DIpil Das

What’s the Story?

Over the last decade, more than 200 DNVBs in apparel and footwear have launched online, selling directly to consumers via their own websites, with many later expanding to include a brick-and-mortar presence. In this report, we discuss DNVB growth and key trends in the US apparel and footwear market—including strategies that brands are leveraging to better serve this market and capitalize on its opportunities. Our coverage of apparel and footwear DNVBs in this report includes:- US-origin DNVBs such as Everlane

- Global DNVBs that generate revenue in the US such as Shein

- Global digitally native apparel retailers of own-brand products such as Boohoo, Glamourous and Missguided that generate revenue in the US

Why It Matters

Many US apparel and footwear DNVBs have seen success in recent years—with the boom in online retail expanding the opportunities to build strong customer relationships through a direct-to-consumer (DTC) model. With the sustained shift to e-commerce following the pandemic and strong recovery in the US apparel and footwear market in 2021, we expect sales by DNVBs in the US apparel and footwear market to see future growth.DNVBs in the US Apparel and Footwear Market: Coresight Research Analysis

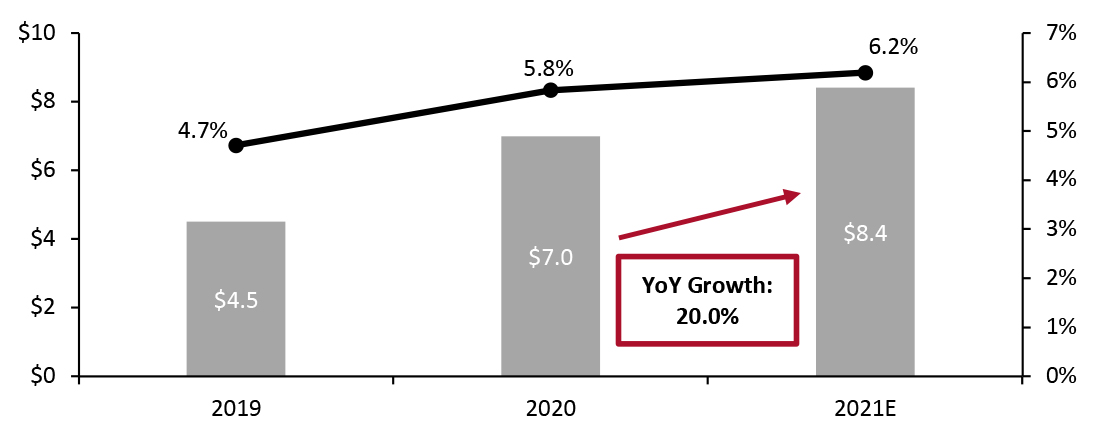

We cover e-commerce sales by DNVBS in the US apparel and footwear market, before discussing the competitive landscape and four key trends. E-Commerce Sales Coresight Research expects sales by DVNBs in the US apparel and footwear market to grow 20.0% to $8.4 billion in 2021, outpacing our estimate of 1.6% sales growth in the overall US e-commerce apparel and footwear market for 2021. This would increase the share that DNVBs hold in the overall apparel and footwear e-commerce market to 6.2%. We estimate that total e-commerce sales by US DNVBs in the apparel and footwear market reached $7.0 billion in 2020, representing year-over-year growth of 55.6%. The growth rate was largely driven by the estimated 200+% sales growth rate of major digitally native brand Shein. Excluding Shein, total e-commerce sales by US DNVBs in the apparel and footwear market reached $3.3 billion in 2020, representing year-over-year growth of 4.9%. This still demonstrates the resilience of the DNVB model as the overall apparel and footwear market declined by 9% in 2020, we estimate. DNVBs accounted for around 5.8% of the total $120.9 billion apparel and footwear e-commerce market in 2020, as estimated by Coresight Research using US Census Bureau data. E-commerce accounted for 33.4% of consumer spending on apparel and footwear in 2020, which totaled $362.0 billion, according to the US Bureau of Economic Analysis. The share of DNVBs in the apparel and footwear market versus the e-commerce apparel and footwear market increased by 1.1 percentage points in 2020.Figure 1. DNVBs: Total Sales in the US Apparel and Footwear Market (Left Axis, USD Bil.) and Share of Total Apparel and Footwear E-Commerce Market (Right Axis, %) [caption id="attachment_133598" align="aligncenter" width="725"]

Source: Company reports/US Census Bureau/Coresight Research[/caption]

The key driver for market growth in 2020 was the shift to online shopping among consumers spending more time at home due to the Covid-19 pandemic. Many consumers switched their browsing to items to wear around the house, including activewear, intimates and lingerie.

We are seeing this e-commerce habit sustain in 2021, supported by consumers’ return to purchasing categories to wear outside their homes such as dresses and footwear. Moreover, strong US apparel market recovery indicates that consumers are buying additional clothing to refresh their wardrobes or make up for missed shopping opportunities in 2020—a positive signal for the US DNVB apparel and footwear market.

Competitive Landscape

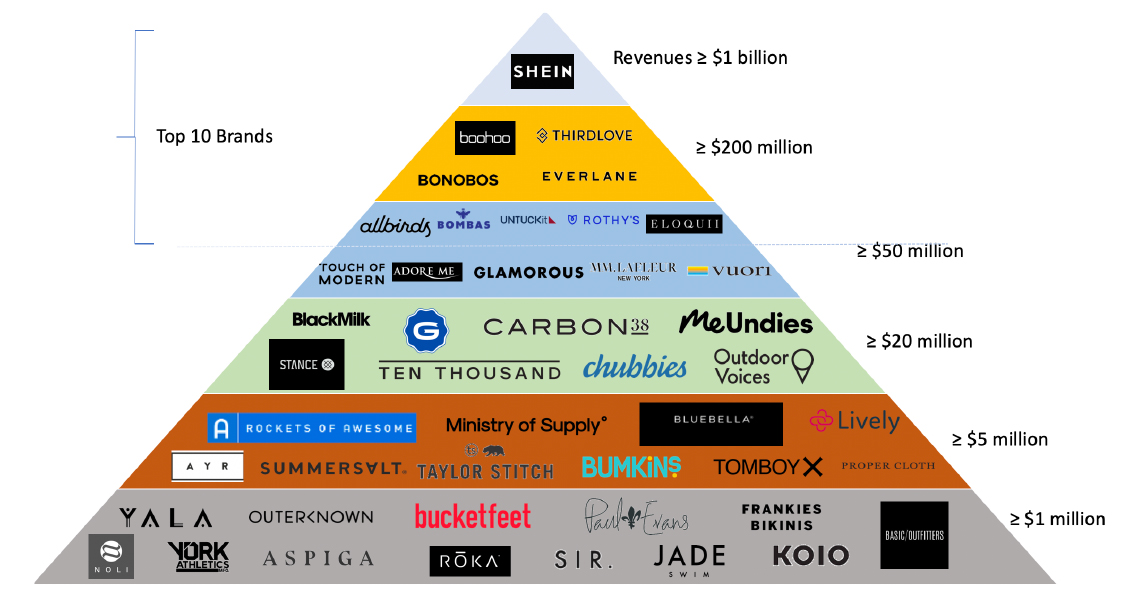

The US DNVB apparel and footwear market is highly concentrated, with the top 10 brands (by revenue) accounting for $5.0 billion in revenue in 2020 and equating to 71.4% of the estimated total sector revenue of $7.0 billion, although this is dominated by Shein. For comparison, the top 10 brands by revenue in the total US apparel and footwear sector accounted for just 12.1% of total sales in 2020.

Figure 2 presents our competitive landscape of DNVBs in the US apparel and footwear market, based on their 2020 revenue.

Source: Company reports/US Census Bureau/Coresight Research[/caption]

The key driver for market growth in 2020 was the shift to online shopping among consumers spending more time at home due to the Covid-19 pandemic. Many consumers switched their browsing to items to wear around the house, including activewear, intimates and lingerie.

We are seeing this e-commerce habit sustain in 2021, supported by consumers’ return to purchasing categories to wear outside their homes such as dresses and footwear. Moreover, strong US apparel market recovery indicates that consumers are buying additional clothing to refresh their wardrobes or make up for missed shopping opportunities in 2020—a positive signal for the US DNVB apparel and footwear market.

Competitive Landscape

The US DNVB apparel and footwear market is highly concentrated, with the top 10 brands (by revenue) accounting for $5.0 billion in revenue in 2020 and equating to 71.4% of the estimated total sector revenue of $7.0 billion, although this is dominated by Shein. For comparison, the top 10 brands by revenue in the total US apparel and footwear sector accounted for just 12.1% of total sales in 2020.

Figure 2 presents our competitive landscape of DNVBs in the US apparel and footwear market, based on their 2020 revenue.

Figure 2. US DNVB Apparel and Footwear Market: Competitive Landscape, by 2020 Revenue (USD Bil.) [caption id="attachment_133155" align="aligncenter" width="725"]

All revenues are US-based only. Our competitive landscape does not include companies that have revenues of less than $1 million. Companies that do not disclose information, or where third-party revenue data is not available, are not included.

All revenues are US-based only. Our competitive landscape does not include companies that have revenues of less than $1 million. Companies that do not disclose information, or where third-party revenue data is not available, are not included. Source: Company reports/Incfact/Owler/Zoominfo/Coresight Research [/caption] Key Trends We discuss four current trends in the US DNVB apparel and footwear market. 1. DNVBs Are Expanding Their Product Portfolios We are seeing DNVBs develop their product mixes to access a wider range of opportunities and test how far they can stretch beyond their initial value propositions. Activewear, loungewear and swimwear are popular categories for apparel and footwear DNVB expansion, largely driven by the ongoing casualization trend in the US market.

Figure 3. DNVBs in Apparel and Footwear: Recent Product Expansion Developments [wpdatatable id=1285]

Source: Company reports In addition, we are seeing some DNVBs taking steps to reposition their product portfolios, for instance, by selling part of their businesses. This can be identified in Ministry of Supply’s sale of its office wear business in March 2021. Following the sale, the company focused more on comfort, and dropped “dress” from descriptions of selected products, for instance, renaming its “Apollo Dress Shirt” to “Apollo Shirt”. We are also seeing DNVBs reintroducing products to stay competitive. For example, Outdoor Voices reintroduced its exercises dress in April 2021. The re-released exercise dress still features its signature built-in bodysuit liner but now includes adjustable straps for a more comfortable fit and a phone-friendly second pocket on the leg liner, according to the company. Building out an appealing product portfolio building is one of the most important business strategies—it helps companies to target specific consumer bases and plan their future product lines accordingly. We expect to see DNVBs in apparel and footwear continue to analyze their product portfolios and create product plans that align with ongoing changes in consumer demand. It is particularly important for brands and retailers previously focused on businesswear, formalwear and occasion-specific to broaden their assortments to find new growth opportunities. 2. DNVBs Are Investing in Physical Stores Although the pandemic has had a severe impact on physical retail, we expect DNVBs in apparel and footwear to continue to value physical stores, and adjust their strategies to better combine online and in-store retail. Of the DNVBs under our coverage in this report, 64.2% have opened physical stores, showrooms or locations in collaboration with retailers since their online inception. As the pandemic eases, we expect to see more brands add in-store experiences such as games, pop-up shows and special-edition products to drive shopper engagement.

Figure 4. DNVBs in Apparel and Footwear: Recent Physical Expansion Developments [wpdatatable id=1286]

Source: Company reports 3. DNVBs Are Expanding Through Partnerships and Collaborations While DNVBs in apparel and footwear typically start selling through their own e-commerce sites, many have begun to sell via online and physical third-party partnerships with marketplaces or retailers. For instance, Alo Yoga sells its products on Amazon, Chubbies sells its shorts via Target and Bonobos lists its products for sale with department store Nordstrom. In April 2021, e-commerce site Zappos announced a new partnership with New York-based women’s apparel brand M.M.LaFleur. Zappos now offers a distinct microsite from its main page featuring a curated collection of M.M.LaFleur pieces. We expect more brands to develop third-party partnerships in order to increase traffic and improve buyer trust by leveraging the reputations of partner retailers.

Figure 5. US DNVBs in Apparel and Footwear: Footprints on Third-Party Retail Sites or Marketplaces [wpdatatable id=1287]

Source: Company reports Furthermore, we are seeing more DNVBs in apparel and footwear launch products in collaboration with other brands, aiming to leverage the unique strengths of each brand and take advantage of surprising partnerships to generate intrigue. We expect to see continued joint product creation to meet consumers’ needs and drive excitement among shoppers going forward.

- Read more about the growing trend of retail collaborations in the overall apparel and footwear market, here.

Figure 6. DNVBs in Apparel and Footwear: Recent Retail Collaborations [wpdatatable id=1288]

Source: Company reports 4. DNVBS Are Focusing on Sustainability We are seeing sustainable apparel and footwear offerings among DNVBs in the US apparel and footwear market. For example, Alo Yoga launched a line of yoga pants marketed as “eco-aware” in early 2021. In addition, Everlane launched a sustainable loungewear collection in February 2021 and MeUndies launched new swimwear made with recycled materials in May 2021. According to a survey by Coresight Research and Blue Yonder in January 2021, 65.6% of US consumers believe that sustainability is an important factor in choosing where to buy apparel and footwear. With shopping choices being influenced by consumers’ growing awareness of sustainability, there are opportunities for DNVBs to appeal to shoppers by reducing the environmental impact of their products and supply chains. We are also seeing the rise of resale and recycling programs among DNVBs in the US apparel and footwear market. For example, Rockets of Awesome launched its Rockets Reverse program in January 2021, allowing subscribers to send back outgrown clothes for shop credits. The initiative aims to reduce waste and unnecessary production of new clothes by extending the life of already-produced items. Furthermore, in March 2021, M.M.LaFleur opened a peer-to-peer resale service, allowing shoppers to resell their used clothing for store credit or cash. The company believes that this program will help the brand build loyalty among its key shoppers and extend the lifecycle of its products. We expect DNVBs to propel the sustainability trend in the US apparel and footwear market. [caption id="attachment_133156" align="aligncenter" width="725"]

The packaging bag for products being recycled through the Rockets Reverse program

The packaging bag for products being recycled through the Rockets Reverse program Source: Rockets of Awesome [/caption]

What We Think

Implications for DNVBs- We expect the estimated 20.0% growth by DNVBs in the US apparel and footwear market in 2021 to be driven by the sustained consumer shift to e-commerce and overall apparel market recovery, presenting opportunities for existing market players and new entrants. Brands should optimize their service offerings and diversify their product mixes by expanding into different categories, in order to broaden their customer base.

- While digitally native apparel and footwear companies are focused on online retail, physical channels remain an important factor in capturing market share. As the pandemic eases, we believe that there will be opportunities for DNVBs in apparel and footwear to offer in-store experiences such as games, pop-up shows and special-edition products to drive shopper engagement.

- Apparel and footwear DNVBs should consider collaborations or partnerships as a means to create excitement around products and create valuable social media buzz.

- We expect traditional apparel and footwear retailers to seek out partnerships with, and acquisitions of, strong brands, including DTC brands. For example, Amazon, Target, Urban Outfitters and Walmart are already carrying DTC apparel brands in their portfolio. We anticipate that more apparel retailers and brands will carry DTC brand offerings or collaborate with them on co-branded products.