Nitheesh NH

[caption id="attachment_80155" align="aligncenter" width="620"] Source: Company reports/Coresight Research[/caption]

4Q18 Results

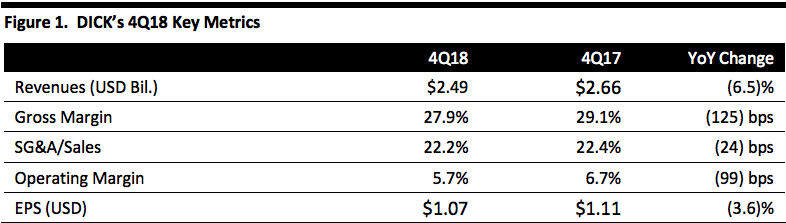

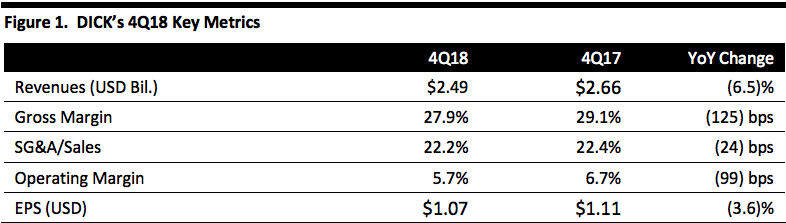

Dick’s Sporting Goods 4Q18 revenues were $2.49 billion, down 6.5% year over year and beating the consensus estimate of $2.48 billion. The company reported 4Q18 EPS of $1.07, down 3.6% from the year-ago period, and above the consensus estimate of $1.06.

Revenues for the fiscal year 2018 decreased 1.8%, from $8.59 billion to $8.44 billion.

The company saw consolidated comparable sales growth of (2.2)% for the quarter on a shifted basis compared to (6.5%) in the year ago period, and the consensus estimate of (3.3)%. This was in line with the company’s expectations. The company reported that it is seeing double-digit declines in the hunt and electronics categories, which taken together, impacted comp sales by 3% for the quarter. Excluding these impacts, consolidated same-store sales increased 0.8%.

Management reported its e-commerce business increased 17% over the same period last year. As a percent of total net sales, e-commerce increased to 23% compared to 19% in the same period last year.

During the quarter, the best performing categories included apparel, athletic footwear, outdoor equipment, fitness and private brands.

The company reported that it is focusing on three investment areas for 2019: The in-store experience, e-commerce fulfillment and technology.

In-store experience: Management reported it will focus on optimizing its assortment, reallocating space for growing categories, and making stores more experiential. The company reported that in 2018, it removed the “hunt category” from 10 Dick’s stores: All hunting-related items – including guns and ammunition. The company reported this category underperformed and replaced it with a more compelling assortment: These stores had positive comp sales during the fourth quarter. Dick’s decided to remove hunt from 125 underperforming stores in 2019.

During 2018, its private brands grew double digits. In 2019, the company stated it will continue to focus on its private brands as a strategy to drive differentiation and exclusivity in assortment. Specifically, management commented that in 2019, it plans to expand Carrie Underwood’s CALIA athletic brand to 80 stores. Additionally, management commented that it plans to launch a new athletic apparel brand in time for back to school.

To enhance the in-store expereince, the company launched “HitTrax” batting cage technology in over 150 stores, which allows consumers to test bats for performance. The technology measures the launch angle, exit velocity and distance. Based on the initial test of HitTrax, the company will expand batting cages into more of its stores in 2019.

E-Commerce Fulfillment: Management reported it is building two new dedicated e-commerce fulfillment centers in New York and California, which will open during the third quarter of 2019. The new fulfillment centers will enable the company to deliver the majority of online orders within two business days.

Technology: Management is improving the functionality and performanc of its websiste through a faster checkout process.

Stores: Management reported it expects to open seven new stores and relocate three in 2019. The company expects to open two new Golf Galaxy stores and relocate one Golf Galaxy store in 2019. Six of the new stores are expected to open during the third quarter.

Outlook

For fiscal year 2019, the company expects earnings per share to be in the range of $3.15-3.35, compared to the consensus estimate of $3.34. Management projects consolidated same store sales to be flat to 2%, compared to the consensus estimate of 0.5%.

Source: Company reports/Coresight Research[/caption]

4Q18 Results

Dick’s Sporting Goods 4Q18 revenues were $2.49 billion, down 6.5% year over year and beating the consensus estimate of $2.48 billion. The company reported 4Q18 EPS of $1.07, down 3.6% from the year-ago period, and above the consensus estimate of $1.06.

Revenues for the fiscal year 2018 decreased 1.8%, from $8.59 billion to $8.44 billion.

The company saw consolidated comparable sales growth of (2.2)% for the quarter on a shifted basis compared to (6.5%) in the year ago period, and the consensus estimate of (3.3)%. This was in line with the company’s expectations. The company reported that it is seeing double-digit declines in the hunt and electronics categories, which taken together, impacted comp sales by 3% for the quarter. Excluding these impacts, consolidated same-store sales increased 0.8%.

Management reported its e-commerce business increased 17% over the same period last year. As a percent of total net sales, e-commerce increased to 23% compared to 19% in the same period last year.

During the quarter, the best performing categories included apparel, athletic footwear, outdoor equipment, fitness and private brands.

The company reported that it is focusing on three investment areas for 2019: The in-store experience, e-commerce fulfillment and technology.

In-store experience: Management reported it will focus on optimizing its assortment, reallocating space for growing categories, and making stores more experiential. The company reported that in 2018, it removed the “hunt category” from 10 Dick’s stores: All hunting-related items – including guns and ammunition. The company reported this category underperformed and replaced it with a more compelling assortment: These stores had positive comp sales during the fourth quarter. Dick’s decided to remove hunt from 125 underperforming stores in 2019.

During 2018, its private brands grew double digits. In 2019, the company stated it will continue to focus on its private brands as a strategy to drive differentiation and exclusivity in assortment. Specifically, management commented that in 2019, it plans to expand Carrie Underwood’s CALIA athletic brand to 80 stores. Additionally, management commented that it plans to launch a new athletic apparel brand in time for back to school.

To enhance the in-store expereince, the company launched “HitTrax” batting cage technology in over 150 stores, which allows consumers to test bats for performance. The technology measures the launch angle, exit velocity and distance. Based on the initial test of HitTrax, the company will expand batting cages into more of its stores in 2019.

E-Commerce Fulfillment: Management reported it is building two new dedicated e-commerce fulfillment centers in New York and California, which will open during the third quarter of 2019. The new fulfillment centers will enable the company to deliver the majority of online orders within two business days.

Technology: Management is improving the functionality and performanc of its websiste through a faster checkout process.

Stores: Management reported it expects to open seven new stores and relocate three in 2019. The company expects to open two new Golf Galaxy stores and relocate one Golf Galaxy store in 2019. Six of the new stores are expected to open during the third quarter.

Outlook

For fiscal year 2019, the company expects earnings per share to be in the range of $3.15-3.35, compared to the consensus estimate of $3.34. Management projects consolidated same store sales to be flat to 2%, compared to the consensus estimate of 0.5%.

Source: Company reports/Coresight Research[/caption]

4Q18 Results

Dick’s Sporting Goods 4Q18 revenues were $2.49 billion, down 6.5% year over year and beating the consensus estimate of $2.48 billion. The company reported 4Q18 EPS of $1.07, down 3.6% from the year-ago period, and above the consensus estimate of $1.06.

Revenues for the fiscal year 2018 decreased 1.8%, from $8.59 billion to $8.44 billion.

The company saw consolidated comparable sales growth of (2.2)% for the quarter on a shifted basis compared to (6.5%) in the year ago period, and the consensus estimate of (3.3)%. This was in line with the company’s expectations. The company reported that it is seeing double-digit declines in the hunt and electronics categories, which taken together, impacted comp sales by 3% for the quarter. Excluding these impacts, consolidated same-store sales increased 0.8%.

Management reported its e-commerce business increased 17% over the same period last year. As a percent of total net sales, e-commerce increased to 23% compared to 19% in the same period last year.

During the quarter, the best performing categories included apparel, athletic footwear, outdoor equipment, fitness and private brands.

The company reported that it is focusing on three investment areas for 2019: The in-store experience, e-commerce fulfillment and technology.

In-store experience: Management reported it will focus on optimizing its assortment, reallocating space for growing categories, and making stores more experiential. The company reported that in 2018, it removed the “hunt category” from 10 Dick’s stores: All hunting-related items – including guns and ammunition. The company reported this category underperformed and replaced it with a more compelling assortment: These stores had positive comp sales during the fourth quarter. Dick’s decided to remove hunt from 125 underperforming stores in 2019.

During 2018, its private brands grew double digits. In 2019, the company stated it will continue to focus on its private brands as a strategy to drive differentiation and exclusivity in assortment. Specifically, management commented that in 2019, it plans to expand Carrie Underwood’s CALIA athletic brand to 80 stores. Additionally, management commented that it plans to launch a new athletic apparel brand in time for back to school.

To enhance the in-store expereince, the company launched “HitTrax” batting cage technology in over 150 stores, which allows consumers to test bats for performance. The technology measures the launch angle, exit velocity and distance. Based on the initial test of HitTrax, the company will expand batting cages into more of its stores in 2019.

E-Commerce Fulfillment: Management reported it is building two new dedicated e-commerce fulfillment centers in New York and California, which will open during the third quarter of 2019. The new fulfillment centers will enable the company to deliver the majority of online orders within two business days.

Technology: Management is improving the functionality and performanc of its websiste through a faster checkout process.

Stores: Management reported it expects to open seven new stores and relocate three in 2019. The company expects to open two new Golf Galaxy stores and relocate one Golf Galaxy store in 2019. Six of the new stores are expected to open during the third quarter.

Outlook

For fiscal year 2019, the company expects earnings per share to be in the range of $3.15-3.35, compared to the consensus estimate of $3.34. Management projects consolidated same store sales to be flat to 2%, compared to the consensus estimate of 0.5%.

Source: Company reports/Coresight Research[/caption]

4Q18 Results

Dick’s Sporting Goods 4Q18 revenues were $2.49 billion, down 6.5% year over year and beating the consensus estimate of $2.48 billion. The company reported 4Q18 EPS of $1.07, down 3.6% from the year-ago period, and above the consensus estimate of $1.06.

Revenues for the fiscal year 2018 decreased 1.8%, from $8.59 billion to $8.44 billion.

The company saw consolidated comparable sales growth of (2.2)% for the quarter on a shifted basis compared to (6.5%) in the year ago period, and the consensus estimate of (3.3)%. This was in line with the company’s expectations. The company reported that it is seeing double-digit declines in the hunt and electronics categories, which taken together, impacted comp sales by 3% for the quarter. Excluding these impacts, consolidated same-store sales increased 0.8%.

Management reported its e-commerce business increased 17% over the same period last year. As a percent of total net sales, e-commerce increased to 23% compared to 19% in the same period last year.

During the quarter, the best performing categories included apparel, athletic footwear, outdoor equipment, fitness and private brands.

The company reported that it is focusing on three investment areas for 2019: The in-store experience, e-commerce fulfillment and technology.

In-store experience: Management reported it will focus on optimizing its assortment, reallocating space for growing categories, and making stores more experiential. The company reported that in 2018, it removed the “hunt category” from 10 Dick’s stores: All hunting-related items – including guns and ammunition. The company reported this category underperformed and replaced it with a more compelling assortment: These stores had positive comp sales during the fourth quarter. Dick’s decided to remove hunt from 125 underperforming stores in 2019.

During 2018, its private brands grew double digits. In 2019, the company stated it will continue to focus on its private brands as a strategy to drive differentiation and exclusivity in assortment. Specifically, management commented that in 2019, it plans to expand Carrie Underwood’s CALIA athletic brand to 80 stores. Additionally, management commented that it plans to launch a new athletic apparel brand in time for back to school.

To enhance the in-store expereince, the company launched “HitTrax” batting cage technology in over 150 stores, which allows consumers to test bats for performance. The technology measures the launch angle, exit velocity and distance. Based on the initial test of HitTrax, the company will expand batting cages into more of its stores in 2019.

E-Commerce Fulfillment: Management reported it is building two new dedicated e-commerce fulfillment centers in New York and California, which will open during the third quarter of 2019. The new fulfillment centers will enable the company to deliver the majority of online orders within two business days.

Technology: Management is improving the functionality and performanc of its websiste through a faster checkout process.

Stores: Management reported it expects to open seven new stores and relocate three in 2019. The company expects to open two new Golf Galaxy stores and relocate one Golf Galaxy store in 2019. Six of the new stores are expected to open during the third quarter.

Outlook

For fiscal year 2019, the company expects earnings per share to be in the range of $3.15-3.35, compared to the consensus estimate of $3.34. Management projects consolidated same store sales to be flat to 2%, compared to the consensus estimate of 0.5%.