the company’s UK electricals business; that the company had invested margin in gaining UK mobile phone market share; and that, in Norway, there were margin pressures from matching online prices and from currency effects due to the depreciation of the krone. Full-year profit before tax is expected to be ahead of consensus.

Dixons Carphone aims to double its market capitalization over time. The company says the following four value drivers will help it achieve this:

- Core business opportunities in the UK, including rolling out its cookware and kitchenware proposition, rolling out same-day delivery across the UK, growing its own mobile virtual network operator for cellphone contracts and extending click-and-collect to Carphone Warehouse.

- Synergies from the Dixons/Carphone merger, including a reduction in stores that should yield an estimated £20 million in annual EBIT gains from fiscal 2018 onward. Total integration savings are expected to be £40 million this year and £80 million next year (US$60 million and US$121 million, respectively).

- Connected World Services, including upgrading its trial with American telecom company Sprint into a full joint venture to manage 500 Sprint-branded stores in the US, and extending its honeyBee sales management platform to the US via an agreement with Apple.

- Consumer services; CEO Sebastian James said innovations in this area will be announced later in 2016.

CHANGING TRADING PATTERNS

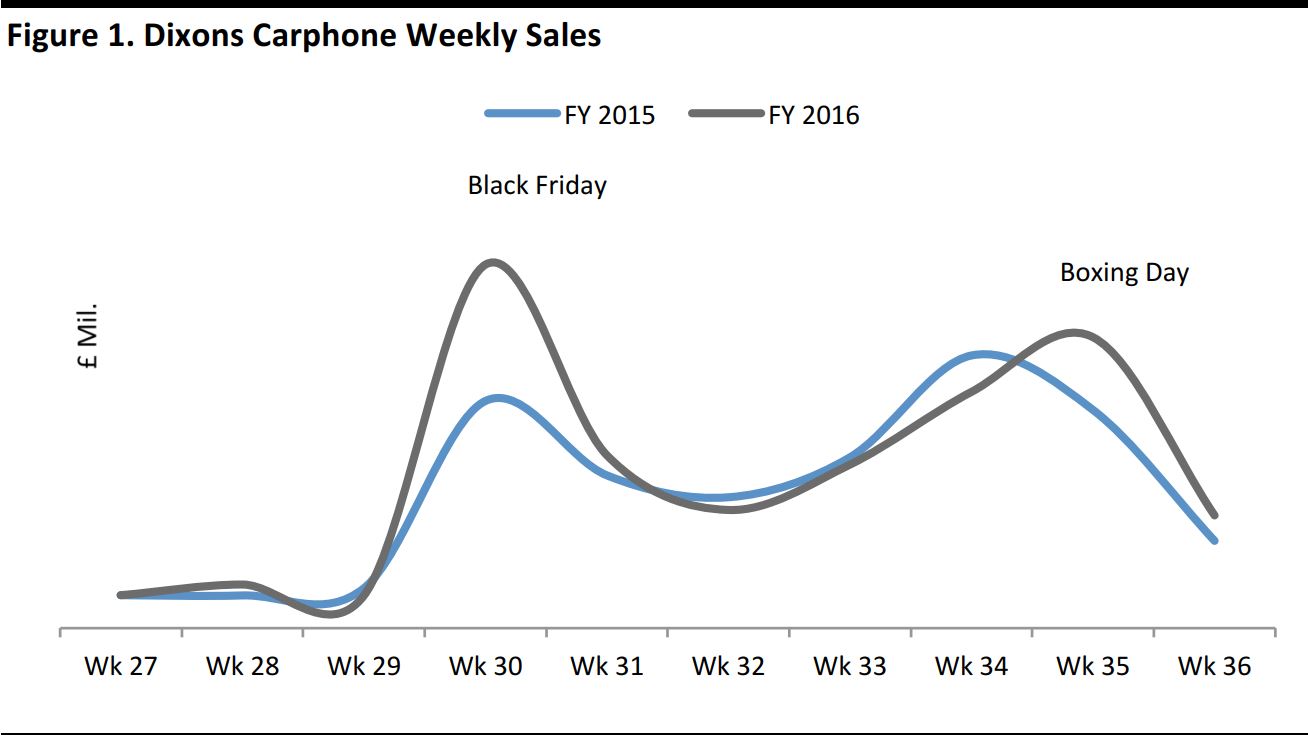

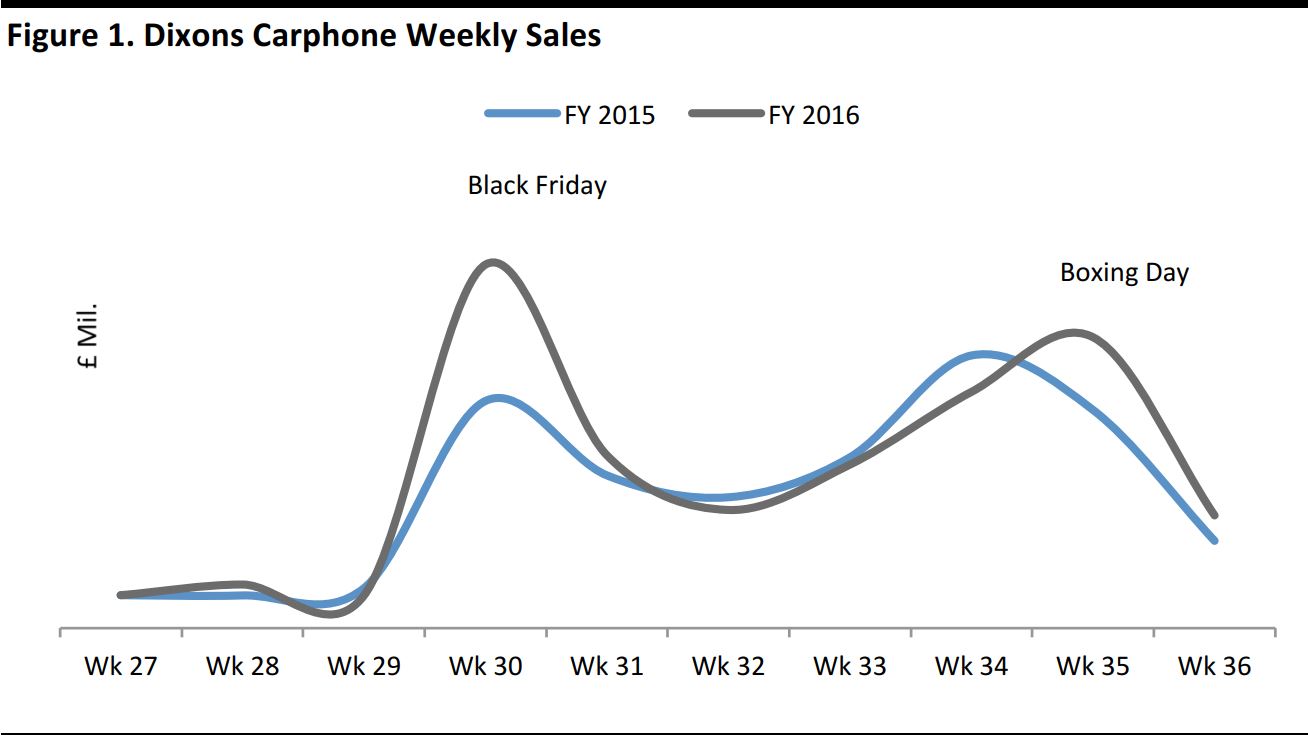

In his presentation of results, James likened the pattern of holiday period sales to a two-humped camel.

The peaks, around Black Friday and Boxing Day (when sales traditionally start in the UK), indicate the extent to which discounting is entrenched in electrical goods retailing. The company saw a substantially stronger Black Friday this year than it did last year, cementing that discounting further.

Reconstructed from a graph prepared by Dixons Carphone, which was provided without absolute data.

Source: Dixons Carphone/FBIC Global Retail & Technology

“SUSTAINABLE” PRICE COMPETITION

Having outlived all its major high-street specialist rivals in the UK, Dixons Carphone now primarily faces competition from Internet pure plays. James said the UK operations had become more competitive on price with Amazon, and that during 2016, the company will eventually match Amazon “pretty much in every single category.”

Matching rivals on price while improving service were key planks of the Dixons Retail strategy even before its merger with Carphone Warehouse. Matching or beating pure plays on price continues to be sustainable, James said, “particularly as we are profitable and they [major pure-play rivals] are not.”

CONSOLIDATION OF UK STORES

Store closures were a headline announcement in today’s results, as the company brings its three UK fascias—Currys, PC World and Carphone Warehouse—under a new “three-in-one” store format. The company will shut 134 stores in the UK and Ireland. The majority (91) will be stores, mainly large units, that were inherited from Dixons Retail. The remaining 43 will be smaller Carphone Warehouse stores.

The closures equate to 0.9 million square feet, or 13% of total space, and will incur an exceptional charge this year of approximately £70 million (US$106 million), but with an EBIT gain of around £20 million (US$ 30 million) from fiscal year 2018 onward.

Even after the closures, UK and Ireland operations will still number 1,093 stores. Of these, 1,007 will be in the UK, 684 of which were inherited from Carphone Warehouse and 323 of which were from Dixons Retail.

BUT STILL LOOKING OVERSPACED

One particular competitive advantage Dixons Retail enjoys over its pure-play rivals is its physical stores, and it is renewing its emphasis on quality of service in-store and expanding multi-channel options such as click-and-collect. The company said that a little over one-third of its UK sales were made online during Black Friday 2015 and that, in turn, around one-third of those purchases were collected in-store.

Yet the company is competing in a market that has migrated online to a far greater extent than other categories have: fully 48% of UK sales of electrical and electronic goods were made online in 2015, according to Mintel. In such a context, it is hard not to see Dixons Carphone, with more than 1,000 UK stores, as being overspaced.