A $121 Billion Market

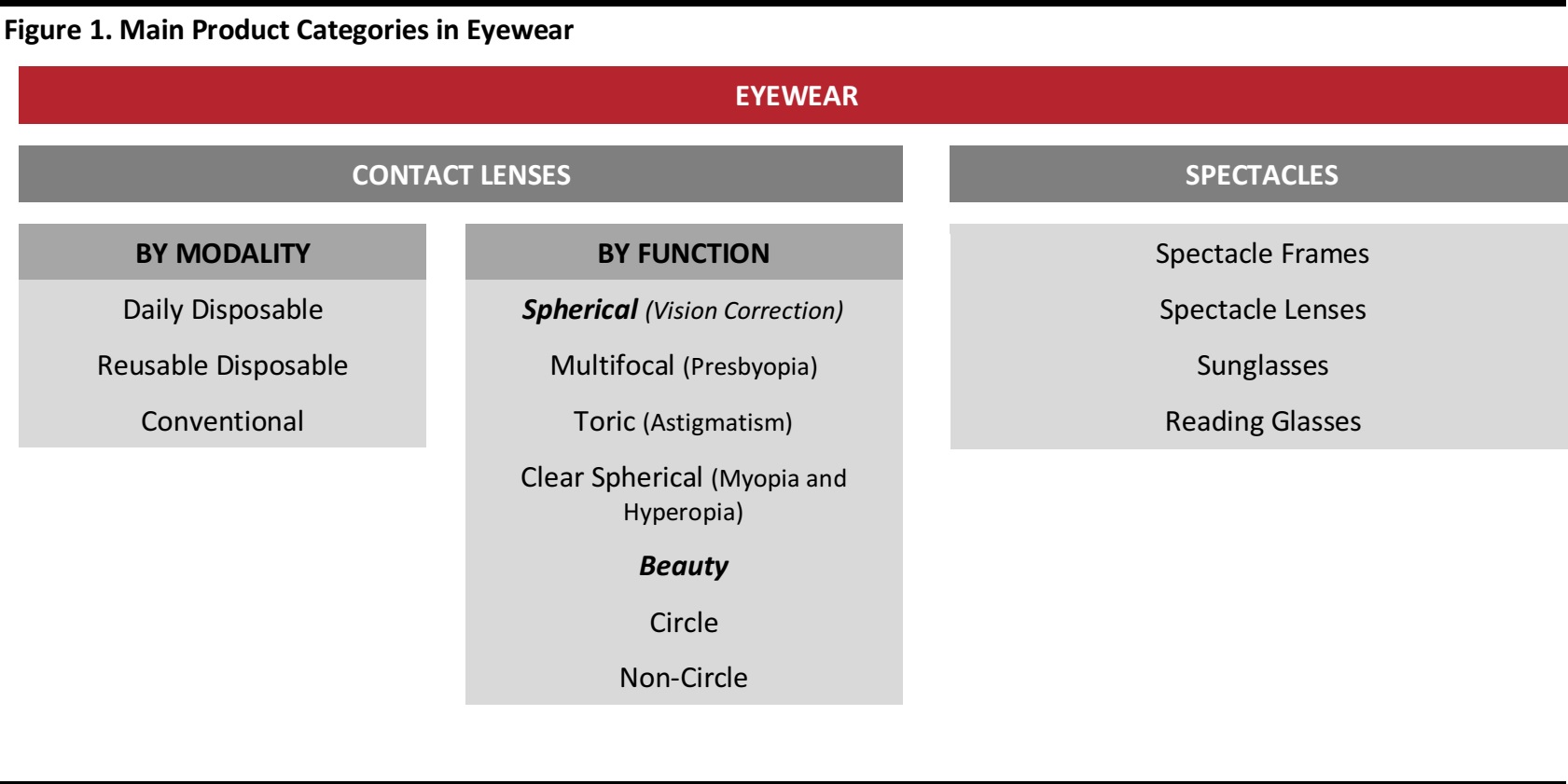

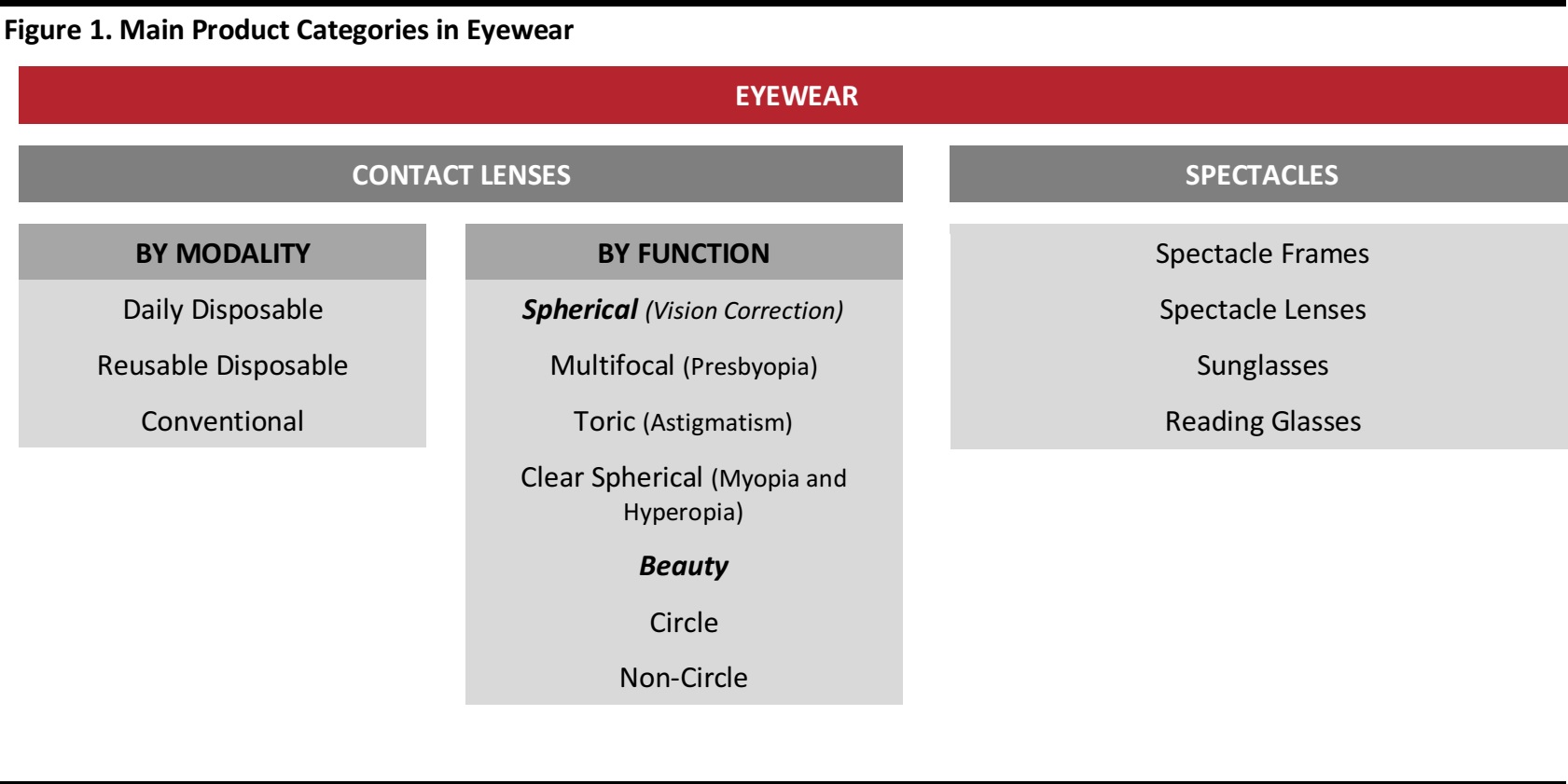

Euromonitor estimates the value of the global eyewear market at $121 billion in 2016, and forecasts it will grow at a CAGR of 2.4% to reach $136 billion by 2021. Eyewear consists of spectacles, sunglasses, contact lenses and beauty and fashion accessories.

The spectacles segment: The largest eyewear category is spectacles, which include spectacle frames, lenses, sunglasses and reading glasses. It was valued at $103 billion in 2016, an increase of 0.2% from the previous year.

The contact lenses segment: The contact lenses segment was valued at $14.6 billion in 2016, recording year-over-year growth of 2%, according to Euromonitor. Within this segment, reusable contact lenses accounted for the largest share of the market at 46% in 2016, followed by daily lenses at 34.8%, according to Technavio.

The beauty and fashion accessories segment: Eyewear is not limited to vision correction needs only. Frames and sunglasses are also considered fashion items, and most of the top designer brands produce eyewear products. Cosmetic contact lenses are also viewed as a beauty accessory, especially in the Asia Pacific market..

Source: FGRT

Eyewear Market Landscape

Online Eyewear Sales Are Gaining Traction

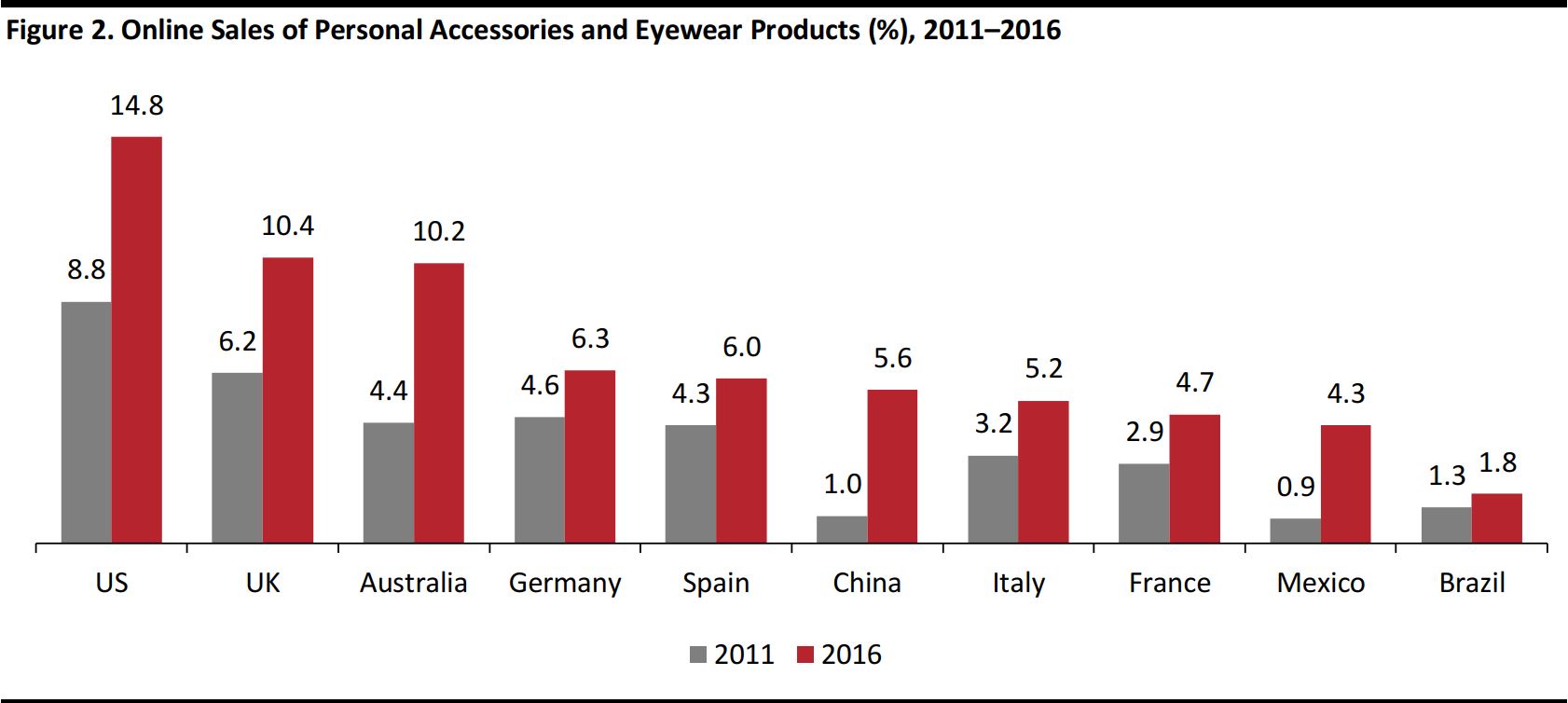

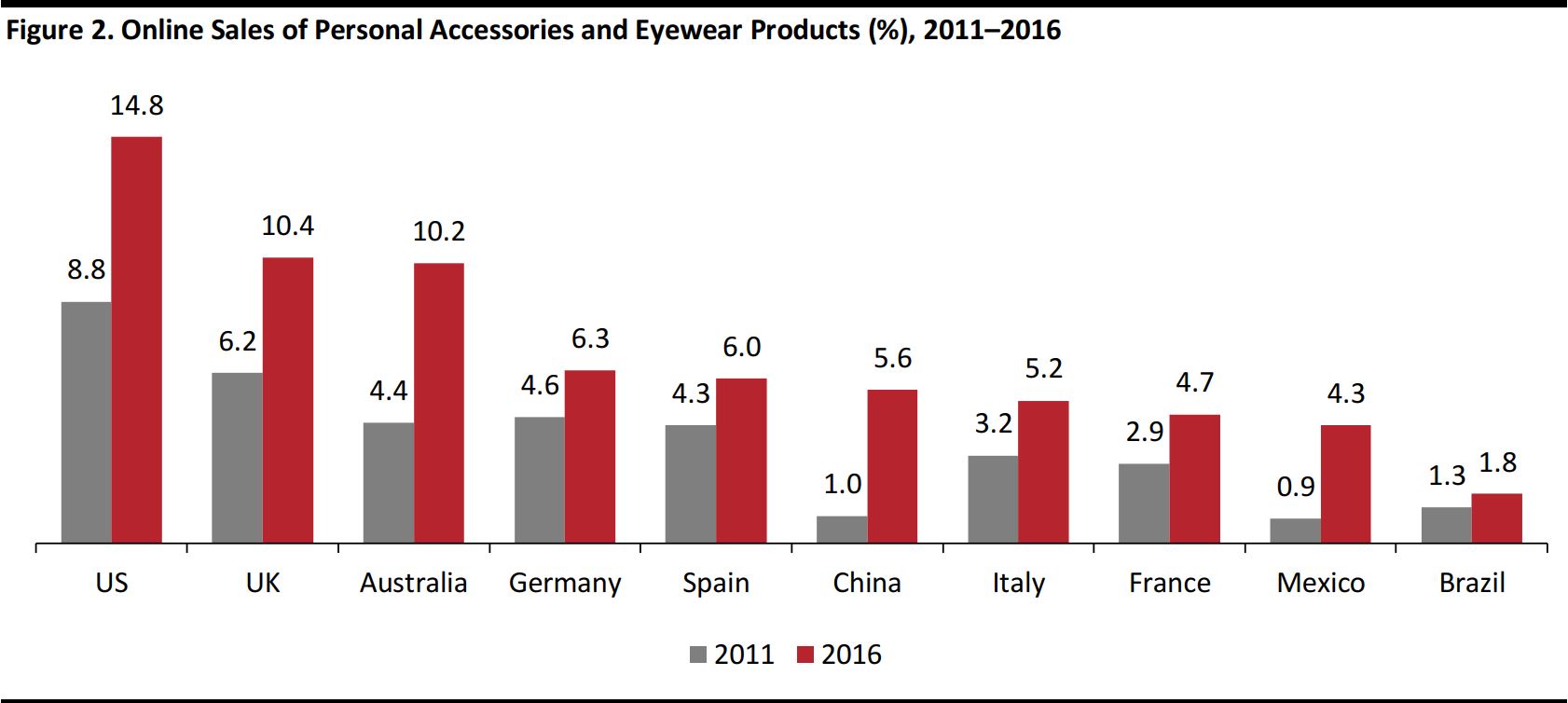

Eyewear is sold mainly through brick-and-mortar retail channels—through independent and chain optical shops. However, similarly to other product categories, e-commerce is a growing sales channel for eyewear sales, and most brands and retailers in the space now have a digital presence. The online eyewear market accounted for around 5% of global eyewear sales in 2016, according to GrandVision.

Online sales of eyewear are gaining traction in a number of markets in the developed world. The US tops the list of countries with the greatest share of personal accessories and eyewear sold online, with their share increasing from 8.8% in 2011 to 14.8% in 2016. Next is the UK and Australia, where online sales accounted for 10.4% and 10.2% of sales, respectively, according to Euromonitor.

Source: Euromonitor International

Competitive Landscape

The spectacles market is oligopolistic and dominated by only a few key players. In January 2017, two of the largest companies, Luxottica (frames and sunglasses) and Essilor (lenses), announced a $49 billion deal, making the merged entity the largest eyewear company in the world. The company had an estimated 54% market share of sunglasses and an estimated 27.2% market share for contact lenses and spectacles globally in 2016, according to Euromonitor.

Luxottica: Milan-based Luxottica is a vertically integrated company covering the design, manufacturing, wholesale and retail of spectacles and sunglasses frames. It has over 8,000 retail outlets with a presence in more than 150 countries. The company had a dominant 50% market share in sunglasses in 2015.

Essilor: French company Essilor had a 45% share of the prescription lenses market and a 15% share of the sunglasses and reading lenses market globally in 2015, according to a company report.

Apart from Essilor and Luxottica, another major player in the industry is

Safilo. The Italian company designs, produces and distributes prescription frames and sunglasses. It owns five in-house brands and has 22 licensed brands. Safilo had a 14% market share for sunglasses and 3.7% market share for contact lenses and spectacles in 2015, according to data from Euromonitor. The merger between Luxottica and Essilor will present a real challenge to Safilo’s market position.

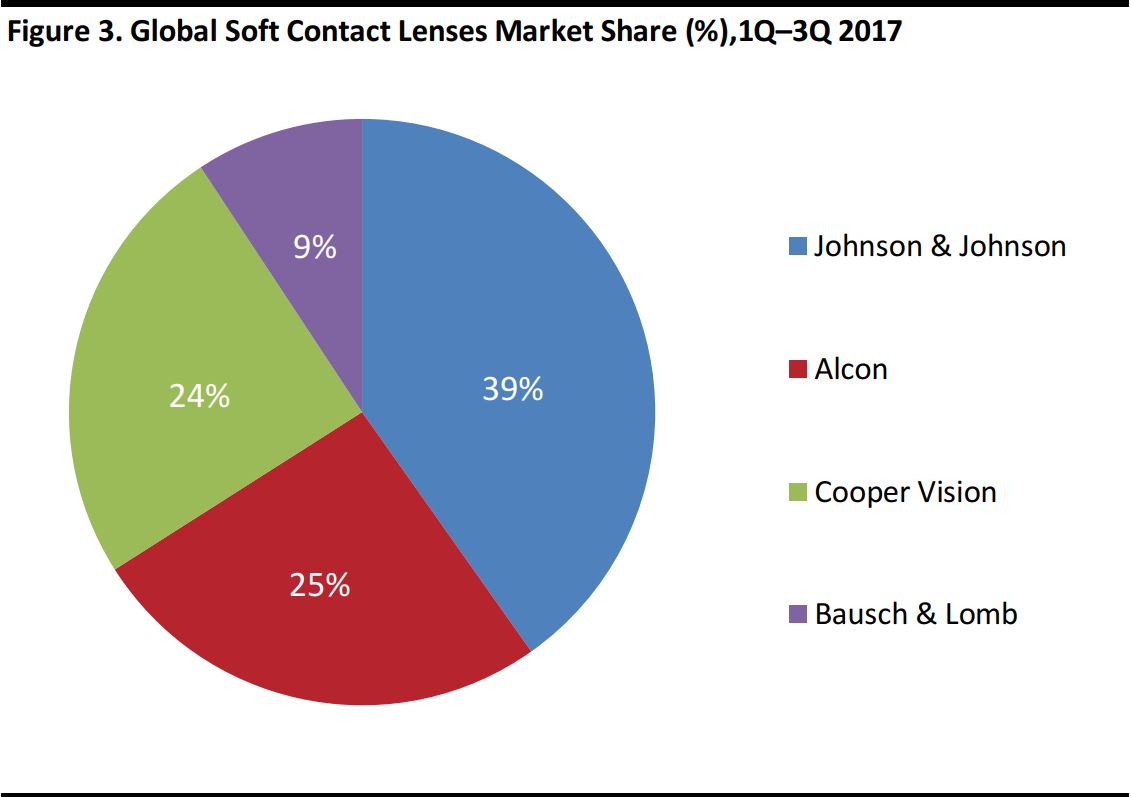

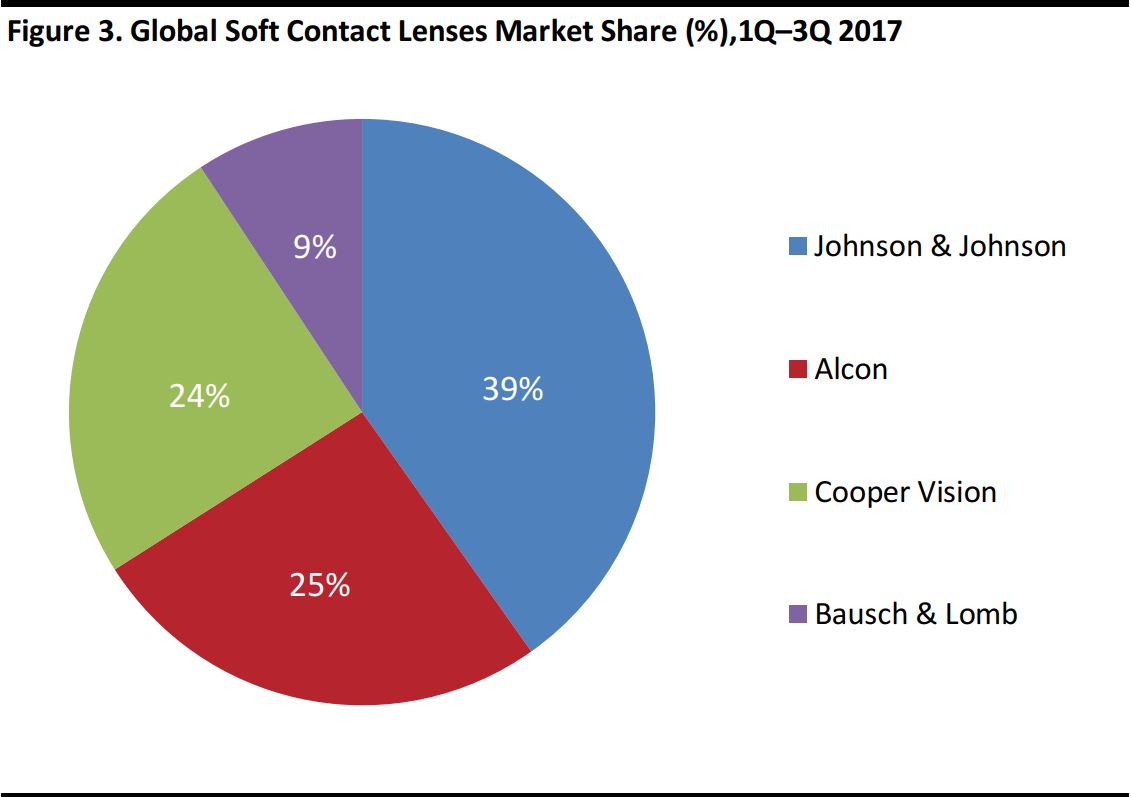

Contact Lenses Market

The contact lenses market is highly concentrated as well. According to company reports, Johnson & Johnson (39%), Alcon (25%), Cooper Vision (24%) and Bausch & Lomb (9%) together account for about 97% of global soft contact lenses sales year to date in 2017.

Source: Cooper Vision

Potential for Disruption in the Eyewear Market

The global eyewear market is mature and estimated to grow at a CAGR of 2.4% from $121 billion in 2016 to $136 billion by 2021, according to data from Euromonitor. However, it still hosts pockets of under-served consumers, mostly in emerging markets. That, combined with the stage and level of consolidation in the market, means that there are opportunities for new nimble entrants with digital roots and lean cost structures.

An Under-Penetrated Market

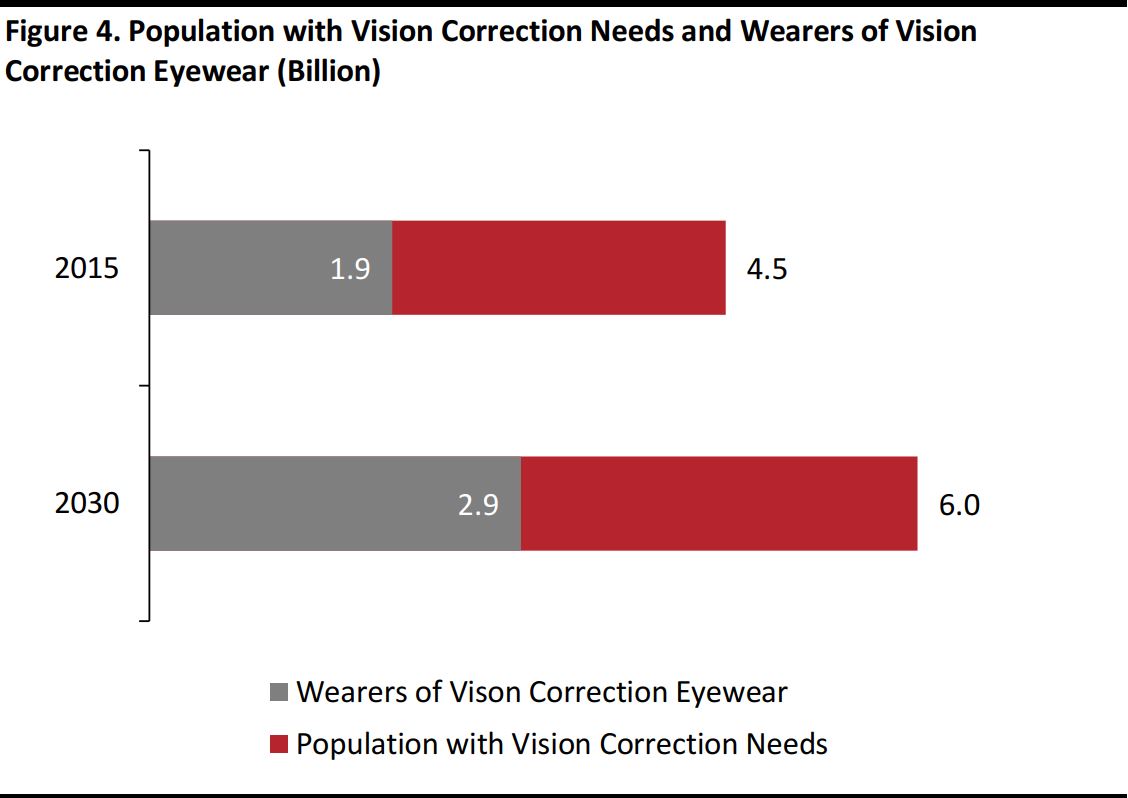

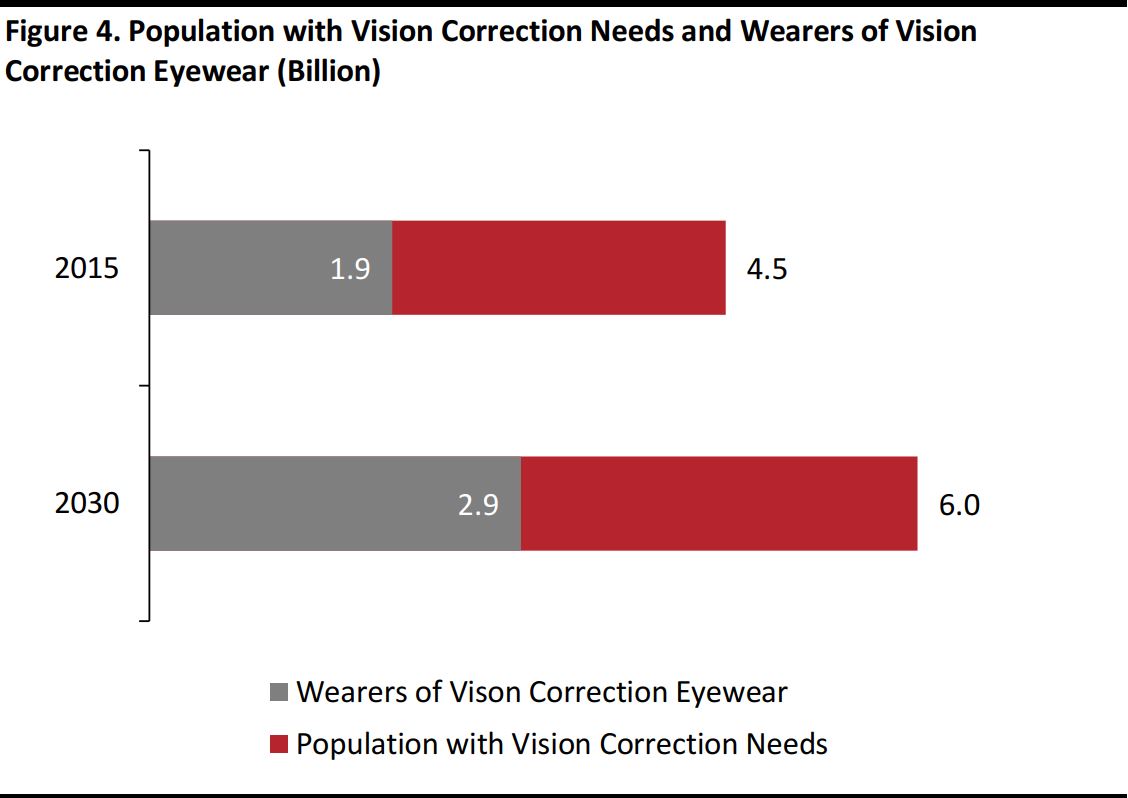

Vision disorders are the most prevalent disability in the world. According to Essilor, 4.5 billion people worldwide had vision correction needs in 2015, representing 63% of the world’s population.

However, the penetration of vision-correction eyewear remains low in emerging markets. There were an estimated 2.5 billion people with uncorrected vision in 2015, of which 1.6 billion are in Asia and 550 million are in Africa.

Source: Essilor

Combining the consumer opportunity with advances in technology means that there is ample room for disruption. The four factors that underpin this are: 1) the high margins of eyewear products; 2) the emergence of online as a distribution channel; 3) the long waiting times for custom eyewear products; and 4) the improvement in new technologies such as 3D printing and online vision tests.

1) Room to lower margins: The high margins of eyewear products offer one area of opportunity for disruption. According to Wisebread.com, eyeglass frames often have a markup of 800%–1,000%. High margins undoubtedly attract lean direct-to-consumer (D2C) competitors, such as Warby Parker in the US. As more lean companies enter the market, we believe the market will undergo a transition to lower margins. An extreme example would be Zenni Optical, which offers frames for as low as $6.95 and bifocal lenses at $17, ten times lower than traditional retailers.

2) The emergence of online as a distribution channel: E-commerce has evolved to become one of the major distribution channels for consumer goods. Similarly to Zenni Optical, EyeBuyDirect, an online retailer, offers frames starting as low as $6, undercutting traditional retailers’ pricing. This compares to LensCrafters, the retail eyewear chain under Luxottica, which offers frames starting at $149 and lenses starting at $299.

3) Long waiting times for custom products: Instant gratification, the desire to experience pleasure or fulfillment without delay, is one of the reasons traditional brick-and-mortar retailers remain the major distribution channel for consumer goods. However, in the case of eyewear, it normally takes around a week for a traditional retail eyewear shop to produce the custom frames and lenses for consumers to pick up. The long waiting time presents an opportunity for newcomers to disrupt the market with speed.

4) New technologies: Traditionally, eyewear products have required the professional diagnosis of a consumer’s eye condition by an optometrist and precision manufacturing to customize a pair of glasses. These can be considered high entry barriers for eyewear products. Recently, we are seeing a few companies, for example, Opternative, which offer online vision tests and provide a prescription for glasses and contact lenses from an ophthalmologist. Also, 3D printing has become more advanced and can produce more precise and tailor-made goods. The combination of the two creates a future where consumers can get prescription eyewear almost immediately at the point of sell, disrupting the traditional model.

Startups Disrupting the Eyewear Model

Direct-to-Consumer (D2C) Model

Due to the high margins of eyewear products, a D2C model based on e-commerce offers an opportunity that companies can explore.

Warby Parker:

Warby Parker: Founded in 2010, Warby Parker is an American brand selling prescription eyeglasses and sunglasses online. It also has a number of physical retail showrooms in the US and Canada. The company allows consumers to order five pairs of glasses to try on at home before committing to purchase, which they can return within five days. The eyewear retailer was valued at $1 billion in 2016.

Readers can refer to our report on September 8, 2017 entitled “

Warby Parker Versus Luxottica” for further information.

Zenni Optical:

Zenni Optical: Founded in 2003, Zenni Optical is another online D2C eyewear startup in the US that provides low-end eyewear products to consumers. Its frames start as low as $6.95 and its bifocal lenses are priced as low as $17. The company provides virtual try on, meaning consumers can upload their photos to see how they would look in the glasses.

Ace & Tate:

Ace & Tate: Ace & Tate is a European D2C eyewear retailer with a presence both online and offline. The company offers eyeglasses and sunglasses at €98, which undercuts the prices of traditional retailers. The company brought the entire eyewear supply chain in-house, including design, manufacturing and sales distribution. As a result, it has lower costs than traditional retailers because it does not need to pay license fees to eyewear brands and having the operations in-house helps keep costs lower than traditional retailers.

Hubble:

Hubble: Cofounded by Ben Cogan and Jesse Horwitz, Hubble is a subscription commerce startup that sells its own brand of daily disposable contact lenses to consumers in the US and Europe. Consumers pay a monthly fee of $30 to get daily disposable contact lenses delivered to their doorstep every month. The company recently raised $16.5 million in a new round of venture funding, five months after having launched its service publicly.

Try-Before-Buying Services

Quattrocento:

Quattrocento: Founded in 2014 by Eugenio Pugliese and Sharon Ezra, Quattrocento is an Italian eyewear brand offering eyewear products 100% handcrafted in Italy. The company offers customers up to five pairs of replica frames made of cardboard delivered to their homes to see how the frames will fit and look before purchasing the actual products. Quattrocento has raised $250,000 in its seed round.

“Glasses in 30 Minutes”

JINS:

JINS: Eyewear products normally require the consumer to wait a long time for their custom frames and lenses to be produced. This leaves the door open for disruption to the traditional retail model. JINS is a Tokyo-based eyewear company that made its debut in the US in 2015. The company sells frames ranging in price from $60 to $120, with lenses included, and it only takes 30 minutes from start to finish for the customer to receive their prescription eyewear.

OWNDAYS:

OWNDAYS: Founded by Také Umiyama, OWNDAYS is a Japanese eyewear chain store that operates mainly in Japan and Southeast Asia. As of the end of October 2016, the company operates more than 180 stores in 10 countries. OWNDAYS also offers quick processing of prescriptions—the glasses are ready in 20 minutes.

Online Eye Exams for Prescription Eyewear

Opternative:

Opternative: One of the major barriers to entry in the eyewear market is the requirement of a professional lenses prescription. Opternative, founded in 2013 by Steven Lee and Aaron Dallek, offers an online vision test for $40 that provides the consumer with a prescription for glasses from an ophthalmologist. The company has raised $9.5 million in six rounds of funding.

Key Takeaways

The global eyewear market was valued at US$121 billion in 2016, and, according to data from Euromonitor, is forecast to grow at a CAGR of 2.4% to reach $136 billion by 2021. We believe that established eyewear brands, and the merged Luxottica-Essilor entity in particular, will remain the major players in the industry over the mid-term, due to the scale of their distribution, supply-chain expertise and brand recognition.

However, there is ample room for disruption because of the category’s traditionally high product margins, the pockets of underserved consumers and the time it takes for companies to deliver custom eyewear products. With improvements in technology, we expect more startups to take on solving these problems, which will eventually bring down industry margins. While many of these companies may fail, these startups will inspire established players to innovate, eventually offering better services at lower prices to customers.

Zenni Optical: Founded in 2003, Zenni Optical is another online D2C eyewear startup in the US that provides low-end eyewear products to consumers. Its frames start as low as $6.95 and its bifocal lenses are priced as low as $17. The company provides virtual try on, meaning consumers can upload their photos to see how they would look in the glasses.

Zenni Optical: Founded in 2003, Zenni Optical is another online D2C eyewear startup in the US that provides low-end eyewear products to consumers. Its frames start as low as $6.95 and its bifocal lenses are priced as low as $17. The company provides virtual try on, meaning consumers can upload their photos to see how they would look in the glasses.

Ace & Tate: Ace & Tate is a European D2C eyewear retailer with a presence both online and offline. The company offers eyeglasses and sunglasses at €98, which undercuts the prices of traditional retailers. The company brought the entire eyewear supply chain in-house, including design, manufacturing and sales distribution. As a result, it has lower costs than traditional retailers because it does not need to pay license fees to eyewear brands and having the operations in-house helps keep costs lower than traditional retailers.

Ace & Tate: Ace & Tate is a European D2C eyewear retailer with a presence both online and offline. The company offers eyeglasses and sunglasses at €98, which undercuts the prices of traditional retailers. The company brought the entire eyewear supply chain in-house, including design, manufacturing and sales distribution. As a result, it has lower costs than traditional retailers because it does not need to pay license fees to eyewear brands and having the operations in-house helps keep costs lower than traditional retailers.

Quattrocento: Founded in 2014 by Eugenio Pugliese and Sharon Ezra, Quattrocento is an Italian eyewear brand offering eyewear products 100% handcrafted in Italy. The company offers customers up to five pairs of replica frames made of cardboard delivered to their homes to see how the frames will fit and look before purchasing the actual products. Quattrocento has raised $250,000 in its seed round.

Quattrocento: Founded in 2014 by Eugenio Pugliese and Sharon Ezra, Quattrocento is an Italian eyewear brand offering eyewear products 100% handcrafted in Italy. The company offers customers up to five pairs of replica frames made of cardboard delivered to their homes to see how the frames will fit and look before purchasing the actual products. Quattrocento has raised $250,000 in its seed round.

Opternative: One of the major barriers to entry in the eyewear market is the requirement of a professional lenses prescription. Opternative, founded in 2013 by Steven Lee and Aaron Dallek, offers an online vision test for $40 that provides the consumer with a prescription for glasses from an ophthalmologist. The company has raised $9.5 million in six rounds of funding.

Opternative: One of the major barriers to entry in the eyewear market is the requirement of a professional lenses prescription. Opternative, founded in 2013 by Steven Lee and Aaron Dallek, offers an online vision test for $40 that provides the consumer with a prescription for glasses from an ophthalmologist. The company has raised $9.5 million in six rounds of funding.