Nitheesh NH

Introduction

What’s the Story? Over the last decade, more than 100 DNVBs in beauty and personal care have launched online in the US, selling directly to consumers via their own websites, with many later expanding to include a brick-and-mortar presence. In this report, we discuss DNVB growth and key trends in the US beauty and personal care market—including strategies that brands are leveraging to better serve this market and capitalize on its opportunities. Our coverage of beauty and personal care DNVBs in this report includes the following:- US-based DNVBs, such as Drunk Elephant, Glossier and Harry’s (the latter is expanding to be a multi-brand retailer)

- Global DNVBs that generate revenue in the US, such as Charlotte Tilbury and Beauty Pie

DNVBs in the US Beauty and Personal Care Market: Coresight Research Analysis

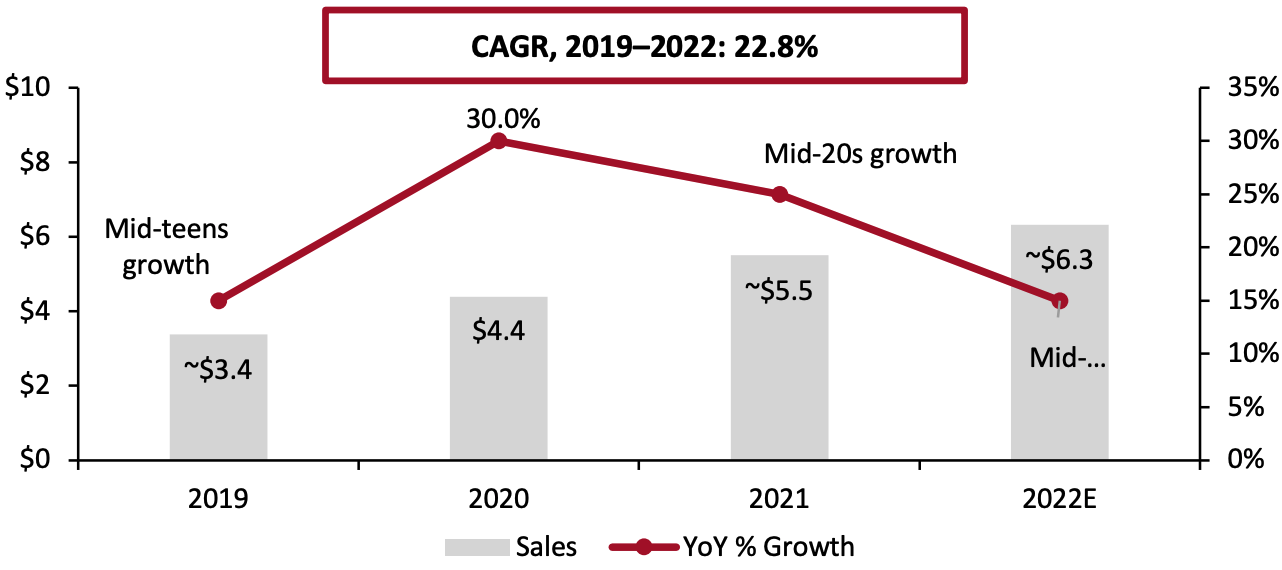

Market Size We expect DNVBs in the US beauty and personal care market to experience a total mid-teens growth rate, in percentage terms, to $6.3 billion in 2022, outpacing our estimate of low-single-digit sales growth in the overall US beauty and personal care market for 2022, but still capturing less than 5% of the total US beauty and personal care market. The share of DNVBs in the beauty and personal market will increase by 0.4 percentage points in 2022 compared to 2021, Coresight Research calculates from Euromonitor International data. Our estimate for 2022 DNVB growth also outpaces our projected high-single-digit percentage increase in total US online beauty sales for 2022. We estimate that total sales by DNVBs in the US beauty and personal care market grew by a mid-20s percentage rate to $5.5 billion in 2021. This increased the share that DNVBs hold in the overall beauty and personal care market to 3.4%, compared to 2.4% in 2020.Figure 1. Total Sales by DNVBs in the US Beauty and Personal Care Market (Left Axis; USD Bil.) and YoY Growth (Right Axis; %) [caption id="attachment_142097" align="aligncenter" width="700"]

Source: Company reports/Coresight Research[/caption]

Competitive Landscape

The US DNVB beauty and personal care sector is concentrated, with the top 10 brands (by revenue) accounting for $2.3 billion in revenue in 2020 and equating to 52.3% of the total sector revenue of $4.4 billion, we estimate.

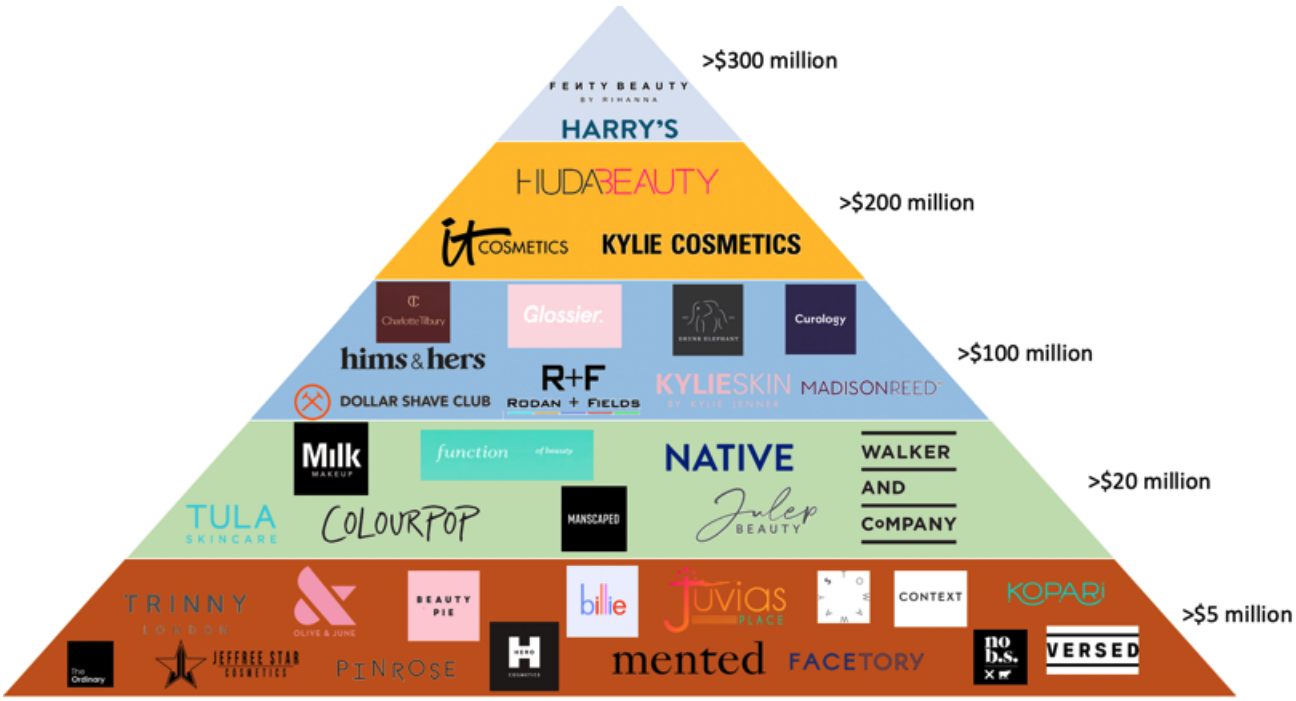

In Figure 2, we present a competitive landscape of DNVBs in the US beauty and personal care market, based on 2020 revenue. In the US DNVB beauty and personal care sector, beauty and cosmetics companies comprise the majority of the market, while personal care industry players capture less than 20% of the total market, according to our estimates.

Source: Company reports/Coresight Research[/caption]

Competitive Landscape

The US DNVB beauty and personal care sector is concentrated, with the top 10 brands (by revenue) accounting for $2.3 billion in revenue in 2020 and equating to 52.3% of the total sector revenue of $4.4 billion, we estimate.

In Figure 2, we present a competitive landscape of DNVBs in the US beauty and personal care market, based on 2020 revenue. In the US DNVB beauty and personal care sector, beauty and cosmetics companies comprise the majority of the market, while personal care industry players capture less than 20% of the total market, according to our estimates.

Figure 2. US DNVB Beauty and Personal Care Sector: Competitive Landscape by 2020 Revenue (USD Mil.) [caption id="attachment_142098" align="aligncenter" width="700"]

All revenues are US-based only. Our competitive landscape does not include companies that have revenues of less than $1 million. Companies that do not disclose information or where third-party revenue data are not available are not included.Source: Company reports/Incfact/Owler/Zoominfo/Coresight Research[/caption]

Key Trends

We discuss four current trends in the US DNVB beauty and personal care sector.

1. DNVBs Are Deepening Engagement with Consumers To Grow Sales

To build brand reputation, acquire customers and increase sales, digitally native beauty and personal care brands are deepening their engagement with consumers. We outline two brand strategies, with examples, below.

All revenues are US-based only. Our competitive landscape does not include companies that have revenues of less than $1 million. Companies that do not disclose information or where third-party revenue data are not available are not included.Source: Company reports/Incfact/Owler/Zoominfo/Coresight Research[/caption]

Key Trends

We discuss four current trends in the US DNVB beauty and personal care sector.

1. DNVBs Are Deepening Engagement with Consumers To Grow Sales

To build brand reputation, acquire customers and increase sales, digitally native beauty and personal care brands are deepening their engagement with consumers. We outline two brand strategies, with examples, below.

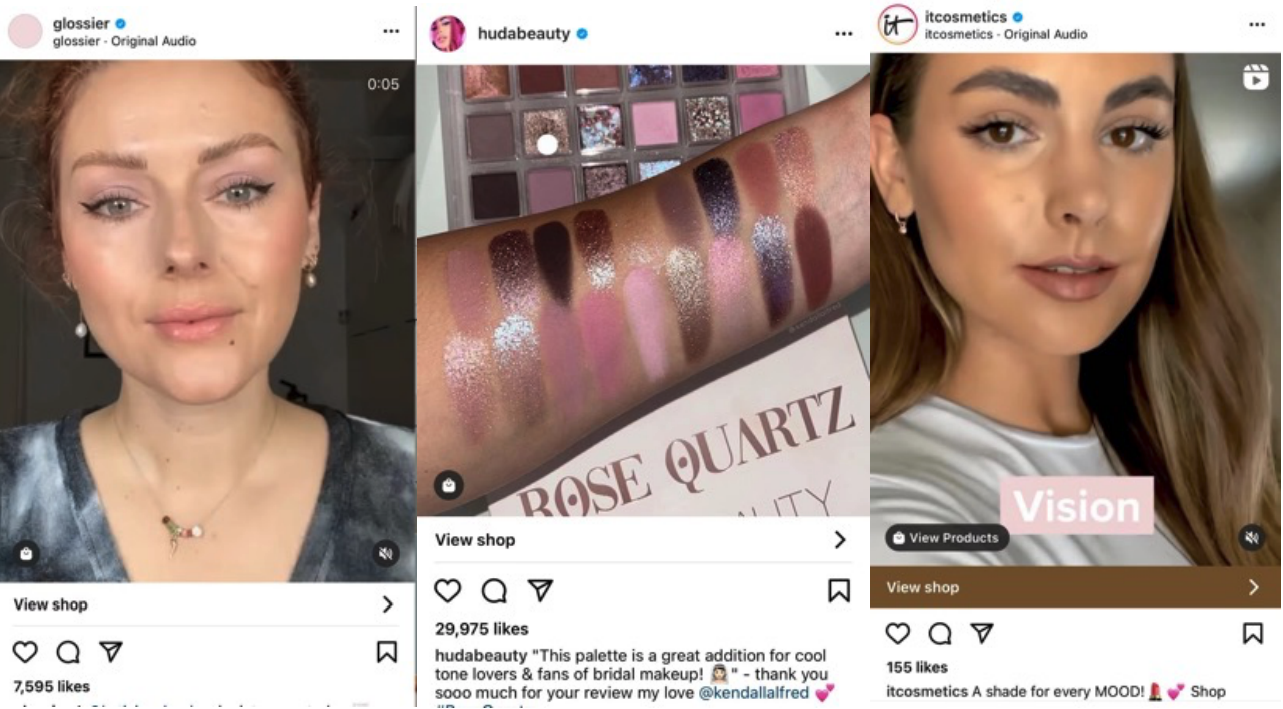

- Using social media to collect feedback on products and innovative ideas

- Collaborating with influencers or customers to introduce/showcase the effectiveness of products

From left to right: Social media posts of Glossier, Huda Beauty and IT Cosmetics

From left to right: Social media posts of Glossier, Huda Beauty and IT CosmeticsSource: Glossier/Huda Beauty/IT Cosmetics[/caption]

Figure 3. Selected DNVBs in Beauty and Personal Care: Social Media Influence [wpdatatable id=1749]

Source: Instagram/Facebook/YouTube

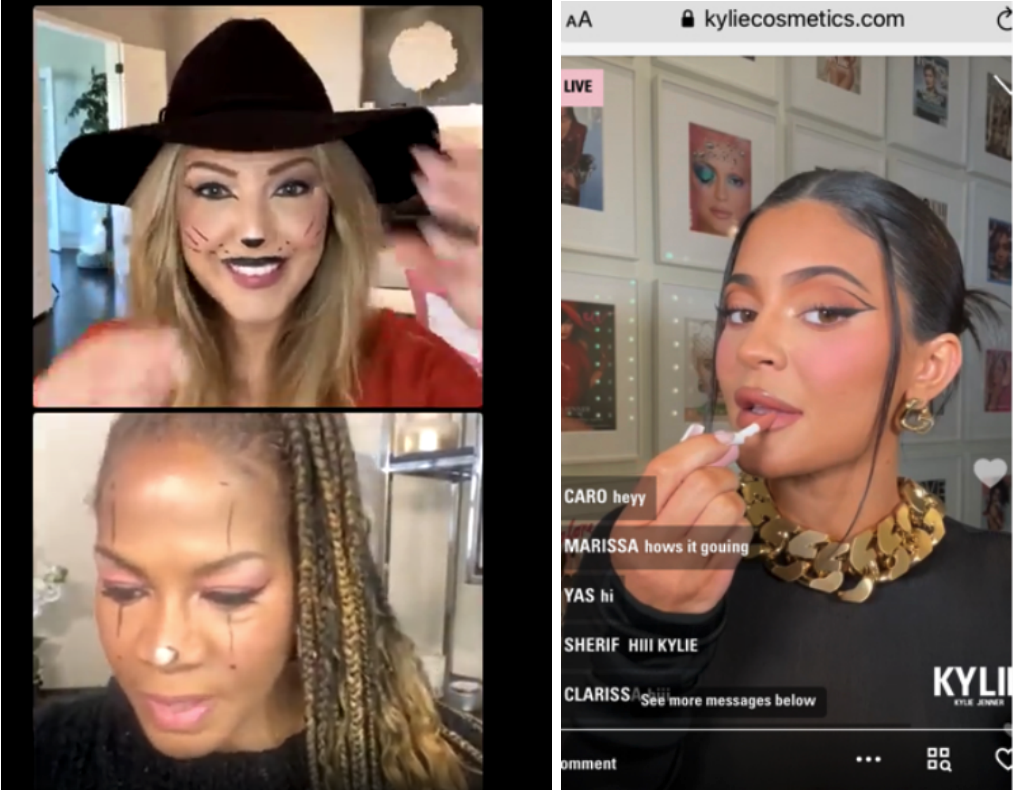

- Launching livestreaming selling sessions to engage with customers

From left to right: Livestreaming sessions by IT Cosmetics and Kylie Cosmetics

From left to right: Livestreaming sessions by IT Cosmetics and Kylie CosmeticsSource: IT Cosmetics/Kylie Cosmetics[/caption]

- Offering personalized online consultation services

- In June 2021, Glossier announced its plan to open three permanent stores, starting in Seattle in August 2021, followed by Los Angeles in the fall and London in the winter.

Glossier’s current flagship store in Seattle

Glossier’s current flagship store in SeattleSource: Glossier[/caption]

- In December 2020, Huda Beauty opened its first pop-up store in London. The pop-up store was painted pink with walls covered with angled mirrors, offering customers a unique outer space-inspired experience.

Huda Beauty’s pop-up store in London, UK

Huda Beauty’s pop-up store in London, UKSource: Huda Beauty[/caption]

- In March 2020, Beauty Pie, a cosmetics brand based in the UK that has US businesses, launched a pop-up store in Harvey Nichols, UK.

Beauty Pie’s pop-up store in Harvey Nichols, UK

Beauty Pie’s pop-up store in Harvey Nichols, UKSource: Beauty Pie[/caption]

- In September 2019, Madison Reed, a brand of hair care and hair color products, announced plans to open 600 stores by 2024, including a mix of 100 company-owned locations and 500 additional franchise salons.

Madison Reed’s current store in the Upper East Side, New York City, US

Madison Reed’s current store in the Upper East Side, New York City, USSource: Madison Reed[/caption] 3. DNVBs Are Expanding Through Partnerships and Collaborations While DNVBs in beauty and personal care typically start selling through their own e-commerce sites, many have begun to sell via online and physical third-party partnerships with marketplaces or retailers. For instance, Glossier sells its products through Nordstrom, Sephora and Ulta Beauty, Dollar Shave Club sells its razors via Amazon, Target, Walgreens and Walmart, and Function of Beauty lists its products for sale with mass merchandiser Target. We expect more brands to develop third-party partnerships in order to increase traffic and improve buyer trust by leveraging the reputations of partner retailers.

Figure 5. Selected US DNVBs in Beauty and Personal Care: Retailer Partnerships [wpdatatable id=1750]

Source: Company reports

4. Relatively More Mature DNVBs Are Expanding into Multi-Brand Retailers We are seeing selected digitally native brands in the beauty and personal care market expanding their portfolios to include more brands and turning into multi-brand retailers. As digitally native brands grow, they begin to eye their next moves Harry’s, originally a brand that manufactures and sells shaving equipment and men’s personal care products under its own Harry’s brand, has launched other brands: women’s razor and body care brand Flamingo, pet brand Cat Person and haircare brand Headquarters. The company raised $155 million from a series E funding in April 2021 and announced plans to use the capital mainly to add more brands to its portfolio. In 2018, Harry’s announced an in-house incubator, called Harry’s Labs, to launch new brands. Glossier launched its first spin-off brand, Glossier Play, a line that targets more millennials with colorful colors in cosmetics, in March 2019, though the brand clarified that it is not a brand incubator.What We Think

Implications for DNVBs- We expect the estimated mid-teens growth by DNVBs in the US beauty and personal care market in 2022 to be driven by the sustained consumer shift to e-commerce and overall market development momentum, presenting opportunities for existing market players and new entrants. Brands should leverage fit-to-purpose strategies, such as deepening engagement with customers, seeking partnerships or collaborations and expanding business reach in order to grow sales.

- While digitally native beauty and personal care companies are focused on online retail, physical channels remain an important factor in capturing market share. As the pandemic eases, we believe that there will be opportunities for DNVBs in beauty and personal care to offer in-store experiences such as pop-up shows and special-edition products to drive shopper engagement.

- We expect traditional beauty and personal care retailers to seek out partnerships with, and acquisitions of, strong brands, including digitally native brands. For example, Amazon, Target, CVS, Sephora and Walgreens are already carrying digitally native beauty or personal care brands in their portfolio. We anticipate that more beauty retailers and brands will carry digitally native brand offerings or collaborate with them on co-branded products.

Source for all Euromonitor data: Euromonitor International Limited 2022 © All rights reserved