DIpil Das

Introduction

Advances in digital technology are changing the way the consumer packaged goods (CPG) category operates — from product design to sales channels to inventory management.

Data analytics powered by machine learning have enabled companies to produce more relevant products and to better manage inventory with more accurate demand forecasting. The growth in e-commerce has also facilitated a direct-to-consumer approach, resulting in the emergence of startups that threaten the status quo of traditional CPG players and which are forcing incumbents to adapt to online.

This is how digital disruption has affected CPG.

E-Commerce Sales Thrive: Traditional Companies Adapt Amid Threats from Startups

As sales in physical stores have become saturated, the online channel has become the principal driver of CPG sales growth:

Unilever’s flagship store on e-commerce platform Tmall.com

Unilever’s flagship store on e-commerce platform Tmall.com

Source: Tmall.com [/caption] [caption id="attachment_87469" align="aligncenter" width="640"] P&G’s online shopping site eStore

P&G’s online shopping site eStore

Source: Pgshop.com [/caption] E-commerce as a share of P&G’s total revenue has increased steadily from about 5% in fiscal 2016 to about 7% in fiscal 2018, according to the company’s annual reports. Unilever recorded 47% growth in e-commerce sales in fiscal 2018 according to the company’s annual report, outpacing global e-commerce market growth. Unilever expects e-commerce sales to account for 10% of its total turnover by 2023. However, incumbent CPG companies are at a disadvantage when adopting the e-commerce model. For CPGs selling typically low-cost items, the direct-to-consumer model carries unfavorable economics: It is much more profitable to ship a large number of units to one retail customer than to dispatch the same number of units, one or a few at a time, to many individual shoppers. Moreover, CPG operations were designed around a wholesale model, meaning they must invest heavily to build out direct-to-consumer fulfillment capabilities. At the same time, CPG companies face challenges from startups. To avoid further disruption from digitally native and omni-channel CPG startups and capture more of the growth in e-commerce, traditional CPG companies have to invest in DTC e-commerce despite the model’s potentially margin-eroding economics. In the long term, established CPG companies are better positioned to understand customers’ shopping behavior by analyzing data from online shopping portals, so they can pinpoint what, when and how many of specific products to produce, enabling them to meet demand in a more agile way while avoiding excess production. As e-commerce ramps up, CPG firms may build their own distribution centers in strategic locations for cost-efficient delivery. Going online gives CPG companies access to valuable customer data they might not otherwise have – and data is becoming increasingly crucial. Direct-to-Consumer Underlines the Need of Personalization We believe the strong growth in online channels is not simply a result of consumers shifting some of their spending online: There is a “pull” effect from CPG startups that personalize offerings and establish a closer relationship with customers. For example, California-based haircare brand eSalon tailors unique hair color formulas for customers after they create a personal profile that asks for information such as hair history, color goals and facial features. This creates a personalized shopping experience, with extra touches such as individually labeled bottles bearing the customers’ name, formula ID and date of production. Since the company’s launch in the US in 2010, it has expanded to Canada, the UK and elsewhere in Europe. In addition to shifting online, traditional CPG brands are also personalizing products. For example, Gillette launched the Razor Maker concept in 2018 that allows customers in the US to create their own razors with customized engraving, preferred grip and color. [caption id="attachment_87470" align="aligncenter" width="640"] Gillette’s Razor Maker concept

Gillette’s Razor Maker concept

Source: P&G [/caption] Packaging Evolution As a Result of E-Commerce Large CPG companies are looking to make e-commerce more operable, especially to overcome the last-mile challenge that carries logistics costs. One of the first steps is to innovate product design and packaging to make products more suitable for delivery – especially for products that contain chemicals or liquids. P&G launched the Tide Eco-Box in January 2019. The bag-in-box design avoids the need for additional boxing or bubble wrap, and concentrating the formula cut water content 30% (shedding extra weight). The lighter box design makes it easier to load onto a delivery truck – and more can be loaded as they take up less space. [caption id="attachment_87471" align="aligncenter" width="640"] P&G’s Tide Eco-Box laundry detergent

P&G’s Tide Eco-Box laundry detergent

Source: P&G [/caption] In 2018, Unilever’s household and personal care brand Seventh Generation, a leader in natural products and sustainable production, launched EasyDose Ultra-Concentrated Laundry Detergent – fully five pounds lighter and nine inches shorter than the original 100-ounce bottle. The smaller size and lighter weight makes it far more delivery-friendly. [caption id="attachment_87474" align="aligncenter" width="409"] Seventh Generation’s EasyDose Ultraconcentrated Laundry Detergent

Seventh Generation’s EasyDose Ultraconcentrated Laundry Detergent

Source: Seventh Generation [/caption] Subscription Model Brings Customers Closer to CPG Companies The subscription model is one of the more disrupting aspects of online as it reinvents the way consumers shop for CPG products: Consumables people buy regularly can be purchased using a monthly or quarterly subscription. A number of startups have launched online services to challenge incumbent CPG brands. US-based Dollar Shave Club delivers razors, shaving amenities and other personal grooming products by mail, successfully challenging the dominant position of P&G-owned Gillette. As Dollar Shave Club directly approaches its customers, it is able to engage them and build a unique brand experience: Dollar Shave Club’s Restock Box for subscribers

Dollar Shave Club’s Restock Box for subscribers

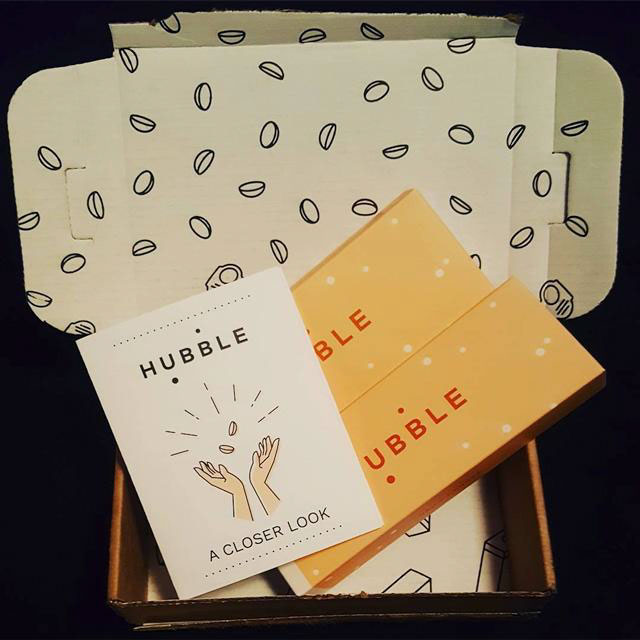

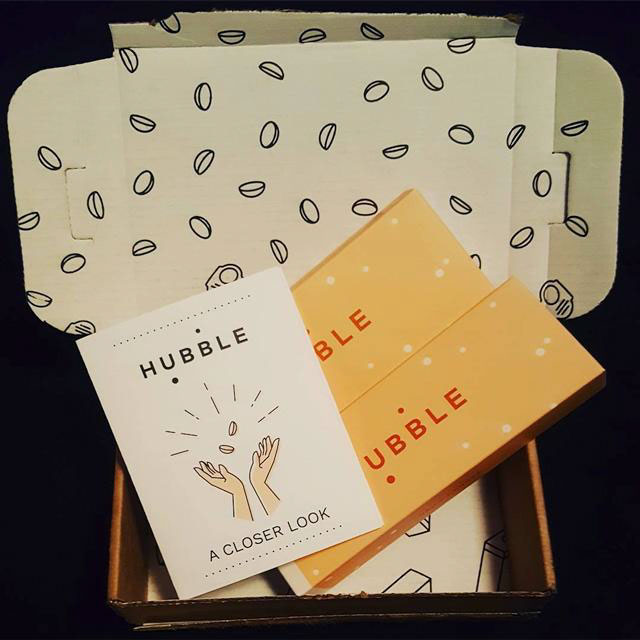

Source: Dollarshaveclub.com [/caption] Similarly, New York-based startup Hubble operates a subscription model for contact lens delivery. Colgate invested in the company in 2018, just two years after it was founded. Under the partnership, Colgate will trial selling its teeth-whitening products through Hubble’s platform. [caption id="attachment_87476" align="aligncenter" width="640"] Hubble’s delivery box

Hubble’s delivery box

Source: Hubblecontacts.com [/caption] The rapid rise of online and the growing popularity of subscription models pose a real threat to traditional CPG companies. To keep up, legacy CPG companies have followed suit by launching their own subscription models for various products. Since acquiring Dollar Shave Club, Unilever has expanded Dollar Shave Club’s subscription service to include shower and oral care products. P&G also started a series of subscription services including:

- Paris-based marketing company Criteo estimates around 90% of overall CPG growth came from online channels in 2018.

- According to US-based market research company Rakuten Intelligence, US e-commerce CPG sales grew 29% year over year in the 52 weeks ended August 25, 2018, while total CPG sales grew only 2.6%.

Unilever’s flagship store on e-commerce platform Tmall.com

Unilever’s flagship store on e-commerce platform Tmall.com Source: Tmall.com [/caption] [caption id="attachment_87469" align="aligncenter" width="640"]

P&G’s online shopping site eStore

P&G’s online shopping site eStore Source: Pgshop.com [/caption] E-commerce as a share of P&G’s total revenue has increased steadily from about 5% in fiscal 2016 to about 7% in fiscal 2018, according to the company’s annual reports. Unilever recorded 47% growth in e-commerce sales in fiscal 2018 according to the company’s annual report, outpacing global e-commerce market growth. Unilever expects e-commerce sales to account for 10% of its total turnover by 2023. However, incumbent CPG companies are at a disadvantage when adopting the e-commerce model. For CPGs selling typically low-cost items, the direct-to-consumer model carries unfavorable economics: It is much more profitable to ship a large number of units to one retail customer than to dispatch the same number of units, one or a few at a time, to many individual shoppers. Moreover, CPG operations were designed around a wholesale model, meaning they must invest heavily to build out direct-to-consumer fulfillment capabilities. At the same time, CPG companies face challenges from startups. To avoid further disruption from digitally native and omni-channel CPG startups and capture more of the growth in e-commerce, traditional CPG companies have to invest in DTC e-commerce despite the model’s potentially margin-eroding economics. In the long term, established CPG companies are better positioned to understand customers’ shopping behavior by analyzing data from online shopping portals, so they can pinpoint what, when and how many of specific products to produce, enabling them to meet demand in a more agile way while avoiding excess production. As e-commerce ramps up, CPG firms may build their own distribution centers in strategic locations for cost-efficient delivery. Going online gives CPG companies access to valuable customer data they might not otherwise have – and data is becoming increasingly crucial. Direct-to-Consumer Underlines the Need of Personalization We believe the strong growth in online channels is not simply a result of consumers shifting some of their spending online: There is a “pull” effect from CPG startups that personalize offerings and establish a closer relationship with customers. For example, California-based haircare brand eSalon tailors unique hair color formulas for customers after they create a personal profile that asks for information such as hair history, color goals and facial features. This creates a personalized shopping experience, with extra touches such as individually labeled bottles bearing the customers’ name, formula ID and date of production. Since the company’s launch in the US in 2010, it has expanded to Canada, the UK and elsewhere in Europe. In addition to shifting online, traditional CPG brands are also personalizing products. For example, Gillette launched the Razor Maker concept in 2018 that allows customers in the US to create their own razors with customized engraving, preferred grip and color. [caption id="attachment_87470" align="aligncenter" width="640"]

Gillette’s Razor Maker concept

Gillette’s Razor Maker concept Source: P&G [/caption] Packaging Evolution As a Result of E-Commerce Large CPG companies are looking to make e-commerce more operable, especially to overcome the last-mile challenge that carries logistics costs. One of the first steps is to innovate product design and packaging to make products more suitable for delivery – especially for products that contain chemicals or liquids. P&G launched the Tide Eco-Box in January 2019. The bag-in-box design avoids the need for additional boxing or bubble wrap, and concentrating the formula cut water content 30% (shedding extra weight). The lighter box design makes it easier to load onto a delivery truck – and more can be loaded as they take up less space. [caption id="attachment_87471" align="aligncenter" width="640"]

P&G’s Tide Eco-Box laundry detergent

P&G’s Tide Eco-Box laundry detergent Source: P&G [/caption] In 2018, Unilever’s household and personal care brand Seventh Generation, a leader in natural products and sustainable production, launched EasyDose Ultra-Concentrated Laundry Detergent – fully five pounds lighter and nine inches shorter than the original 100-ounce bottle. The smaller size and lighter weight makes it far more delivery-friendly. [caption id="attachment_87474" align="aligncenter" width="409"]

Seventh Generation’s EasyDose Ultraconcentrated Laundry Detergent

Seventh Generation’s EasyDose Ultraconcentrated Laundry Detergent Source: Seventh Generation [/caption] Subscription Model Brings Customers Closer to CPG Companies The subscription model is one of the more disrupting aspects of online as it reinvents the way consumers shop for CPG products: Consumables people buy regularly can be purchased using a monthly or quarterly subscription. A number of startups have launched online services to challenge incumbent CPG brands. US-based Dollar Shave Club delivers razors, shaving amenities and other personal grooming products by mail, successfully challenging the dominant position of P&G-owned Gillette. As Dollar Shave Club directly approaches its customers, it is able to engage them and build a unique brand experience:

- Dollar Shave Club offers subscribers an exclusive community experience. When customers sign up, they get a welcome email, occasional free samples and a monthly newsletter called The Bathroom Minutes to keep customers informed of new product information and offers.

- The company also focuses heavily on social media: When members share pictures of their monthly box on Instagram, the company selects favorites and rewards members who posted the winning pictures.

Dollar Shave Club’s Restock Box for subscribers

Dollar Shave Club’s Restock Box for subscribers Source: Dollarshaveclub.com [/caption] Similarly, New York-based startup Hubble operates a subscription model for contact lens delivery. Colgate invested in the company in 2018, just two years after it was founded. Under the partnership, Colgate will trial selling its teeth-whitening products through Hubble’s platform. [caption id="attachment_87476" align="aligncenter" width="640"]

Hubble’s delivery box

Hubble’s delivery box Source: Hubblecontacts.com [/caption] The rapid rise of online and the growing popularity of subscription models pose a real threat to traditional CPG companies. To keep up, legacy CPG companies have followed suit by launching their own subscription models for various products. Since acquiring Dollar Shave Club, Unilever has expanded Dollar Shave Club’s subscription service to include shower and oral care products. P&G also started a series of subscription services including:

- Gillette On Demand razor subscriptions to counter Dollar Shave Club.

- Tide Wash Club in Atlanta: Customers sign up online for regular delivery of Tide detergent.

- Tide Spin service in Chicago that will pick up, wash, fold, and deliver laundry.

- Hindustan Unilever, Unilever’s India subsidiary, used a predictive analytics software called Jarvis driven by artificial intelligence technology to forecast demand and sales.

- P&G partnered with US-based supply chain solutions company E2open to develop its latest demand planning solution for the global market.