Source: Company reports

1Q16 RESULTS

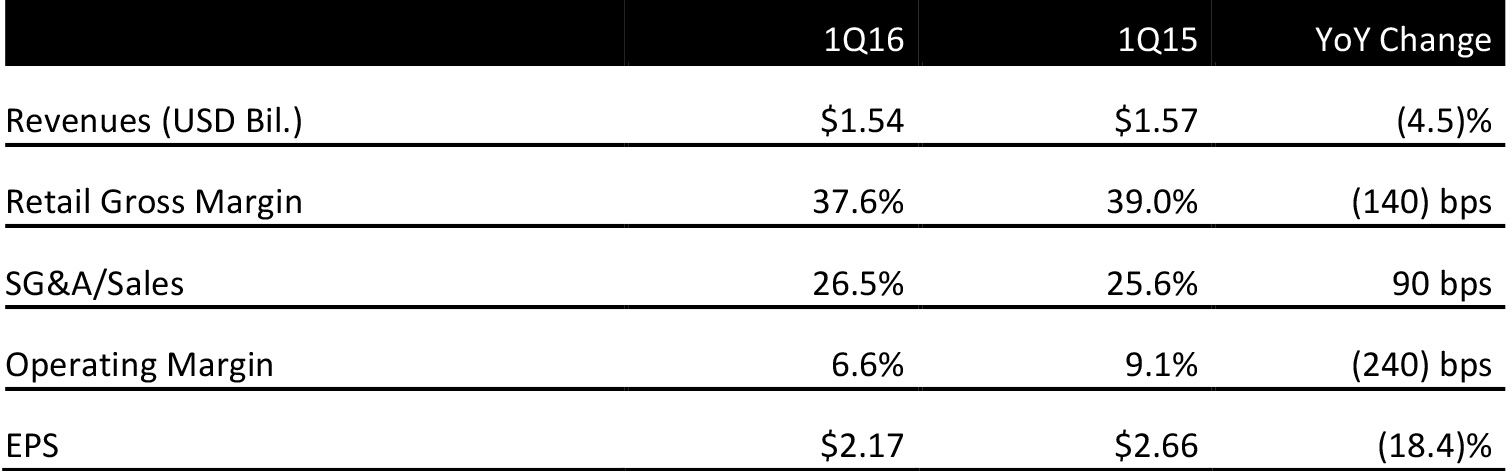

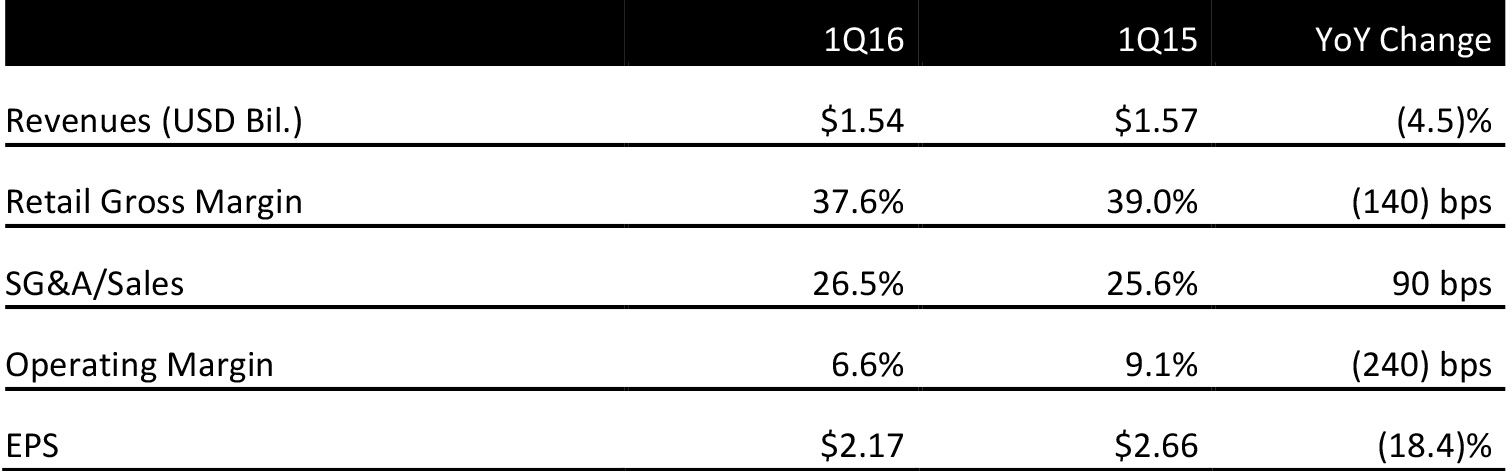

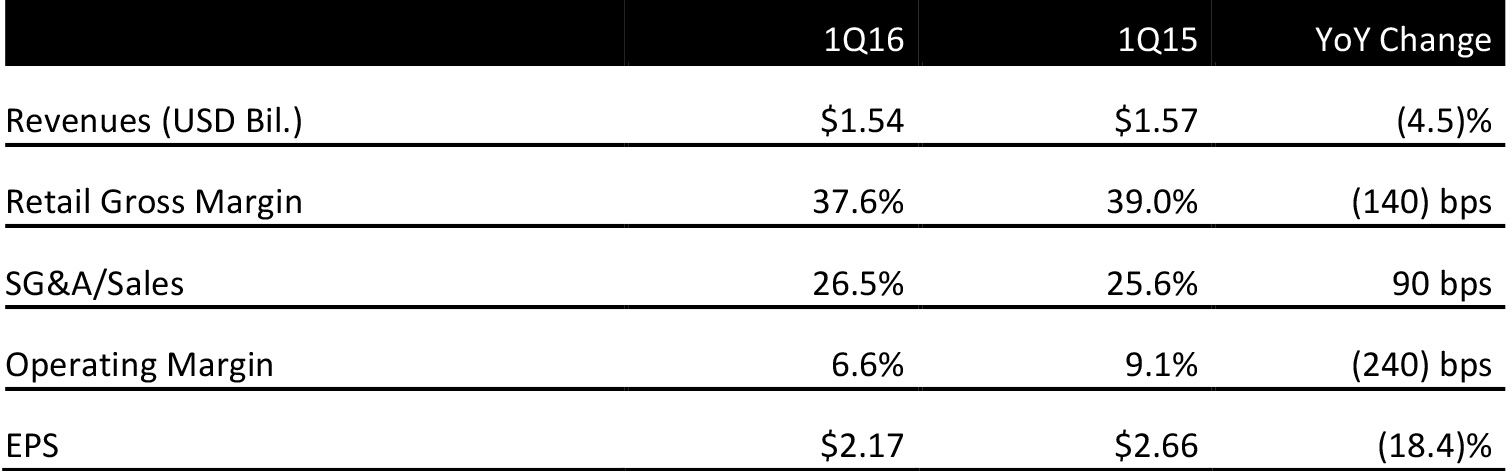

Dillard’s reported 1Q16 EPS of $2.17 versus the consensus estimate of $2.52.

Total revenue was $1.54 billion versus consensus of $1.57 billion. Comps were down 5% versus analysts’ expectations of a 2.3% decline.

Sales trends were strongest in shoes. Weaker categories were home and furniture, women’s accessories and lingerie. Sales trends were strongest in the Eastern region, followed by the Central and Western regions, respectively.

Gross margin declined by 140 basis points, to 37.6%, from 39.0% in the year-ago period, due to higher markdowns in the quarter given the challenging sales environment.

SG&A costs as a percent of sales increased by 90 basis points during the quarter, to 26.5% from 25.6% last year.

Total inventory was up 0.5% year over year versus a 4.5% decline in sales during the quarter.

Dillard’s repurchased $58.4 million in stock during the quarter under its $500-million repurchase program. As of the end of 1Q16, the remaining authorization under the current plan is $441.6 million.

The company closed its 105,000-square-foot store at the Aiken Mall in Aiken, South Carolina. Dillard’s now operates 272 locations.