DIpil Das

[caption id="attachment_86506" align="aligncenter" width="720"] Source: Company reports/Coresight Research[/caption]

1Q19 Results

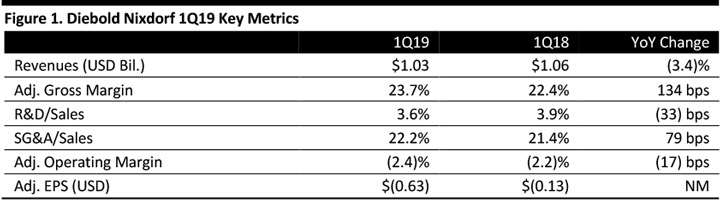

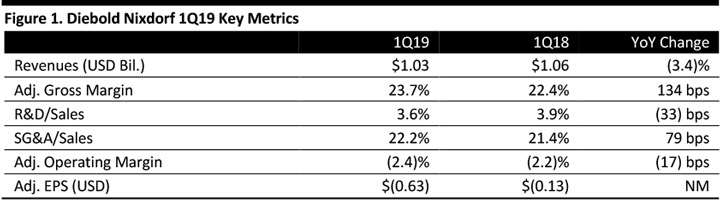

Diebold Nixdorf reported 1Q19 revenues of $1.03 billion, down 3.4% as reported but up 3.0% in constant currency, below the $1.05 billion consensus estimate.

Source: Company reports/Coresight Research[/caption]

1Q19 Results

Diebold Nixdorf reported 1Q19 revenues of $1.03 billion, down 3.4% as reported but up 3.0% in constant currency, below the $1.05 billion consensus estimate.

Source: Company reports/Coresight Research[/caption]

1Q19 Results

Diebold Nixdorf reported 1Q19 revenues of $1.03 billion, down 3.4% as reported but up 3.0% in constant currency, below the $1.05 billion consensus estimate.

Source: Company reports/Coresight Research[/caption]

1Q19 Results

Diebold Nixdorf reported 1Q19 revenues of $1.03 billion, down 3.4% as reported but up 3.0% in constant currency, below the $1.05 billion consensus estimate.

- Service revenue was $544 million, down 8.1% as reported and down 2.9% in constant currency.

- Product revenue was $376 million, up 6.6% as reported and up 10.6% in constant currency.

- Software revenue was $283 million, down 4.3% as reported and up 3.0% in constant currency.

- Revenues in the Eurasia banking segment were $382.6 million, down 12.1% as reported and down 4.2% in constant currency. Revenues declined in Asia due to a focus on higher-margin business, the decision not to renew a low-margin contract in India, a divestiture, all somewhat offset by modest growth in the EMEA region. Within the segment:

- Service revenues were $212.3 million, down 11.0% as reported and down 3.5% in constant currency.

- Product revenues were $127.8 million, down 13.2% as reported and down 5.0% in constant currency.

- Software revenues were $42.5 million, down 13.8% as reported and down 5.3% in constant currency.

- Revenues in the Americas banking segment were $362.7 million, up 8.7% as reported and up 10.6% in constant currency. Growth was strong year over year due to Windows 10 upgrades, growth in software, however, services were down slightly year over year. Within the segment:

- Service revenues were $222.1 million, down 4.0% as reported and down 2.6% in constant currency.

- Product revenues were $108.5 million, up 49.4% as reported and up 52.0% in constant currency.

- Software revenues were $32.1 million, up 8.1% as reported and up 13.0% in constant currency.

- Revenues in the retail segment were $282.8 million, down 4.3% as reported and up 4.2% in constant currency. Product growth was led by Europe and the Americas, partially offset by decreases in services and software. Within the segment:

- Service revenues were $109.8 million, down 10.2% as reported and down 2.3% in constant currency.

- Product revenues were $139.4 million, up 5.1% as reported and up 14.2% in constant currency.

- Software revenues were $33.6 million, down 17.0% as reported and down 8.9% in constant currency.

- Revenues of $4.4-4.5 billion (down 2-4%).

- Adjusted EBITDA of $380-420 million (up 15-27%).