Nitheesh NH

Introduction

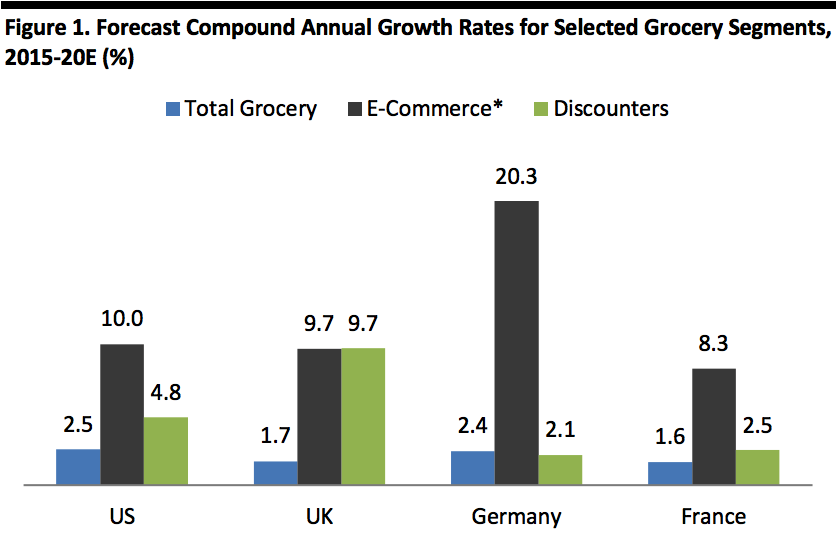

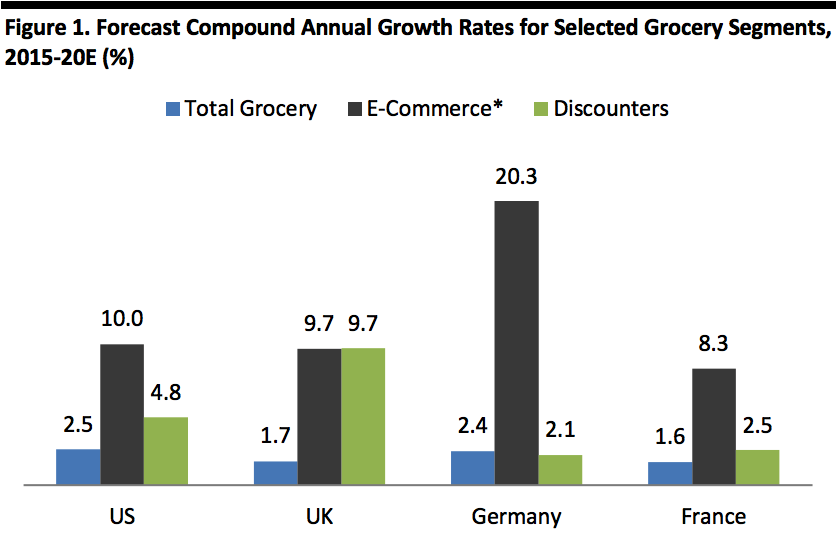

E-commerce and hard discount are fast-growing channels in a number of markets. These include the UK, where the rapid growth of Aldi and Lidl has hit the incumbent grocery retailers hard, and the US, where the nascent online grocery market is set for rapid growth and where Lidl is set to join Aldi by 2018.

The everyday-low-cost, no-frills model of hard discount means these two channels have, in the past, rarely intersected. However, we are now seeing a flurry of activity from discounters, notably Lidl, as they trial various e-commerce models across grocery and nongrocery categories.

[caption id="attachment_100272" align="aligncenter" width="700"] Source: Shutterstock[/caption]

In this report, we wrap up the recent permutations of discount e-commerce, consider what consumers want from these channels, and look at the barriers and opportunities for discount operators in e-commerce. We focus on grocery e-commerce, but include coverage of ventures into online retailing of nongrocery categories.

Readers may also be interested in the following reports:

Source: Shutterstock[/caption]

In this report, we wrap up the recent permutations of discount e-commerce, consider what consumers want from these channels, and look at the barriers and opportunities for discount operators in e-commerce. We focus on grocery e-commerce, but include coverage of ventures into online retailing of nongrocery categories.

Readers may also be interested in the following reports:

*Food and drink only

*Food and drink only

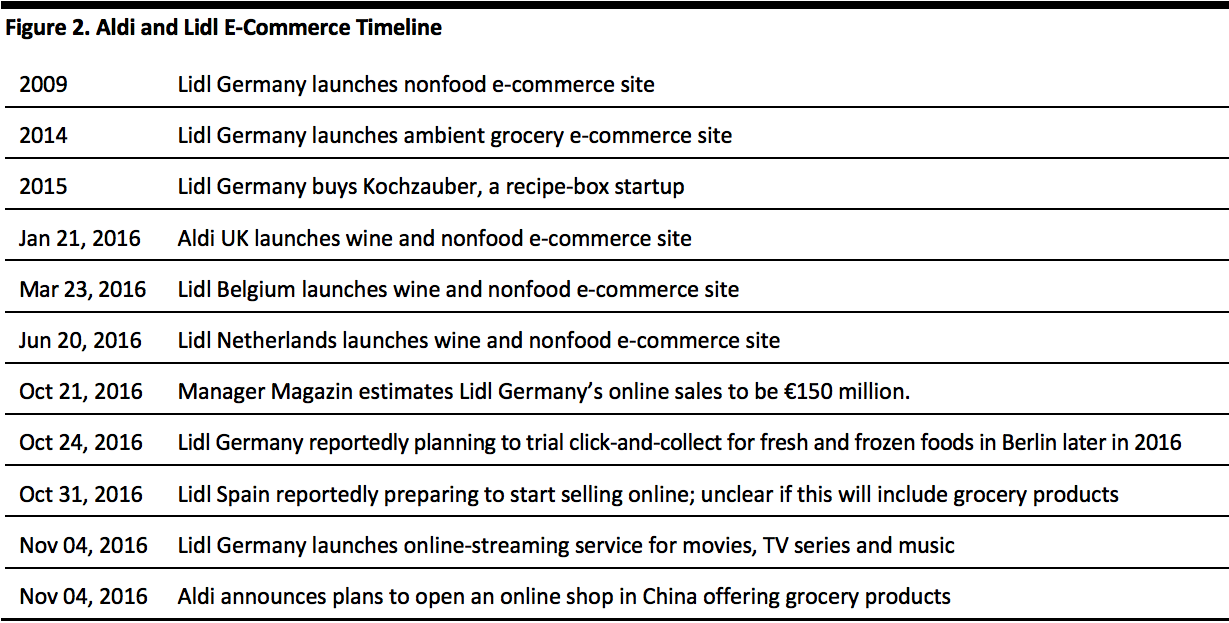

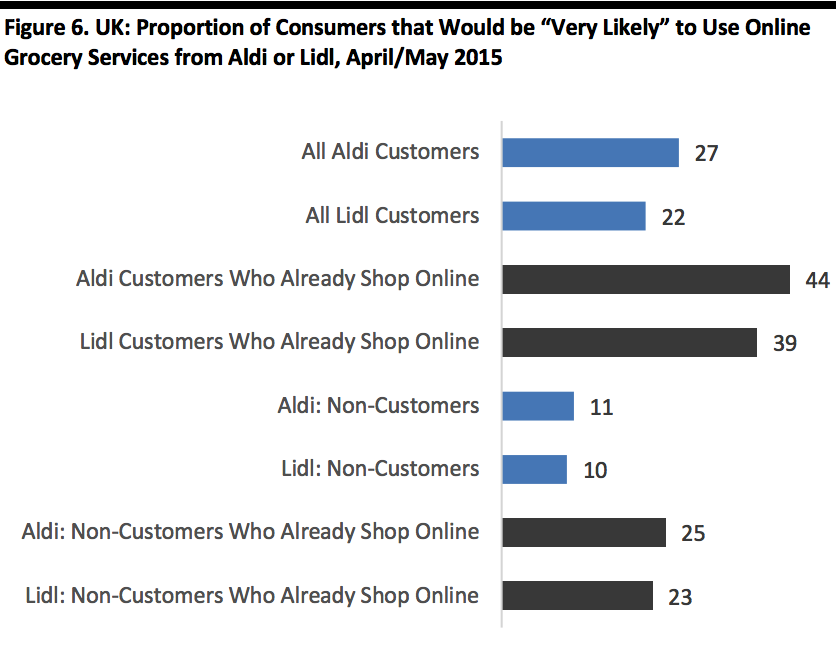

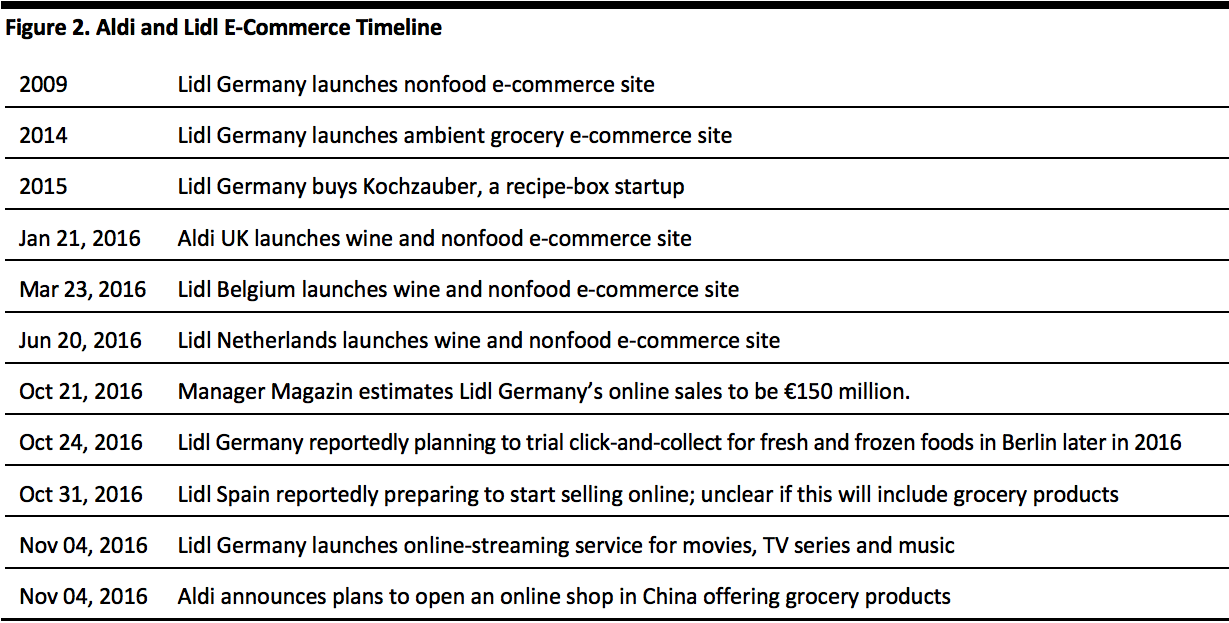

Source: Euromonitor International/Fung Global Retail & Technology[/caption] Discounters Push into E-Commerce Below, we wrap up the key moves from Aldi and Lidl into e-commerce. Until this year, their online offerings had steered clear of fresh foods, and focused on their nonfood special deals in categories such as apparel, furniture, electronics and home improvements, or wine, which is a higher-value, nonperishable category. [caption id="attachment_100274" align="aligncenter" width="700"] Source: Company reports[/caption]

Two recent announcements have been the most striking: 1) Aldi’s move into the Chinese market purely through e-commerce; and 2) Lidl Germany’s plans to trial a grocery click-and-collect service in Berlin.

1. Aldi announces move into Chinese market purely through e-commerce

This will be the first time a grocery discounter has launched e-commerce in a country in which it does not have stores.

So far, we know that Aldi’s China offering will include grocery products (unlike in some other markets), it will offer home delivery and it will rely heavily on its Australian supply chain. In early November, an Aldi spokesperson told Australia’s Sydney Morning Herald:

Source: Company reports[/caption]

Two recent announcements have been the most striking: 1) Aldi’s move into the Chinese market purely through e-commerce; and 2) Lidl Germany’s plans to trial a grocery click-and-collect service in Berlin.

1. Aldi announces move into Chinese market purely through e-commerce

This will be the first time a grocery discounter has launched e-commerce in a country in which it does not have stores.

So far, we know that Aldi’s China offering will include grocery products (unlike in some other markets), it will offer home delivery and it will rely heavily on its Australian supply chain. In early November, an Aldi spokesperson told Australia’s Sydney Morning Herald:

Source: Fung Global Retail & Technology[/caption]

Picking and delivery costs

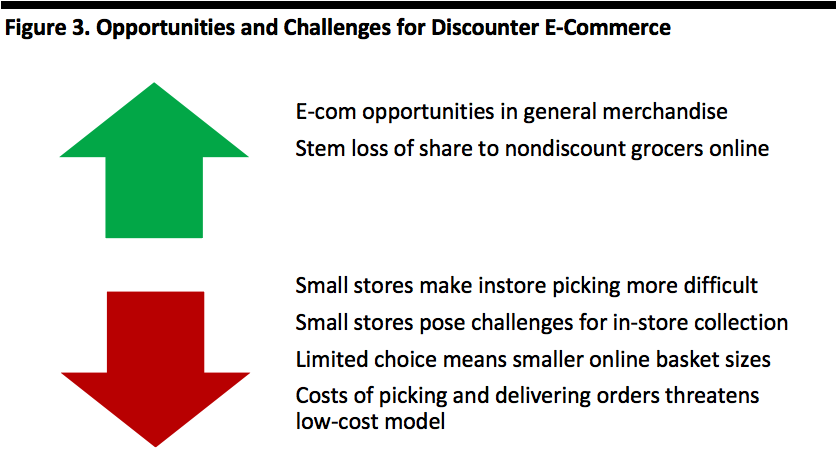

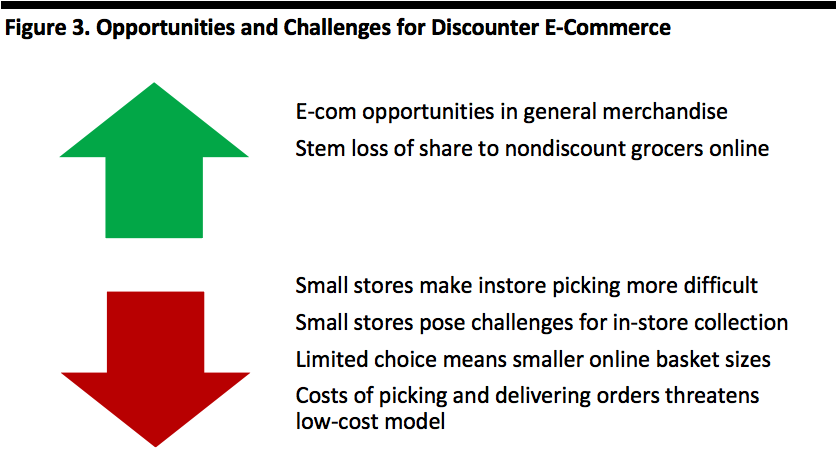

A significant potential barrier for grocery e-commerce is the added cost that picking an order brings to the retailer, even if the customer collects the order rather than have it home delivered. Later in this report, we discuss ways in which discounters can drive down the cost of delivering online grocery orders.

In the UK, it costs an average £15 to pick and deliver an online grocery order, according to Bernstein research; around £9 of this is reported to be the cost of delivering the order to the customer. Yet, British online grocery retailers typically charge customers between £0 and £7 for grocery deliveries. Discounters base their business model on stripping out unnecessary costs, so the inference is that no-frills discounters must be willing to charge their customers picking and delivery fees that reflect their costs, or find ways of delivering an online service at a lower cost.

Smaller stores

We think the logistical challenges unique to discounters should be recognized, too: it is hard to see how in-store grocery picking or collection points could fit easily in the traditionally small stores of Aldi and Lidl. Lidl has been pushing into larger stores, but even its newer stores average around 1,200 square meters; the average store at Lidl and Aldi remains below 1,000 square meters, according to Euromonitor International.

This paucity of space means click-and-collect is no low-cost panacea for the discounters.

Smaller baskets

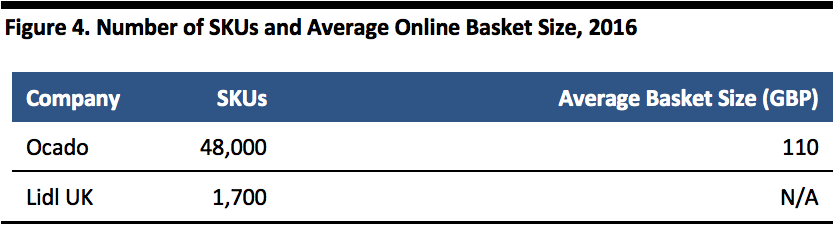

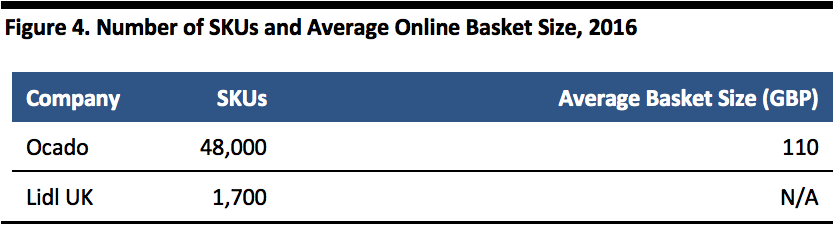

We suspect the economics of online grocery would be even worse for discount grocers than for their nondiscount rivals, due to smaller basket sizes resulting in a deleveraging effect. The much more limited choice would almost certainly yield smaller online average order values than those at retailers offering many thousands of branded and private-label stock-keeping units (SKUs).

In the UK, for instance, Aldi offers only 1,500 SKUs, 94% of which are private-label products. We estimate Lidl UK offers around 1,700 products. These compare to up to 50,000 SKUs in larger superstores operated by nondiscount rivals, and 48,000 at UK grocery pure-play Ocado. As anyone who shops at discounters will know, the result of visiting Aldi or Lidl is often a secondary top-up shop elsewhere to buy the products and brands that are not sold at discounters.

We see the limited potential to build big baskets as a near-insurmountable hurdle that could prove detrimental to the margins of discounters, even if these retailers solve the challenges around picking and delivery.

As we show below, Ocado yields an average basket size of £110 from 48,000 SKUs. We infer from this that discounters such as Lidl would struggle to garner substantial basket sizes online.

[caption id="attachment_100276" align="aligncenter" width="700"]

Source: Fung Global Retail & Technology[/caption]

Picking and delivery costs

A significant potential barrier for grocery e-commerce is the added cost that picking an order brings to the retailer, even if the customer collects the order rather than have it home delivered. Later in this report, we discuss ways in which discounters can drive down the cost of delivering online grocery orders.

In the UK, it costs an average £15 to pick and deliver an online grocery order, according to Bernstein research; around £9 of this is reported to be the cost of delivering the order to the customer. Yet, British online grocery retailers typically charge customers between £0 and £7 for grocery deliveries. Discounters base their business model on stripping out unnecessary costs, so the inference is that no-frills discounters must be willing to charge their customers picking and delivery fees that reflect their costs, or find ways of delivering an online service at a lower cost.

Smaller stores

We think the logistical challenges unique to discounters should be recognized, too: it is hard to see how in-store grocery picking or collection points could fit easily in the traditionally small stores of Aldi and Lidl. Lidl has been pushing into larger stores, but even its newer stores average around 1,200 square meters; the average store at Lidl and Aldi remains below 1,000 square meters, according to Euromonitor International.

This paucity of space means click-and-collect is no low-cost panacea for the discounters.

Smaller baskets

We suspect the economics of online grocery would be even worse for discount grocers than for their nondiscount rivals, due to smaller basket sizes resulting in a deleveraging effect. The much more limited choice would almost certainly yield smaller online average order values than those at retailers offering many thousands of branded and private-label stock-keeping units (SKUs).

In the UK, for instance, Aldi offers only 1,500 SKUs, 94% of which are private-label products. We estimate Lidl UK offers around 1,700 products. These compare to up to 50,000 SKUs in larger superstores operated by nondiscount rivals, and 48,000 at UK grocery pure-play Ocado. As anyone who shops at discounters will know, the result of visiting Aldi or Lidl is often a secondary top-up shop elsewhere to buy the products and brands that are not sold at discounters.

We see the limited potential to build big baskets as a near-insurmountable hurdle that could prove detrimental to the margins of discounters, even if these retailers solve the challenges around picking and delivery.

As we show below, Ocado yields an average basket size of £110 from 48,000 SKUs. We infer from this that discounters such as Lidl would struggle to garner substantial basket sizes online.

[caption id="attachment_100276" align="aligncenter" width="700"] Source: Company reports/Fung Global Retail & Technology[/caption]

New Delivery Models to Overcome Hurdles

In markets where online grocery retailers provide home-delivery services, this has traditionally been fulfilled through fleets of temperature-controlled trucks, owned and operated by the retailers themselves; this is the model used by AmazonFresh in the US or Tesco in the UK, for example.

It seems hard to balance this kind of investment and operating cost with the discount model. However, we see alternative fulfillment options arising.

Source: Company reports/Fung Global Retail & Technology[/caption]

New Delivery Models to Overcome Hurdles

In markets where online grocery retailers provide home-delivery services, this has traditionally been fulfilled through fleets of temperature-controlled trucks, owned and operated by the retailers themselves; this is the model used by AmazonFresh in the US or Tesco in the UK, for example.

It seems hard to balance this kind of investment and operating cost with the discount model. However, we see alternative fulfillment options arising.

Source: IGD[/caption]

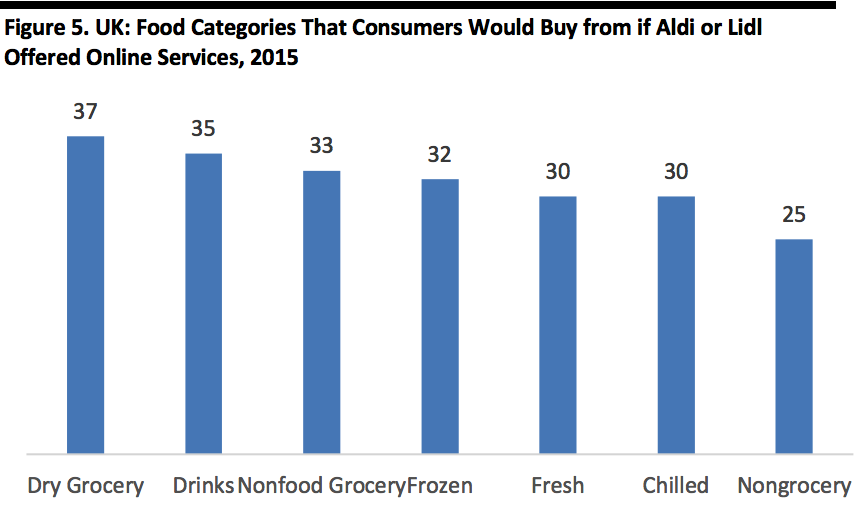

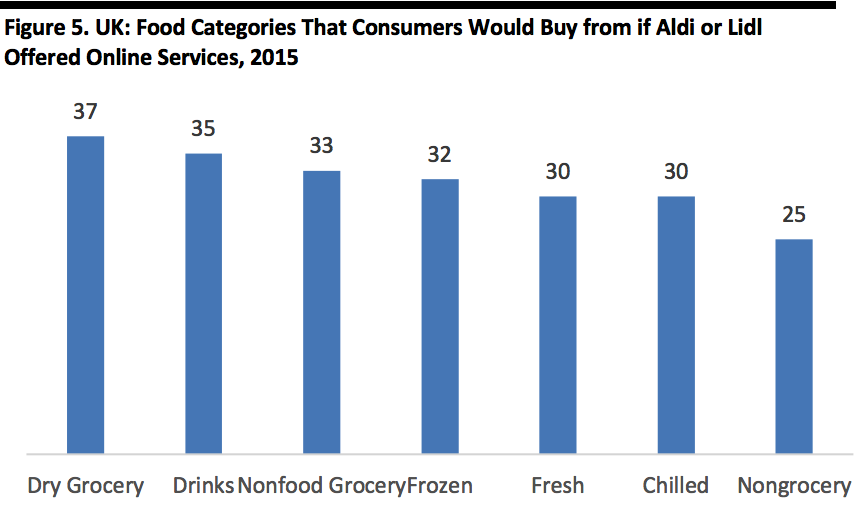

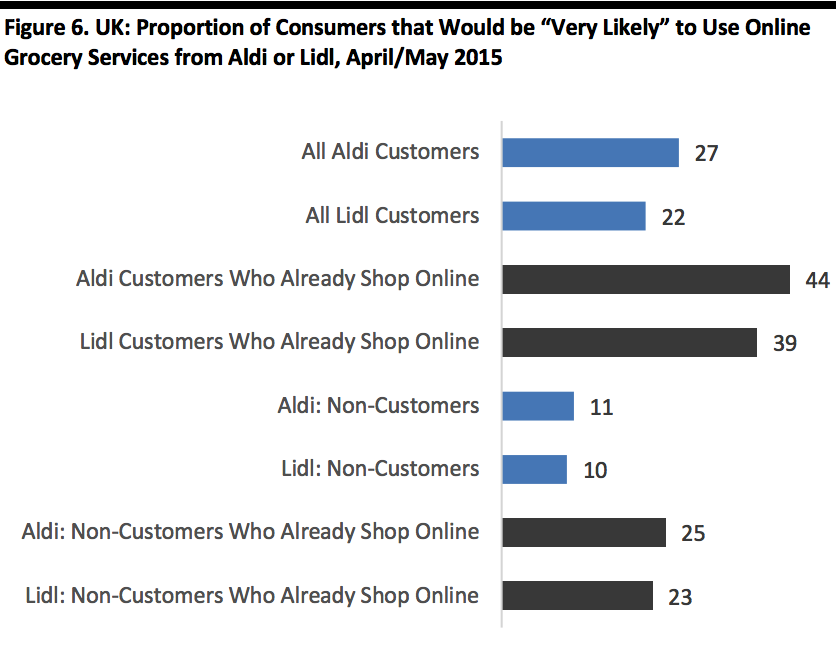

In a 2015 survey by Impact Research, around one-quarter of existing Aldi or Lidl shoppers would be very likely to buy groceries from these retailers online, if they had the chance. Among non-customers, around one in ten would buy from the discounters online. Aldi tends to come out slightly ahead of Lidl in all metrics.

A significant barrier is simply the willingness to buy online, regardless of retailer: once we drill down to those consumers who already buy groceries online, the proportions become much higher.

[caption id="attachment_100278" align="aligncenter" width="700"]

Source: IGD[/caption]

In a 2015 survey by Impact Research, around one-quarter of existing Aldi or Lidl shoppers would be very likely to buy groceries from these retailers online, if they had the chance. Among non-customers, around one in ten would buy from the discounters online. Aldi tends to come out slightly ahead of Lidl in all metrics.

A significant barrier is simply the willingness to buy online, regardless of retailer: once we drill down to those consumers who already buy groceries online, the proportions become much higher.

[caption id="attachment_100278" align="aligncenter" width="700"] Source: Impact Research[/caption]

Key Takeaways

Source: Impact Research[/caption]

Key Takeaways

Source: Shutterstock[/caption]

In this report, we wrap up the recent permutations of discount e-commerce, consider what consumers want from these channels, and look at the barriers and opportunities for discount operators in e-commerce. We focus on grocery e-commerce, but include coverage of ventures into online retailing of nongrocery categories.

Readers may also be interested in the following reports:

Source: Shutterstock[/caption]

In this report, we wrap up the recent permutations of discount e-commerce, consider what consumers want from these channels, and look at the barriers and opportunities for discount operators in e-commerce. We focus on grocery e-commerce, but include coverage of ventures into online retailing of nongrocery categories.

Readers may also be interested in the following reports:

- Our Online Grocery series which provides analysis by country. Reports on the UK, the US, France and Germany can be found on FungGlobalRetailTech.com.

- Our report European Grocery Discounters: Small Stores, Big Threats? at bit.ly/FungGroceryDiscounters

*Food and drink only

*Food and drink onlySource: Euromonitor International/Fung Global Retail & Technology[/caption] Discounters Push into E-Commerce Below, we wrap up the key moves from Aldi and Lidl into e-commerce. Until this year, their online offerings had steered clear of fresh foods, and focused on their nonfood special deals in categories such as apparel, furniture, electronics and home improvements, or wine, which is a higher-value, nonperishable category. [caption id="attachment_100274" align="aligncenter" width="700"]

Source: Company reports[/caption]

Two recent announcements have been the most striking: 1) Aldi’s move into the Chinese market purely through e-commerce; and 2) Lidl Germany’s plans to trial a grocery click-and-collect service in Berlin.

1. Aldi announces move into Chinese market purely through e-commerce

This will be the first time a grocery discounter has launched e-commerce in a country in which it does not have stores.

So far, we know that Aldi’s China offering will include grocery products (unlike in some other markets), it will offer home delivery and it will rely heavily on its Australian supply chain. In early November, an Aldi spokesperson told Australia’s Sydney Morning Herald:

Source: Company reports[/caption]

Two recent announcements have been the most striking: 1) Aldi’s move into the Chinese market purely through e-commerce; and 2) Lidl Germany’s plans to trial a grocery click-and-collect service in Berlin.

1. Aldi announces move into Chinese market purely through e-commerce

This will be the first time a grocery discounter has launched e-commerce in a country in which it does not have stores.

So far, we know that Aldi’s China offering will include grocery products (unlike in some other markets), it will offer home delivery and it will rely heavily on its Australian supply chain. In early November, an Aldi spokesperson told Australia’s Sydney Morning Herald:

Aldi has been active in the China market for several years undertaking detailed feasibility studies regarding potential market entry options. This work has resulted in the decision to commence retail operations in the China market, initially with an e-commerce retail offering.

In the second quarter of 2017, Aldi will commence selling a carefully selected range of everyday grocery items to Chinese consumers via an online retailing platform with products delivered to consumers’ homes.

The majority of these products will be sourced from Aldi’s existing Australian suppliers, offering many of Aldi’s supply partners a new distribution channel and access to the world’s biggest market.

2. Lidl Germany set to trial a click-and-collect service in Berlin Lidl Germany announced it plans to trial a click-and-collect service encompassing fresh foods in Berlin before the end of 2016. This will be the first move into fresh foods online from either Lidl or Aldi, and it will be the first grocery click-and-collect offering from the discounters. As we discuss in more detail later, we believe a rollout of in-store collection will pose challenges for these small-store retailers. While click-and-collect may initially appear to be a better fit with the low-cost model, we question whether it is scalable across the discounters’ store estates. Lidl’s sister chain Kaufland started delivery service in October It is worth noting here the online moves from Kaufland, Lidl’s sister chain of discount hypermarkets. Kaufland started its delivery service in October 2016, initially only in the Berlin area. Kaufland orders are fulfilled from a “dark store”—a store used simply for picking online orders—according to news website Stimme.de. Given the small store size of Aldi and Lidl, we see the dark-store picking model as more suitable than in-store picking for these discounters—if they are willing to invest to build scale.- We discuss the moves into e-commerce by grocery retailers in Germany in our report, Online Grocery Series: Germany—Playing Catchup, available on FungGlobalRetailTech.com.

Source: Fung Global Retail & Technology[/caption]

Picking and delivery costs

A significant potential barrier for grocery e-commerce is the added cost that picking an order brings to the retailer, even if the customer collects the order rather than have it home delivered. Later in this report, we discuss ways in which discounters can drive down the cost of delivering online grocery orders.

In the UK, it costs an average £15 to pick and deliver an online grocery order, according to Bernstein research; around £9 of this is reported to be the cost of delivering the order to the customer. Yet, British online grocery retailers typically charge customers between £0 and £7 for grocery deliveries. Discounters base their business model on stripping out unnecessary costs, so the inference is that no-frills discounters must be willing to charge their customers picking and delivery fees that reflect their costs, or find ways of delivering an online service at a lower cost.

Smaller stores

We think the logistical challenges unique to discounters should be recognized, too: it is hard to see how in-store grocery picking or collection points could fit easily in the traditionally small stores of Aldi and Lidl. Lidl has been pushing into larger stores, but even its newer stores average around 1,200 square meters; the average store at Lidl and Aldi remains below 1,000 square meters, according to Euromonitor International.

This paucity of space means click-and-collect is no low-cost panacea for the discounters.

Smaller baskets

We suspect the economics of online grocery would be even worse for discount grocers than for their nondiscount rivals, due to smaller basket sizes resulting in a deleveraging effect. The much more limited choice would almost certainly yield smaller online average order values than those at retailers offering many thousands of branded and private-label stock-keeping units (SKUs).

In the UK, for instance, Aldi offers only 1,500 SKUs, 94% of which are private-label products. We estimate Lidl UK offers around 1,700 products. These compare to up to 50,000 SKUs in larger superstores operated by nondiscount rivals, and 48,000 at UK grocery pure-play Ocado. As anyone who shops at discounters will know, the result of visiting Aldi or Lidl is often a secondary top-up shop elsewhere to buy the products and brands that are not sold at discounters.

We see the limited potential to build big baskets as a near-insurmountable hurdle that could prove detrimental to the margins of discounters, even if these retailers solve the challenges around picking and delivery.

As we show below, Ocado yields an average basket size of £110 from 48,000 SKUs. We infer from this that discounters such as Lidl would struggle to garner substantial basket sizes online.

[caption id="attachment_100276" align="aligncenter" width="700"]

Source: Fung Global Retail & Technology[/caption]

Picking and delivery costs

A significant potential barrier for grocery e-commerce is the added cost that picking an order brings to the retailer, even if the customer collects the order rather than have it home delivered. Later in this report, we discuss ways in which discounters can drive down the cost of delivering online grocery orders.

In the UK, it costs an average £15 to pick and deliver an online grocery order, according to Bernstein research; around £9 of this is reported to be the cost of delivering the order to the customer. Yet, British online grocery retailers typically charge customers between £0 and £7 for grocery deliveries. Discounters base their business model on stripping out unnecessary costs, so the inference is that no-frills discounters must be willing to charge their customers picking and delivery fees that reflect their costs, or find ways of delivering an online service at a lower cost.

Smaller stores

We think the logistical challenges unique to discounters should be recognized, too: it is hard to see how in-store grocery picking or collection points could fit easily in the traditionally small stores of Aldi and Lidl. Lidl has been pushing into larger stores, but even its newer stores average around 1,200 square meters; the average store at Lidl and Aldi remains below 1,000 square meters, according to Euromonitor International.

This paucity of space means click-and-collect is no low-cost panacea for the discounters.

Smaller baskets

We suspect the economics of online grocery would be even worse for discount grocers than for their nondiscount rivals, due to smaller basket sizes resulting in a deleveraging effect. The much more limited choice would almost certainly yield smaller online average order values than those at retailers offering many thousands of branded and private-label stock-keeping units (SKUs).

In the UK, for instance, Aldi offers only 1,500 SKUs, 94% of which are private-label products. We estimate Lidl UK offers around 1,700 products. These compare to up to 50,000 SKUs in larger superstores operated by nondiscount rivals, and 48,000 at UK grocery pure-play Ocado. As anyone who shops at discounters will know, the result of visiting Aldi or Lidl is often a secondary top-up shop elsewhere to buy the products and brands that are not sold at discounters.

We see the limited potential to build big baskets as a near-insurmountable hurdle that could prove detrimental to the margins of discounters, even if these retailers solve the challenges around picking and delivery.

As we show below, Ocado yields an average basket size of £110 from 48,000 SKUs. We infer from this that discounters such as Lidl would struggle to garner substantial basket sizes online.

[caption id="attachment_100276" align="aligncenter" width="700"] Source: Company reports/Fung Global Retail & Technology[/caption]

New Delivery Models to Overcome Hurdles

In markets where online grocery retailers provide home-delivery services, this has traditionally been fulfilled through fleets of temperature-controlled trucks, owned and operated by the retailers themselves; this is the model used by AmazonFresh in the US or Tesco in the UK, for example.

It seems hard to balance this kind of investment and operating cost with the discount model. However, we see alternative fulfillment options arising.

Source: Company reports/Fung Global Retail & Technology[/caption]

New Delivery Models to Overcome Hurdles

In markets where online grocery retailers provide home-delivery services, this has traditionally been fulfilled through fleets of temperature-controlled trucks, owned and operated by the retailers themselves; this is the model used by AmazonFresh in the US or Tesco in the UK, for example.

It seems hard to balance this kind of investment and operating cost with the discount model. However, we see alternative fulfillment options arising.

- We envision the UberEATS and Deliveroo “gig economy” business models as transferring to the online grocery world: in other words, low-cost, third-party couriers could take the place of expensive, company-owned trucks.

- In the UK, AmazonFresh launched in 2016 with this courier model: shoppers buying from AmazonFresh find their groceries delivered by third-party couriers using cool-bags and cars.

- In the US, several retailers moving into delivery offerings are contracting out this option to third-party service Instacart; this includes Whole Foods Market, Target and Publix.

Source: IGD[/caption]

In a 2015 survey by Impact Research, around one-quarter of existing Aldi or Lidl shoppers would be very likely to buy groceries from these retailers online, if they had the chance. Among non-customers, around one in ten would buy from the discounters online. Aldi tends to come out slightly ahead of Lidl in all metrics.

A significant barrier is simply the willingness to buy online, regardless of retailer: once we drill down to those consumers who already buy groceries online, the proportions become much higher.

[caption id="attachment_100278" align="aligncenter" width="700"]

Source: IGD[/caption]

In a 2015 survey by Impact Research, around one-quarter of existing Aldi or Lidl shoppers would be very likely to buy groceries from these retailers online, if they had the chance. Among non-customers, around one in ten would buy from the discounters online. Aldi tends to come out slightly ahead of Lidl in all metrics.

A significant barrier is simply the willingness to buy online, regardless of retailer: once we drill down to those consumers who already buy groceries online, the proportions become much higher.

[caption id="attachment_100278" align="aligncenter" width="700"] Source: Impact Research[/caption]

Key Takeaways

Source: Impact Research[/caption]

Key Takeaways

- The tentative moves into e-commerce by Aldi and Lidl continue their moves to soften their propositions. But, as with previous shifts, e-commerce comes with the probability of adding cost to their no-frills business model.

- Click-and-collect may initially look like a lower-cost way of moving into grocery e-commerce. However, we see real challenges for in-store picking and collection, given Aldi and Lidl operate typically small stores.

- If discounters are willing to invest to build scale in grocery e-commerce, using “dark stores” dedicated to picking online orders looks like a better option than in-store picking.

- We do not see home delivery as an insurmountable cost hurdle: we see delivery via “Uberized” third-party couriers as a more cost-effective, low-investment and scalable model than using temperature controlled, company-owned delivery trucks. This model is already being used by AmazonFresh in the UK.

- We think one remaining challenge will be the smaller average basket sizes online: the highly limited choice offered by Aldi and Lidl will almost certainly yield lower online order values than at nondiscount rivals. This would make the economics of online retail even more detrimental for discounters than they are for their nondiscount peers.