Source: Company reports/Coresight Research

Fiscal 1Q19 Results

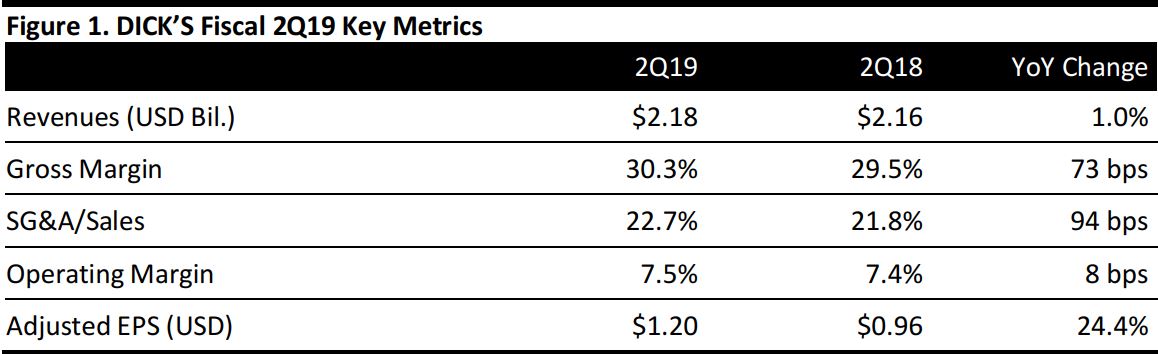

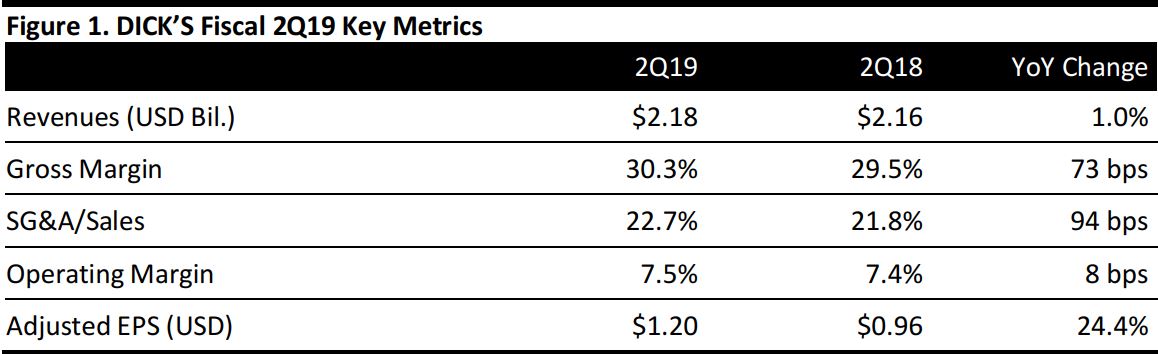

DICK’S reported fiscal 2Q19 revenues of $2.18 billion, up 1.0% year over year but below the $2.24 billion consensus estimate.

Comps declined by 4.0%, adjusted for the calendar shift, missing the consensus estimate of a 0.7% decline. Based on an unshifted calendar, comps decreased 1.9%. Comps were impacted by strategic decisions made regarding the slow growth, low-margin hunt and electronics business.

E-commerce sales grew by 12%, and penetration was approximately 11% of sales, compared to 9% in the year-ago quarter.

Adjusted EPS was $1.20, up 24.4% from $0.96 a year ago and beating the $1.04 consensus estimate. GAAP EPS in 2Q18 was $1.03.

Details from the Quarter

Management commented that earnings reflected improved execution of the company’s merchandising strategy, which resulted in higher merchandise margins. Product newness, strength in its private brands and a more refined assortment led to a much healthier business, with fewer promotions and cleaner inventory throughout the quarter. The company expects these benefits to continue as it optimizes its assortment. DICK’S also plans to continue to invest to enhance its omnichannel experience.

- During this quarter, DICK’s delivered double-digit growth in private brands and athletic apparel, excluding Under Armour, which experienced significant declines because of distribution expansion.

- Merchandise margin expanded 141 basis points, primary driven by improved product cycles, fewer promotions and a favorable merchandising mix.

- Total inventory decreased 6.4% at the end of the quarter versus a year ago, reflecting better execution, which translates to better merchandise margin rates. The company continues to work at optimizing its assortment and vendor base.

- DICK’S has expanded its CALIA collection to new categories and given it premium space in its stores. In the three years since launch, CALIA has grown to be the company’s number-three private brand and the number-two brand in women's athletic apparel, after Nike.

- In 2Q19, DICK’s partnered with its vendors to elevate the collective voices. The company co-launched the Play Like campaign with Nike, and received over 20 million views in its first week.

- Management cited its strategic framework for improving the omnichannel experience for athletes:

- The company is pursuing relentless improvement of its core execution to make its shopping experience the best in retail, including making it frictionless for athletes to engage all touch points of their journey, regardless of when, where or how they want to visit.

- There are two areas within the shopping path that are key priorities: first, making it easier for athletes to find the best products to meet their needs by increasing in-stock positions and depth and presenting products in powerful and impactful ways; and second, making it more convenient for athletes to complete transactions. This includes focusing on speed of checkout, both in-store and online.

- The company is focused on lowering costs and eliminating unnecessary spending to reinvest in strategic growth initiatives. It will continue to invest in the customer experience, the store environment and its supply chain.

Outlook

The company provided the following guidance for fiscal 2019:

- It raised EPS guidance to $3.02–$3.20 from $2.92–$3.12 previously.

- It reiterated comps of flat to a low single-digit decline on a 52-week to 52-week basis, compared to a decline of 0.3% the previous year.

DICK’s is investing in its first company-operated regional e-commerce fulfillment center in the Bennington, New York area. In addition, the company expects to open a small fulfillment center for the Western region of the US late in 2019.