Source: Company reports

4Q15 RESULTS

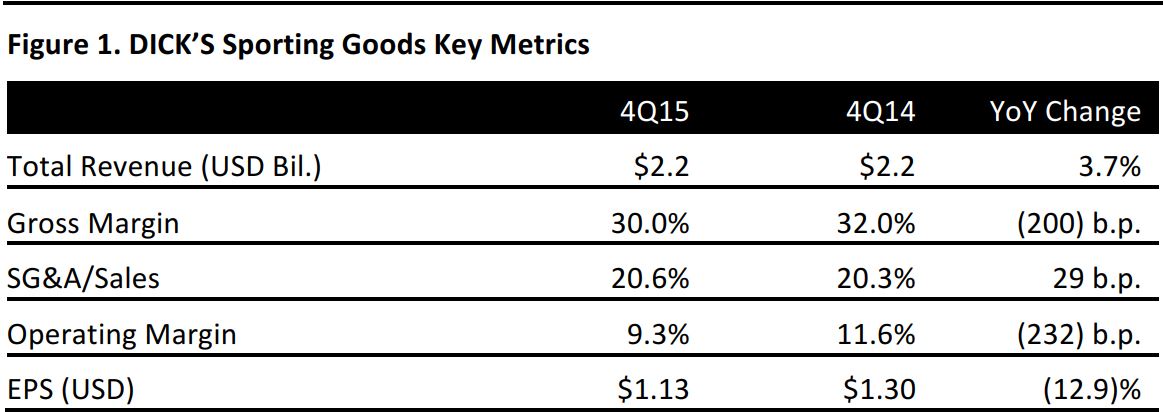

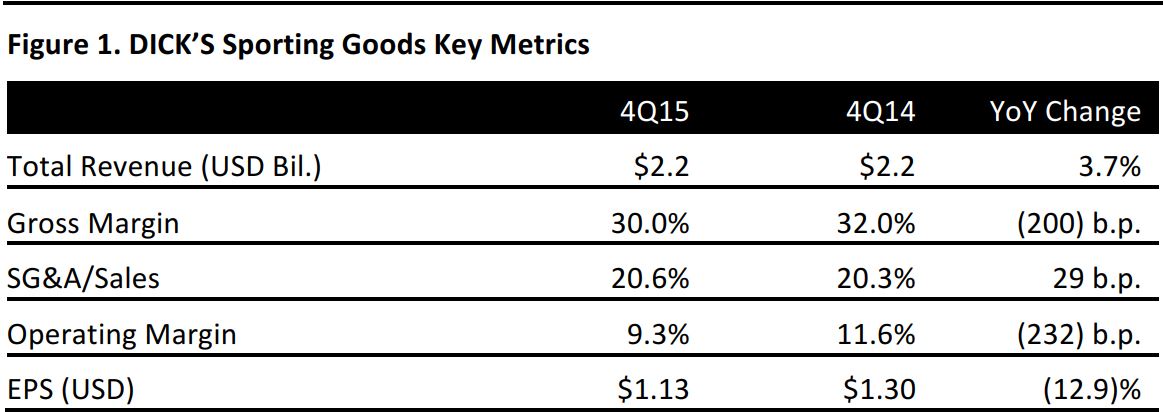

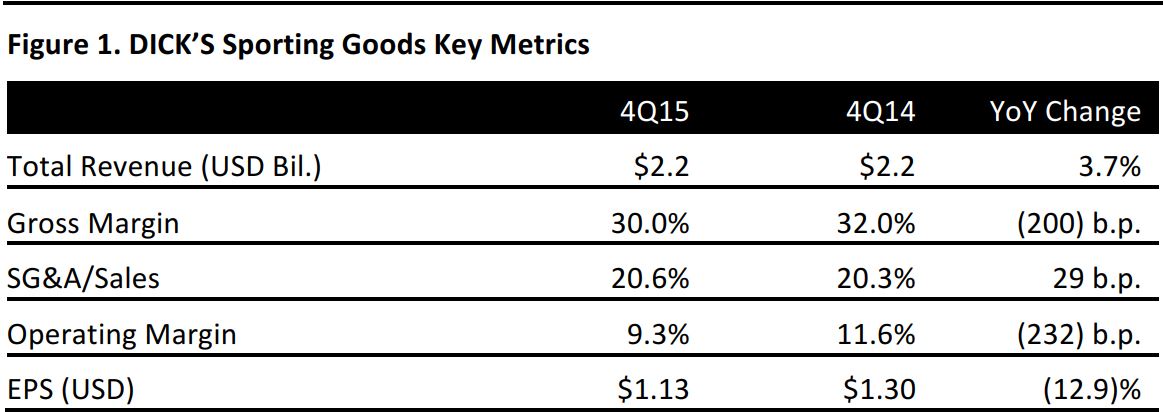

DICK’S Sporting Goods reported 4Q15 revenues of $2.2 billion, $40 million below the consensus estimate. Comps fell by 2.5%, comprising a comp decline of 2.5% for DICK’s Sporting Goods and a decline of 5.8% for Golf Galaxy.

E-commerce amounted to 15.7% of sales, compared to 14.4% in the year-ago quarter.

In the quarter, the company opened one new DICK’S Sporting Goods store (in Farmington, NM), relocated one store and closed two stores. It also closed two Golf Galaxy stores.

2015 RESULTS

Full-year revenues were $7.3 billion, up 6.7% from the prior year. The increase was driven by new store openings, but was partially offset by a 0.2% consolidated same-store sales decrease.

In the year, e-commerce amounted to 10.3% of net sales, compared to 9.2% in the prior year.

During the year, the company opened 44 DICK’S Sporting Goods stores and 11 specialty store concepts (combo stores, which combine a DICK’S store with Golf Galaxy or Field & Stream). It also remodeled two DICK’S stores and relocated a total of eight stores.

GAAP EPS was $2.83, compared to $2.84 the prior year. Non-GAAP EPS was $2.87, which excludes a pretax litigation settlement charge of $7.9 million.

OUTLOOK

For 2016, the company expects a same-store sales increase of 0%–2%, which puts revenues in the range of $7.3–$7.4 billion, below the consensus estimate of $7.9 billion. EPS guidance is for $2.85–$3.00, below the consensus estimate of $3.25.

In the year, the company expects to open about 36 new DICK’S Sporting Goods stores and to relocate about nine. It also plans to open approximately nine new Field & Stream stores and two new Golf Galaxy stores.

The company also expects capital expenditures of $230 million on a net basis (compared to $204 million in 2015) and of approximately $420 million on a gross basis (compared to approximately $370 million in 2015).

For 1Q16, the company expects same-store sales to increase by 0%–1%, which would put revenues at approximately $1.6 billion, below the $1.7 billion consensus estimate. The company also expects EPS of $0.48–$0.50, below the consensus estimate of $0.54.