DIpil Das

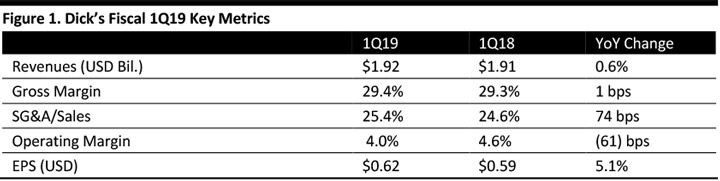

[caption id="attachment_89420" align="aligncenter" width="720"] Source: Company reports/Coresight Research[/caption]

1Q19 Results

Dick’s reported fiscal 1Q19 revenues of $1.92 billion, beating the consensus estimate of $1.90 billion, and up 0.6% year over year. The company reported 1Q19 earnings per share of $0.62, higher than the consensus estimate of $0.58 and higher than the year-ago period.

Comparable sales were flat for the quarter compared to the consensus estimate of (1.3%).

The company reported its e-commerce business grew 15% over last year. Dick’s commented that it is continuing to improve the functionality and performance of its website. During the first quarter, the company launched a new search engine that improved page load times for search results across both desktop and mobile, which the company said grew buy online pick up in store (BOPIS) orders. Management commented that growth was accomplished via improved site messaging, inventory availability and in-store execution.

Management stated that BOPIS is a strategic priority to enhance e-commerce profitability, increase store traffic and get products into the hands of consumers. Nearly 90% of all BOPIS orders are filled and ready for pickup within 30 minutes, according to the company.

Same-store sales turned positive in March and remained positive in April.

In the third quarter last year, Dick’s removed the hunt category from ten Dick's stores in which it underperformed and replaced it with a localized assortment. Management said it sees strength in these stores with positive comps sales and merchandise margin rate improvement. Dick’s is on track to reallocate floor space in approximately 125 additional Dick’s stores during the second quarter, replacing the hunt category (which consists of supplies for hunting including ammunition and rifles) with merchandise categories based on local markets. The company is completing a strategic review of its hunt business, including its Field & Stream stores.

During the first quarter, Dick’s expanded its HitTrax technology and batting cage experience to approximately 150 stores, and plans to add this interactive consumer experience to 20 more stores in the second quarter.

Management commented that its private brands business outpaced the company average, delivering positive comps in the first quarter. Management said it is focusing on growing existing brands while launching new brands as part of reaching its $2 billion sales goal in private brands.

During the quarter, the company expanded Carrie Underwood’s athletic brand (CALIA) footprint to 80 stores. For back-to-school, the company announced it plans to launch DSG, a high-quality, value-oriented performance brand across men's, women's and kids' athletic apparel. DSG will be available only at Dick’s and is positioned to compete against similar offerings in department and other sporting goods stores.

The company expects to open seven new Dick’s Sporting Goods stores and relocate three in 2019. The company also expects to open two new Golf Galaxy stores and relocate one in 2019. Six of the new stores are expected to open during the third quarter.

Outlook

The company raised its fiscal year 2019 EPS guidance to $3.20-3.40 from $3.15-3.35, versus the consensus estimate of $3.27. The company projects consolidated comps will be slightly positive to up 2%, in line with prior guidance of flat to up 2% and compared to the consensus estimate of 0.7%. Dicks expects to deliver positive same-store sales beginning in 2Q19.

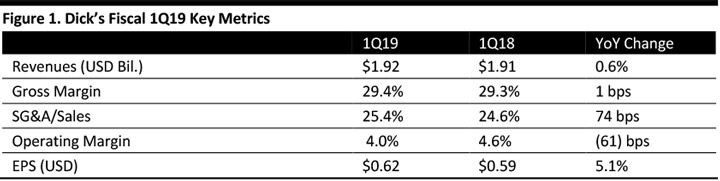

Source: Company reports/Coresight Research[/caption]

1Q19 Results

Dick’s reported fiscal 1Q19 revenues of $1.92 billion, beating the consensus estimate of $1.90 billion, and up 0.6% year over year. The company reported 1Q19 earnings per share of $0.62, higher than the consensus estimate of $0.58 and higher than the year-ago period.

Comparable sales were flat for the quarter compared to the consensus estimate of (1.3%).

The company reported its e-commerce business grew 15% over last year. Dick’s commented that it is continuing to improve the functionality and performance of its website. During the first quarter, the company launched a new search engine that improved page load times for search results across both desktop and mobile, which the company said grew buy online pick up in store (BOPIS) orders. Management commented that growth was accomplished via improved site messaging, inventory availability and in-store execution.

Management stated that BOPIS is a strategic priority to enhance e-commerce profitability, increase store traffic and get products into the hands of consumers. Nearly 90% of all BOPIS orders are filled and ready for pickup within 30 minutes, according to the company.

Same-store sales turned positive in March and remained positive in April.

In the third quarter last year, Dick’s removed the hunt category from ten Dick's stores in which it underperformed and replaced it with a localized assortment. Management said it sees strength in these stores with positive comps sales and merchandise margin rate improvement. Dick’s is on track to reallocate floor space in approximately 125 additional Dick’s stores during the second quarter, replacing the hunt category (which consists of supplies for hunting including ammunition and rifles) with merchandise categories based on local markets. The company is completing a strategic review of its hunt business, including its Field & Stream stores.

During the first quarter, Dick’s expanded its HitTrax technology and batting cage experience to approximately 150 stores, and plans to add this interactive consumer experience to 20 more stores in the second quarter.

Management commented that its private brands business outpaced the company average, delivering positive comps in the first quarter. Management said it is focusing on growing existing brands while launching new brands as part of reaching its $2 billion sales goal in private brands.

During the quarter, the company expanded Carrie Underwood’s athletic brand (CALIA) footprint to 80 stores. For back-to-school, the company announced it plans to launch DSG, a high-quality, value-oriented performance brand across men's, women's and kids' athletic apparel. DSG will be available only at Dick’s and is positioned to compete against similar offerings in department and other sporting goods stores.

The company expects to open seven new Dick’s Sporting Goods stores and relocate three in 2019. The company also expects to open two new Golf Galaxy stores and relocate one in 2019. Six of the new stores are expected to open during the third quarter.

Outlook

The company raised its fiscal year 2019 EPS guidance to $3.20-3.40 from $3.15-3.35, versus the consensus estimate of $3.27. The company projects consolidated comps will be slightly positive to up 2%, in line with prior guidance of flat to up 2% and compared to the consensus estimate of 0.7%. Dicks expects to deliver positive same-store sales beginning in 2Q19.

Source: Company reports/Coresight Research[/caption]

1Q19 Results

Dick’s reported fiscal 1Q19 revenues of $1.92 billion, beating the consensus estimate of $1.90 billion, and up 0.6% year over year. The company reported 1Q19 earnings per share of $0.62, higher than the consensus estimate of $0.58 and higher than the year-ago period.

Comparable sales were flat for the quarter compared to the consensus estimate of (1.3%).

The company reported its e-commerce business grew 15% over last year. Dick’s commented that it is continuing to improve the functionality and performance of its website. During the first quarter, the company launched a new search engine that improved page load times for search results across both desktop and mobile, which the company said grew buy online pick up in store (BOPIS) orders. Management commented that growth was accomplished via improved site messaging, inventory availability and in-store execution.

Management stated that BOPIS is a strategic priority to enhance e-commerce profitability, increase store traffic and get products into the hands of consumers. Nearly 90% of all BOPIS orders are filled and ready for pickup within 30 minutes, according to the company.

Same-store sales turned positive in March and remained positive in April.

In the third quarter last year, Dick’s removed the hunt category from ten Dick's stores in which it underperformed and replaced it with a localized assortment. Management said it sees strength in these stores with positive comps sales and merchandise margin rate improvement. Dick’s is on track to reallocate floor space in approximately 125 additional Dick’s stores during the second quarter, replacing the hunt category (which consists of supplies for hunting including ammunition and rifles) with merchandise categories based on local markets. The company is completing a strategic review of its hunt business, including its Field & Stream stores.

During the first quarter, Dick’s expanded its HitTrax technology and batting cage experience to approximately 150 stores, and plans to add this interactive consumer experience to 20 more stores in the second quarter.

Management commented that its private brands business outpaced the company average, delivering positive comps in the first quarter. Management said it is focusing on growing existing brands while launching new brands as part of reaching its $2 billion sales goal in private brands.

During the quarter, the company expanded Carrie Underwood’s athletic brand (CALIA) footprint to 80 stores. For back-to-school, the company announced it plans to launch DSG, a high-quality, value-oriented performance brand across men's, women's and kids' athletic apparel. DSG will be available only at Dick’s and is positioned to compete against similar offerings in department and other sporting goods stores.

The company expects to open seven new Dick’s Sporting Goods stores and relocate three in 2019. The company also expects to open two new Golf Galaxy stores and relocate one in 2019. Six of the new stores are expected to open during the third quarter.

Outlook

The company raised its fiscal year 2019 EPS guidance to $3.20-3.40 from $3.15-3.35, versus the consensus estimate of $3.27. The company projects consolidated comps will be slightly positive to up 2%, in line with prior guidance of flat to up 2% and compared to the consensus estimate of 0.7%. Dicks expects to deliver positive same-store sales beginning in 2Q19.

Source: Company reports/Coresight Research[/caption]

1Q19 Results

Dick’s reported fiscal 1Q19 revenues of $1.92 billion, beating the consensus estimate of $1.90 billion, and up 0.6% year over year. The company reported 1Q19 earnings per share of $0.62, higher than the consensus estimate of $0.58 and higher than the year-ago period.

Comparable sales were flat for the quarter compared to the consensus estimate of (1.3%).

The company reported its e-commerce business grew 15% over last year. Dick’s commented that it is continuing to improve the functionality and performance of its website. During the first quarter, the company launched a new search engine that improved page load times for search results across both desktop and mobile, which the company said grew buy online pick up in store (BOPIS) orders. Management commented that growth was accomplished via improved site messaging, inventory availability and in-store execution.

Management stated that BOPIS is a strategic priority to enhance e-commerce profitability, increase store traffic and get products into the hands of consumers. Nearly 90% of all BOPIS orders are filled and ready for pickup within 30 minutes, according to the company.

Same-store sales turned positive in March and remained positive in April.

In the third quarter last year, Dick’s removed the hunt category from ten Dick's stores in which it underperformed and replaced it with a localized assortment. Management said it sees strength in these stores with positive comps sales and merchandise margin rate improvement. Dick’s is on track to reallocate floor space in approximately 125 additional Dick’s stores during the second quarter, replacing the hunt category (which consists of supplies for hunting including ammunition and rifles) with merchandise categories based on local markets. The company is completing a strategic review of its hunt business, including its Field & Stream stores.

During the first quarter, Dick’s expanded its HitTrax technology and batting cage experience to approximately 150 stores, and plans to add this interactive consumer experience to 20 more stores in the second quarter.

Management commented that its private brands business outpaced the company average, delivering positive comps in the first quarter. Management said it is focusing on growing existing brands while launching new brands as part of reaching its $2 billion sales goal in private brands.

During the quarter, the company expanded Carrie Underwood’s athletic brand (CALIA) footprint to 80 stores. For back-to-school, the company announced it plans to launch DSG, a high-quality, value-oriented performance brand across men's, women's and kids' athletic apparel. DSG will be available only at Dick’s and is positioned to compete against similar offerings in department and other sporting goods stores.

The company expects to open seven new Dick’s Sporting Goods stores and relocate three in 2019. The company also expects to open two new Golf Galaxy stores and relocate one in 2019. Six of the new stores are expected to open during the third quarter.

Outlook

The company raised its fiscal year 2019 EPS guidance to $3.20-3.40 from $3.15-3.35, versus the consensus estimate of $3.27. The company projects consolidated comps will be slightly positive to up 2%, in line with prior guidance of flat to up 2% and compared to the consensus estimate of 0.7%. Dicks expects to deliver positive same-store sales beginning in 2Q19.