DIpil Das

Source: Company reports/Coresight Research[/caption]

Source: Company reports/Coresight Research[/caption]

2Q19 Results

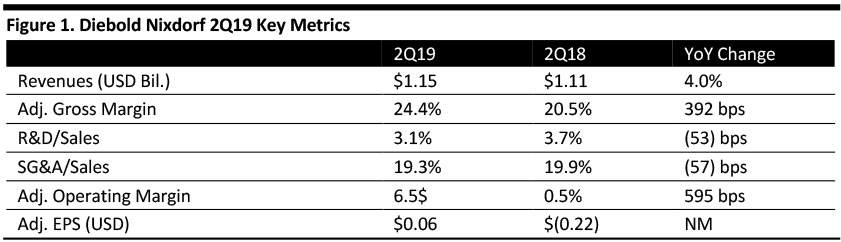

Diebold Nixdorf reported 2Q19 revenues of $1.15 billion, up 4.0% as reported and up 8.0% in constant currency and beating the $1.07 billion consensus estimate.

The 392 basis-point gross-margin gain is a result of the company’s services modernization plan, which runs through 2021.

Adjusted EPS was $0.06, above $(0.22) in the year-ago quarter and beating the $(0.15) consensus estimate. GAAP EPS was $(0.66), compared to $(1.76) in the year-ago quarter.

Adjusted EBITDA was $106.8 million, up from $40.8 million in the year-ago quarter.

Management characterized performance in the quarter as strong, with revenues increasing in constant currency in all three segments, and adjusted operating profit improved $69 million year over year. Management commented further that its DN Now initiatives are gaining traction and it anticipates building momentum following the FN Series next-generation banking solution, which was announced during the quarter.

Details from the Quarter

- Announced the next-generation DN Series family of self-service solutions (i.e., ATMs) that enable multiple capabilities for financial-service companies, including as Internet of Things connectivity, interface with mobile devices, near-field communication (NFC) technology, biometric technology, high note capacity and anti-skimming options.

- Completed the process to squeeze out minority shareholders in the German Diebold Nixdorf AG subsidiary to complete the acquisition.

- Won a $17 million contract from Banco Itaú Unibanco in Brazil to transform its branch network and increase automation via cash recyclers, full-function ATMs and maintenance services.

- Experienced solid growth in self-checkout demand from several European customers, including a $7 million contract with UK-based retailer Co-Op for more than 400 self-checkout terminals and related services.

- Won a new frame agreement with Commerzbank for several hundred ATMs with a multi-year software and services maintenance contract.

- Won a contract to upgrade BBVA Bancomer’s ATM fleet in Mexico with 750 cash recyclers.

- Orders increased 5% year over year in constant currency.

Results by Segment

Eurasia Banking SegmentRevenues were $438 million, down 1.7% as reported and up 4% in constant currency. Strong product growth in EMEA was partially offset by declines in Asia Pacific. Software revenue was down, primarily due to divestitures. Service revenue was down slightly in EMEA.

Americas Banking SegmentRevenues in the Americas banking segment were $371 million, up 13.3% as reported and up 14% in constant currency. Strong product revenue growth was driven by Windows 10 upgrades and recycling. Service and software revenue were down slightly.

Retail SegmentRevenues were $298 million, up 0.9% as reported and up 6% in constant currency. Product growth was centered primarily in Europe. Service revenue was up slightly despite divestitures, and software revenue grew modestly.

DW Now Update

The program aims to achieve total savings of $400 million through 2021E, which is expected to generate $100 million of cash in 2019 to be used for debt reduction. The key points of the program are:

- Streamlining the operating model.

- Simplifying the product portfolio and the manufacturing footprint.

- Implementing a services modernization plan.

- Reducing SG&A expense further, including global spend analytics and targets.

- Improving net working capital.

- Divesting non-core businesses.

Implications for Retail

Diebold Nixdorf is oriented towards retail, serving as an innovation partner to the majority of the top 25 global retailers. Its business is benefiting from the continued acceptance of its self-checkout and POS solutions, and the company won four major contracts during the quarter.

Outlook The company raised/reiterated its prior 2019 guidance:- Revenues of $4.5 billion (down 2% over the same period last year), up from $4.4-4.5 billion.

- Adjusted EBITDA of $380-420 million (up 15-27% over the same period last year).