Source: Company reports/Coresight Research

Source: Company reports/Coresight Research

Q17 Results

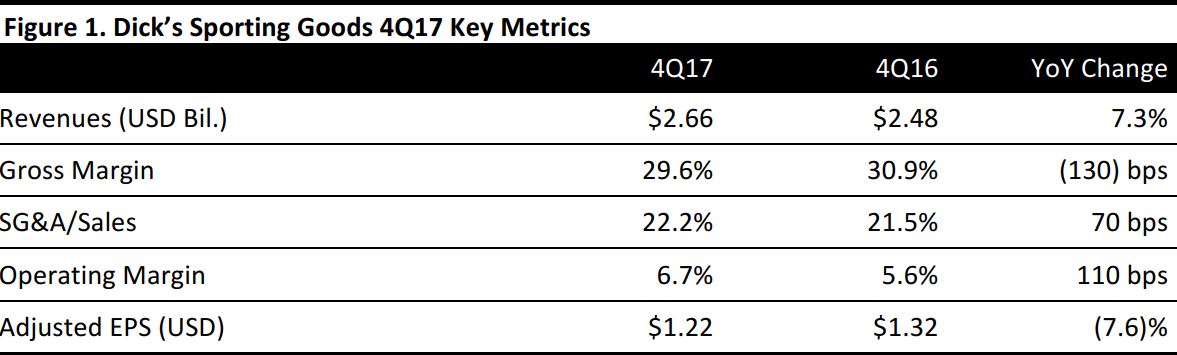

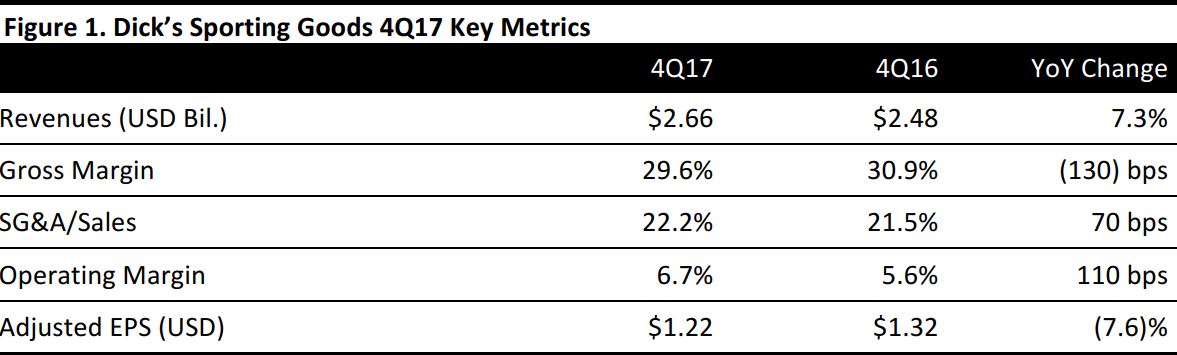

Dick’s Sporting Goods reported 4Q17 adjusted EPS of $1.22, down 7.6% year over year but beating the $1.20 consensus estimate and in line with company guidance. Revenues were $2.66 billion, up 7.3% year over year but below the $2.74 billion consensus estimate. Online sales increased by 9% from the prior-year quarter.As a percent of total net sales, online sales increased from 17.9% to 19.0% year over year.

Comps were down 2.0%, missing the consensus estimate of a 0.9% decline and versus prior guidance calling for a low-single-digit decline. The comp decline was driven by a 2% decline in average ticket due to promotions. Transactions were flat, while merchandise inventories were $1.71 billion, up 4.4% from the prior-year quarter.

By category, the team sports, footwear and outdoor equipment categories reported positive comps. The company’s private-label brands reported double-digit comp sales and improved margins. These gains were offset by comps in the hunt and electronics categories, which fell by high single digits and double digits, respectively. The apparel business reported flat comps.

Details from the Year

- Dick’s Sporting Goods raised the age limit for the purchase of any firearm from 18 to 21.

- The company has been expanding its distribution and discounting merchandise.

- The private-label business posted a double-digit comp increase and reported expanded gross margins, with sales reaching $1 billion.

- The company made enhancements to its Score Card loyalty program.

FY17 Results

- Full-year revenues were $8.59 billion, up 8.4% from FY16. Comps decreased by 0.3% from the previous year.

- Adjusted EPS was $3.01, compared with $3.12 in the prior year.

Outlook

For FY18, management expects:

- Comps to be flat to down by low single digits. The consensus estimate calls for comp growth of 0.2%.

- EPS of $2.80–$3.00, above the $2.79 consensus estimate.

The company plans to give more store space to its private-label brands, such as Second Skin workout apparel. Management expects sales of its private-label brands to continue to outpace the company average in FY18 and to surpass $2 billion in sales in a “short period of time,” although no exact time frame was specified.The company said that it expected to see continued softness in the hunting gear market this year and that it expects foot traffic to be negatively affected by the gun sales policy change.

Source: Company reports/Coresight Research

Source: Company reports/Coresight Research