DIpil Das

Introduction

What’s the Story? DNVBs are brands born online, selling and shipping their own branded products. Over the last decade, over 50 DNVBs in the US food, beverage and food supplement market have launched online, selling directly to consumers via their own websites, with many later expanding to include a brick-and-mortar presence. In this report, we discuss DNVB growth and key trends in the US food, beverage and food supplement market—including strategies that brands are leveraging to better serve this market and capitalize on its opportunities. We exclude digitally native multi-brand retailers and marketplaces such as Naked Wines, as well as meal-kit providers such as HelloFresh and Blue Apron. Why It Matters Many US food, beverage and food supplement DNVBs have seen success in recent years—with the boom in online retail expanding the opportunities to build strong customer relationships through a direct-to-consumer (DTC) model. With the sustained shift to e-commerce following the Covid-19 pandemic and strong recovery in the US grocery (food and beverage) market in 2021, we expect sales by DNVBs in the US food, beverage and food supplement market to see future growth.DNVBs in the US Food, Beverage and Food Supplement Market: Coresight Research Analysis

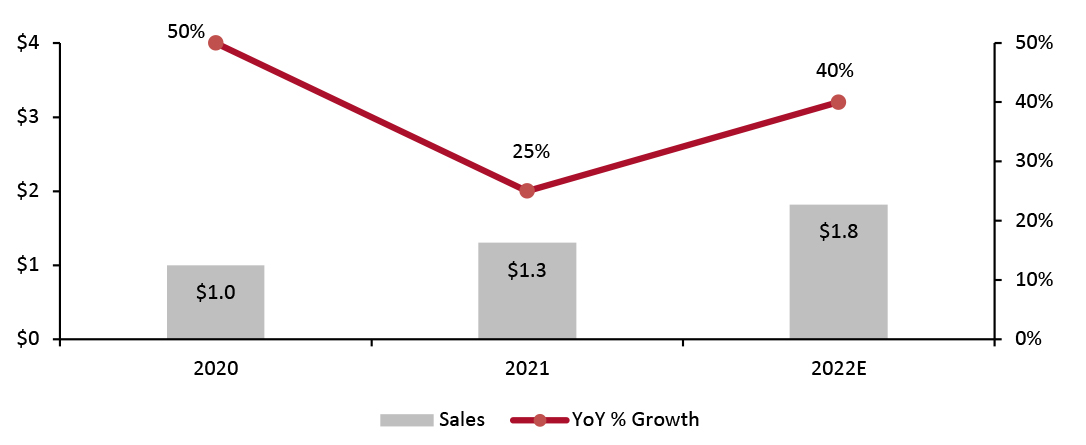

Total Sales by DNVBs in the US Food, Beverage and Food Supplement Market The US DNVB food, beverage and food supplement sector is still relatively small compared to the total market, but it is growing fast. We estimate that DNVB sector sales will grow by almost 40% to reach $1.8 billion in 2022, driven by consumers’ online shopping stickiness: According to Coresight Research’s annual online grocery survey conducted in April 2021, over one-third of online grocery shoppers do not expect to change their online grocery shopping habits once the crisis eases or ends. Additionally, over one-quarter of shoppers said that they plan to buy groceries online more frequently after the crisis subsides than they did during the crisis. Growth in 2022 will also be driven by industry players further developing close partnerships with offline retailers such as CVS, Target and Walmart, boosting brands’ sales in the brick-and-mortar channel. That projected 40% increase in DNVB sales compares to Coresight Research’s estimate of 32.4% growth in total US online food and beverage sales in 2022. Coresight Research estimates that sales by DNVBs in the US food, beverage and food supplement market saw around 50% growth in 2020 as consumers spent more time at home amid the Covid-19 pandemic. Sales grew by a mid-20s percentage rate in 2021 as this habit continued, totaling around $1.3 billion, we estimate—outpacing both the 4.5% year-over-year growth in the overall US grocery market and the 17.9% estimated increase in total online food and beverage sales in 2021.Figure 1. Total Sales by DNVBs in the US Food, Beverage and Food Supplement Market (Left Axis; USD Bil.) and YoY Growth (Right Axis; %) [caption id="attachment_141752" align="aligncenter" width="700"]

Source: Company reports/Coresight Research[/caption]

Competitive Landscape

The US DNVB food, beverage and food supplement market is fragmented, with the top five brands (by revenue) accounting for $453 million in revenue in 2020 and equating to 45.3% of the total sector revenue of $1 billion, we estimate.

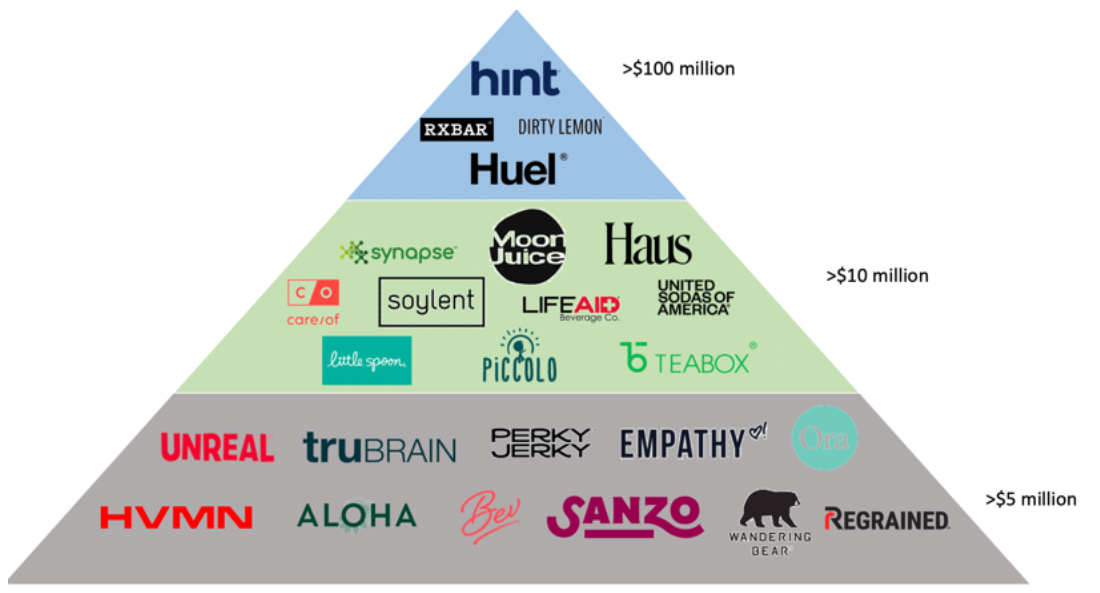

In Figure 2, we present a competitive landscape of DNVBs in the US food, beverage and food supplement market, based on 2020 revenue.

Source: Company reports/Coresight Research[/caption]

Competitive Landscape

The US DNVB food, beverage and food supplement market is fragmented, with the top five brands (by revenue) accounting for $453 million in revenue in 2020 and equating to 45.3% of the total sector revenue of $1 billion, we estimate.

In Figure 2, we present a competitive landscape of DNVBs in the US food, beverage and food supplement market, based on 2020 revenue.

Figure 2. US DNVB Food, Beverage and Food Supplement Sector: Competitive Landscape by 2020 Revenue (USD Mil.) [caption id="attachment_141753" align="aligncenter" width="700"]

All revenues are US-based only. Our competitive landscape does not include companies that have revenues of less than $1 million. Companies that do not disclose information or where third-party revenue data are not available are not included.

All revenues are US-based only. Our competitive landscape does not include companies that have revenues of less than $1 million. Companies that do not disclose information or where third-party revenue data are not available are not included. Source: Company reports/Incfact/Owler/Zoominfo/Coresight Research [/caption] Key Trends We discuss three current trends in the US DNVB food, beverage and food supplement sector. 1. DNVBs Are Expanding Their Products To Attract Consumers We are seeing DNVBs develop innovative products to access a wider range of opportunities and respond to consumer needs. We observe that DNVBS are entering four key areas:

- Vegan-based food and beverage—Huel, Perky Jerky, RXBAR and Soylent are launching vegan-based foods and beverages to offer consumers more health benefits. For example, plant-based nutrients keep blood sugar levels low, reduce the risk of heart disease and improve kidney function.

- Food and beverage with new flavors—Baby and toddler food brand Piccolo continues to test new flavors to appeal to a broader base of parents and cater for different cooking occasions.

- Cobranded food and beverage—DNVBs including ReGrained are launching food collaborations with other retailers or brands.

- New lines of food and beverage—DNVBs such as LifeAid and Ora Organic are launching new product lines to test beyond their initial value propositions.

Figure 3. US DNVB Food, Beverage and Food Supplement Sector: Recent Product Portfolio Expansions [wpdatatable id=1725 table_view=regular]

Source: Company reports 2. DNVBs Are Expanding Through Partnerships While DNVBs in the food, beverage and food supplement market typically start selling through their own e-commerce sites, many have begun to sell via online and physical third-party partnerships with marketplaces or retailers. Of the 29 DNVBs in the market, 9.7% have opened individual physical stores or pop-up stores since their online inception; 74.2% have collaborated with grocery stores, mass merchandisers, restaurants and bars; and most of them are still seeking more partnerships to expand their influence and increase revenues. For example, Fly By Jing (an all-natural Sichuan Flavor sauces and spices brand) and Parlor Coffee joined the menu of Neighborhood Goods’ in-store restaurant in Austin, Texas, in May 2021. Haus signed contracts with restaurants in California in early 2021. Nuggs, a plant-based nugget brand, is pursuing quick-service partnerships. We expect more brands to develop third-party partnerships in order to increase traffic and improve buyer trust by leveraging the reputations of partner retailers.

Figure 4. US DNVB Food, Beverage and Food Supplement Sector: Partnerships with Third Parties [wpdatatable id=1726 table_view=regular]

Source: Company reports 3. DNVBS Are Deepening Digital Connections with Consumers DNVBs continue to deepen their digital connection with consumers in two key ways, which we discuss below.

- Community Building Through Social Media

DNVB brands showcase products and engage consumers on social media

DNVB brands showcase products and engage consumers on social media Source: Huel/Instagram/RXBAR/Soylent [/caption]

- Educating or Inspiring Consumers

RXBAR’s recipe section provides inspirational ideas

RXBAR’s recipe section provides inspirational ideas Source: Company website [/caption]

What We Think

Implications for DNVBs in the Food, Beverage and Food Supplement Market- We expect 40% growth in the US DNVB food beverage and food supplement sector in 2022 to be driven by a sustained consumer shift to e-commerce and brands’ growing presence in physical stores in partnership with retailers and restaurants. There are opportunities for existing players and new entrants.

- While digitally native food, beverage and food supplement companies are focused on online retail, physical channels remain an important factor in capturing market share. As the pandemic eases, we believe that there will be opportunities for DNVBs to gain a physical presence by working with large retailers.

- DNVBs should consider collaborations or partnerships as a means to create excitement around products and increase both online and offline brand exposure.

- We expect traditional food, beverage and food supplement retailers to seek out partnerships with, and acquisitions of, strong brands, including DTC brands. For example, 7-Eleven, CVS, Target and Walmart are already carrying digitally native food, beverage and food supplement brands in their portfolio.