Nitheesh NH

What’s the Story?

Over the last decade, a number of vertical furniture and home-furnishings brands have launched online, selling directly to consumers via their own websites, with many later expanding to include a brick-and-mortar presence. These digitally native vertical brands (DNVBs, and often termed direct-to-consumer brands) are the focus of this report. We assess their success in the US furniture and home-furnishings market and examine the strategies that brands are leveraging to better serve this market and capitalize on the opportunities it presents. We include digitally native product and service providers in the furniture and home-furnishings sector, such as rental subscription company Feather, and exclude digitally native multibrand retailers and marketplaces such as Wayfair. Our definition of furniture and home-furnishings includes bedding and mattresses, home decorations, houseware and other home accessories.Why It Matters

Many US furniture and home-furnishings DNVBs have seen success in recent years. The boom in online retail has given more opportunities to brands such as Casper, Nectar and Purple to stand out as they connect with customers through the DTC (direct-to-consumer) model. As the effects of the pandemic see a sustained shift to e-commerce and a heightened focus on the home, we expect sales by US DNVBs in the US furniture and home-furnishings market to grow in 2021.DNVBs in the US Furniture and Home-Furnishings Market: In Detail

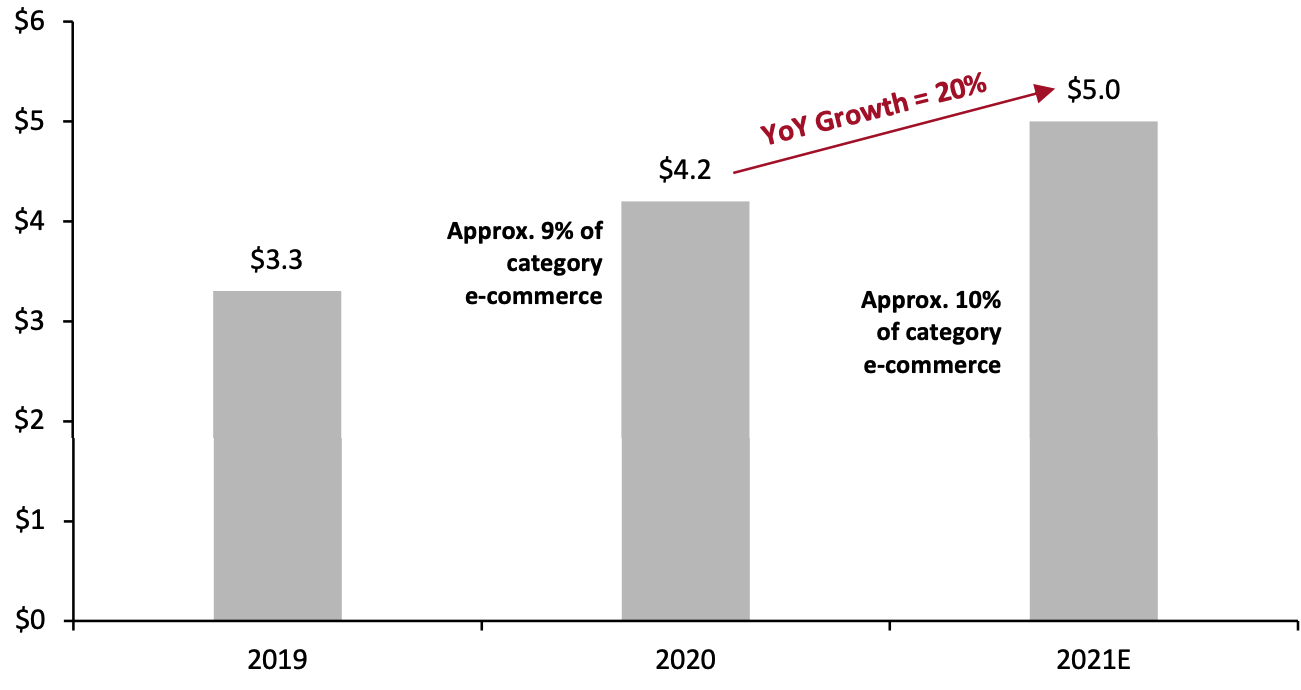

Market Size and Growth Projections We estimate that total e-commerce sales by US DNVBs in the furniture and home-furnishings market reached $4.2 billion in 2020, representing year-over-year growth of 27%. DNVBs therefore accounted for around 9% of the $45.6 billion total homewares and home-furnishings e-commerce market in 2020, as estimated by Euromonitor International. E-commerce accounted for a little under 2% of consumer spending on furniture and home furnishings last year, which totaled $238.8 billion according to the US Bureau of Economic Analysis. We expect sales by DVNBs to grow by 20% to $5.0 billion in 2021, outpacing the 11.9% sales growth in the overall US furniture and furnishings market, as estimated by Euromonitor International. This would also increase the share that DNVBs hold in the overall homewares and home-furnishings e-commerce market to 10%. Figure 1. US DNVBs: Total Sales in the Furniture and Home-Furnishings Market (USD Bil.) [caption id="attachment_129811" align="aligncenter" width="700"] Source: Euromonitor International Limited 2021 © All rights reserved/Coresight Research[/caption]

The key driver for market growth in 2020 was strong demand for home goods, as consumers spent more time at home due to the Covid-19 pandemic and were increasingly looking to furniture and home-furnishings brands to help with room décor and renew houseware. In 2021, this growth driver will persist, as many consumers will continue to spend more time at home, including to work, even as restrictions are lifted.

In Figure 2, we chart guidance for 2021 from public companies in the US DNVB furniture and home-furnishings sector, highlighting the market trends identified by each company.

Figure 2. US DNVBs in the Furniture and Home-Furnishings Market: Selected Companies’ Guidance for 2021

[wpdatatable id=1103]

Source: Euromonitor International Limited 2021 © All rights reserved/Coresight Research[/caption]

The key driver for market growth in 2020 was strong demand for home goods, as consumers spent more time at home due to the Covid-19 pandemic and were increasingly looking to furniture and home-furnishings brands to help with room décor and renew houseware. In 2021, this growth driver will persist, as many consumers will continue to spend more time at home, including to work, even as restrictions are lifted.

In Figure 2, we chart guidance for 2021 from public companies in the US DNVB furniture and home-furnishings sector, highlighting the market trends identified by each company.

Figure 2. US DNVBs in the Furniture and Home-Furnishings Market: Selected Companies’ Guidance for 2021

[wpdatatable id=1103]

Source: Company reports/Coresight Research

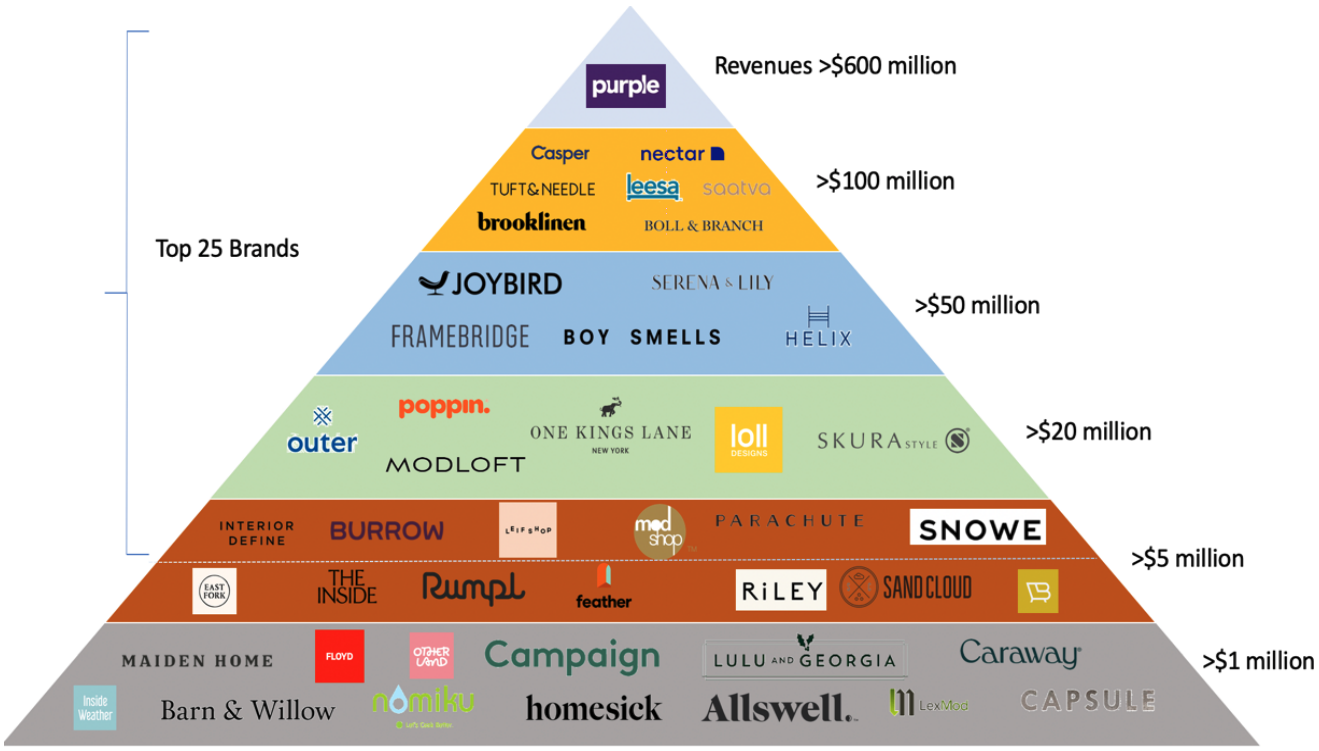

Competitive Landscape The US DNVB furniture and home-furnishings sector is relatively concentrated, with the top 25 brands (by revenue) accounting for approximately $3.2 billion in revenue in 2020, or 76% of the estimated total sector revenue of $4.2 billion. Figure 3 shows the competitive landscape of selected US furniture and home-furnishings DNVBs, based on their reported revenues in 2020. Figure 3. US DNVB Furniture and Home-Furnishings Market: Competitive Landscape by 2020 Revenue (USD) [caption id="attachment_129812" align="aligncenter" width="700"] All revenues are US-based only. Our competitive landscape does not include companies that have revenues of less than $1 million, do not disclose revenues, or where third-party revenue data is not available.

All revenues are US-based only. Our competitive landscape does not include companies that have revenues of less than $1 million, do not disclose revenues, or where third-party revenue data is not available.Source: Company reports/Incfact/Owler/Zoominfo/Coresight Research[/caption] Five Key Trends We discuss five current trends in the US DNVB furniture and home-furnishings sector, with examples. 1. Expanding Product Portfolios We expect DNVBs to expand their product mix to gain more business opportunities and test how far they can stretch beyond their initial value propositions.

- Casper stated in its February 2021 earnings call that it now offers a broader range of mattresses at different price points to appeal to consumers with different preferences and budgets. The company is also continuing to develop its revenue streams with the successful introduction of sleep products such as pillows, sheets and other accessories and is finding success with its pillow line: Casper’s North American pillow revenue was up 35% year over year in 2020, according to the company, demonstrating its ability to leverage its brand beyond mattresses.

- Candle brand Boy Smells expanded its product portfolio in March 2021 by launching its first collection of fine fragrances, aiming to provide customers with more choices and expand its business reach.

- Home décor brand Framebridge opened two retail locations in Washington, D.C., and another in Bethesda, Maryland, in November 2020, with three further openings planned in 2021. In selected Framebridge stores, customers can bring in their art and photos to have customized frames created within two weeks—an example of a personalized service that cannot be replicated online.

- La-Z-Boy, the parent company of Joybird, stated in its February 2021 earnings call that it will continue to open physical Joybird stores in markets where it is already making extensive online sales.

Frames of different sizes on the wall of Framebridge’s store in Bethesda, Maryland

Frames of different sizes on the wall of Framebridge’s store in Bethesda, MarylandSource: Framebridge[/caption] 3. Diversifying Selling Channels Through Third-Party Partnerships DNVBs in furniture and home furnishings typically start selling through their own e-commerce websites, but many have recently begun to sell on third-party marketplaces (such as Amazon), or through retailers (such as Target and Walmart) and department stores (such as Macy’s and Nordstrom). We expect more brands to make such moves in order to increase traffic and improve buyer trust by leveraging the reputations of partner retailers. It will remain attractive for DNVBs to diversify their selling channels and capture more market share among e-commerce competition—even as that dilutes their original DTC differentiation and brings their distribution strategies closer to those of traditional retailers.

- Purple is pursuing this strategy: The company announced in its March 2021 earnings call that it intends to lean into accelerated wholesale growth. The company’s current plan is to add approximately 1,500 new doors in 2021, with a focus on expanding its footprint with existing partners as well as launching with additional leading regional furniture players. Purple projects its channel mix to be roughly 70% DTC and 30% wholesale for 2021, with some margin pressure compared to the nearly 75% DTC mix in 2020. (Look out for our upcoming deep dive to read more about wholesale versus DTC.)

- Furniture brand Burrow is experiencing increased demand but a reduction in fulfillment operations at its manufacturing and fulfillment center in North Carolina, according to its brand website as of June 2021, which indicates a delayed delivery schedule and problems in its supply chain. The brand is working to address the challenges by recruiting more logistics workers and increasing production volumes.

- Purple reported its manufacturing expansion on its earnings call in March 2021. The company added two more manufacturing machines (called Max Machines) in September 2020 and opened Purple South, a new 525,000-square-foot facility south of Atlanta that will ultimately house six more Max Machines. The company grew sales of its innovative pillows and seat cushions by over 140% year over year in 2020.

- Casper’s management stated in its February 2021 earnings call that in addition to providing educational materials online, the company has created a new field team to educate its retail partners’ sales staff about the key differentiators of its products and to ensure they are merchandised in a manner consistent with the brand’s strategies.

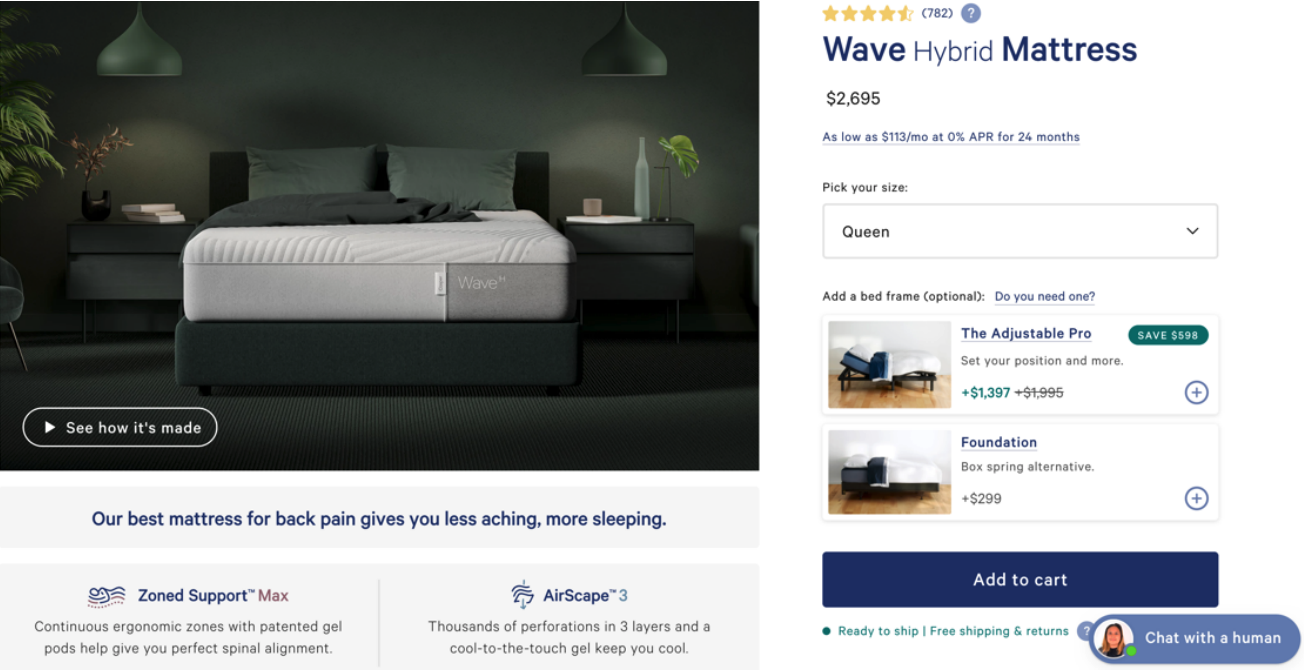

Casper provides a video of how its mattresses are made and notes that explain the technologies used, to give customers a better understanding of the product

Casper provides a video of how its mattresses are made and notes that explain the technologies used, to give customers a better understanding of the productSource: Casper[/caption]

What We Think

Implications for DNVBs- There is opportunity for brands to grow, but the competition is fierce. It is important that brands expand their product offerings and further diversify their channel mix to broaden their customer base.

- DNVBs in the furniture and home-furnishings market should make efforts to meet increased demand for home products and address supply chain disruptions such as shipping delays. Returns and last-mile delivery are further supply chain challenges for the furniture sector.

- New AR technologies, not yet widely adopted among DNVBs, offer opportunities for brands to educate their customers and reduce returns.

- Consumers will continue to buy from established furniture and home-furnishings retailers, given the wide product selection and ease of accessibility both online and offline. We expect retailers to seek out partnerships with, and acquisitions of, strong brands, including DNVBs.

- Customers’ shopping experience has become important for both DNVBs and traditional brands and retailers. Bed Bath and Beyond and Marshalls are examples of furniture retailers that, according to their earnings calls, are focusing on experiential shopping in order to find new ways to engage with customers. Consumers are seeking our brands that resonate with their lifestyle choices more than ever.