Nitheesh NH

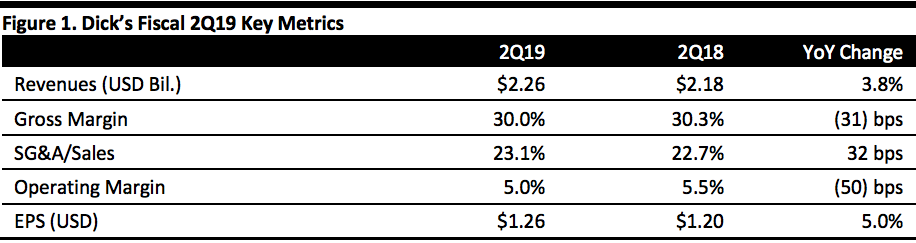

[caption id="attachment_95197" align="aligncenter" width="700"] Source: Company reports/Coresight Research[/caption]

1Q19 Results

Dick’s reported fiscal 2Q19 revenues of $2.26 billion, beating the consensus estimate of $2.21 billion, and up 3.8% year over year. The company reported 2Q19 earnings per share of $1.26, higher than the consensus estimate of $1.21 and higher than the year ago period.

Consolidated same store sales were up 3.2%, driven by an increase in average ticket and transactions and beating the consensus estimate of 0.9%. Comp store sales achieved the strongest quarterly growth since 2016.

During the quarter, the company completed the sale of two technology subsidiaries, Blue Sombrero and Affinity Sports, to Stack Sports for $45 million. The sale is expected to result in a one-time gain which will be determined later in the third quarter.

Management said its inventory levels were too lean. Therefore, Dick’s made strategic inventory investments in key growth categories, which increased inventory 19% by the end of the second quarter compared to same period last year. The company reported that inventory investment has improved in-stock levels.

Dick’s removed the hunt category (which consists of supplies for hunting, including ammunition and rifles) from 10 underperforming stores last year. The company replaced it with more compelling localized assortments. During the second quarter, these stores generated their third consecutive quarter of positive comp sales and outperformed the balance of the chain. This quarter, Dick’s removed the hunt category from approximately 125 additional stores and replaced it with categories and products that can drive growth. It is too early to assess the result, but the company is optimistic regarding the change.

During the second quarter, Dick’s expanded its HitTrax technology and batting cage experience to approximately 20 more stores, bringing the enhanced interactive consumer experience to a total of 170 stores in the second quarter.

The company reported its e-commerce business grew 21% over the same quarter last year. Dick’s commented it continues to improve the functionality and performance of its website. Nearly 90% of all BOPIS orders are filled and ready for pickup within 30 minutes, according to the company.

The company opened two dedicated e-commerce fulfillment centers in New York and California and formed a delivery partnership with FedEx. Management said it seeks to cut delivery time by nearly one day in many cases and create delivery efficiencies.

Dick’s scorecard loyalty program has more than 20 million active users, who account for over 70% of sales. In October, the company will launch the scorecard gold program nationally, an enhanced tier to better reward and engage its most loyal members. Gold benefits will include opportunities to redeem points, early access to sales and product launches and VIP events. The company plans to make improvements and offer customers increased benefits.

The company reported it is getting more involved in community experiences. For example, in partnership with the Dick’s Sporting Goods Foundation, the company founded the Sports Matter program in 2014, focused on youth sports funding. Last month, the Dick’s Sporting Goods Foundation pledged to provide access to sports for one million additional young athletes nationwide by 2024 by matching up to $1 million in donations made by outside athletes to the foundation. Additionally, the foundation created a new Sports Matter Advisory Board comprised of influential sports figures.

Management said it is looking at other experiential trials it may bring to the store, such as climbing and other outdoor categories. For example, next year, Dick’s plans to open a store in Rochester, New York, that will include a climbing wall.

Outlook

The company raised its fiscal year 2019 diluted EPS guidance to $3.30-3.45 compared to prior guidance of $3.20-3.40.

The company said its updated earnings guidance is based on an estimated 90 million average shares outstanding and includes the expected impact from all tariffs currently in effect, as well as a new 10% tariff on most remaining imports slated to go into effect later this fall.

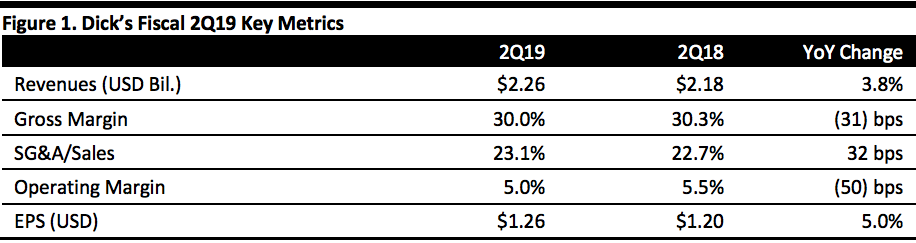

Source: Company reports/Coresight Research[/caption]

1Q19 Results

Dick’s reported fiscal 2Q19 revenues of $2.26 billion, beating the consensus estimate of $2.21 billion, and up 3.8% year over year. The company reported 2Q19 earnings per share of $1.26, higher than the consensus estimate of $1.21 and higher than the year ago period.

Consolidated same store sales were up 3.2%, driven by an increase in average ticket and transactions and beating the consensus estimate of 0.9%. Comp store sales achieved the strongest quarterly growth since 2016.

During the quarter, the company completed the sale of two technology subsidiaries, Blue Sombrero and Affinity Sports, to Stack Sports for $45 million. The sale is expected to result in a one-time gain which will be determined later in the third quarter.

Management said its inventory levels were too lean. Therefore, Dick’s made strategic inventory investments in key growth categories, which increased inventory 19% by the end of the second quarter compared to same period last year. The company reported that inventory investment has improved in-stock levels.

Dick’s removed the hunt category (which consists of supplies for hunting, including ammunition and rifles) from 10 underperforming stores last year. The company replaced it with more compelling localized assortments. During the second quarter, these stores generated their third consecutive quarter of positive comp sales and outperformed the balance of the chain. This quarter, Dick’s removed the hunt category from approximately 125 additional stores and replaced it with categories and products that can drive growth. It is too early to assess the result, but the company is optimistic regarding the change.

During the second quarter, Dick’s expanded its HitTrax technology and batting cage experience to approximately 20 more stores, bringing the enhanced interactive consumer experience to a total of 170 stores in the second quarter.

The company reported its e-commerce business grew 21% over the same quarter last year. Dick’s commented it continues to improve the functionality and performance of its website. Nearly 90% of all BOPIS orders are filled and ready for pickup within 30 minutes, according to the company.

The company opened two dedicated e-commerce fulfillment centers in New York and California and formed a delivery partnership with FedEx. Management said it seeks to cut delivery time by nearly one day in many cases and create delivery efficiencies.

Dick’s scorecard loyalty program has more than 20 million active users, who account for over 70% of sales. In October, the company will launch the scorecard gold program nationally, an enhanced tier to better reward and engage its most loyal members. Gold benefits will include opportunities to redeem points, early access to sales and product launches and VIP events. The company plans to make improvements and offer customers increased benefits.

The company reported it is getting more involved in community experiences. For example, in partnership with the Dick’s Sporting Goods Foundation, the company founded the Sports Matter program in 2014, focused on youth sports funding. Last month, the Dick’s Sporting Goods Foundation pledged to provide access to sports for one million additional young athletes nationwide by 2024 by matching up to $1 million in donations made by outside athletes to the foundation. Additionally, the foundation created a new Sports Matter Advisory Board comprised of influential sports figures.

Management said it is looking at other experiential trials it may bring to the store, such as climbing and other outdoor categories. For example, next year, Dick’s plans to open a store in Rochester, New York, that will include a climbing wall.

Outlook

The company raised its fiscal year 2019 diluted EPS guidance to $3.30-3.45 compared to prior guidance of $3.20-3.40.

The company said its updated earnings guidance is based on an estimated 90 million average shares outstanding and includes the expected impact from all tariffs currently in effect, as well as a new 10% tariff on most remaining imports slated to go into effect later this fall.

Source: Company reports/Coresight Research[/caption]

1Q19 Results

Dick’s reported fiscal 2Q19 revenues of $2.26 billion, beating the consensus estimate of $2.21 billion, and up 3.8% year over year. The company reported 2Q19 earnings per share of $1.26, higher than the consensus estimate of $1.21 and higher than the year ago period.

Consolidated same store sales were up 3.2%, driven by an increase in average ticket and transactions and beating the consensus estimate of 0.9%. Comp store sales achieved the strongest quarterly growth since 2016.

During the quarter, the company completed the sale of two technology subsidiaries, Blue Sombrero and Affinity Sports, to Stack Sports for $45 million. The sale is expected to result in a one-time gain which will be determined later in the third quarter.

Management said its inventory levels were too lean. Therefore, Dick’s made strategic inventory investments in key growth categories, which increased inventory 19% by the end of the second quarter compared to same period last year. The company reported that inventory investment has improved in-stock levels.

Dick’s removed the hunt category (which consists of supplies for hunting, including ammunition and rifles) from 10 underperforming stores last year. The company replaced it with more compelling localized assortments. During the second quarter, these stores generated their third consecutive quarter of positive comp sales and outperformed the balance of the chain. This quarter, Dick’s removed the hunt category from approximately 125 additional stores and replaced it with categories and products that can drive growth. It is too early to assess the result, but the company is optimistic regarding the change.

During the second quarter, Dick’s expanded its HitTrax technology and batting cage experience to approximately 20 more stores, bringing the enhanced interactive consumer experience to a total of 170 stores in the second quarter.

The company reported its e-commerce business grew 21% over the same quarter last year. Dick’s commented it continues to improve the functionality and performance of its website. Nearly 90% of all BOPIS orders are filled and ready for pickup within 30 minutes, according to the company.

The company opened two dedicated e-commerce fulfillment centers in New York and California and formed a delivery partnership with FedEx. Management said it seeks to cut delivery time by nearly one day in many cases and create delivery efficiencies.

Dick’s scorecard loyalty program has more than 20 million active users, who account for over 70% of sales. In October, the company will launch the scorecard gold program nationally, an enhanced tier to better reward and engage its most loyal members. Gold benefits will include opportunities to redeem points, early access to sales and product launches and VIP events. The company plans to make improvements and offer customers increased benefits.

The company reported it is getting more involved in community experiences. For example, in partnership with the Dick’s Sporting Goods Foundation, the company founded the Sports Matter program in 2014, focused on youth sports funding. Last month, the Dick’s Sporting Goods Foundation pledged to provide access to sports for one million additional young athletes nationwide by 2024 by matching up to $1 million in donations made by outside athletes to the foundation. Additionally, the foundation created a new Sports Matter Advisory Board comprised of influential sports figures.

Management said it is looking at other experiential trials it may bring to the store, such as climbing and other outdoor categories. For example, next year, Dick’s plans to open a store in Rochester, New York, that will include a climbing wall.

Outlook

The company raised its fiscal year 2019 diluted EPS guidance to $3.30-3.45 compared to prior guidance of $3.20-3.40.

The company said its updated earnings guidance is based on an estimated 90 million average shares outstanding and includes the expected impact from all tariffs currently in effect, as well as a new 10% tariff on most remaining imports slated to go into effect later this fall.

Source: Company reports/Coresight Research[/caption]

1Q19 Results

Dick’s reported fiscal 2Q19 revenues of $2.26 billion, beating the consensus estimate of $2.21 billion, and up 3.8% year over year. The company reported 2Q19 earnings per share of $1.26, higher than the consensus estimate of $1.21 and higher than the year ago period.

Consolidated same store sales were up 3.2%, driven by an increase in average ticket and transactions and beating the consensus estimate of 0.9%. Comp store sales achieved the strongest quarterly growth since 2016.

During the quarter, the company completed the sale of two technology subsidiaries, Blue Sombrero and Affinity Sports, to Stack Sports for $45 million. The sale is expected to result in a one-time gain which will be determined later in the third quarter.

Management said its inventory levels were too lean. Therefore, Dick’s made strategic inventory investments in key growth categories, which increased inventory 19% by the end of the second quarter compared to same period last year. The company reported that inventory investment has improved in-stock levels.

Dick’s removed the hunt category (which consists of supplies for hunting, including ammunition and rifles) from 10 underperforming stores last year. The company replaced it with more compelling localized assortments. During the second quarter, these stores generated their third consecutive quarter of positive comp sales and outperformed the balance of the chain. This quarter, Dick’s removed the hunt category from approximately 125 additional stores and replaced it with categories and products that can drive growth. It is too early to assess the result, but the company is optimistic regarding the change.

During the second quarter, Dick’s expanded its HitTrax technology and batting cage experience to approximately 20 more stores, bringing the enhanced interactive consumer experience to a total of 170 stores in the second quarter.

The company reported its e-commerce business grew 21% over the same quarter last year. Dick’s commented it continues to improve the functionality and performance of its website. Nearly 90% of all BOPIS orders are filled and ready for pickup within 30 minutes, according to the company.

The company opened two dedicated e-commerce fulfillment centers in New York and California and formed a delivery partnership with FedEx. Management said it seeks to cut delivery time by nearly one day in many cases and create delivery efficiencies.

Dick’s scorecard loyalty program has more than 20 million active users, who account for over 70% of sales. In October, the company will launch the scorecard gold program nationally, an enhanced tier to better reward and engage its most loyal members. Gold benefits will include opportunities to redeem points, early access to sales and product launches and VIP events. The company plans to make improvements and offer customers increased benefits.

The company reported it is getting more involved in community experiences. For example, in partnership with the Dick’s Sporting Goods Foundation, the company founded the Sports Matter program in 2014, focused on youth sports funding. Last month, the Dick’s Sporting Goods Foundation pledged to provide access to sports for one million additional young athletes nationwide by 2024 by matching up to $1 million in donations made by outside athletes to the foundation. Additionally, the foundation created a new Sports Matter Advisory Board comprised of influential sports figures.

Management said it is looking at other experiential trials it may bring to the store, such as climbing and other outdoor categories. For example, next year, Dick’s plans to open a store in Rochester, New York, that will include a climbing wall.

Outlook

The company raised its fiscal year 2019 diluted EPS guidance to $3.30-3.45 compared to prior guidance of $3.20-3.40.

The company said its updated earnings guidance is based on an estimated 90 million average shares outstanding and includes the expected impact from all tariffs currently in effect, as well as a new 10% tariff on most remaining imports slated to go into effect later this fall.