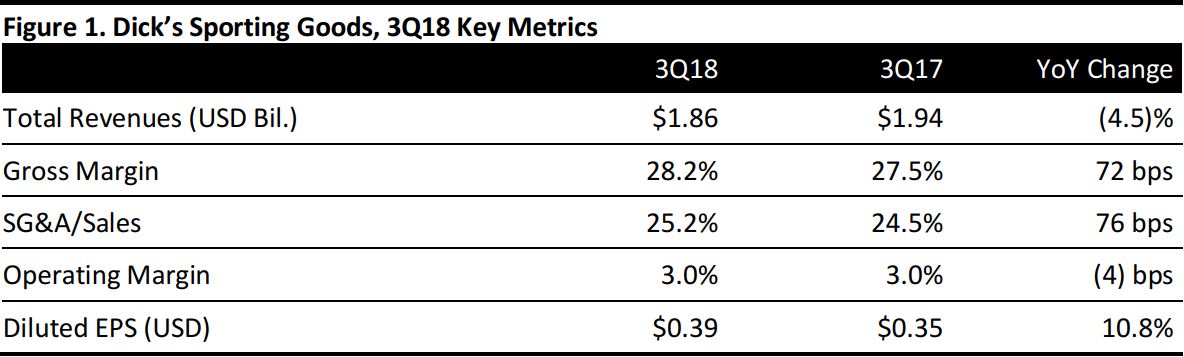

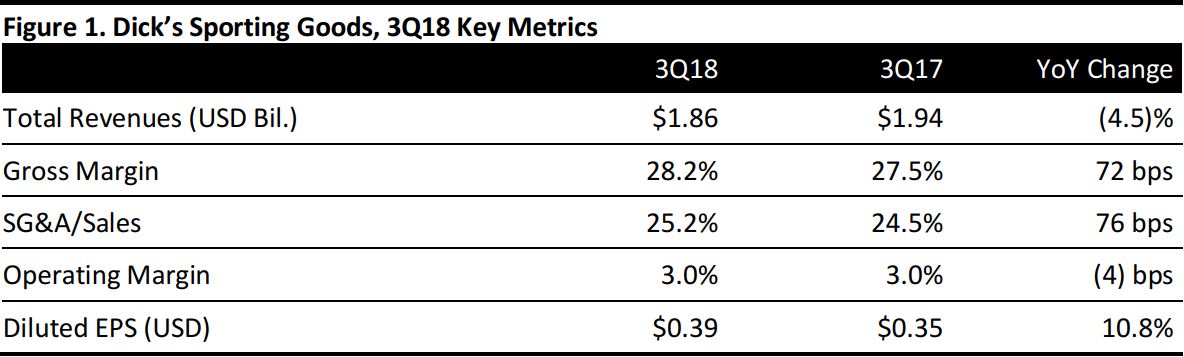

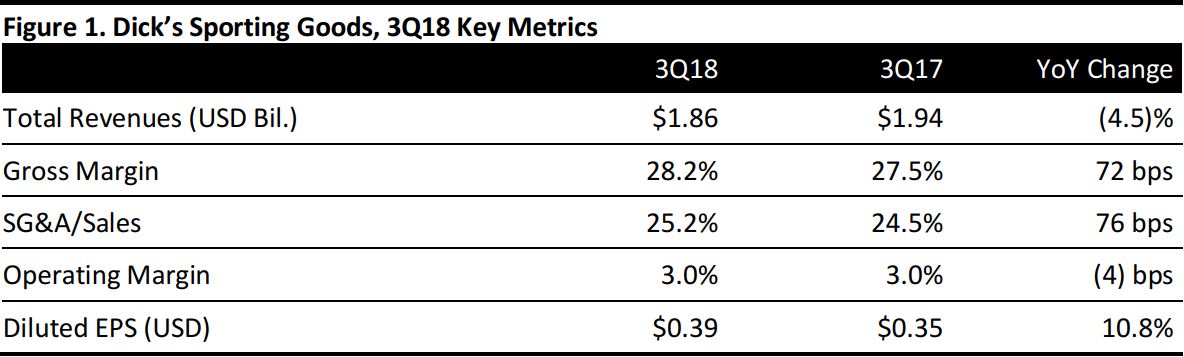

Source: Company reports/Coresight Research

3Q18 Results

Dick’s Sporting Goods reported 3Q18 revenues of $1.86 billion, down 4.5% year over year and below the consensus estimate of $1.88 billion. Diluted EPS was $0.39, above the year-ago quarter of $0.35 and above the consensus estimate of $0.26.

Based on an unshifted calendar, comparable sales decreased 6.1% compared with the year-ago quarter, and below the consensus estimate of (5.0)%. Adjusted for the calendar shift, due to the 53rd week in 2017, consolidated same store sales declined 3.9% compared to the consensus estimate of (3.8)%.

During the quarter, the company reported its best-performing categories included outdoor and athletic apparel, which combined for a mid-single-digit comp sales increase, and its private brands continued to comp positively with high penetration. However, Dick’s reported that sales continued to be negatively impacted by double-digit declines in

Hunt and Electronics categories, which contributed approximately 255 basis points to the comp decline. The company reported it removed the Hunt and Electronic categories from 10 stores in which these categories were underperforming, and replaced them with other categories including baseball, licensed products and outerwear.

Adjusted for the calendar shift, e-commerce sales for the third quarter of 2018 increased 16%. E-commerce for the third quarter of 2018 was approximately 12% of total net sales, compared to approximately 10% during the same quarter last year.

The company opened three new Dick’s Sporting Goods stores in the third quarter. As of November 3, the company operated 732 Dick’s Sporting Goods stores in 47 states, 94 Golf Galaxy stores in 32 states, and 35 Field & Stream stores in 16 states.

The company reported it will launch new brands. Earlier in the quarter, it launched the outdoor apparel brand Alpine Design and has been pleased with its early success and reported it also expects private brands to continue to deliver growth.

Dick’s reported it is working to deliver e-commerce orders to customers within two business days. To achieve this, the company is investing in fulfillment and delivery capabilities, which includes creating e-commerce fulfillment centers in New York and California. The center in New York will feature automation and robotics to reduce labor costs. The company reported it will enable regional distribution centers to fulfill online customer orders and is shipping from stores.

Outlook

Dick’s Sporting Goods raised its full year earnings per share guidance to $3.15–$3.25, up from the previous guidance of $3.02–$3.20, compared to the consensus estimate of $3.14. The company reaffirmed expectations for comp sales to be in the range of (4)%–(3)% compared to the consensus estimate of (3.3)%.