Nitheesh NH

What’s the Story?

Retail media advertising originated in brick-and-mortar retail environments and has migrated to digital platforms to serve much the same purpose. Originally, brands paid retailers to display signage and promotional materials in store to drive more purchases for their products. Similarly, brands now pay retailers to showcase their products, usually consumer goods, through adverts or preferential placement within their e-commerce websites or mobile applications. We assess key emerging trends in retail media in the US grocery market, and consider future prospects for the sector.Why It Matters

Due to the pandemic-driven e-commerce boom, retail media has become an important category within digital advertising. It allows retailers to monetize the traffic already coming to their e-commerce website or app and offset the higher operating expenses associated with online fulfillment. Brands seeking to increase their visibility throughout the consumers’ purchasing journey are also directing more of their advertising spending toward retail media to influence shoppers at the digital point of sale.Figure 1. Benefits of Retail Media to Retailers, Brands and Consumers [wpdatatable id=1423]

Source: Coresight Research

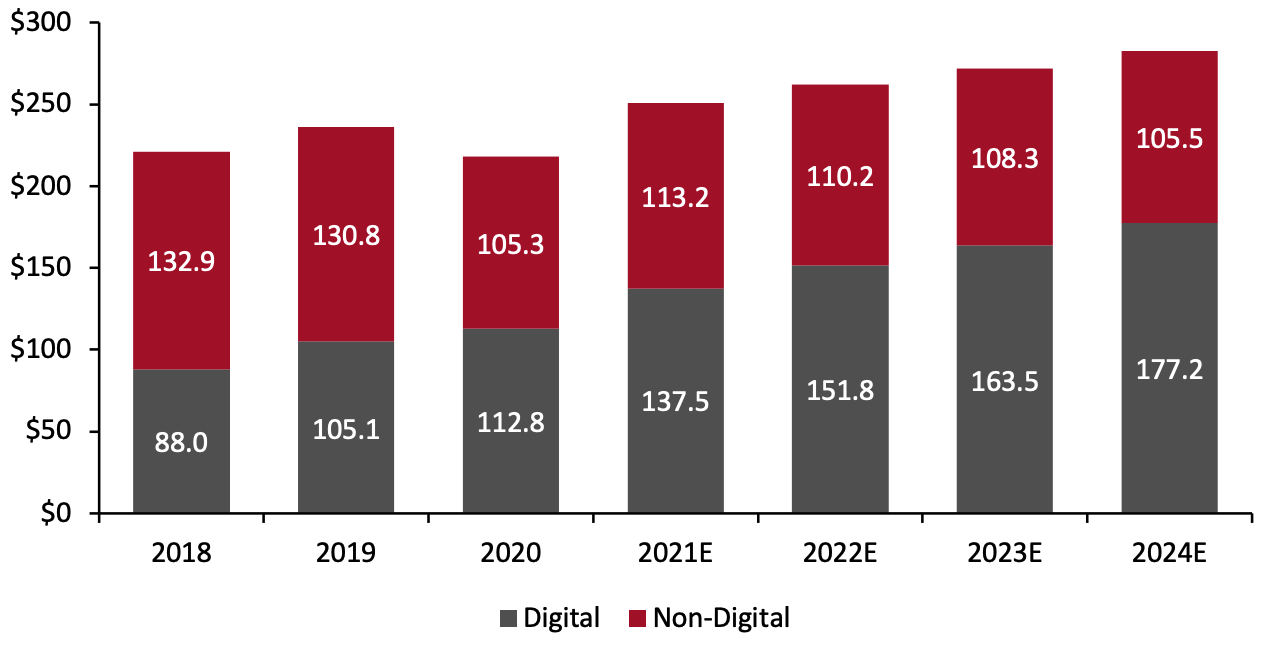

According to media investment company GroupM, digital channels accounted for around 52% of advertising revenue in the US in 2020. Advertising spending on non-digital channels saw double-digit declines in 2020, while spending on digital advertising still grew 7.3%. GroupM forecasts digital advertising to grow a robust 22% year over year in 2021.Figure 2. US Advertising Revenue Ex. Political, by Channel (USD Bil.) [caption id="attachment_135776" align="aligncenter" width="700"]

Non-digital channels include television, radio, newspapers, magazines, outdoor, cinema, direct mail and directories

Non-digital channels include television, radio, newspapers, magazines, outdoor, cinema, direct mail and directoriesSource: GroupM[/caption] Rob Christian, Chief Strategy Officer at grocery e-commerce technology provider ShopHero, Inc., told Coresight Research that CPG brands are raising their marketing budgets and are allocating “brand new money” for the retail media landscape.

Digital Retail Media—a New Opportunity for US Grocery: Coresight Research Analysis

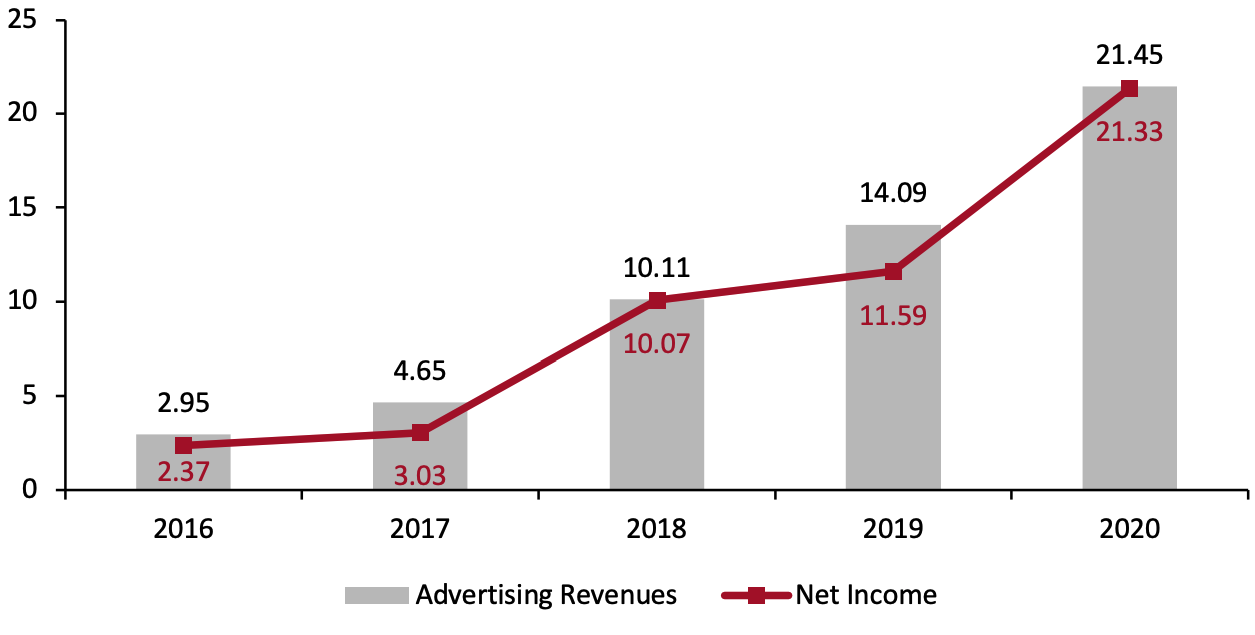

1. Retailers are Capitalizing on the E-Commerce Boom Using Retail Media Over the past two years, many grocery retailers have launched retail media offerings, in some cases listing them as separate entities from their core retail segment. These include the largest players, such as Walmart, Kroger, Albertsons and Ahold Delhaize, as well as regional grocers like Wakefern, Hy-Vee and Southeastern Grocers. However, the pandemic-induced surge in online grocery shopping—with much of it happening on traditional grocers’ websites—has increased the scale of the overall retail media opportunity, making grocers’ websites more valuable as advertising properties and establishing their growing online audiences as important marketing assets. Amazon, which spearheaded the retail media trend, has taken advantage of its massive audience: The online retailer offers preferential placement of “sponsored products” and other promoted marketing on its website. This incremental advertising revenue has a high drop-through to the bottom line, and has allowed Amazon to invest in price and service capabilities.Figure 3. Amazon: Advertising Revenues and Net Income (USD Bil.) [caption id="attachment_135777" align="aligncenter" width="700"]

Amazon lists its advertising revenues in “Other” segment, which primarily consists of sales of advertising services and sales related to its service offerings

Amazon lists its advertising revenues in “Other” segment, which primarily consists of sales of advertising services and sales related to its service offeringsSource: Company reports[/caption] In its Investor Day held on March 31, 2021, Kroger reported that its retail media business grew 135% year over year in FY2021, with almost 1,300 brands using its Kroger Precision Marketing platform. This helped contribute $150 million in incremental operating profit to the company. The company projects its advertising business to grow nearly 30% in FY2022 and sees the potential for a multibillion-dollar retail media business in the next few years. In its second-quarter earnings call ended July 31, 2021, Walmart reported that its advertising business, Walmart Connect (known as Walmart Media Group until January 2021), grew 95% year over year, with the number of active advertisers rising by more than 175% in the second quarter. Brands and retailers are not the only ones looking to capitalize on the retail media surge. A significant new category of third-party technology providers has emerged to help retailers set up their own media networks or help brands buy from those retail media networks. This space is highly fragmented and overlapping, and still expanding with new entrants.

Figure 4. Technology Vendor Landscape in Retail Media [wpdatatable id=1424]

Source: Coresight Research

2. Instacart Is Doubling Down as an Advertising Platform for CPG Brands Instacart is an important player to watch as the US grocery sector turns its focus toward retail media. The pandemic spurred a surge in grocery delivery demand, catapulting Instacart from a luxury to almost an essential service. The company’s substantial growth has made it a serious contender in grocery e-commerce alongside Walmart and Amazon. Instacart has ambitions to grow into a significant advertising platform. In May 2020, Instacart launched a new advertising tool that CPG brands can use to promote their products on Instacart’s website and app. The new self-service tool, called “Featured Products,” is based around keyword-targeted advertising campaigns and allows advertisers to bid on relevant keywords and then promote products related to those terms. Instacart’s other ad formats, including coupons, promotions for free delivery and banner adverts, will remain a part of its managed advertising offering. The company reportedly introduced more advertising placements after 2020 saw uptake of its Featured Products service triple and the number of advertisers on the platform quintuple. Coresight Research has identified from job advertisements posted by Instacart that the company is looking to grow its advertising revenue by five times over the next two to three years. Instacart is also investing heavily in advertising expertise to strengthen its retail media team. In August 2021, Instacart appointed Fidji Simo as its new CEO, replacing its founder Apoorva Mehta. Before joining Instacart, Simo served as VP and Head of the Facebook app, and oversaw Facebook’s mobile monetization strategy and advertising business. Instacart also appointed Carolyn Everson as President in the same month; like the new CEO, she spent more than a decade at Facebook and brings extensive experience in building advertising relationships. Over the past year, Instacart has also added two senior hires to its retail media business: Vice President of Ad Sales Ryan Mayward, who joined from Amazon, and Vice President of Ads Engineering Vik Gupta, previously from Google. Other players in quick commerce are pushing into retail media, too—as we noted in our recent report, these companies enjoy greater opportunities in advertising as they scale. At the Groceryshop 2021 conference, Yakir Gola, Co-Founder and Co-CEO of vertically integrated instant-needs company Gopuff, pointed to the company’s opportunities in retail media, stating that as an instant-needs platform, it can influence the customer’s decision at the moment of consumption. DoorDash launched a new advertising offering in October 2021. 3. Tightening Consumer Privacy Standards Heighten the Opportunity Tightening consumer privacy standards have undercut longstanding digital marketing tools such as third-party cookies. In June 2021, Google announced that it would begin phasing out third-party cookie functionality in Chrome’s browser by 2023, with Firefox and Safari following suit. The digital marketing ecosystem has long relied upon third-party cookies as the primary mode of orchestrating digital advertising. In addition, in April 2021, Apple announced that it had made the Identifier for Advertisers (IDFA) opt-in, which makes it much more difficult for marketers to track users. These developments will hinder advertisers’ insights into which consumers have been exposed to ads, as well as their ability to connect data to that of other channels. Retail media fills this void: retailers’ ability to access first-party data and close the loop by identifying those who make a purchase after seeing an ad makes it a compelling new channel for advertisers. Some retailers such as Walmart and Kroger aim to blend in-store sales into the picture as well, and they have the first-party shopper data across traditional and digital channels to do it. Retail media offers advertisers the ability to use closed-loop attribution, meaning transaction data is tied to advertising data. This is possible because the same company is running the advertisement and selling the product advertised. This allows marketers to prove return on advertising spend (RoAS) and connect media exposure with product purchase decisions. It is harder for advertising platforms such as Facebook and Google to do this because users typically click away to retail sites or apps to complete their purchases. As the digital privacy landscape evolves, retail media is well positioned to benefit.What We Think

We believe retail media will become a permanent and integral part of how grocery retailers generate revenue. Structural shifts in the advertising marketplace have created the opportunity for retailers to become highly effective channels for marketing investment. Since building out e-commerce capabilities consumes much of retailers’ time and resources, monetizing their sites will be a priority—particularly as they look for a source of steady profits to offset their lower-margin e-commerce business. Implications for Retailers- We believe retail media will increase in importance as consumers continue to shift their habits online. The advertising solution can be a win-win for all parties involved, with shoppers benefitting from the personalized offers, CPG companies experiencing increased brand awareness and higher return on their ad spend and retailers garnering increased product sales and alternative revenue.

- As Instacart doubles down on retail media, other quick-commerce players will be watching closely and learning from its example—and a number of rivals are already pushing into retail media. As Instacart prepares for a possible public offering, the growth prospects in retail media could be an important focus for future investors. Retail media revenue can compensate if pandemic-driven demand in its core business fades, and can be supported by the addition of new features such as live video streams from influencers, conversational AI and augmented reality to unlock opportunities.

- As more retailers join the retail media bandwagon, competition for advertising budgets will increase, underscoring the need to provide brands and advertisers with a good experience and greater return on their spending. Retailers should provide efficient workflows, greater access to data and more accurate measurement within their retail media solutions.

- Regional and smaller grocers who rely solely on delivery-provider marketplaces such as Instacart are automatically excluded from the benefits of advertising. By developing their own e-commerce websites and digital capabilities they could take advantage of the opportunities that exist in retail media and grow new revenue streams.