Nitheesh NH

Introduction

What’s the Story? External events have further ignited the supply issues facing the retail industry. The war in Ukraine and China lockdowns, for example, have led to reduced food supplies, out-of-stock products and a surge in labor, shipping and raw material costs. Even more recently, a recall of powdered baby formula by Abbott Laboratories caused a nationwide baby formula shortage in the US, pressing FMCG (fast-moving consumer goods) retailers to respond swiftly to resolve out-of-stock issues. As indicated in recent earnings calls, retailers and suppliers such as Procter & Gamble (P&G), Target and Walmart have expressed concerns around supply chain challenges and outlined the measures they plan to take, signaling a need for other FMCG companies to also place a strong focus on their supply chains. FMCG retailers and suppliers cannot deal with supply chain challenges alone—they need to collaborate. Data sharing increases collaboration between FMCG retailers and suppliers by helping both better address supply chain challenges and changes in consumer demand. In this report, we analyze findings from a Coresight Research survey of 160 FMCG retailers and suppliers in North America, conducted in April 2022, to identify key supply chain challenges and examine data exchange and data monetization (the process of using data to obtain quantifiable economic benefits that retailers can use as an additional revenue stream). This report is sponsored by global measurement and data analytics company NielsenIQ, which partners with global consumer goods companies and retailers to provide a forward-looking view into consumer behavior through comprehensive data sets and actionable insights. Why It Matters Out-of-stocks are a major driver of customer dissatisfaction and decreasing customer loyalty, which leads to lower sales. According to NielsenIQ, an average out-of-stock rate of 7.4% caused at least $88 billion in lost sales in the US retail industry in the 52-week period ending February 12, 2022. Phil Lempert, CEO and Founder of SupermarketGuru.com and Retail Dietitians Business Alliance, said:In an unsure economy in which food prices have soared to the highest levels in 40 years, grocers must put as a priority their obligation to soothe shoppers’ anxiety in order to avoid the panic and hoarding we witnessed at the beginning of the pandemic. The best way to do that is to create a better user experience—and that starts with having stocked shelves.

Demonstrating that retailers recognize the importance of on-shelf availability (OSA), food brand owner Mondelēz said in a January 2022 earnings call that it is focusing on simplifying operations and cutting SKUs (stock-keeping units) to ensure OSA. It is essential for retailers and suppliers to invest in technology and work with vendors to tackle this important issue. Data sharing is one method that FMCG retailers and suppliers are using to cope with supply chain challenges and drive incremental sales. External vendors may play a role in helping to realize incremental sales—or to recover lost sales—by providing technology expertise for data sharing and collaboration. New, innovative solutions are also offering retailers a data monetization opportunity, enabling a new stream of revenue.Discovering Hidden Treasure in Your Supply Chain Data: Coresight Research Analysis

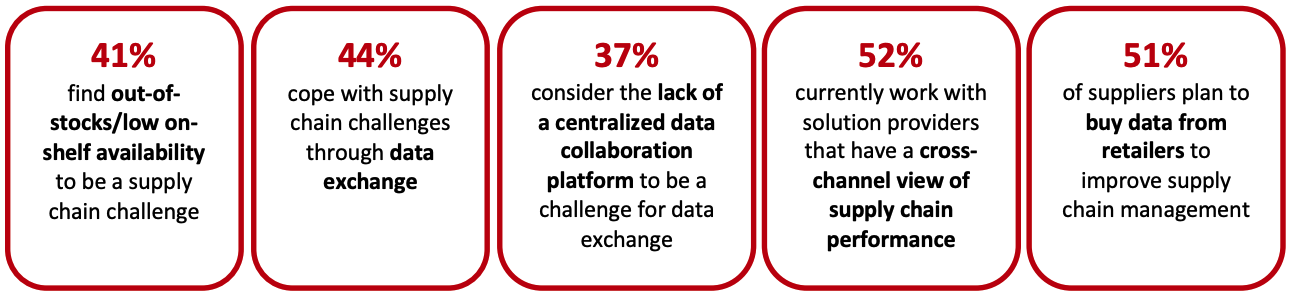

We summarize our key survey findings below, prior to presenting our analysis and exploring the implications of each in detail below.Figure 1. Key Survey Findings (% of Respondents) [caption id="attachment_149816" align="aligncenter" width="700"]

Base: 160 North American FMCG retailers and suppliers

Base: 160 North American FMCG retailers and suppliersSource: Coresight Research[/caption] Supply Chain Challenges: Rising Costs, Data Inaccuracies and Out-of-Stocks The top two supply chain challenges FMCG retailers and suppliers face are rising costs (cited by 54% of our survey respondents) and shipping delays (44%). When respondents were asked what kind of costs are currently increasing, the highest proportion of respondents (70%) cited inflation and shipping costs, followed by energy costs (57%) and labor costs (56%). In order to mitigate rising costs, retailers and consumer goods suppliers need to implement measures where they can, such as improving fulfillment and optimizing pricing strategies. Grocery Outlet, Costco, Target and P&G offer examples of approaches to this:

- Charles Bracher, CFO of Grocery Outlet, said on a May 2022 earnings call that the company is mitigating inflationary pressures through pivoting between alternative suppliers and switching from direct store delivery to warehouse distribution for certain suppliers.

- Bob Nelson, SVP of Finance and Investor Relations of Costco, shared on a May 2022 earnings call that the company has been continuously transitioning from vendor dropshipping to shipping directly from its own inventory in order to reduce delivery costs.

- Target announced in March 2022 (and confirmed in its updated 2022 plan released on June 7, 2022) that it plans to expand supply capacity to support future growth and ease supply chain delays by adding five distribution centers over the next two fiscal years.

- Andre Schulten, CFO at P&G, hinted in the company’s third-quarter 2022 earnings call about price hikes on P&G products in 2022 to cope with inflation.

- Antoine Bernard de Saint-Affrique, CEO of CPG brand owner Danone, acknowledged in a February 23, 2022, earnings call that service-level issues prevented the company from meeting consumer demand, which translated to revenue loss. Danone plans to further increase productivity.

- In April 2022, grocery chain Lunds & Byerlys started using Pensa Systems’ automated retail shelf intelligence solution to closely monitor stock levels and shelf performance across its 28 locations, gaining near-real-time access to data to better identify stockouts and availability of goods, and to better enhance demand forecasting.

- Unilever announced in April 2022 that it is monitoring the out-of-stock issue through a data-driven tool, which recommends which SKUs to delist, maintain or increase—leading to increased productivity and less waste.

- Brian Cornell, CEO of Target, said in a June 2022 CNBC interview that Target is marking down prices of unwanted items and canceling orders to avoid excess inventory and improve the relevance of its store assortment to customers.

- John Furner, President and CEO of Walmart US, shared in June 2022 that it will take a couple of quarters for the company to lower its inventory to a desirable level.

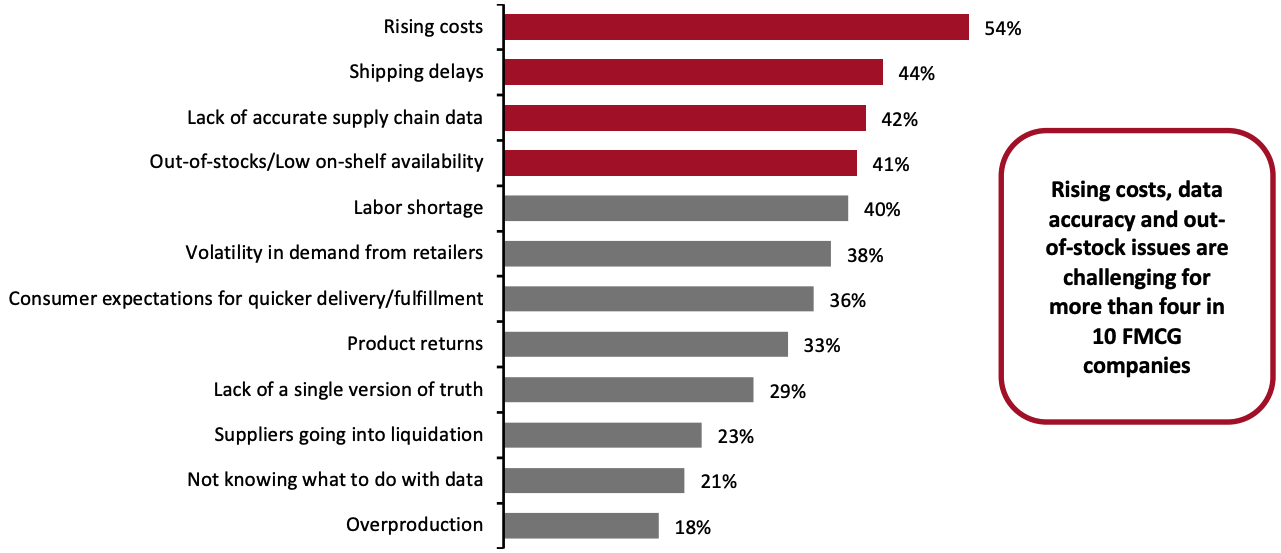

Figure 2. Supply Chain Challenges That FMCG Retailers and Suppliers Currently Face (% of Respondents) [caption id="attachment_149817" align="aligncenter" width="700"]

Respondents were asked to report whether or not their organizations are currently facing each challenge

Respondents were asked to report whether or not their organizations are currently facing each challengeBase: 160 North American FMCG retailers and suppliers

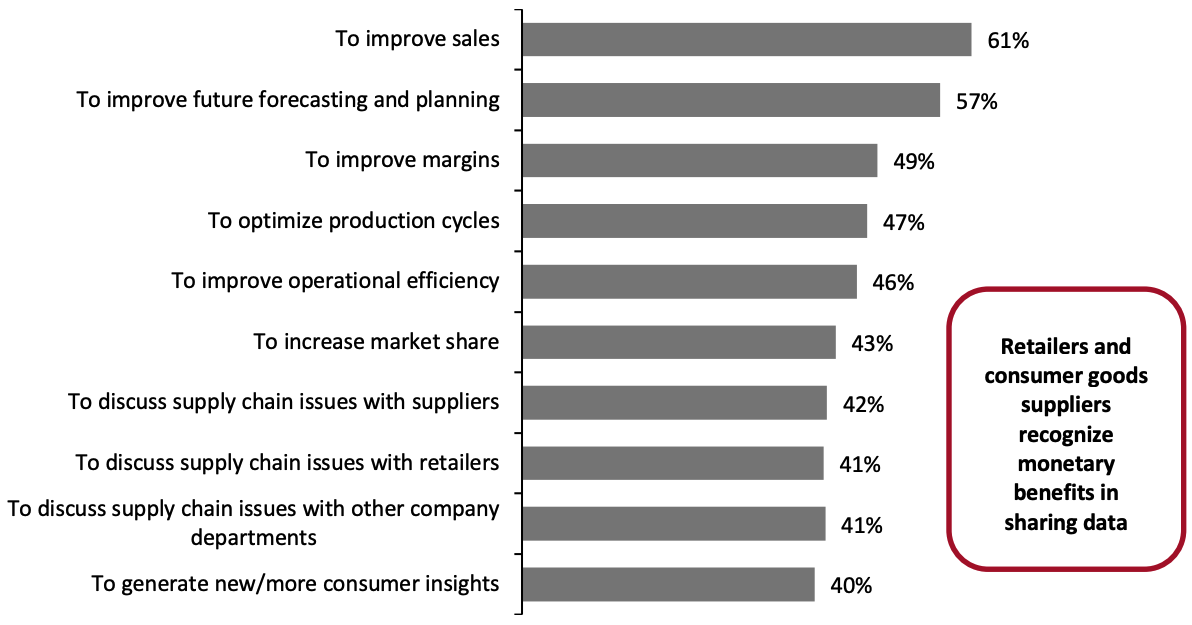

Source: Coresight Research[/caption] Coping with Supply Chain Challenges: Data Sharing In light of pandemic-led and other major supply chain challenges, both retailers and suppliers are realizing that a siloed approach no longer works: 44% of retailers and suppliers have used data exchange to cope with supply chain challenges, and 79% agree or strongly agree that data exchange has become more important than it was before the Covid-19 pandemic. Through data collaboration, multiple parties can improve supply chain performance at the same time. Among the surveyed FMCG retailers and suppliers that exchange data to cope with supply chain challenges, improving sales (61%), improving future forecasting and planning (57%) and improving margins (49%) emerged as the top three ways that shared data is used. Only slightly more than four in 10 respondents use the data shared to actually discuss supply chain issues with internal company departments and retailers/suppliers—perhaps believing it to be sufficient to simply share the data with supply chain parties without needing to discuss it. We believe that more in-depth communication and collaboration would support the supply chain benefits realized through data sharing. To ensure the best usage of data being shared for supply chain management, FMCG retailers and suppliers need to develop cross-department discussions to gain a holistic understanding of supply chain issues. Similarly, suppliers also need to discuss things like their production levels and potential service level challenges with retailers.

Figure 3. FMCG Retailers and Suppliers That Share Data: How They Use the Shared in Supply Chain Management (% of Respondents) [caption id="attachment_149818" align="aligncenter" width="700"]

Respondents could select multiple options

Respondents could select multiple optionsBase: 70 North American FMCG retailers and suppliers that exchange data with each other to cope with supply chain challenges

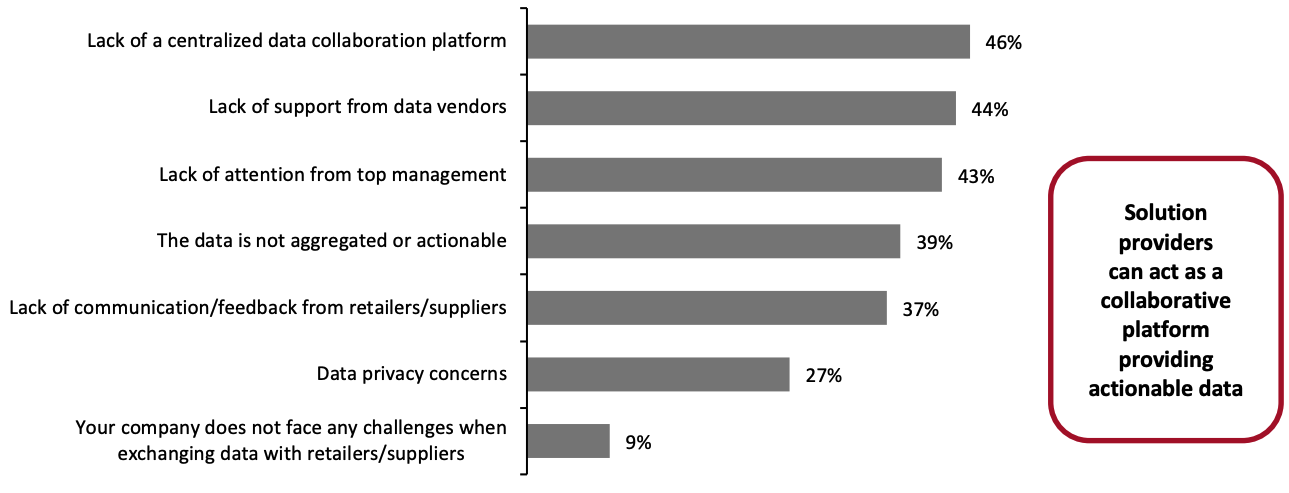

Source: Coresight Research[/caption] The Role of Solution Providers in Facilitating Data Exchange Although retailers and brands recognize the benefits of data sharing, our survey reported that they experience multiple challenges during the data-exchange process. Among FMCG retailers and suppliers that share data with each other to cope with supply chain challenges, 46% of respondents cited a lack of a centralized data collaboration platform, followed by lack of support from data vendors (44%) and lack of attention from top management (43%).

Figure 4. Challenges That FMCG Retailers and Suppliers Face in the Data-Exchange Process (% of Respondents) [caption id="attachment_149819" align="aligncenter" width="700"]

Respondents could select multiple options

Respondents could select multiple optionsBase: 70 North American FMCG retailers and suppliers that exchange data with each other to cope with supply chain challenges

Source: Coresight Research[/caption] FMCG retailers and suppliers—particularly those that lack technology expertise or resources—can address such challenges by working with supply chain management solution providers, which integrate data from multiple sources, facilitate collaborative efforts between FMCG retailers and suppliers through online dashboards/portals, and provide accurate, actionable insights. In addition to facilitating data exchange, solution providers can help FMCG retailers and suppliers alleviate the workload of internal staff and allow the company’s internal resources to work on other business priorities instead. This is supported by our survey showing that 71% of FMCG retailers and suppliers work with solution providers to improve supply chain management.

- In mid-April 2022, Kraft Heinz announced plans to accelerate its supply chain transformation in collaboration with Microsoft Corporation, enabling it to streamline daily operations, better anticipate consumer demand and improve inventory transparency.

- Carrefour France works with NielsenIQ on OSA collaboration, which includes checking store inventory and tracking out-of-stock alerts. Carrefour France saw improvement in both OSA and sales after the first year alone.

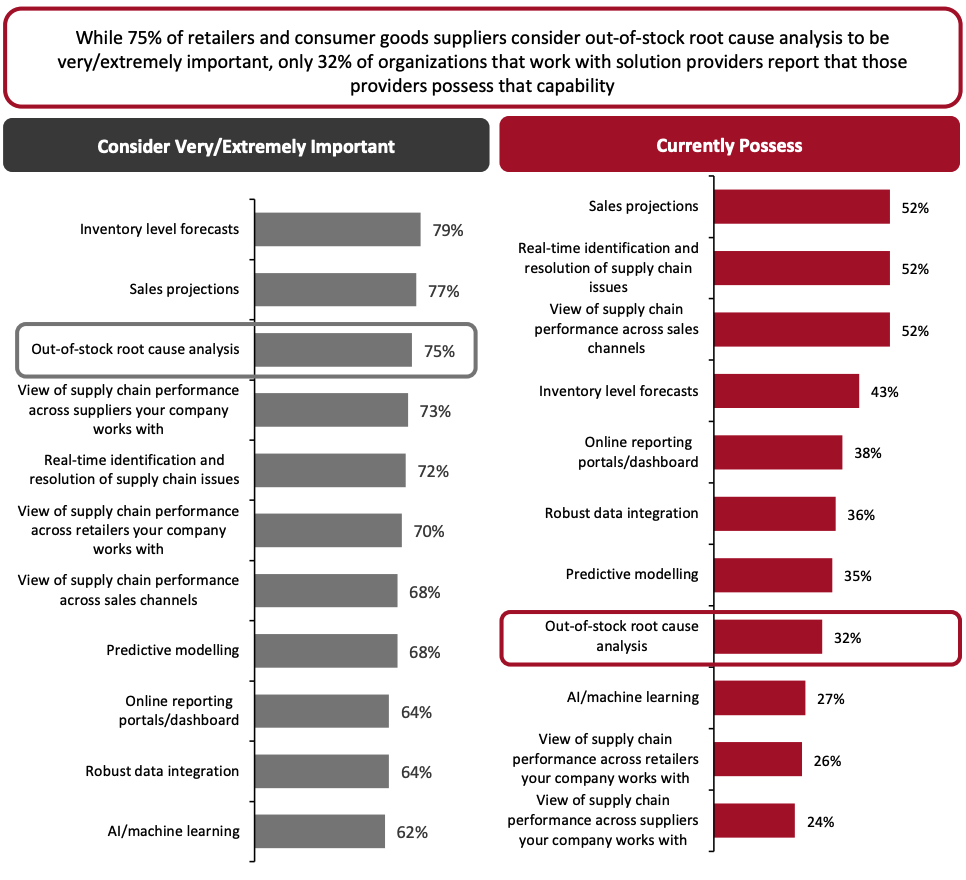

- Out-of-stock root-cause analysis (75% of respondents consider it to be very/extremely important, while 32% of FMCG retailers and suppliers that work with solution providers report that they currently possess this capability)

- View of supply chain performance across consumer goods suppliers (73% versus 24%)

- View of supply chain performance across retailers (70% versus 26%)

Figure 5. Capabilities That FMCG Retailers and Suppliers Consider To Be Very/Extremely Important and Currently Possess Through Solution Providers (% of Respondents) [caption id="attachment_149820" align="aligncenter" width="700"]

Base: 160 North American FMCG retailers and suppliers selling consumer goods (Left: consider to be very/extremely important), 113 of which currently work with supply chain management solution providers to improve supply chain management (Right: currently possess)

Base: 160 North American FMCG retailers and suppliers selling consumer goods (Left: consider to be very/extremely important), 113 of which currently work with supply chain management solution providers to improve supply chain management (Right: currently possess)Source: Coresight Research[/caption] FMCG retailers and suppliers are cognizant of the detrimental impacts of out-of-stocks, such as decreased customer loyalty and risk of losing sales, and are therefore making plans to invest in solving the issue. Our survey found that 38% of respondents have invested in OSA improvement over the past two years, and a further 50% are planning to invest in OSA improvement within the next three years. For example, through its Fast Track initiative, Dollar General has been adopting sorting-process optimization and case-pack optimization to make stocking more efficient and improve OSA, according to the company’s first-quarter 2022 earnings call in May 2022. On the other hand, in a survey of 73 North American food retailers and wholesalers in April 2021 conducted by FMI (the food industry association), 64% cited using data analytics to assist with assortment planning and replenishment. The Data Monetization Opportunity As supply chain management solution providers have technology expertise, they can help retailers to monetize data—sell data to consumer goods suppliers—which presents a growing opportunity to increase incremental profit while also realizing the benefits of data sharing (such as optimizing inventory management and improving supply chain operations by providing suppliers with access to valuable data). In addition, data collaboration and monetization occur through other means such as retail media, as exemplified by Dollar General’s and CVS Pharmacy’s own data monetization initiatives:

- Dollar General announced in June 2022 that it is enhancing its retail media network DGMN, which was first launched in 2018, to better serve the US’s rural communities through audience insights and closed-loop reporting for its brand partners. According to Jayme Jansky, Head of Field Shopper Marketing at Unilever, DGMN helped Unilever better develop advertising campaigns through data-driven insights.

- CVS Pharmacy launched CVS Media Exchange (cMx) in August 2020, which enabled its CPG supplier partners to reach consumers with digital ads through various purchase channels within CVS Pharmacy. According to Erin Condon, VP of Front Store and Omnichannel Marketing at CVS Health, cMx was launched to alleviate advertisers’ concern on maximizing efficiency and return on investment.

- 37% of suppliers want OSA data—while 18% want OSA data on a category level, 13% want data on a store level and 6% want it on a SKU level.

- 35% of suppliers want to know customer satisfaction levels for different products, which helps indicate customer demand.

- 29% of suppliers want customers’ demographics/purchase history, which indicate the latest consumption trends.

- Syndicated data— License data, such as supply chain data, to third parties to aggregate and syndicate, with the possibility of comparing product information across different stores, categories, channels or markets for FMCG retailers and suppliers.

- Shopper insights—Create online portals to analyze point-of-sale (POS), supply chain and other data. NielsenIQ’s Activate is a solution that helps retailers to achieve comprehensive shopper insights and to better manage promotions.

- Retail media— Deliver data from relevant media campaigns, personalized offers and activations. (Read Coresight Research and NielsenIQ’s report on retail media trends to watch.)

- Data integration with third parties—Integrate retailer data with third-party data providers to provide attribution analysis. NielsenIQ’s product enrichment and personalization solutions, for instance, provide the consumer goods industry with rich digital product content to drive product discovery and improved consumer engagement.

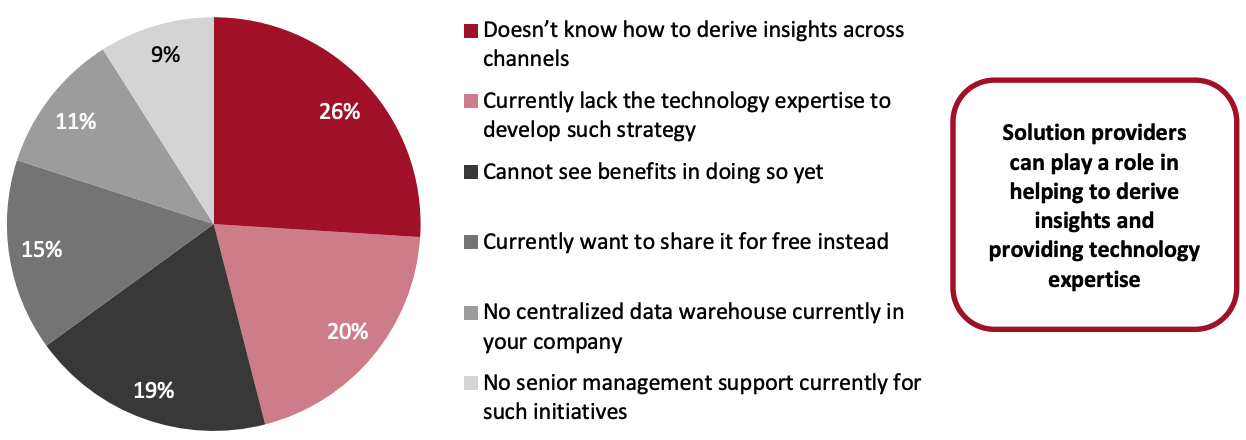

Figure 6. Retailers That Do Not Sell Data to FMCG Suppliers: Most Important Reason for Not Selling Data (% of Respondents) [caption id="attachment_149824" align="aligncenter" width="700"]

Respondents were asked to select one option: the reason they consider to be the most important

Respondents were asked to select one option: the reason they consider to be the most importantBase: 54 North American FMCG retailers that do not currently sell data to suppliers they work with

Source: Coresight Research[/caption] Types of Solutions for Supply Chain Management and Data Monetization FMCG retailers and suppliers can consider working with solution providers across five different areas to address current supply chain challenges and partner on data monetization opportunities:

- Retailer-supplier collaboration— Through software-as-a-service (SaaS)-based applications with user-friendly dashboards and guided workflows, these solutions provide both retailers and suppliers with a centralized data platform for collaboration as a single source of truth. This allows both parties to have a comprehensive understanding of the customer in real time. By leveraging the same data and analytics, they can make better decisions to meet the needs of the customer. NielsenIQ’s Supplier Collaboration and Analytics cloud-based solutions are examples.

- OSA—OSA solutions can provide actionable insights by different levels (such as by item, by brand, by category and by store), providing granular data to retailers and consumers suppliers where most out-of-stock issues occur. Examples include NielsenIQ’s OSA Barometer and Supply Chain Analytics solutions, which provide insights and recommended actions to take for resolving OSA issues.

- Data aggregation—These solutions are for acquiring, aggregating, packaging, marketing and monetizing third-party data. NielsenIQ is one example.

- Supplier risk management—These solutions enable a 360-degree view of consumer goods suppliers, analyzing different risk factors to identify potential supply chain disruptions for retailers.

- Price optimization—By providing access to better price transparency for their sales teams, retailers can maintain competitive pricing through AI, and predict margin and revenue impacts through different pricing scenarios.

What We Think

Implications for Retailers and Suppliers- Low OSA, as a major driver of customer dissatisfaction and lost sales, is a supply chain challenge that FMCG retailers and suppliers must not ignore.

- Retailers can share data on customer satisfaction, preferences and OSA with consumer goods suppliers to derive insights that address supply chain pain points such as low OSA and to improve sales.

- Retailers and suppliers need to work on one version of truth with connected data sources for true collaboration to occur.

- Furthermore, data monetization is an untapped revenue-generating opportunity for retailers: retailers can generate 0.1%–1.0% of total sales in data revenue, depending on the volume and uniqueness of the data being shared, Coresight Research estimates.

- Retailers can work with supply chain solution providers to access the necessary technological expertise and analytics to effectively monetize their data and create a single source of truth with consumer goods suppliers.

- Solutions need to offer the various capabilities that FMCG retailers and suppliers demand, including sales projections, out-of-stock root cause analysis, and real-time identification and resolution of supply chain issues.

- To best help retailers and suppliers mitigate supply chain disruptions and optimize costs, solutions need to provide data on different levels—from distribution center to store to item level.

- Supply chain solution providers have the opportunity to capitalize on retailers’ and suppliers’ need for technical expertise as they look to tackle supply chain challenges.

Methodology

This study is based on the analysis of data from an online survey of 160 FMCG retailers and suppliers. Coresight Research conducted the survey in April 2022.- Respondents in the survey satisfied the following criteria:

- Companies based in North America (Canada and the US)

- Companies with an annual revenue of $500 million or above

- Companies sell, or supply retailers with, consumer goods

- Hold senior executive roles and contribute to decisions on category management, replenishment or supply chain management

- Retailers: sell products through physical locations; include drugstores, dollar/discount stores, mass merchandisers, convenience stores and supermarkets/grocery stores

About NielsenIQ NielsenIQ, a global information services company, delivers the gold standard in consumer and retail measurement, through the most connected, complete, and actionable understanding of the evolving global, omnichannel consumer. NielsenIQ is the source of confidence for the industries we serve and the pioneer defining the next century of consumer and retail measurement. Our data, connected insights, and predictive analytics optimize the performance of CPG and retail companies, bringing them closer to the communities they serve and helping to power their growth. NielsenIQ, an Advent International portfolio company, has operations in 90+ markets, covering more than 90% of the world’s population. For more information, visit NielsenIQ.com.